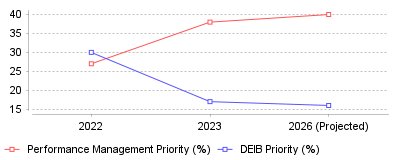

HR Strategic Priorities: Performance Mgmt vs. DEIB (2022-2026)

| Year | Performance Management Priority (%) | DEIB Priority (%) |

|---|

| 2022 | 27 | 30 |

| 2023 | 38 | 17 |

| 2026 (Projected) | 40 | 16 |

The Efficiency Pivot: Performance Management Overtakes DEIB

What is this showing

Data collected throughout late 2024 and projected into 2026 highlights a massive strategic crossover in the Human Resources and Operations landscape. Performance management has surged to become the number one priority for HR teams globally (40%), while prioritization of DEIB (Diversity, Equity, Inclusion, and Belonging) programs has plummeted to an all-time low of 16%, having virtually halved since 2022 [1] [2]. This data indicates that organizations are trading soft-skill cultural initiatives for hard-metric accountability systems like OKRs (Objectives and Key Results).

What this means

On a macro level, this signals the official end of the "talent hoarding" era that defined the post-pandemic market; companies are no longer prioritizing attraction (Talent Acquisition) or retention via social values (DEIB) as their primary levers. Instead, the focus has shifted entirely to operational efficiency and workforce productivity [3]. For the software industry, this means OKR and performance platforms are transitioning from "nice-to-have" engagement tools into critical infrastructure for business survival. HR departments are being forced to act less like cultural stewards and more like strategic performance partners, using data to justify headcount and maximize output per employee [4].

Why is this important

This trend is critical because it fundamentally alters how performance software is purchased and utilized; it is no longer sufficient for platforms to merely track goals—they must now prove ROI through efficiency gains. With 92% of HR professionals viewing engagement as important but only 39% having the resources to act on it, there is a dangerous "delivery gap" that only automated, high-efficiency platforms can fill [4]. Furthermore, high-performing HR teams are now 5x more likely to use deep tech stacks to track these metrics, creating a widening competitive moat between data-driven companies and those relying on manual processes [5].

What might have caused this

The primary driver is almost certainly the tightening economic climate which has forced the "C-Suite" to prioritize immediate business outcomes over long-term cultural investments [2]. HR teams have struggled to demonstrate a concrete Return on Investment (ROI) for DEIB initiatives, leading executives to slash those budgets in favor of performance management, which offers tangible metrics like goal completion rates and revenue per employee [4]. Additionally, the rise of AI in the workplace has pressured organizations to rigorously measure human output to understand where technology complements or replaces human effort [6].

Conclusion

The "Year of Efficiency" has seemingly become the "Decade of Performance," with organizations forcefully returning to business basics. While DEIB remains a concern for European markets, the global trend is a decisive move toward measurable performance outcomes, cementing OKR platforms as the central nervous system of modern organizational strategy [5]. Companies that fail to adopt rigorous performance management systems risk being left behind by competitors who are actively using these tools to identify and amplify their highest performers.

The High Cost of Disengagement and the Consolidation of Strategy Execution

Global employee disengagement cost the world economy $438 billion in 2024

[1]. That figure, released by Gallup, represents more than a morale statistic; it quantifies a systemic failure in how organizations translate high-level strategy into daily execution. For a decade, the software sector promised that digitizing Objectives and Key Results (OKRs) would bridge this gap. Yet, as we move through 2025, the market faces a reckoning. The sector is contracting through aggressive consolidation, facing new regulatory reporting burdens from the EU, and grappling with the failure of major incumbents to gain traction.

The initial promise of

Project Management & Productivity Tools was simple: align the workforce and productivity follows. The reality is messier. Gartner reports that 84% of Chief Marketing Officers now report high levels of "strategic dysfunction" within their organizations

[2]. This dysfunction is not abstract; it correlates directly with a 36% lower likelihood of reporting strong business performance.

We are witnessing a correction in the

OKR & Performance Goal Platforms market. The era of standalone "goal-setting" apps is ending. In its place, a heavier, more integrated operational layer is forming—one that demands direct connections between strategy, execution data, and increasingly, non-financial reporting metrics required by law.

Market Contraction and the Microsoft Exit

The most telling signal of market maturity—and difficulty—arrived with Microsoft’s decision to retire Viva Goals. Once positioned as a central pillar of its employee experience suite, Microsoft confirmed it would cease new feature development in December 2024 and fully retire the product by December 31, 2025

[3].

Microsoft’s retreat validates a specific operational reality: putting goals into a generalist collaboration platform does not guarantee adoption. The company cited low adoption rates as the primary driver for the decision

[4]. Organizations using Viva Goals now face a forced migration, with Microsoft recommending data exports via API, Excel, or PowerPoint before the 2025 cutoff. This disruption forces CIOs to re-evaluate whether strategy execution belongs in a generalist suite or requires a dedicated system of record.

While Microsoft exited, specialized platforms doubled down on scale. WorkBoard completed its acquisition of Quantive in May 2025, merging two of the largest standalone players in the sector

[5]. This consolidation is not merely about acquiring customer lists; it is a defensive move to secure dominance in the enterprise segment. The combined entity now claims 40 large enterprise customers migrating to the unified platform

[6].

The market metrics support this shift toward larger, consolidated platforms. Fortune Business Insights valued the global OKR software market at $1.15 billion in 2023, projecting it to reach $2.98 billion by 2030

[7]. This growth is not coming from small-business adoption of lightweight tools, but from large enterprises standardizing on heavy-duty platforms that can handle complex, multi-layered strategy execution.

The Rise of AI Agents in Strategy Execution

The functional definition of these platforms is changing. The dashboard—a static view of red, yellow, and green indicators—is being replaced by active AI agents. In 2024 and 2025, vendors moved beyond simple "generative text" features for writing goals and began deploying autonomous agents designed to nag, nudge, and coach employees.

Lattice sparked industry debate with its introduction of "digital workers"—AI agents that would appear on the organizational chart alongside human employees

[8]. While the company walked back the specific visual of AI on the org chart following backlash, the underlying operational shift remains: AI is moving from a passive analytics tool to an active participant in performance management.

WorkBoard followed suit, reporting that 75% of its new customers in the first half of 2025 hired "WorkBoardAI agents"

[6]. These agents perform tasks traditionally left to middle managers: identifying dependencies between teams, flagging risks in real-time, and preparing meeting agendas based on goal progress.

This trend addresses a critical operational bottleneck: the "set and forget" mentality. Traditional

Team OKR Platforms with Collaboration features often failed because users stopped logging in to update progress. AI agents invert this dynamic by extracting progress data from work systems (Jira, Salesforce, Slack) and proactively engaging users only when intervention is required.

Regulatory Pressure: The CSRD Impact

A new, external pressure is forcing European and multinational companies to treat goal platforms as compliance systems. The Corporate Sustainability Reporting Directive (CSRD) mandates that companies report on environmental, social, and governance (ESG) impacts with the same rigor as financial reporting

[9].

This directive is not a suggestion. Non-compliance carries significant penalties. In Germany, fines can reach up to €10 million or 5% of total annual turnover

[10]. In Italy, penalties range from €20,000 to €150,000, while France imposes fines up to €75,000 and potential imprisonment for directors in cases of obstructed audits

[10].

Operational teams are scrambling to find systems of record for these non-financial goals. Spreadsheets are insufficient for audit-ready ESG tracking. Consequently, OKR platforms are being repurposed to track sustainability targets—Scope 1, 2, and 3 emissions reductions, diversity metrics, and governance standards—alongside revenue targets.

This regulatory environment creates a bifurcated market. US-centric platforms that ignore these requirements risk losing multinational customers. Platforms that integrate ESG frameworks directly into their objective hierarchy offer a defensive moat against compliance risks. HR leaders, specifically, are using

Goal Tracking Tools for HR & People Teams to ensure the "Social" aspect of ESG—diversity, equity, and inclusion metrics—are rigorously tracked and audit-ready.

The Convergence of Performance and Strategy

The artificial wall between "Company Strategy" (OKRs) and "Individual Performance" (Reviews) is crumbling. Historically, HR departments ran performance reviews on annual cycles, while Strategy offices ran OKRs on quarterly cycles. This misalignment created the "strategic dysfunction" cited by Gartner.

Vendors are aggressively merging these workstreams. 15Five, a player that originated in the continuous performance management space, acquired Emplify to integrate engagement data directly into performance workflows

[11]. The logic is financial as much as it is operational: Gallup’s data indicates that low engagement is a $438 billion productivity drain. Platforms that treat engagement and goal attainment as separate datasets fail to capture the leading indicators of attrition.

For buyers, this means the "best-of-breed" stack—buying one tool for OKRs and another for Performance Reviews—is becoming harder to justify.

OKR Platforms with Performance Tracking represent the unified future. These systems allow a manager to see not just *if* an employee hit their target, but *how* they did it, and whether they are at risk of burning out in the process.

This convergence also exposes operational flaws in legacy HRIS systems. Traditional HR platforms were built for compliance and payroll, not for the agile realignment of workforce priorities. The specialized platforms are winning by offering "continuous" performance management—weekly check-ins and real-time feedback—rather than the static, backward-looking annual review.

Operational Challenges in Revenue Operations

Nowhere is the execution gap more expensive than in sales. The disconnect between a corporate objective (e.g., "Enter the APAC market") and the daily activity of a sales representative (e.g., "Call 50 leads in California") is a primary source of revenue leakage.

Salesforce and other CRM giants have long held the data, but rarely the strategy. OKR platforms are attempting to bridge this by integrating directly into the CRM. The trend is moving away from manual updates—where a sales rep types "50% complete"—to automated key results driven by CRM objects.

Profit.co and Oboard are examples of vendors pushing deep Salesforce integration, turning CRM data into direct inputs for goal tracking

[12]. This integration removes the administrative burden from sales staff, a critical adoption factor.

Goal Management Tools for Sales & Revenue Teams that fail to offer bi-directional sync with Salesforce or HubSpot are increasingly viewed as "admin-heavy" and rejected by Revenue Operations leaders.

The operational challenge here is data hygiene. Automating goal progress based on CRM data requires clean data. If the CRM is filled with "garbage" opportunities, the strategic view in the OKR platform will be equally flawed. This dependency forces organizations to clean up their underlying operational data before they can successfully automate strategy execution.

The Dysfunction of Marketing Strategy

Marketing departments are exhibiting specific symptoms of the execution crisis. Gartner's survey of 403 CMOs in late 2024 revealed that organizations with high strategic dysfunction are 36% less likely to report strong business performance

[2].

This dysfunction stems from "unclear, too numerous, or conflicting enterprise objectives." Marketing sits at the intersection of product, sales, and brand, often inheriting conflicting goals from each. Without a centralized system to adjudicate these conflicts, marketing resources are diluted across too many initiatives.

The implication for platform buyers is that "marketing work management" tools (like Asana or Monday.com) are insufficient for solving *strategic* conflicts. While they manage tasks efficiently, they do not force the hard trade-off decisions required when strategy outstrips capacity. Senior marketing leaders are increasingly looking for platforms that visualize capacity against strategic priority, forcing executive alignment before resources are committed.

Financial Implications of Execution Failure

The cost of these failures is quantifiable. Beyond the Gallup engagement data, the inability to execute strategy has direct revenue implications. In-Parallel reports that strategic misalignment can waste up to 60% of a company's resources and cost up to 10% of annual revenue

[13]. For a $1 billion enterprise, that is $100 million in lost value annually due to drift, poor prioritization, and siloed execution.

This "execution drift" occurs when daily activities slowly veer away from strategic intent. It is invisible in the short term but catastrophic in the long term. Companies often try to solve this with more meetings or more rigorous reporting, but without a shared digital system of record, these manual interventions fail to scale.

Investment in OKR platforms is thus shifting from an "HR initiative" to a "CFO imperative." The business case is no longer just about "better culture"; it is about asset utilization. If 60% of resources are misaligned, the return on payroll spend is severely depressed.

Future Outlook: 2026 and Beyond

As we look toward 2026, three trends will define the sector:

"1. The End of Standalone OKRs:" The acquisition of Quantive by WorkBoard and the integration of Emplify by 15Five signal the end of the standalone OKR tool. Strategy execution will become a feature set within broader "Business Operating Systems" that combine project management, performance reviews, and BI analytics.

"2. Predictive Strategy:" AI agents will move from reactive reporting to predictive adjustment. Platforms will use historical execution data to predict the likelihood of goal attainment *before* the quarter ends. If a team has missed its leading indicators for three weeks, the system will automatically flag the risk to leadership, suggesting resource reallocation.

"3. The Auditability of Strategy:" With CSRD and increasing board scrutiny, strategy execution data will become subject to audit. Companies will need to prove not just what their goals were, but how they tracked them, who signed off on them, and the veracity of the data underpinning them.

The market has moved past the "hype cycle" of OKRs. We are now in the phase of hard operationalization. The tools that survive will be those that can handle the grit of daily execution—integrating with messy CRMs, navigating complex compliance mandates, and automating the administrative burden that has killed so many implementations before.