Best for teams that are

- Tech startups and founders (especially Y Combinator alumni) wanting autopilot compliance

- Companies scaling from 10 to 1,000 employees needing automated state tax registrations

- Founders who want to minimize time spent on administrative payroll tasks

Skip if

- Traditional non-tech businesses requiring phone-based support

- Companies needing a full-suite HRIS with deep performance management tools

- Businesses that need complex manual controls rather than automated workflows

Expert Take

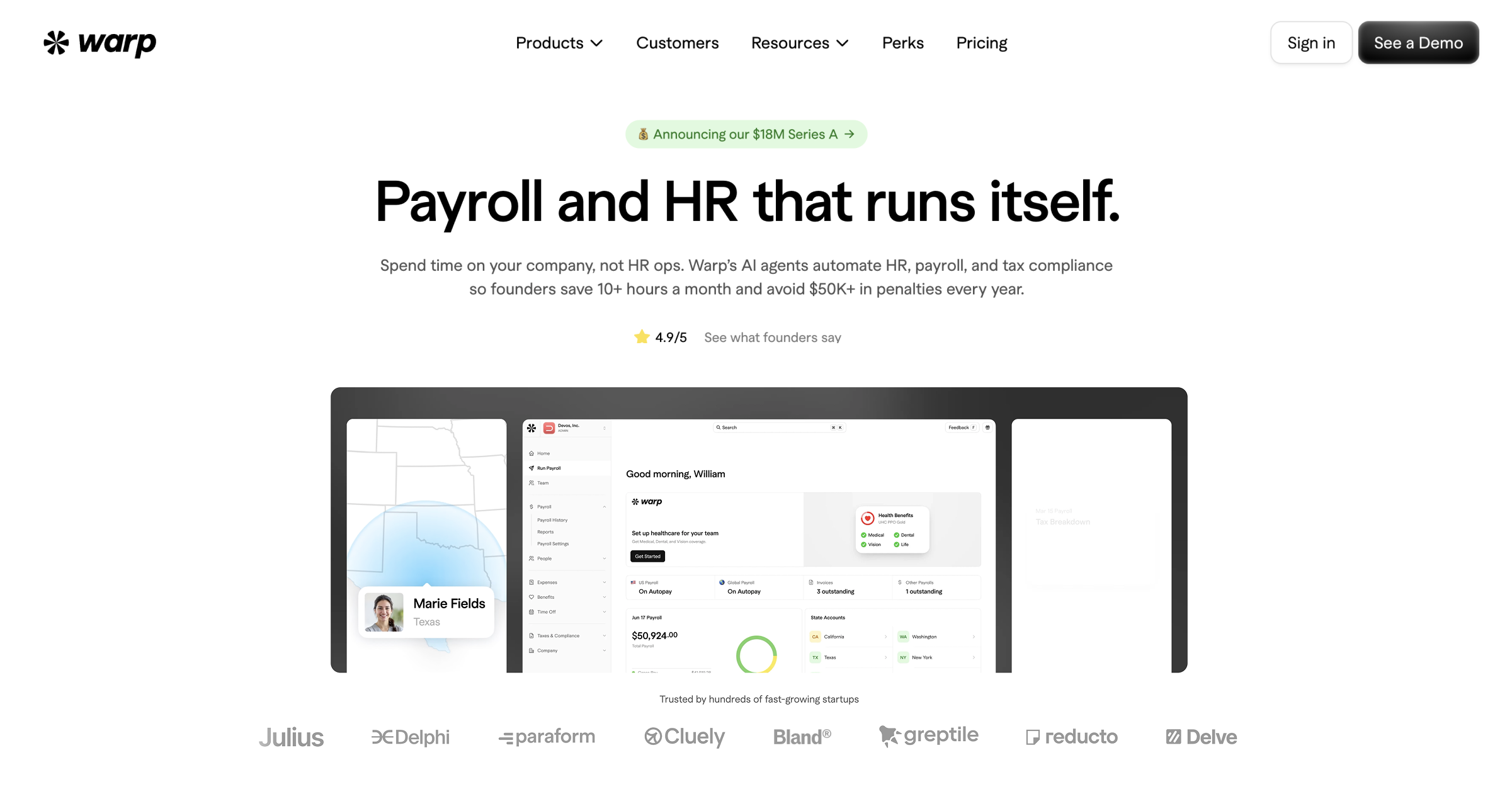

Our analysis shows Warp effectively solves the specific pain point of multi-state compliance for early-stage startups by automating tax registrations that typically require manual effort. Based on documented features, its 'autopilot' approach to state filings and 5-minute setup time makes it highly efficient for founders who need to offload administrative burdens immediately. While it lacks the deep HR customization of enterprise tools, its streamlined focus on compliance speed is a significant advantage for its niche.

Pros

- Automated 50-state tax compliance

- Fast setup in under 5 minutes

- Transparent 3-tier pricing model

- Global contractor payments (150+ countries)

- SOC 2 Type 2 certified security

Cons

- Relies on third-party infrastructure APIs

- Limited HR automation workflows

- Support friction for plan downgrades

- Smaller integration ecosystem than competitors

- Platform fees increase total cost