What Is Applicant Tracking Systems (ATS)?

An Applicant Tracking System (ATS) is the central operating system for modern recruitment, designed to manage the end-to-end hiring process from job requisition to offer letter. Unlike a standard database or a simple spreadsheet, an ATS is a workflow automation engine that standardizes how organizations source, screen, interview, and hire talent. It serves as the single source of truth for candidate data, ensuring that every interaction—from a resume submission to interview feedback—is captured, compliant, and actionable.

The category covers the full pre-hire lifecycle: requisition management, job posting distribution, candidate data capture (resume parsing), pipeline management, interview scheduling, and offer management. It sits squarely between recruitment marketing platforms (which focus on attracting traffic and lead generation at the top of the funnel) and Human Resource Information Systems (HRIS) (which manage the post-hire employee lifecycle). While some Human Capital Management (HCM) suites include an ATS module, the dedicated ATS category includes both general-purpose platforms suitable for corporate HR teams and specialized, vertical-specific tools built for high-volume staffing, healthcare, or executive search.

This distinction is critical. A general-purpose tool might suffice for a corporate finance team hiring ten analysts a year, but it will fail catastrophically for a staffing agency placing 500 nurses a month. The former needs collaborative evaluation tools; the latter needs speed, shift management, and credential verification. Understanding these boundaries is the first step to selecting the right infrastructure for your talent strategy.

History of the Applicant Tracking System

The Applicant Tracking System emerged in the late 1990s as a direct response to the digitization of the resume. Before this era, recruitment was a paper-heavy administrative burden involving physical filing cabinets and fax machines. The gap that created this category was the inability of existing ERP systems to handle unstructured data like resumes or the dynamic workflows of interviewing. Early solutions were essentially digital filing cabinets—on-premise databases designed to store scanned documents and basic contact information. They were clunky, expensive, and focused entirely on compliance and storage rather than usability.

The market shifted dramatically in the mid-2000s with the rise of Software as a Service (SaaS). Vendors like Taleo (founded in 1999 and later acquired by Oracle) and BrassRing (acquired by IBM) defined the "enterprise" standard, moving data to the cloud but retaining complex, rigid workflows that frustrated users. These systems were built for the buyer (procurement and legal), not the user (recruiters and candidates). This era was characterized by the "black hole" phenomenon, where candidate applications vanished into a database, never to be seen again.

By the 2010s, a new wave of "modern" ATS platforms like Lever and Greenhouse entered the market, driven by a fundamental shift in buyer expectations. Companies no longer just wanted a database; they wanted "actionable intelligence" and a user experience comparable to consumer software. This period marked the transition from "applicant tracking" to "recruitment optimization," with a heavy focus on collaborative hiring, API connectivity, and reporting. Today, the market is undergoing another consolidation wave, where the boundary between ATS, CRM (Candidate Relationship Management), and AI automation is blurring, pushing the category toward "Talent Intelligence" platforms that predict hiring outcomes rather than just tracking them.

What to Look For in an ATS

Evaluating an ATS requires looking past the shiny dashboard to the underlying architecture of the system. The most critical evaluation criterion is workflow flexibility vs. enforcement. A robust ATS must allow you to enforce compliance steps (e.g., background check consent) while offering the flexibility to skip superfluous stages for hard-to-fill roles. If the system forces a software engineer to go through the same 12-step process as a retail cashier, adoption among hiring managers will plummet.

Red flags and warning signs often appear in the details of data ownership and migration. Be wary of vendors that cannot clearly explain how you would export your data if you chose to leave. A "proprietary data format" is often a trap designed to lock you in. Furthermore, pay close attention to the "search" functionality. If a vendor claims "AI matching," ask for a demonstration of how it handles false positives. Does it rank a resume with the keyword "Java" highly even if the candidate worked at a coffee shop? Poor search capabilities turn your ATS into a digital graveyard where great candidates are lost.

Key questions to ask vendors include:

- "Can you walk me through the exact steps a hiring manager takes to provide interview feedback, and can we do it on a mobile device right now?" (Tests usability).

- "Does your open API allow for bi-directional sync with our specific HRIS, or is it a one-way push?" (Tests integration depth).

- "How does the system handle duplicate profiles if a candidate applies for three different roles over two years?" (Tests data hygiene).

Industry-Specific Use Cases

Retail & E-commerce

In retail and e-commerce, the primary currency is speed. High turnover and seasonal spikes mean that the ATS is less about "tracking" and more about "processing." These buyers need mobile-first application flows that allow candidates to apply via SMS or QR codes without creating a login account. A 2025 analysis of retail hiring suggests that drop-off rates increase by 50% if an application takes longer than 5 minutes on a mobile device. Evaluation priorities should focus on automated screening questions (e.g., "Can you work weekends?") that instantly qualify or disqualify applicants, and self-scheduling tools that let candidates book their own interviews immediately. A system that requires a recruiter to manually review every cashier application is a bottleneck that retail operations cannot afford.

Healthcare

Healthcare recruitment is governed by credentialing and compliance. Unlike corporate hiring, where a "good cultural fit" might suffice, healthcare hires must possess specific, valid licenses (RN, MD, CNA). A specialized healthcare ATS must automatically verify licenses against state databases and track expiration dates. [1] The evaluation priority here is integration with background check providers and the ability to manage "shift-based" hiring rather than just role-based hiring. Unique considerations include HIPAA compliance for handling patient-related scenarios in interview questions and the ability to handle high-volume hiring for nursing staff alongside white-glove executive search for physicians.

Financial Services

For financial services, the non-negotiable is auditability and regulatory compliance (e.g., OFCCP, SEC, FINRA). Every decision to advance or reject a candidate must be logged and defensible. An ATS in this sector must provide granular role-based permissions to ensure that sensitive compensation data is partitioned correctly. Unique considerations include complex "conflict of interest" checks and pre-clearance workflows that must happen before an offer is extended. Furthermore, as regulators crack down on off-channel communications, the ATS must capture all candidate correspondence, including SMS and WhatsApp, to ensure the firm isn't fined for unmonitored communications. [2]

Manufacturing

Manufacturing recruitment faces a "skills gap" crisis combined with an aging workforce. The ATS needs to support "skills-based hiring" rather than just resume parsing, as many qualified machinists or welders may not have polished CVs. [3] Evaluation priorities include the ability to host walk-in application kiosks on the factory floor and integration with shift scheduling software. The system must also handle safety certification tracking as a gatekeeping mechanism. Unlike tech hiring, where the pipeline is digital, manufacturing often involves physical job fairs, so the ATS must have strong offline-to-online data capture capabilities.

Professional Services

In professional services (consulting, legal, accounting), the product is the people. The ATS must integrate tightly with Resource Management and Project Management tools. When a candidate is hired, they aren't just filling a slot; they are becoming a billable asset. The system needs to track "future start dates" and align them with project pipeline demands. [4] A unique consideration is the handling of "alumni networks" and "silver medalists" (candidates who were good but not hired), as professional services firms often re-engage past applicants for contract work or future projects. The candidate experience here must be high-touch and white-glove, as applicants are often future clients.

Subcategory Overview

Applicant Tracking Systems (ATS) for Contractors

This niche serves businesses that rely heavily on a contingent workforce, freelancers, or gig workers. Unlike standard ATS platforms designed for W-2 employees with long onboarding cycles, these tools prioritize speed and compliance with worker classification laws (1099 vs. W-2). A specific workflow only this tool handles well is the "instant deployment" cycle: verifying a contractor's insurance and tax forms (W-9) and assigning them to a project in minutes rather than days. [5] Buyers turn to this niche because general ATS tools often clutter the database with transient workers, skewing analytics on turnover and retention. For a deeper analysis of tools that manage this high-velocity workforce, see our guide to Applicant Tracking Systems (ATS) for Contractors.

Applicant Tracking Systems (ATS) for Staffing Agencies

Staffing agency software is fundamentally different because it must act as both an ATS and a CRM (Customer Relationship Management) system. The core problem here isn't just filling a role; it's selling a candidate to a client. These platforms include "blind submittal" features that generate anonymized candidate profiles to send to clients for review—a workflow generic ATS tools simply do not support. [6] The pain point driving buyers here is the need to manage the "client side" of the equation (bill rates, markups, and client portal access) alongside the candidate side. Learn more about these dual-sided platforms in our guide to Applicant Tracking Systems (ATS) for Staffing Agencies.

Applicant Tracking Systems (ATS) for Recruitment Agencies

While similar to staffing, recruitment agency software focuses more on permanent placements and executive search ("headhunting") rather than high-volume temp staffing. The unique differentiator is the focus on "split fee" networks and long-term candidate nurturing. A workflow unique to this niche is the "ownership period" tracking, which prevents disputes between recruiters over who "owns" a candidate commission. [7] Agencies buy these tools because generic platforms lack the commission tracking and advanced Boolean search capabilities required to hunt passive talent. Explore these specialized tools in our guide to Applicant Tracking Systems (ATS) for Recruitment Agencies.

Applicant Tracking Systems (ATS) for Private Equity Firms

Private Equity (PE) firms require tools that manage talent not just for themselves, but across their entire portfolio of companies. This isn't about filling a seat; it's about "value creation" through human capital. These systems often feature a "Talent Bank" or "Executive Bench"—a shared pool of pre-vetted C-suite executives who can be deployed into portfolio companies during a turnaround. [8] General ATS tools fail here because they lack the multi-tenant architecture to allow a parent firm visibility into multiple subsidiary hiring pipelines while maintaining data segregation. [9] Read more about portfolio-level talent management in our guide to Applicant Tracking Systems (ATS) for Private Equity Firms.

Applicant Tracking Systems (ATS) for Home Care Agencies

Home care recruiting is an existential challenge due to extreme turnover and regulatory pressure. The defining feature of this niche is the integration of Electronic Visit Verification (EVV) compatibility and caregiver-specific matching (e.g., "Must have a car," "Must speak Spanish," "Must be OK with cats"). [10] A generic ATS cannot filter candidates by their proximity to a patient's home or verify if their certifications meet state Medicaid reimbursement requirements. [11] The pain point is compliance risk; hiring an unverified caregiver can lead to lawsuits and loss of license. Discover compliant hiring solutions in our guide to Applicant Tracking Systems (ATS) for Home Care Agencies.

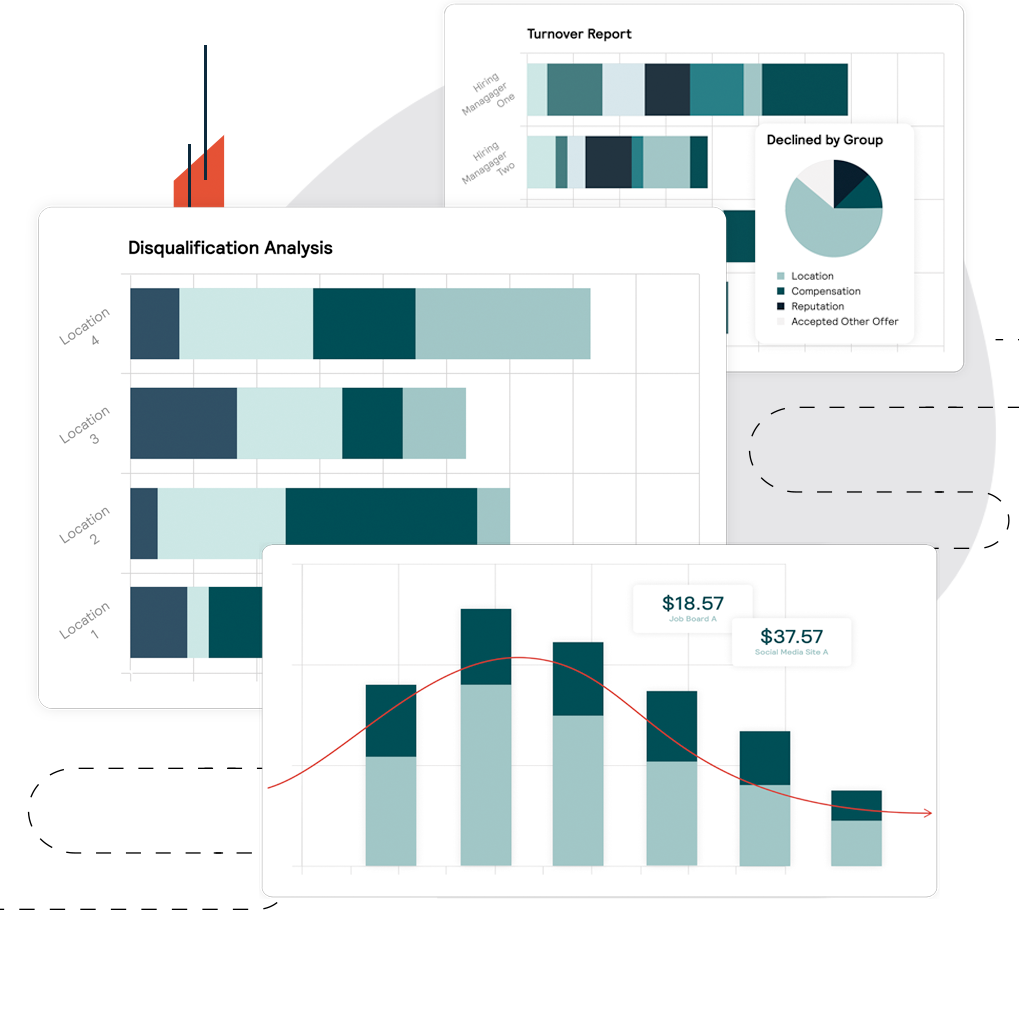

Integration & API Ecosystem

The "all-in-one" suite is a myth; the reality of modern recruitment is a fragmented stack of specialized tools. A successful ATS implementation depends entirely on its API ecosystem. Statistics show that 65% of companies face significant challenges transferring candidate data between their ATS and other HR systems, leading to data silos that cripple decision-making [12]. Gartner analysts have noted that "integration complexity is the single biggest cause of dissatisfaction in HR technology deployments," often leading to "zombie systems" that employees work around rather than with.

Real-World Scenario: Consider a professional services firm with 150 employees. They use Greenhouse for hiring, ADP for payroll, and Slack for communication. A poor integration strategy means that when a recruiter marks a candidate as "Hired" in Greenhouse, nothing happens in ADP. The HR manager must manually re-type the candidate's name, social security number, and salary into ADP. Inevitably, a typo occurs—the salary is entered as $80,000 instead of $85,000. The new hire receives their first paycheck with an error, souring their onboarding experience immediately. A robust integration would use a middleware connector (like Workato or a native API integration) to trigger the "New Hire" workflow in ADP instantly upon the status change in the ATS, mapping fields like start_date, salary_base, and department_code automatically without human intervention.

Security & Compliance

Security in an ATS is not just about password protection; it is about data sovereignty and regulatory defense. With the rise of GDPR in Europe and CCPA/CPRA in California, the ATS is a liability magnet. In 2023, Meta was fined a record €1.2 billion for mishandling user data transfers between the EU and US, a precedent that has put every SaaS vendor handling personal data on high alert [13]. If your ATS vendor cannot explain their data residency policy (where the physical servers are located), you are at risk.

Real-World Scenario: A mid-sized healthcare provider collects resumes that include home addresses and previous employment history. A candidate requests to have their data deleted under GDPR's "Right to be Forgotten." If the ATS lacks a "compliance deletion" feature, the HR manager might delete the candidate's profile but fail to realize that the resume is still stored in a cached "search index" or a backup server. Six months later, the company is audited. The discovery of this "deleted" data constitutes a compliance breach. A compliant ATS automates this process, propagating the deletion request across all backups and logs, and providing a certificate of deletion to the compliance officer.

Pricing Models & TCO

ATS pricing is notoriously opaque, often hiding the true Total Cost of Ownership (TCO). Pricing generally falls into two models: Per-Seat (user licenses) or Per-Employee (company size). For small businesses, costs can range from $250 to $3,000 per year, while enterprise systems can easily exceed $50,000 to $125,000 annually [14]. However, the sticker price is rarely the final price.

Real-World Scenario: A 50-person tech company buys an ATS with a "Per Seat" model at $90/user/month. They buy 3 seats for their recruiting team ($3,240/year). Sounds cheap. However, they soon realize that hiring managers need to view resumes to conduct interviews. The vendor requires a full paid seat for anyone who "views" data. Suddenly, they need 15 seats for their engineering leads and VPs. The cost balloons to $16,200/year. Furthermore, they didn't account for the "implementation fee" ($5,000) and the "data migration fee" ($2,500) to move resumes from their old system. The Year 1 TCO is actually $23,700—nearly 7x the initial estimate. Buyers must model their TCO based on future headcount, not just current users.

Implementation & Change Management

Implementation is where most software purchases fail. Research from various studies indicates that up to 70% of HR transformations fail to achieve their intended goals due to poor adoption and change management [15]. Gartner has also predicted that by 2027, 80% of data governance initiatives will fail due to a lack of business-centric adoption strategies [16].

Real-World Scenario: A manufacturing firm implements a sophisticated new ATS to replace paper forms. The HQ team loves the analytics dashboard. However, the plant managers on the floor, who actually do the hiring, find the mobile app clunky and confusing. They stop using it and revert to accepting paper resumes, which they stack on their desks. The central HR team sees "0 candidates" in the system for critical roles, panics, and spends money on external agencies. The ATS is technically "live," but practically dead. A successful implementation would have involved "champion" users from the factory floor during the selection process to vet the mobile experience before signing the contract.

Vendor Evaluation Criteria

When selecting a vendor, support and roadmap are as important as current features. According to SelectSoftware Reviews, 94% of recruiters say their ATS has positively impacted their hiring process—but this sentiment is heavily skewed toward vendors with responsive support teams [17]. A critical evaluation metric is the "Support-to-Sales Ratio." If a vendor has 100 sales reps and 5 support agents, you know where their priorities lie.

Real-World Scenario: A rapid-growth startup evaluates Vendor A and Vendor B. Vendor A has more features but outsources support to a generic call center. Vendor B has fewer features but offers a dedicated Customer Success Manager (CSM) for accounts of their size. During a critical hiring sprint, the system goes down. Vendor A's call center reads a script and opens a ticket with a 48-hour SLA. Vendor B's CSM gets on a Zoom call within 30 minutes, identifies the API error, and offers a workaround. The startup chose Vendor B, saving their hiring quarter. Buyers should test support during the trial—submit a ticket and measure the response time yourself.

Emerging Trends and Contrarian Take

Emerging Trends 2025-2026: The dominance of Agentic AI is the next frontier. Unlike generative AI which simply writes emails, agentic AI acts autonomously to execute complex workflows—sourcing candidates, screening them against criteria, and even scheduling interviews without human intervention. By 2025, it is expected that agentic AI will begin to function as a "digital co-worker" rather than just a tool, potentially autonomously managing the top-of-funnel for high-volume roles [18]. Additionally, we are seeing the rise of the "Workforce OS," where the lines between ATS, VMS (Vendor Management System), and internal mobility platforms dissolve into a single talent ecosystem.

Contrarian Take: The standalone ATS is dying, and the "All-in-One" suite will eventually suffocate innovation in the mid-market. While best-of-breed tools offer superior UX, the sheer weight of integration maintenance (the "API tax") is driving buyers back to consolidated HCM suites, even if the recruiting modules are inferior. The insight here is that for many businesses, data continuity is becoming more valuable than feature depth. A mediocre ATS that shares a native database with payroll and performance management is often more valuable to the C-suite than a best-in-class ATS that sits in a data silo. The mid-market is effectively being forced to choose between "good recruiting" and "good data," and data is winning.

Common Mistakes

Over-customizing the application process: Adding "knock-out" questions and essay requirements reduces application volume by up to 50%. Don't ask for a cover letter if you aren't going to read it.

Ignoring the "Candidate Re-engagement" loop: Most companies treat their ATS as a one-way street—candidates enter and are either hired or ignored. Failing to use the ATS to nurture "silver medalists" (finalists who weren't hired) is a waste of already-acquired assets.

Buying for the Recruiter, not the Hiring Manager: Recruiters live in the ATS; hiring managers visit it. If the system is too complex for a manager who logs in once a month, they will bypass it, breaking your compliance and data integrity.

Questions to Ask in a Demo

Don't let the sales rep stick to their script. Ask these targeted questions:

- "Show me the 'Candidate View' on a mobile device—not a slide, but the actual live interface. I want to see how hard it is to apply."

- "What happens to my data if we cancel our contract? Do we get a CSV dump, or a structured SQL export? Is there a fee for offboarding?"

- "Can you show me the backend configuration for changing a workflow? Do I need to submit a ticket to your support team to add an interview stage, or can I do it myself?"

- "How does your search algorithm handle abbreviations? If I search for 'CPA', will it find 'Certified Public Accountant'?"

Before Signing the Contract

Final Decision Checklist:

- API Validation: Have your technical lead review the API documentation. "We have an API" is not the same as "We have a documented, open, and stable API."

- SLA Negotiation: Ensure the Service Level Agreement (SLA) includes uptime guarantees with financial penalties for downtime. 99.9% uptime should be the floor, not the ceiling.

- Hidden Costs: Check for caps on storage, number of resumes, or SMS credits. "Unlimited" often has a "fair use" asterisk.

- Deal-Breaker: If the vendor refuses to put implementation timelines in writing with milestones, walk away. Open-ended implementation is a recipe for billing overages.

Closing

Selecting an Applicant Tracking System is one of the highest-stakes infrastructure decisions a People team will make. It dictates the pace at which you can grow and the quality of talent you can attract. If you need help navigating the vendor landscape or validating your shortlist, feel free to reach out.

Email: albert@whatarethebest.com