What Is Territory Mapping & Quota Planning Tools?

Territory Mapping and Quota Planning Tools form a specialized category of sales performance management software designed to optimize the allocation of market potential across a sales organization. Unlike Customer Relationship Management (CRM) systems, which record transactional data and individual interactions, or Incentive Compensation Management (ICM) systems, which calculate payouts after the fact, this category focuses on the strategic design and distribution of the addressable market. It sits squarely between the "strategy" phase of sales planning and the "execution" phase of CRM.

This software category covers the full lifecycle of territory and quota construction: ingesting market data, segmenting accounts based on logic (geography, vertical, revenue band), visualizing coverage gaps on geospatial maps, assigning fair and equitable quotas based on historical velocity and future potential, and deploying these targets to the field. It includes both general-purpose platforms suitable for broad B2B sales and vertical-specific tools tailored for complex field sales networks in industries like pharmaceuticals, consumer goods, and financial services.

The core problem these tools solve is the inefficiency and inequality of manual sales planning. Without dedicated software, organizations rely on static spreadsheets and intuition, leading to unbalanced territories where some representatives starve while others leave revenue on the table due to lack of capacity. By digitizing this process, businesses ensure that every dollar of quota is backed by empirical market potential, maximizing revenue capture and minimizing sales force attrition due to perceived unfairness.

History of the Category

The evolution of Territory Mapping and Quota Planning tools tracks the broader shift in enterprise software from static systems of record to dynamic systems of intelligence. In the 1990s, territory planning was largely a manual exercise dominated by mainframe exports and physical maps. Sales operations leaders would print customer lists from early contact management databases and literally draw lines on wall-mounted maps with markers. The digital equivalent was the early spreadsheet—a tool that, while flexible, lacked any spatial awareness or dynamic link to the underlying data. The primary "gap" that birthed this category was the inability of early CRM and ERP systems to handle the complex, "what-if" scenario modeling required to carve up a market equitably.

The late 1990s and early 2000s saw the emergence of desktop-based Geographic Information Systems (GIS) adapted for business use. These were powerful but clunky, requiring specialized analysts to operate. They allowed for the first true digital visualizations of sales data but remained disconnected from the daily workflow of the sales rep [1]. The market began to shift significantly with the rise of vertical SaaS and the cloud revolution in the late 2000s. As CRM moved to the cloud, buyers began to demand that their planning tools live where their data lived. This killed off many legacy desktop mapping applications and gave rise to browser-based solutions that could sync changes instantly.

Recent market consolidation waves have further shaped the landscape. Large Sales Performance Management (SPM) suites began acquiring standalone territory and quota niche players to create end-to-end "planning-to-payment" platforms. Simultaneously, CRM giants expanded their native capabilities, forcing standalone vendors to pivot toward deep, specialized intelligence. Today, buyer expectations have evolved from "give me a database of zip codes" to "give me actionable intelligence." Modern buyers expect tools not just to display data, but to recommend optimal territory splits using predictive algorithms, marking the transition from simple mapping to strategic revenue optimization [2].

What to Look For

When evaluating Territory Mapping and Quota Planning software, buyers must look beyond basic visualization features. The market is saturated with tools that can put pins on a map; the differentiator is the ability to handle complex logic and bi-directional data flow. Critical evaluation criteria should center on the tool's "scenario modeling" capabilities. Can the system run multiple parallel "what-if" scenarios without affecting the live production environment? A robust tool must allow operations teams to model a 10% headcount reduction or a merger with a competitor and instantly see the impact on quota coverage and travel time.

Another vital area is attribute-based balancing. While legacy tools rely heavily on geography (zip codes), modern sales organizations often carve territories based on non-spatial attributes like industry vertical, company revenue, or technician skill set. The software must be able to balance territories using weighted scores that combine these variables—for example, creating a territory that contains "50 high-value healthcare accounts" rather than just "all of Chicago." [3].

Red flags and warning signs often appear in the integration capabilities. Be wary of vendors who promise "seamless integration" but rely on flat-file CSV uploads for data transfer. In a high-velocity sales environment, data stale by even a week can lead to conflict when two reps claim the same account. A system that does not support API-based, scheduled, or real-time sync with your CRM is a significant liability. Furthermore, avoid tools that lack hierarchy management. If a tool cannot easily handle parent-child account relationships (ensuring a subsidiary is in the same territory as its headquarters), it will fail in enterprise environments.

Key questions to ask vendors include: "How does your system handle exception management when a rep leaves mid-year?" "Can we lock specific named accounts while auto-optimizing the rest of the territory?" and "Does the quota planning module support top-down, bottom-up, and hybrid planning methodologies simultaneously?"

Industry-Specific Use Cases

Retail & E-commerce

In the retail and e-commerce sector, territory mapping is less about assigning salespeople to leads and more about optimizing physical footprint and logistics. These businesses use mapping tools to define catchment areas—the geographic sphere from which a store draws the majority of its customers [4]. The evaluation priority here is heavily weighted toward demographic data enrichment. A capable tool must overlay external datasets—such as household income, population density, and competitor locations—over internal sales data. This allows planners to identify "cannibalization zones" where a new store might steal revenue from an existing one, rather than capturing net new market share. For e-commerce specifically, these tools help align last-mile delivery territories to balance driver workload, ensuring that delivery quotas are achievable based on drive-time analysis rather than simple straight-line distance.

Healthcare

The healthcare sector, particularly medical device and pharmaceutical sales, requires a unique approach centered on referral patterns and point-of-care coverage. Unlike standard B2B sales, the "customer" (a patient or prescribing doctor) often moves between facilities. Territory tools here must track affiliations—mapping how a physician splits time between a private clinic and a major hospital system [5]. Evaluation priorities include the ability to ingest complex third-party data sources (like prescription volume data) and handle strict compliance boundaries. A critical consideration is ensuring that territory alignments do not violate anti-kickback statutes or internal compliance rules regarding representative rotation. Tools must support "teams-based" coverage where a clinical specialist and a sales rep share a territory but have different quotas and activity targets.

Financial Services

In financial services, territory planning focuses on managing a book of business rather than pure geographic prospecting. Wealth management and insurance firms use these tools to ensure that advisors are not hoarding accounts they cannot service. The software must analyze "wallet share"—the percentage of a client's total assets managed by the firm—and identify under-penetrated territories [6]. A unique need in this industry is the handling of "orphaned accounts." When an advisor retires, their book must be redistributed immediately to prevent client attrition. Financial services buyers prioritize tools with robust succession planning workflows that can automatically carve up a departing advisor's territory and distribute it to peers based on capacity and certification levels (e.g., ensuring a rep has the right licenses to sell in a specific state).

Manufacturing

Manufacturing sales territories are often complex hybrids of direct sales teams and third-party distributor networks. The primary use case here is channel conflict management. Manufacturers need tools that can map not only their own reps but also the coverage areas of their distributors to spot white space or overlap [7]. If a distributor covers the Midwest, the direct team must be blocked from prospecting there to maintain partner relationships. Evaluation priorities include "partner portal" capabilities, where distributors can view their assigned territories, and "supply chain alignment," where sales territories are mapped against warehouse locations to minimize shipping costs and lead times. The tool must be able to visualize the physical flow of goods alongside the flow of deals.

Professional Services

For law firms, consulting agencies, and accounting firms, territory planning is often about relationship mapping and conflict of interest avoidance rather than geographic conquest. "Territories" in this context are often defined by industry vertical or named accounts (e.g., "The Global Banking Practice"). Tools must integrate deeply with CRM to map the "who knows who" web of relationships. A unique consideration is conflict checking—ensuring that assigning a partner to a new client in the Energy sector doesn't create a conflict with an existing client in the same territory [8]. Workflows here emphasize collaborative planning, allowing multiple partners to negotiate account ownership within the tool to ensure that the firm's best resources are aligned with its highest-potential clients.

Subcategory Overview

Lightweight Territory and Quota Tools for Growing Teams

This subcategory serves small to mid-sized businesses that are graduating from spreadsheets but do not yet require enterprise-grade governance. What makes this niche genuinely different is its focus on speed of deployment and visualization over complex logic. These tools often lack deep integration capabilities or hierarchical permission structures but excel at drag-and-drop interface design. A workflow that only this specialized tool handles well is the "rapid rebalance"—a sales manager can pull up a map, circle a group of pins with a lasso tool, and drag them to a new rep's bucket in seconds during a weekly meeting. The specific pain point driving buyers here is administrative overhead; they want to avoid the multi-month implementation cycles of enterprise platforms. For a deeper look, consult our guide to Lightweight Territory and Quota Tools for Growing Teams.

Territory Alignment Tools Integrated with CRM

This niche is defined by its architectural dependency: these tools often live inside the CRM (like Salesforce native apps) rather than syncing with it. This distinction makes them genuinely different because they share the same data schema and security model as the CRM, eliminating the need for complex API maintenance. A workflow that only these tools handle well is the real-time routing trigger. When a lead is created in the CRM, these tools can instantly check the territory logic and assign ownership without a sync delay. Buyers choose this niche to solve the pain point of data latency and "swivel-chair" management—they want their operations team to work in the same environment as their sellers. Explore more in our breakdown of Territory Alignment Tools Integrated with CRM.

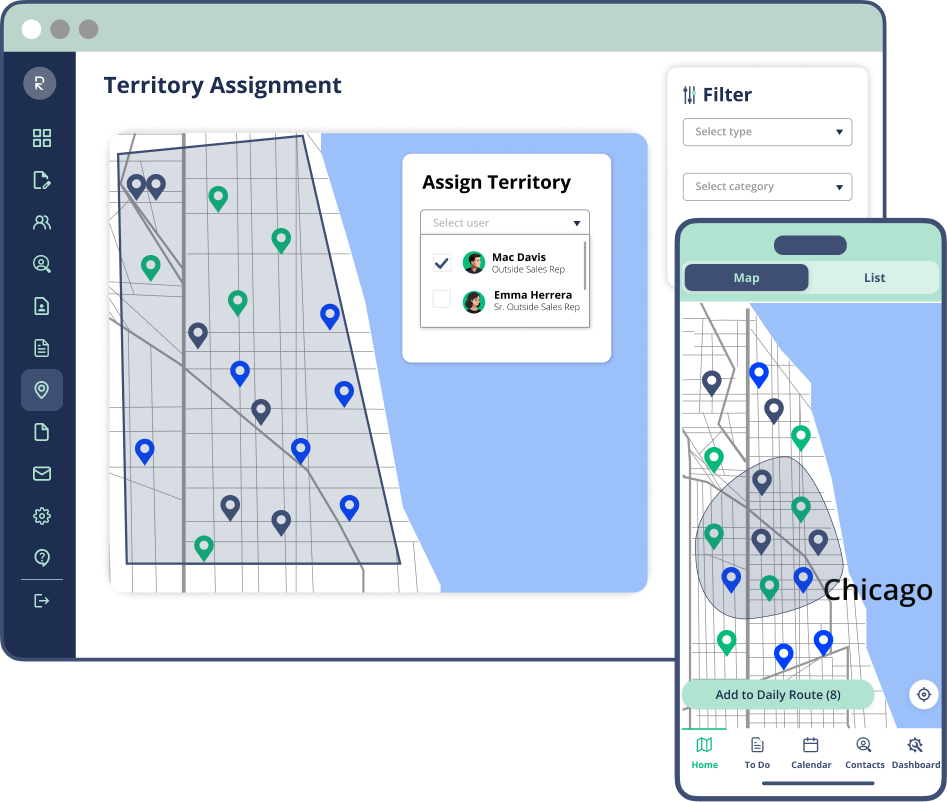

Territory Management Tools for Field Sales Teams

These tools are purpose-built for the "road warrior." They differ from generic tools by prioritizing mobile-first experiences and logistics over desktop planning. While a generic tool focuses on annual planning, these tools focus on daily execution. A workflow unique to this niche is route density optimization: the tool not only defines the territory but automatically sequences the rep's daily appointments to minimize windshield time and maximize face-to-face visits. The driving pain point here is operational inefficiency in the field—buyers invest in these tools because their reps are spending more time driving than selling. Learn more about these specific solutions in our guide to Territory Management Tools for Field Sales Teams.

Territory Management Tools with Mapping and Geo Intelligence

This subcategory represents the high-end analytical tier of the market. What sets it apart is the inclusion of proprietary external datasets—these vendors don't just map your data; they sell you data about the world (traffic patterns, weather, detailed census demographics). A workflow exclusive to this group is white space discovery based on lookalike modeling. The tool can analyze a high-performing territory and scan the entire country to find geographically similar regions that are currently unassigned. Buyers move to this niche when they hit the pain point of market saturation; they have squeezed all efficiency out of their current data and need external intelligence to find growth. See our detailed review of Territory Management Tools with Mapping and Geo Intelligence.

Integration & API Ecosystem

In the modern sales stack, a territory planning tool that stands alone is a liability. The strength of a tool’s Integration & API Ecosystem determines whether your territory plan is a living strategy or a static snapshot. Enterprise buyers must prioritize bi-directional synchronization—the ability to not only pull historical data from a CRM but to push complex territory definitions and split-credit logic back into it. According to research by the Aberdeen Group, companies with strong sales and marketing alignment—underpinned by integrated data systems—achieve 32% higher revenue growth [9]. The ecosystem must also extend beyond CRM to ERP (for revenue actuals) and HRIS (for headcount planning).

Experts warn against the hidden costs of poor integration. As noted by industry analysts, "API limits are the silent killer of real-time territory management." A specific scenario illustrating this involves a 50-person professional services firm using a CRM-integrated planning tool. If the integration is poorly designed, a bulk update of 5,000 account assignments at the start of a quarter might trigger API rate limits [10]. This causes the sync to fail silently, leaving half the sales team with the old territory map while the other half sees the new one. The result is "commission chaos," where reps close deals they no longer own, leading to payment disputes and hours of manual reconciliation by finance.

Security & Compliance

Security in territory planning is no longer just about password protection; it is about Data Residency and Governance. As territory tools ingest sensitive customer data—addresses, revenue figures, and sometimes patient health information—they fall under the scope of GDPR, CCPA, and HIPAA. A critical evaluation criterion is whether the vendor allows you to define where your data physically resides. For global teams, this is non-negotiable. Research indicates that data residency requirements are becoming a primary driver for software selection in the EU, with strict limitations on cross-border data transfers [11].

Consider a multinational financial services company planning territories for advisors in Europe and North America. They select a US-based tool that does not offer EU data hosting. When they attempt to upload their German client list to optimize territories, they violate GDPR data localization mandates, risking fines of up to 4% of global turnover [12]. Beyond regulation, internal compliance is equally vital. "Ethical walls" features are necessary to ensure that a rep covering "Competitor A" cannot see the territory data or pricing strategy for "Competitor B," a common requirement in consulting and investment banking.

Pricing Models & TCO

Pricing for territory mapping tools has shifted from perpetual licenses to complex SaaS models, making Total Cost of Ownership (TCO) harder to calculate. The two dominant models are "per user" (seat-based) and "per record" (consumption-based). While per-user pricing seems predictable, it often hides the cost of "viewer" licenses—stakeholders who need to see the map but not edit it. Conversely, per-record pricing can skyrocket as your database grows. Gartner analysis suggests that SaaS costs are growing "without control" in many organizations due to decentralized purchasing and hidden consumption metrics [13].

To visualize this, let's walk through a TCO calculation for a hypothetical 25-person sales team.

- Scenario A (Per-Seat): Vendor charges $75/user/month.

Calculation: $75 * 25 users * 12 months = $22,500/year.

Hidden Cost: The VP of Sales and 5 regional directors need "Admin" access at $150/month ($4,500 extra), plus a required "Success Package" for implementation ($5,000). Total Year 1: $32,000.

- Scenario B (Per-Record): Vendor charges $500/month for up to 10,000 records.

The team has 8,000 accounts today. However, they buy a lead list of 5,000 prospects in Q2, pushing them to 13,000 records. This triggers a tier jump to $1,000/month.

Hidden Cost: Geocoding fees. The vendor charges $0.01 per address verification after the first 1,000. For 13,000 records, that's an extra $120 one-time fee every quarter they refresh data. Total Year 1: $13,500 approx., but highly variable.

For a stable team, Scenario A is safer. For a high-growth data environment, Scenario B introduces unpredictable variance that can wreck a budget.

Implementation & Change Management

The most common cause of failure in territory planning software is not technical bugs, but cultural rejection. Sales representatives are notoriously protective of their patches; shifting a zip code from Rep A to Rep B is often perceived as "taking money out of my pocket." Successful implementation requires a strategy of transparency. According to the Alexander Group, thoughtfully designing and optimizing sales territories can realize productivity increases of 10–20%, but only if the field adopts the new plan [14].

A concrete example of failure occurs when a company rolls out a new AI-driven territory map without explaining the "why." Imagine a manufacturing firm that uses a "black box" algorithm to reassign territories. A senior rep who has cultivated relationships in a specific county for 10 years suddenly loses it because the algorithm flagged it as "inefficient drive time." Without a change management process—specifically, a "Ranger Rep" program where senior sellers are involved in the pilot phase—the rep may quit, taking their institutional knowledge and relationships to a competitor [15]. Effective implementation involves a "soft launch" period where reps can challenge the data before it becomes official policy.

Vendor Evaluation Criteria

When selecting a vendor, buyers must evaluate the Scalability of Logic. Many tools function beautifully with 50 territories but crumble under the weight of 500 complex hierarchies. Evaluation must focus on the "Rule Engine." Can the system handle complex "if/then" logic? (e.g., "Assign to Rep A IF zip code is 90210 AND revenue > $1M, UNLESS industry is Healthcare, then assign to Specialist B"). Simple mapping tools fail this test.

Expert analysts at Gartner emphasize that organizations must adopt a "structured approach to adaptive decision making," moving away from static plans [16]. In practice, this means testing the vendor's support for hierarchy changes. Ask the vendor to demonstrate a "reorg scenario." Give them a dataset and ask: "Show me how your tool handles splitting the 'Northeast' region into 'New England' and 'Mid-Atlantic' while preserving historical quota attainment data for year-over-year reporting." If the vendor says "you'd need to export to Excel and re-import," that is a disqualifying red flag for enterprise teams.

Emerging Trends and Contrarian Take

Emerging Trends 2025-2026: The next frontier is the rise of Agentic AI in Territory Management. We are moving beyond "predictive" tools (which suggest a territory split) to "autonomous" agents. These AI agents will monitor territory health in real-time and automatically propose micro-adjustments—like moving a set of neglected accounts to a rep with excess capacity—requiring only a manager's one-click approval. Another trend is the convergence of Territory Planning with Revenue Intelligence. Instead of just mapping "potential," tools will overlay "conversation intelligence" data (e.g., call sentiment analysis) to heat-map territories based on engagement quality, not just demographics [17].

Contrarian Take: The concept of the "Annual Territory Plan" is a relic that is actively harming sales organizations. Most businesses would get more ROI from scrapping the Q4 planning marathon entirely and shifting to a Continuous Planning Model. The market shifts too fast for a plan locked in January to be relevant in June. Companies obsessed with "locking" territories for 12 months are prioritizing administrative comfort over revenue reality. The highest-performing teams of the future will treat territories as liquid assets, rebalanced quarterly or even monthly based on real-time triggers, rather than static fiefdoms protected by tradition [18].

Common Mistakes

The most pervasive mistake is Over-Optimizing for Equity at the Expense of Continuity. Sales ops leaders often obsess over making every territory mathematically equal in potential (e.g., every rep gets exactly $1M in pipeline). While fair on paper, this often necessitates dissecting existing relationships. Disrupting a strong client-rep relationship to balance a spreadsheet is a net loss for the business. Stability often outperforms theoretical optimization.

Another major error is Ignoring "Windshield Time" in Virtual Sales. Even inside sales teams have a "virtual commute"—the mental switching cost of jumping between time zones and industries. Assigning a rep a "patchwork" territory of accounts scattered across four time zones destroys productivity, even if they never leave their desk. Failing to account for the logistics of attention is a critical oversight. Finally, buyers often mistake Visualization for Planning. Buying a tool that makes pretty heat maps is useless if it lacks the workflow engine to effectively communicate and enforce those maps in the CRM. A map is a picture; a plan is a process.

Questions to Ask in a Demo

- "Can you show me the exact workflow for handling a mid-year rep departure and splitting their territory among three peers?" (Watch for how many clicks/screens this takes).

- "How does your system handle 'parent-child' account hierarchies where the HQ is in one territory and the subsidiary is in another?" (This reveals if they truly understand B2B complexity).

- "Does the geocoding engine charge extra for verifying addresses, and what happens if an address is ambiguous?" (Checks for hidden costs and data quality features).

- "Can we create 'overlay' territories for product specialists that sit on top of geographic territories without double-counting revenue?" (Essential for matrixed organizations).

- "Show me how a rep disputes a quota or territory assignment within the tool." (Tests the collaboration/workflow capabilities).

Before Signing the Contract

Final Decision Checklist: Ensure the tool supports your specific "Fiscal Year" structure (e.g., 4-4-5 calendars). Verify that the vendor has documented distinct "Sandbox" and "Production" environments to prevent planning accidents from impacting live sales data. Check the Service Level Agreement (SLA) for support during "crunch times"—specifically the end of Q4 when your team will be scrambling to finalize plans for the new year.

Common Negotiation Points: Negotiate the definition of a "User." Vendors often push for licenses for everyone who views a map. Push for a "Viewer" class license that is free or deeply discounted, paying full price only for the Ops planners. Also, negotiate the "Data Storage" limits. If the tool charges by record count, ensure the contract creates a buffer for "lead spikes" (e.g., after a trade show) so you aren't hit with overage fees for temporary data.

Deal-Breakers to Watch For: If the vendor cannot provide a verified reference from a customer with a similar data volume (not just similar industry), walk away. A tool that works for 1,000 accounts may crash with 100,000. Additionally, lack of SSO (Single Sign-On) support is a security deal-breaker for any modern enterprise. Finally, if the integration with your CRM relies on a third-party connector (like Zapier) rather than a native API integration, consider it a significant reliability risk.

Closing

Territory mapping is the architectural blueprint of your revenue strategy. Getting it right requires tools that balance mathematical precision with the human reality of sales. If you have specific questions about your tech stack or need a sounding board for your TCO calculations, don't hesitate to reach out.

Email: albert@whatarethebest.com