What Is Subscription & Membership Commerce Platforms?

This category covers software used to manage the complete lifecycle of recurring revenue relationships: handling complex billing logic, automating renewals and dunning processes, managing subscriber entitlements and tiers, and orchestrating the customer journey from signup to retention. It sits between CRM (which manages the sales pipeline and acquisition) and ERP (which handles the general ledger and back-office financial reporting), often serving as the financial engine that connects the two. It includes both general-purpose recurring billing engines and vertical-specific membership management tools built for sectors like digital media, associations, and physical subscription boxes.

The core problem this software solves is the operational rigidity of traditional commerce systems. Standard e-commerce platforms are built for "carts" and one-off transactions; they struggle with the concept of a relationship that changes over time (upgrades, downgrades, pauses, and usage-based metering). Subscription and membership platforms replace manual spreadsheets and disparate payment gateways with a unified system of record for recurring revenue. This matters because it allows businesses to scale beyond simple monthly fees into sophisticated monetization models—such as hybrid one-time plus recurring charges, consumption-based pricing, or tiered membership access—without requiring an army of finance staff to manually reconcile invoices every month.

Who uses these platforms? They are essential for any organization shifting from a transaction-based model to a relationship-based model. This includes SaaS companies managing thousands of seats, digital publishers gating content behind paywalls, physical goods retailers shipping monthly boxes, and professional services firms automating retainer billing. For the finance team, these platforms ensure revenue recognition compliance (ASC 606/IFRS 15). For the product team, they provide the agility to launch new pricing packages without engineering bottlenecks. For customer success teams, they offer visibility into churn risks and renewal health.

History of the Category

The trajectory of Subscription & Membership Commerce Platforms is effectively the history of the "Subscription Economy"—a shift from buying products to subscribing to outcomes. In the 1990s and early 2000s, recurring billing was largely the domain of telecommunications and utilities, managed by massive, custom-built on-premise mainframes or rigid ERP modules. If a software company wanted to charge a monthly fee, they often built a custom billing script on top of a payment gateway. There was no distinct software category; there was just "billing code" maintained by frustrated engineering teams.

The first major gap that created this category appeared in the mid-2000s with the rise of Software-as-a-Service (SaaS). As companies like Salesforce normalized the idea of renting software rather than buying perpetual licenses, the limitations of traditional ERP systems became glaring. ERPs were designed to record a sale once; they were terrible at handling prorated upgrades in the middle of a billing cycle or managing "grandfathered" pricing tiers. This operational gap birthed the first wave of cloud-native subscription management vendors, who decoupled the billing engine from the general ledger.

The late 2000s and early 2010s marked a pivotal "consolidation and definition" phase. As the "Subscription Economy" concept gained traction—evidenced by the explosion of B2C subscription boxes and digital media paywalls—buyer expectations shifted. It was no longer enough to just process a credit card every 30 days. Businesses demanded "subscription intelligence": the ability to analyze Monthly Recurring Revenue (MRR), track Churn Rates, and automate "dunning" (the process of recovering failed payments). This era saw the market split into two distinct directions: broad, horizontal billing platforms serving high-growth tech companies, and vertical-specific membership tools serving gyms, associations, and non-profits.

From 2015 to the present, the market has matured into a complex ecosystem of "monetization platforms." The shift from simple flat-rate subscriptions to complex consumption-based models (pay-per-use) forced another wave of innovation. Buyers moved from asking "Can you bill monthly?" to "Can you handle a hybrid model with a base fee, overage charges, and a one-time setup fee, all recognized correctly under new accounting standards?" Today, the category is defined by this flexibility. We have moved past the era of simple "membership databases" into an era of intelligent revenue lifecycle management, where the platform is expected not just to bill, but to actively optimize revenue through AI-driven churn prevention and dynamic pricing engines [1].

What to Look For

Evaluating Subscription & Membership Commerce Platforms requires a shift in mindset from "feature counting" to "workflow verification." The most critical evaluation criterion is flexibility in billing logic. A platform might look robust in a demo, but can it handle your specific edge cases? Ask specifically about "proration logic." If a customer upgrades from a Silver to a Gold plan on the 12th day of the month, how does the system calculate the difference? Does it issue a credit, charge the difference immediately, or add it to the next bill? The inability to configure this logic to match your business rules is a major warning sign.

Another critical factor is Revenue Recognition automation. As businesses scale, complying with accounting standards like ASC 606 becomes non-negotiable. A robust platform should automatically separate "billed revenue" (what you invoiced) from "recognized revenue" (what you have earned based on service delivery). Red flags include systems that rely heavily on manual journal entries or third-party spreadsheets to handle revenue deferrals. If the vendor says, "You can just export that to Excel to calculate deferred revenue," proceed with extreme caution.

When interviewing vendors, move beyond the standard feature list with these key questions:

- "How does your system handle 'grandfathering' pricing for legacy customers while simultaneously rolling out price increases for new signups?" (This tests their versioning capabilities).

- "Walk me through the dunning process: can we trigger different retry schedules for soft declines vs. hard declines?" (This tests their churn recovery sophistication).

- "Can I decouple the billing date from the service start date?" (Crucial for B2B contracts where onboarding might delay the subscription start).

- "Show me how a customer self-service portal handles a 'pause' request." (Many platforms claim to support pausing but actually require a cancellation and re-signup).

Finally, look for API extensibility. Your subscription platform will need to talk to your CRM, your tax calculation software, your general ledger, and your customer support desk. A "closed garden" ecosystem is a significant risk. Look for well-documented, RESTful APIs and pre-built connectors to major ERPs. If the integration relies on flat-file uploads (CSVs) rather than real-time syncing, your data latency will eventually cause customer service issues.

Industry-Specific Use Cases

Retail & E-commerce

In retail and e-commerce, the subscription platform is the operational heart of "replenishment" and "curation" models. Unlike B2B software, physical goods subscriptions involve complex logistics integration. The platform must trigger an order in the fulfillment system only after a successful payment renewal. A critical need here is inventory-aware billing: the system must know not to renew a subscription if the SKU is out of stock, or to trigger a "skip" or "swap" offer instead. Evaluation priorities often focus on the customer experience (CX) in the self-service portal. Retail buyers should look for "build-a-box" functionality where subscribers can customize their bundle each month. Unique considerations include handling shipping, tax calculations across thousands of jurisdictions, and managing "gift subscriptions" which have different expiration logic than standard recurring orders. The churn dynamics in retail are brutal, so features like "skip a month" or "change delivery frequency" are not optional—they are survival mechanisms [2].

Healthcare

For healthcare, the shift toward "value-based care" and direct primary care memberships drives the need for these platforms. Here, the priority is HIPAA compliance and data security above all else. Unlike a Netflix subscription, a healthcare membership might involve "patient adherence" tracking—where the subscription is tied to a care plan. Healthcare providers need platforms that can handle "hybrid payments," where part of the fee is paid by the member and part might be reimbursable or covered by an employer benefit. Evaluation priorities include the ability to manage family memberships (parent/child hierarchies) and integration with Electronic Health Records (EHR) systems. A unique consideration is the sensitivity of the data; the subscription platform must mask Protected Health Information (PHI) while still enabling billing triggers. As the market moves toward holistic wellness memberships, the ability to bundle services (e.g., unlimited visits) with products (e.g., supplements) is increasingly vital [3].

Financial Services

Financial services firms, including fintechs and wealth management advisories, use these platforms to manage retainer fees, advisory subscriptions, and usage-based transaction fees. The overriding need here is auditability and precision. Every cent must be accounted for, and every change to a subscription must have an immutable audit log. Evaluation priorities focus on "hierarchical billing"—the ability to bill a parent organization for the usage of hundreds of child accounts/advisors. Unlike retail, where a failed payment might just pause a shipment, in financial services, a lapse in subscription could mean a lapse in regulatory coverage or service access, carrying significant legal risks. Therefore, the "dunning" logic must be highly sophisticated, often involving manual account management intervention steps before service cut-off. Security compliance (SOC 2 Type II, PCI-DSS Level 1) is a non-negotiable gatekeeper [4].

Manufacturing

Manufacturing is undergoing a massive shift toward "Servitization" or "Equipment-as-a-Service" (EaaS). Instead of selling a compressor for $50,000, a manufacturer might sell "compressed air as a service" for a monthly fee plus usage. This requires Subscription & Membership Commerce Platforms to ingest IoT data (Internet of Things) to meter usage. The platform needs to bill based on "uptime hours," "units produced," or "gigabytes processed." Evaluation priorities shift heavily toward metering capabilities: can the system ingest millions of usage events and aggregate them into a single accurate invoice? Unique considerations include "asset-centric" billing, where the subscription is tied to a specific machine serial number rather than just a user account. This model transforms the manufacturer's cash flow from lumpy capex sales to predictable recurring revenue, but requires a billing engine capable of handling complex hardware-software service bundles [5].

Professional Services

Professional services firms (agencies, consultancies, legal firms) use these platforms to productize their services. The goal is to move away from the "feast or famine" of project-based work to steady "retainer-based" revenue. Specific needs include recurring invoicing with variable line items—for example, a flat $5,000/month retainer plus variable charges for ad spend or hours worked over a cap. Evaluation priorities include integration with project management and time-tracking software. If a consultant logs hours in a project tool, the subscription platform should ideally capture that for "overage" billing. A unique consideration is the "contract renewal" workflow. Unlike a Spotify subscription that runs forever, professional services contracts often have definitive terms (e.g., 6 or 12 months) that require a renegotiation or formal renewal event, demanding a platform that supports "renewal forecasting" and automated reminders for account managers [6].

Subcategory Overview

Subscription & Membership Commerce Platforms for Marketing Agencies

Marketing agencies face a unique challenge: they sell "time and talent," which is notoriously difficult to productize. Unlike general subscription tools that assume a standard widget is being sold, Subscription & Membership Commerce Platforms for Marketing Agencies are designed to handle high-touch, retainer-based relationships. The differentiator here is the focus on client portals and approval workflows. A generic tool might just send a PDF invoice. These specialized platforms often provide a branded portal where clients can not only pay their retainer but also view their service entitlements—for example, seeing that they have used 10 of their 15 allotted design hours for the month.

One workflow that only this specialized niche handles well is the "Retainer Rollover" logic. If a client pays for 20 hours of consulting but only uses 15, does the remaining 5 hours expire, or does it roll over to the next month? General tools struggle with this "banking" of credits. Specialized agency platforms can automate this logic, tracking the "liability" of unused hours automatically. The specific pain point driving buyers here is revenue leakage from scope creep. Agencies often do more work than the retainer covers because they lack a system that connects the billing agreement directly to the service delivery. These tools bridge that gap, ensuring that every extra hour is either billed as an overage or explicitly written off, rather than just forgotten.

Subscription & Membership Commerce Platforms for Ecommerce Businesses

While general billing platforms focus on digital access, Subscription & Membership Commerce Platforms for Ecommerce Businesses are obsessed with logistics and physical fulfillment. The key differentiator is the deep integration with shipping carriers and inventory management systems (IMS). A generic tool will happily renew a subscription for a product that has been discontinued or is backordered, leading to customer fury. These specialized tools perform "inventory checks" before processing renewals. They also handle the complexity of "box curation," allowing customers to swap flavors or sizes month-to-month without canceling the subscription.

A workflow unique to this niche is the "pre-dunning" shipment hold. If a credit card is about to expire, the system can hold the physical shipment of the box before it leaves the warehouse, saving the merchant the cost of goods and shipping for an order that hasn't been paid for. General payment gateways don't understand that a "failed payment" means "stop the warehouse picker." The primary pain point driving buyers to this niche is high churn due to lack of flexibility. E-commerce subscribers cancel when they have too much product piled up. These tools offer "skip shipment" or "change frequency" options directly in the consumer email notifications, drastically reducing churn compared to rigid "cancel only" interfaces.

Subscription & Membership Commerce Platforms for Digital Marketing Agencies

This subcategory is distinct from general marketing agency tools because of its focus on media spend reconciliation and performance-based billing. Subscription & Membership Commerce Platforms for Digital Marketing Agencies are built to handle "pass-through" costs. Digital agencies often manage thousands of dollars in ad spend on behalf of clients (on Google or Meta) and charge a percentage management fee on top. A generic subscription tool cannot dynamically calculate a bill that says: "Fixed Fee $2,000 + 10% of Ad Spend ($5,400) = Total $2,540."

The specialized workflow here is the automated ingestion of ad spend data to calculate variable billing. The platform connects to the Facebook Ads API, pulls the exact spend for the billing cycle, calculates the commission, adds the base retainer, and generates a unified invoice. The specific pain point driving buyers here is the administrative nightmare of manual reconciliation. Without this tool, finance teams spend the first week of every month downloading CSVs from ad platforms and manually typing numbers into invoices—a process prone to human error and massive delays in cash flow. These specialized platforms automate that entirely.

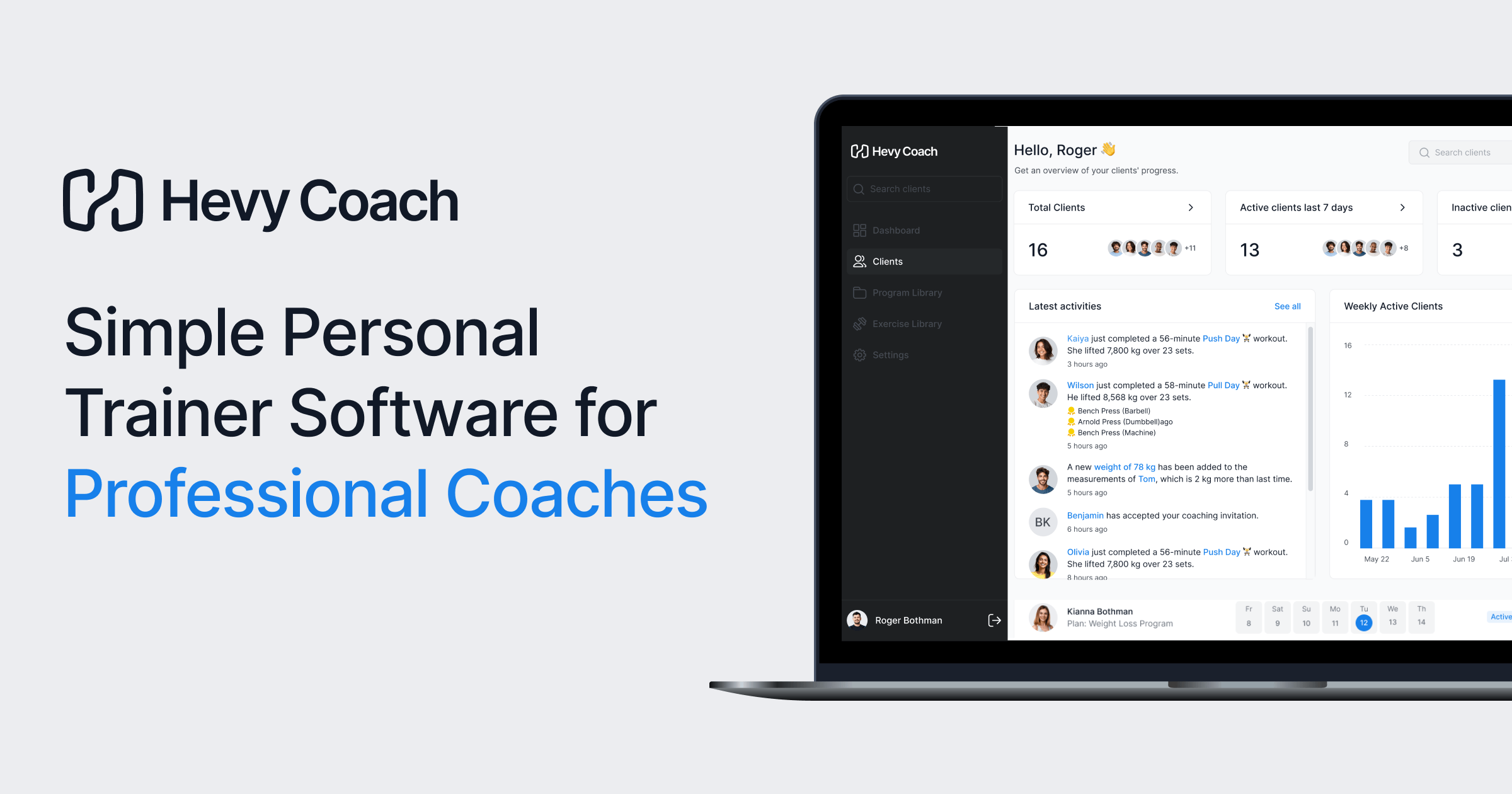

Subscription & Membership Commerce Platforms for Fitness Coaches

This niche caters to the "creator economy" and wellness professionals where the product is a mix of digital content and physical access. Subscription & Membership Commerce Platforms for Fitness Coaches differentiate themselves by combining billing with scheduling and content gating. A general subscription tool can bill $50/month, but it cannot stop a non-paying user from booking a spot in a limited-capacity Zoom class or walking into a gym.

One workflow unique to this niche is the "credit-based booking" system. A subscription might grant "8 class credits per month." The platform manages the allocation, consumption, and expiration of these credits in real-time as the client books sessions. If the payment fails, the booking rights are immediately revoked. The pain point driving buyers here is client accountability and access control. Fitness coaches lose money when clients book slots and don't show up, or when they access workout videos after their subscription has lapsed. These tools act as a digital bouncer, strictly enforcing the "no pay, no access" rule across both video libraries and calendar slots, which general billing tools simply cannot do.

Integration & API Ecosystem

The strength of a Subscription & Membership Commerce Platform is rarely defined by its standalone features, but by how well it "plays" with the rest of the tech stack. In a mature organization, the subscription engine is the "financial heart" that must pump data to the CRM (Salesforce/HubSpot) for sales visibility and the ERP (NetSuite/QuickBooks) for financial reporting. Gartner notes that integration complexity is often the single largest "hidden cost" in SaaS implementations, with integration-related expenses potentially increasing Total Cost of Ownership (TCO) by 20% or more [7]. The sheer volume of data exchange required—customer details, plan changes, usage data, payment status—makes a robust API ecosystem critical.

Scenario: Consider a 50-person professional services firm that uses a separate project management tool (like Asana) and a generic accounting tool (like Xero). They decide to implement a subscription management platform to handle their new "retainer" model. Without a pre-built, bi-directional integration, a dangerous disconnect occurs. An account manager extends a client's retainer in the subscription platform, but the project management tool isn't updated. The delivery team, thinking the contract has ended, stops work. The client, who just paid, is furious. Conversely, if the integration is poorly designed (e.g., one-way sync), a billing failure might occur, but the project team keeps working for weeks, accumulating "bad debt" that can never be recovered. A well-integrated system would instantly lock the project board when a payment fails, enforcing operational discipline automatically.

Security & Compliance

Security in subscription platforms goes far beyond basic encryption. Because these platforms store payment methods (credit card tokens) and often govern access to services, they are high-value targets for attackers. The stakes are incredibly high: according to the 2024 IBM Cost of a Data Breach Report, the global average cost of a data breach has reached $4.88 million, a 10% increase from the previous year [8]. For financial services or healthcare companies, a breach doesn't just mean a fine; it means a loss of trust that can permanently destroy the recurring revenue stream.

Scenario: Imagine a mid-sized fintech company that uses a subscription platform to manage access to its proprietary trading data. To save money, they choose a vendor that claims "security" but lacks SOC 2 Type II attestation and robust "shadow IT" controls. An employee who leaves the company retains access to an API key because the offboarding process wasn't automated via Single Sign-On (SSO). That former employee downloads the entire customer list. Or, consider a "tokenization" failure: the platform fails to properly isolate credit card tokens from the general database. A minor SQL injection attack exposes raw customer billing data. The company is now subject to massive GDPR fines and must notify every subscriber, leading to a churn spike that cripples their MRR for years. The "compliance" feature set—specifically PCI-DSS Level 1 certification and automated GDPR "Right to be Forgotten" workflows—is effectively an insurance policy against company-ending events.

Pricing Models & TCO

Pricing for Subscription & Membership Commerce Platforms typically falls into two camps: a flat monthly platform fee or a "revenue share" model (e.g., 1% of transaction volume). While the revenue share model looks attractive to early-stage startups because of low upfront costs, it can become punitive as you scale. Gartner estimates that "toxic spend"—spending on unused features or inefficient licensing—accounts for up to 30% of SaaS expenditure in enterprise companies [9]. Buyers must calculate the Total Cost of Ownership (TCO) not just on the license fee, but on the transaction volume.

Scenario: Let's look at a hypothetical 25-person team running a subscription box business. They evaluate two vendors. Vendor A charges $500/month flat. Vendor B charges $0/month but takes 1.5% of revenue. In Year 1, with $10,000 MRR, Vendor B costs them $150/month—a steal compared to Vendor A. The team chooses Vendor B. But by Year 3, the business hits $500,000 MRR. Suddenly, they are paying Vendor B $7,500 per month. The migration cost to switch platforms at this scale—migrating tokenized credit card data is notoriously difficult and risky—effectively locks them in. They are paying an "inertial tax" of $84,000 per year purely because they didn't forecast the TCO against their growth curve. The lesson: always negotiate a "cap" on transaction fees or a path to switch to flat pricing once volume thresholds are met.

Implementation & Change Management

Implementing a subscription platform is not a software installation; it is a business transformation. It requires changing how Sales sells (from one-time to recurring), how Finance recognizes revenue (from cash to accrual), and how Support handles customers. The failure rate is daunting: McKinsey research consistently shows that 70% of digital transformation initiatives—including major platform re-platforming—fail to meet their stated objectives [10]. This failure usually stems from "process debt" rather than software bugs.

Scenario: A manufacturing company decides to shift to an "Equipment-as-a-Service" model. They buy a top-tier subscription billing platform. However, they fail to involve the sales team in the implementation. The sales team, accustomed to receiving big commission checks upfront for selling hardware, revolts against the new "recurring revenue" compensation model, which pays smaller commissions over time. They simply stop selling the new subscription product, or worse, they sell it but enter the data incorrectly into the new system because they weren't trained on the rigorous data requirements of recurring billing (e.g., start dates, renewal terms). The system ends up filled with "garbage data," invoices are sent with errors, and customers refuse to pay. The implementation is technically a success—the software works—but commercially a failure because the change management regarding people and incentives was ignored.

Vendor Evaluation Criteria

When selecting a vendor, "feature parity" is often a mirage. Most vendors claim to do everything. The differentiation lies in the "depth" of specific capabilities. Forrester's research into recurring billing solutions emphasizes that "business adaptability" and the ability to handle complex, hybrid billing scenarios are the key differentiators for market leaders [11]. Buyers must evaluate vendors based on their "worst-case scenario" handling.

Scenario: A digital media company issues an RFP (Request for Proposal). Instead of asking "Do you support coupons?", they ask: "Demonstrate how your system handles a customer who applies a 50% off coupon for 3 months, then upgrades to a higher tier in the middle of month 2. Does the coupon carry over? Does it prorate? Can we prevent it from applying to the higher tier?" Vendor A says "Yes, we support coupons." Vendor B says "Here is our coupon logic engine that allows you to set 'stacking rules' and 'category exclusions'." Vendor B is the expert choice. In practice, Vendor A's simplistic coupon system might allow a savvy user to stack discounts and get the service for free, causing massive revenue leakage. Real evaluation requires testing the logic, not just the interface.

Emerging Trends and Contrarian Take

Emerging Trends 2025-2026

We are seeing a rapid shift toward "Agentic" Billing Workflows. It is no longer enough for a system to report that a payment failed; AI agents are now being tasked with autonomous recovery—generating personalized emails based on the customer's history and risk profile to recover the revenue without human intervention. Additionally, the line between "billing" and "usage analytics" is vanishing. As IDC forecasts that 80% of software revenue will come from service models by 2024-2027 [12], platforms are evolving into "Monetization Data Hubs" that don't just bill for usage but actively predict future consumption and prompt sales teams to upsell before the customer even hits their limit.

Contrarian Take

The "All-in-One" Platform is a Trap for the Mid-Market.

The industry marketing machine pushes the narrative that you need a massive, unified "Revenue Cloud" that handles everything from CPQ (Configure, Price, Quote) to Billing to Revenue Recognition. The reality is that for 90% of mid-market companies, these monolithic platforms are shelfware-in-waiting. They are overly complex, exorbitantly expensive to implement, and rigid. The contrarian truth is that a modular, "best-of-breed" stack—connecting a specialized billing engine via API to a lightweight ledger and a separate CRM—offers far more agility and ROI. Most businesses would be better off hiring one robust "Revenue Operations" engineer to manage these API connections than paying six-figure implementation fees for a monolithic suite that takes 12 months to deploy (and is obsolete by the time it goes live).

Common Mistakes

One of the most frequent mistakes is conflating "Merchant of Record" (MoR) with "Subscription Management." Many buyers assume their billing platform will handle global tax compliance (sales tax, VAT, GST). However, unless the vendor explicitly acts as the MoR, the legal liability for tax calculation and remittance remains with you. Buyers often sign a contract thinking their global tax headache is solved, only to realize the platform merely calculates the tax but doesn't remit it, leaving them exposed to audits in 50 different jurisdictions.

Another critical error is over-customization of the billing logic. Businesses often try to bend the software to fit their legacy, convoluted pricing models (e.g., "we bill on the third Tuesday unless it's a leap year"). Instead of simplifying their pricing strategy to fit standard SaaS best practices, they pay for expensive custom code. This creates "technical debt" that makes future upgrades impossible. If the software doesn't support your pricing model out of the box, it is usually a sign that your pricing model is too complex for the market, not that the software is lacking.

Finally, neglecting data migration strategy is a classic implementation killer. Companies assume they can just "import" their existing subscribers. They forget that they cannot export "credit card tokens" from their old provider easily due to PCI security rules. This often leads to a scenario where they have to ask all their existing customers to "re-enter their credit card details," resulting in a massive, self-inflicted churn event.

Questions to Ask in a Demo

- "Can you demonstrate a mid-cycle upgrade with proration, and show me exactly how the invoice looks to the customer?" (Tests the billing logic engine and CX).

- "Do you act as the Merchant of Record, or do you just integrate with a tax engine like Avalara/Vertex?" (Clarifies tax liability).

- "How do you handle 'Grandfathering'? Show me how to increase prices for new customers while keeping existing customers on their old rate." (Tests versioning capabilities).

- "What is your process for migrating credit card tokens from my current gateway (e.g., Stripe/Braintree) to your platform?" (Tests migration feasibility).

- "Show me the audit log for a subscription change. Can I see who changed the price and when?" (Tests security and compliance).

- "If I want to leave your platform in 3 years, what is the contractual SLAs for you to export my tokenized data to a new provider?" (Tests vendor lock-in).

Before Signing the Contract

Before you commit, perform a final "deal hygiene" check. First, ensure you have a "Sandbox" environment included in the contract forever, not just during implementation. You will need a place to test new pricing models without breaking your live revenue stream. Second, scrutinize the "Overage" fees. Many contracts have aggressive penalties if you exceed your transaction volume or API call limits. Negotiate these buffers upfront while you have leverage.

Check the Support SLA carefully. "24/7 Support" often means "access to a knowledge base," not a human. For a billing platform, when things break, you cannot invoice, which means you cannot collect cash. Demand defined response times for "Severity 1" issues (e.g., "Billing run failure"). Finally, look for a "Price Protection" clause for renewal. Vendor lock-in in this category is high because moving billing systems is painful; vendors know this and often hike prices significantly at renewal. A cap on future increases (e.g., "CPI + 2%") is a crucial safeguard.

Closing

Selecting a Subscription & Membership Commerce Platform is one of the most high-stakes infrastructure decisions a modern business can make. It is the operating system for your revenue. If you have specific questions about your use case or need a sounding board for your evaluation strategy, feel free to reach out.

Email: albert@whatarethebest.com