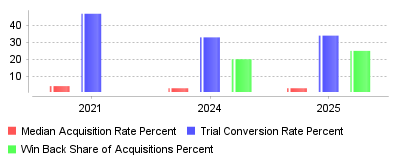

| Year | Median Acquisition Rate Percent | Trial Conversion Rate Percent | Win Back Share of Acquisitions Percent |

|---|---|---|---|

| 2021 | 4.1 | 47 | |

| 2024 | 2.8 | 33 | 20 |

| 2025 | 2.8 | 34 | 25 |

The subscription economy is undergoing a fundamental structural change characterized by significantly harder customer acquisition and the normalization of "churn and return" behavior. Data reveals that the median subscriber acquisition rate dropped from 4.1% in 2021 to just 2.8% in 2024, while free trial conversion rates plummeted from roughly 47% to 34% over the same period [1] [2]. Conversely, "pause" feature usage surged by 68% year-over-year in 2024, with some merchants seeing a 337% increase in pause usage when implementing "pause before cancel" logic [3] [4].

This trend signals that the linear "acquisition funnel" is dead; it has been replaced by a "subscriber lifecycle loop." In the macro sense, the market has reached a saturation point where consumers are no longer blindly accumulating subscriptions but are instead actively managing a portfolio of services they toggle on and off. For the industry, this means that a "cancelled" customer can no longer be viewed as a permanent loss. With nearly 1 in 4 new sign-ups now being "win-backs" (returning former subscribers), the distinction between acquisition and retention is blurring [4]. Businesses must now treat the cancellation flow not as a breakup, but as a bridge to a future reactivation.

This shift is critical because the economics of subscription commerce have changed: Customer Acquisition Cost (CAC) is rising while conversion efficiency is falling. Reliance on 2021-era growth tactics—such as aggressive free trials—is yielding diminishing returns, as trial conversion rates have dropped by over 10 percentage points [2]. Merchants ignoring this trend risk hemorrhaging marketing budget on low-quality leads, while missing the high-margin opportunity of reactivating dormant users who already know and trust the brand. The data shows that 70% of subscribers will reconsider canceling if presented with the right loyalty reward or pause option, making "save logic" a financial imperative [5].

Several converging factors likely drove this cyclical behavior. First, economic inflation and "subscription fatigue" have forced consumers to be more ruthless with their discretionary spending, leading to a "subscribe, binge, cancel" behavior pattern rather than passive retention. Second, the market has matured; consumers are now sophisticated enough to utilize "pause" features to manage their cash flow without losing their account history. Finally, regulatory pressure (such as "click-to-cancel" initiatives) has forced platforms to make cancellation easier, paradoxically pushing merchants to innovate with "pause" options to prevent total churn [6].

The winning strategy for 2025 and beyond is to embrace flexibility as a feature, not a bug. With return acquisitions accounting for 20% to 25% of "new" subscribers, the most profitable growth lever is no longer the cold lead, but the warm "win-back" [5]. Merchants must optimize their platforms to allow friction-free pausing and automated reactivation, acknowledging that in the modern subscription economy, goodbye is often just "see you later."

The global subscription economy is undergoing a fundamental maturation phase. Once characterized by a "growth at all costs" mentality driven by venture capital and novelty, the sector has pivoted sharply toward operational efficiency, retention, and complex monetization strategies. As of 2024, the global subscription economy was valued at approximately $492 billion, with projections suggesting a surge to over $1.5 trillion by 2033 [1]. However, this growth trajectory masks significant underlying volatility. The easy wins of the past decade—where acquiring a customer was simply a matter of digital arbitrage—are gone. Today, operators of Subscription & Membership Commerce Platforms face a trifecta of pressures: regulatory crackdowns on cancellation flows, the technical complexity of hybrid billing models, and the "silent killer" of involuntary churn.

This report analyzes the current operational landscape for subscription businesses, ranging from enterprise ecommerce retailers to service-based agencies. It explores how platforms are evolving to handle productized services, the specific demands of the creator economy (particularly fitness coaching), and the critical need for compliance infrastructure in an era of heightened consumer protection.

The subscription model has expanded well beyond the "box of the month" origins. While media and physical goods remain dominant, the most significant structural shifts are occurring in B2B SaaS and service-based memberships. The market is projected to grow at a Compound Annual Growth Rate (CAGR) of 13.3% through 2033, driven largely by businesses adopting recurring revenue models to ensure financial predictability [2]. However, this shift has introduced friction. Consumers and businesses alike are experiencing "subscription fatigue," leading to higher scrutiny of recurring charges.

Operational resilience is now the primary differentiator. Successful platforms are no longer just billing engines; they are comprehensive lifecycle management systems that must integrate with broader Ecommerce & Retail Software ecosystems. They must handle complex inventory forecasting for physical goods, manage usage-based metering for digital services, and automate retention workflows that prevent customers from slipping away due to technical errors.

While voluntary churn (customers choosing to leave) captures the most attention in marketing discussions, involuntary churn remains a pervasive operational failure. Involuntary churn occurs when a customer's subscription is cancelled due to payment failures, expired cards, or banking declines, despite the customer's intent to remain subscribed. Research indicates that involuntary churn accounts for approximately 20% to 40% of overall churn for subscription businesses [3].

The financial impact is severe. For a company with millions in Annual Recurring Revenue (ARR), even a 1% involuntary churn rate can compound into hundreds of thousands of dollars in lost revenue. Data from 2024 benchmarks shows an average churn rate of 4.2% across subscription businesses, with 0.7% specifically attributed to involuntary issues [4]. While this percentage seems small, it represents a "leaky bucket" that undermines acquisition efforts.

To combat this, modern commerce platforms are increasingly integrating "dunning" management—automated processes to retry payments and communicate with customers. However, basic email reminders are no longer sufficient. Leading platforms now employ:

Businesses failing to implement these decline management techniques often see churn rates significantly higher than the industry average [5].

Perhaps the most immediate operational threat to subscription businesses in 2024 and 2025 is the global regulatory shift toward "click-to-cancel" mandates. Governments are aggressively dismantling "dark patterns"—interface designs that make it easy to sign up but difficult to cancel.

In the United States, the Federal Trade Commission (FTC) finalized a "Click-to-Cancel" rule in late 2024, requiring that cancellation mechanisms be as simple as the signup process. However, this federal rule faces legal challenges, including a vacatur by the Eighth Circuit Court of Appeals in July 2025 on procedural grounds [6]. Despite this federal setback, businesses cannot be complacent. State-level laws, particularly California's amended Automatic Renewal Law (ARL) which took effect on July 1, 2025, impose strict requirements that effectively set a national standard for any digital business with customers in California [7].

California's ARL mandates:

Internationally, the landscape is equally rigorous. Germany's "Fair Consumer Contracts Act" requires a two-step cancellation button ("Cancel contracts here" followed by "Cancel now") on websites, a standard that has been strictly enforced by courts since 2022 [9]. Similarly, the UK's Digital Markets, Competition and Consumers Act (DMCC), expected to be fully enforced by 2026, introduces "cooling-off" periods for renewals and mandates straightforward exit routes [10].

For Subscription & Membership Commerce Platforms for Ecommerce Businesses, compliance is no longer a legal checkbox but a core feature requirement. Platforms must natively support regional compliance settings, allowing merchants to toggle "German-style" cancellation buttons or "California-compliant" renewal notices based on the customer's IP address or billing location. Failure to adapt leads to class-action risks and unenforceable contracts.

The traditional flat-rate subscription model (e.g., $29/month for unlimited access) is proving insufficient for many modern businesses, particularly in B2B SaaS and high-volume ecommerce. The emerging standard for 2025 is "Hybrid Billing"—a combination of a fixed recurring base fee plus variable usage charges.

Data suggests that companies employing hybrid pricing models (subscription + usage) are achieving median revenue growth rates of 21%, outperforming those utilizing pure subscription or pure usage models [11]. This shift is driven by the need to align price with value; customers prefer to pay for what they actually consume, while businesses need the safety net of recurring revenue.

Implementing hybrid billing is operationally complex. It requires a "metering" infrastructure that can track events (e.g., API calls, gigabytes stored, boxes shipped) in real-time and map them to billing cycles. Legacy billing platforms often struggle with this, leading to the rise of specialized tools like Maxio, Metronome, and Orb that sit between the product and the payment gateway [12]. For ecommerce merchants, this might manifest as a "subscribe and save" model for core items, combined with one-off add-ons that are billed to the same card on file without requiring a new checkout flow.

A significant shift is occurring in the professional services sector. Digital marketing agencies, traditionally reliant on billable hours or custom project fees, are increasingly adopting subscription models to stabilize cash flow and increase valuation. This trend, known as "productized services," involves packaging services (e.g., SEO articles, graphic design tasks) into standardized monthly subscriptions with defined deliverables.

By 2025, the pressure to adopt this model has intensified due to the need for predictable revenue. Agencies are using Subscription & Membership Commerce Platforms for Digital Marketing Agencies to manage these relationships. These platforms differ from standard ecommerce tools; they require client portals for request management, integrated approval workflows, and recurring billing that handles "pausing" (a common feature in productized services) rather than just cancellation.

Tools catering to Subscription & Membership Commerce Platforms for Marketing Agencies must now offer "self-service" capabilities where clients can upgrade their tier to get faster turnaround times or more simultaneous requests. This operationalizes the agency delivery model, turning service execution into a logistics challenge similar to shipping physical boxes.

The fitness industry offers a clear case study of how membership platforms are evolving vertically. The post-pandemic landscape has cemented a "hybrid" model where fitness professionals combine in-person training with online coaching apps. Revenue in the digital fitness segment is projected to grow significantly, but competition is fierce [13].

Generic membership software is often insufficient for this vertical. Subscription & Membership Commerce Platforms for Fitness Coaches must now integrate:

Platforms like Trainerize, Everfit, and HubFit are battling for dominance by attempting to balance ease of use with deep functionality [14]. A key trend here is "white-labeling," where coaches demand their own branded apps to build asset value, rather than just being a tenant on a third-party platform. This shift forces software vendors to offer enterprise-grade customization at price points accessible to solo entrepreneurs.

To address the conflicting needs of regulatory compliance, hybrid billing, and unique front-end experiences, enterprise subscription businesses are moving toward "headless" architecture. Headless commerce decouples the customer-facing front end (website, mobile app) from the back-end commerce engine (billing, inventory).

This separation allows for greater agility. For example, a business can update its cancellation flow to comply with new German regulations without risking the stability of its global billing system [15]. It also facilitates the "omnichannel" experience, allowing a user to manage their subscription via a mobile app, a web dashboard, or even a smart speaker interaction, with all data syncing to a central repository.

However, the move to headless is not without costs. It increases development complexity and requires a higher level of technical maturity. "Composable commerce"—selecting best-of-breed solutions for billing (e.g., Stripe/Recurly), CMS (e.g., Contentful), and email (e.g., Klaviyo)—is becoming the preferred approach for high-growth subscription brands over monolithic, all-in-one platforms [16].

As we look toward 2026, the subscription commerce landscape will be defined by retention engineering. With customer acquisition costs (CAC) remaining high, the platforms that win will be those that use AI to predict churn before it happens—analyzing usage patterns to flag at-risk customers and automatically deploying retention offers or "pause" options instead of full cancellations [17].

Furthermore, the regulatory environment will likely tighten further. The "click-to-cancel" philosophy will expand into "click-to-control," where consumers expect granular control over what they pay for (unbundling), when they pay (flexible billing dates), and how they pay (wallet consolidation). Platforms that rigidly stick to simple monthly recurring revenue models will find themselves outmaneuvered by agile competitors offering hybrid, customer-centric billing structures.