What Is In-App Survey & User Feedback Tools?

In-App Survey & User Feedback Tools represent a specialized category of software designed to capture quantitative data and qualitative insights directly from users while they are engaged with a digital product, web application, or mobile app. Unlike traditional survey methods that rely on email delivery or external links—which often suffer from low response rates and contextual disconnect—these tools interject precisely at moments of high user intent. They bridge the critical gap between Product Analytics (which tells you what users are doing) and Customer Support (which tells you what users are complaining about), providing the "why" behind user behaviors.

This software category covers the entire feedback lifecycle within the application interface: from triggering targeted micro-surveys based on specific user behaviors (such as completing a purchase or abandoning a workflow) to capturing passive, always-on feedback via widgets and bug reporting buttons. It sits cleanly between CRM platforms, which focus on the commercial relationship and pipeline, and Digital Experience Intelligence (DXI) tools, which focus on session replay and technical friction. While broad Voice of the Customer (VoC) platforms may include in-app capabilities, dedicated In-App Survey tools differ by prioritizing lightweight SDKs (Software Development Kits), minimal latency, and deep integration with product telemetry.

The category includes both general-purpose platforms suitable for mid-market SaaS and enterprise-grade, vertical-specific solutions tailored for highly regulated industries like healthcare and finance. The core problem solved is the "Context Gap": by the time a user opens an email survey three days after using a feature, their emotional state and specific friction points have faded. In-app tools capture sentiment in real-time, delivering response rates that are often 10x higher than email-based alternatives [1].

History of the Category

The lineage of In-App Survey & User Feedback Tools traces back to the late 1990s and early 2000s, a period dominated by on-premise Customer Relationship Management (CRM) systems. During this era, customer feedback was largely a "system of record" problem. Organizations treated feedback as data to be stored rather than intelligence to be acted upon. The primary mechanisms were paper comment cards digitized into databases or clunky email surveys sent weeks after a transaction. The gap was palpable: businesses had databases full of customer contacts but zero visibility into the actual user experience (UX) of their burgeoning digital products.

The mid-2000s saw the rise of web intercepts—annoying pop-ups that asked "Do you want to take a survey?" before a user had even engaged with the site. While rudimentary, these were the ancestors of modern in-app feedback. The real inflection point arrived in the early 2010s with the explosion of the mobile app ecosystem and the shift to SaaS business models. Product teams realized that retention, not just acquisition, was the engine of growth. This shifted buyer expectations from "give me a database" to "give me actionable intelligence."

By 2015, a wave of vertical SaaS and specialized tools emerged, driven by the realization that email surveys yielded abysmal response rates (typically 1-3%). New players focused on "micro-surveys"—one or two questions delivered natively within the app interface. This period also marked significant market consolidation and the rise of the "Experience Management" (XM) category, cemented by SAP's acquisition of Qualtrics for $8 billion in 2018 (later spun out) and massive valuations for players like Medallia. These acquisitions signaled that user feedback had graduated from a support ticket metric to a boardroom-level KPI. Today, the market has matured into a sophisticated ecosystem where tools are expected not just to collect data, but to close the feedback loop automatically through integrations with Slack, Jira, and Salesforce.

What to Look For

Evaluating In-App Survey & User Feedback Tools requires a discerning eye for technical performance and data utility. The most critical criterion is technical weight and latency. Because these tools operate inside your live product, a "heavy" script or poorly optimized SDK can slow down your application, degrading the very experience you are trying to measure. Buyers must ask vendors for specific documentation on script size and loading behavior (asynchronous vs. synchronous).

Another vital factor is targeting logic and segmentation depth. A generic tool will blast a survey to every user who logs in. A superior tool allows you to trigger surveys based on complex boolean logic: "Show this survey only to Enterprise users who have used Feature X three times in the last 7 days but have not submitted a support ticket." This precision prevents survey fatigue and ensures relevance. Red flags include vendors who cannot demonstrate granular event-based triggering or who rely solely on URL targeting (which is insufficient for single-page applications).

Data portability and integration should be non-negotiable. Warning signs appear when a vendor treats your data as a silo. You should look for bidirectional synchronization—feedback should flow into your data warehouse or CRM, and user attributes from your CRM should flow into the survey tool to enrich analysis. Key questions to ask vendors include: "Does your SDK support custom variables for user identification?", "Can we throttle survey frequency at a global level to prevent over-surveying?", and "How do you handle data residency requirements for GDPR/CCPA compliance?"

Industry-Specific Use Cases

Retail & E-commerce

In the high-volume world of Retail and E-commerce, In-App Feedback tools are primarily used as conversion optimization engines. The specific need here is identifying friction at the point of purchase without interrupting the checkout flow. Retailers use "exit-intent" surveys on cart pages to ask, "What stopped you from buying today?" capturing reasons like unexpected shipping costs or coupon failures in real-time. Unlike B2B sectors, the volume of feedback is massive, so the priority is on Natural Language Processing (NLP) capabilities that can auto-categorize thousands of "sizing was off" or "delivery too slow" comments.

Evaluation priorities for this sector focus on mobile responsiveness and speed. With mobile commerce dominating, the feedback widget must not cover the "Buy Now" button or slow down page load times, which directly impacts Google Core Web Vitals and SEO rankings. A unique consideration is the integration with loyalty programs; advanced retailers link survey responses to loyalty IDs to offer immediate remediation (e.g., a discount code) to dissatisfied high-value shoppers. Recent data indicates that optimizing conversion rates is critical, as average e-commerce conversion rates hover around 2.5%, meaning 97.5% of visitors leave without purchasing [2].

Healthcare

For Healthcare, the stakes for In-App Feedback tools shift from conversion to compliance and patient outcomes. These tools are used to measure Patient Experience (PX) within telemedicine apps and patient portals. The specific need is to capture feedback on care quality ("Did the doctor explain your diagnosis clearly?") immediately after a video consultation. Unlike other industries, anonymity and data security are paramount due to HIPAA regulations in the US and GDPR in Europe.

Evaluation priorities must center on security certifications. A red flag here is any vendor unwilling to sign a Business Associate Agreement (BAA). Unique considerations include "adverse event reporting." If a patient provides feedback indicating a medical emergency or a severe side effect via a feedback widget, the system must have immediate escalation workflows to alert medical staff, rather than just logging the data for later analysis. Mobile app development in healthcare is increasingly requiring robust encryption and role-based access control to protect Protected Health Information (PHI) [3].

Financial Services

Financial Services firms use these tools to build trust and ensure regulatory compliance, such as the FCA's Consumer Duty in the UK or CFPB requirements in the US. The specific need is monitoring "customer understanding"—verifying that users actually understood the terms of a loan or investment product they just viewed in the app. Banks use feedback tools to intercept users who linger on "Terms and Conditions" pages to ask, "Is this information clear to you?"

Evaluation priorities include on-premise or private cloud deployment options, as many financial institutions restrict data from leaving their controlled environments. A unique consideration is the requirement for audit trails; every piece of feedback and the subsequent action taken must be logged to prove to regulators that the firm is acting in the customer's best interest. The stakes are high: enhancing customer experience can reduce churn by 15% and increase win rates by 40% in this sector [4].

Manufacturing

In Manufacturing, In-App Feedback tools are deployed not for consumers, but for the "frontline workforce" using tablets and HMI (Human-Machine Interface) screens on the shop floor. The specific need is to capture operator feedback on machine performance, safety hazards, or digital work instructions. A worker might flag a confusing step in a digital assembly guide directly through the interface.

Evaluation priorities shift to usability in harsh environments (e.g., large buttons that can be tapped while wearing safety gloves) and offline capabilities, as many factory floors have spotty Wi-Fi. A unique consideration is the integration with Manufacturing Execution Systems (MES). Feedback often needs to be tied to specific work orders or equipment IDs to be actionable. Research indicates that 78% of frontline workers are dissatisfied with aspects of their job, often citing outdated tools and lack of voice [5].

Professional Services

Professional Services firms (consultancies, legal, agencies) use these tools to manage client health during long-term engagements. Instead of transactional feedback, they use "relationship" surveys (like periodic NPS) triggered within client portals. The specific need is to identify "silent churn"—clients who are still logging in but whose engagement is dropping, or who are quietly unhappy with deliverables.

Evaluation priorities focus on non-intrusiveness and high-touch integration with Account Management systems. Feedback shouldn't just go to a dashboard; it should trigger a task for the Account Partner in Salesforce. A unique consideration is the "multi-stakeholder" nature of these accounts; tools need to track sentiment across different roles within a single client organization (e.g., the user vs. the buyer) to give a true health score. Automation in feedback loops is becoming a key differentiator here to maintain high-touch relationships at scale [6].

Subcategory Overview

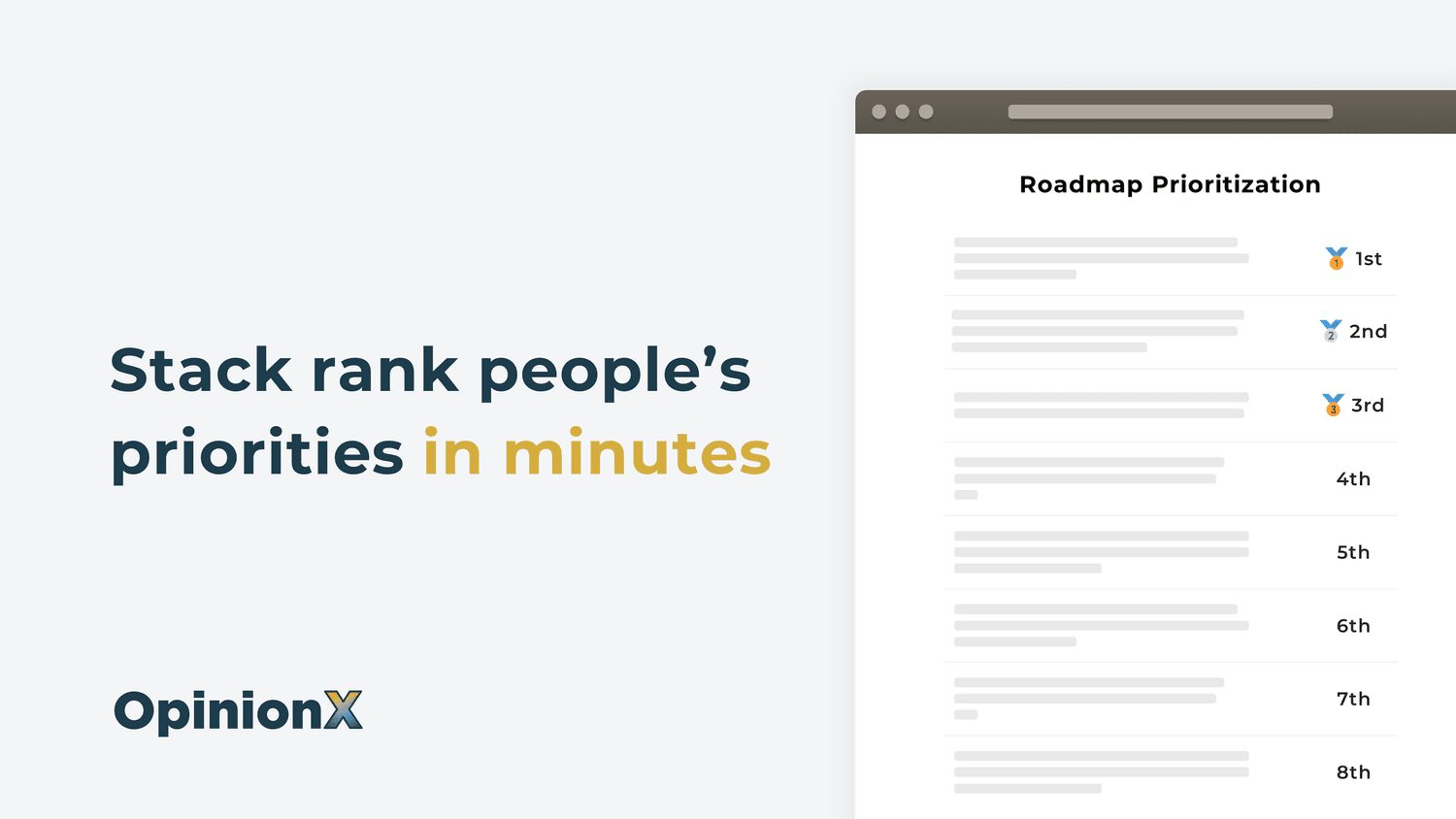

User Survey Tools with Targeting and Segmentation

This subcategory is distinct because its primary value proposition is precision. Unlike generic tools that broadcast surveys to all users, these platforms ingest live user data—such as "Total Spend > $500" or "Days Since Last Login < 2"—to trigger surveys only when relevant. The specific differentiator is the bi-directional data flow: the tool doesn't just display a survey; it reads the user's state from your database to decide if it should display. One workflow that ONLY this niche handles well is "feature-specific adoption research." For example, triggering a "How was this?" micro-survey exactly 5 seconds after a user interacts with a new beta feature for the first time. Buyers are driven to this niche by the pain point of "survey fatigue" and low data quality caused by asking the wrong users irrelevant questions. For a deeper look at these precision instruments, refer to our guide to User Survey Tools with Targeting and Segmentation.

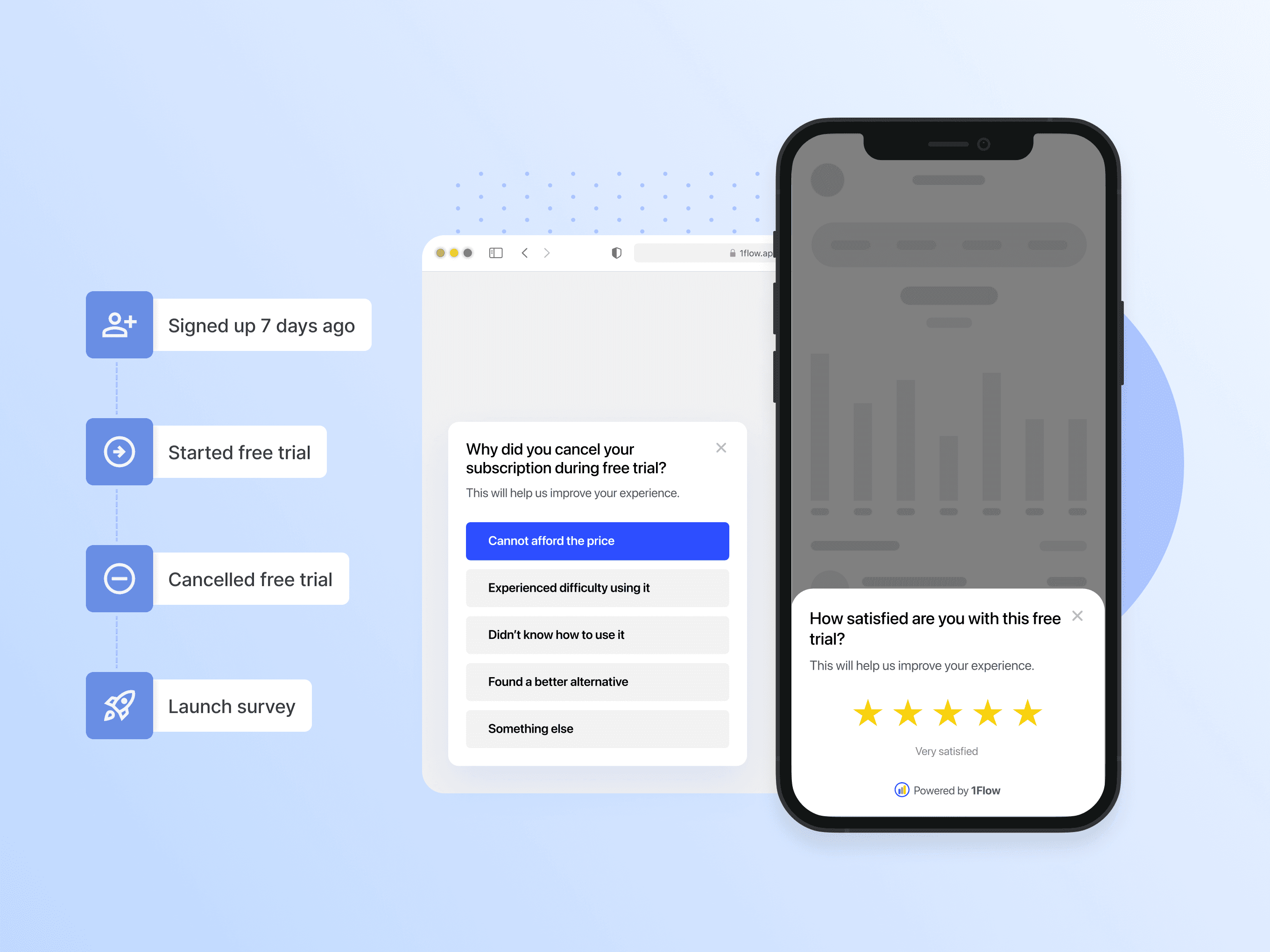

In App Survey Tools for SaaS Products

These tools are purpose-built for the subscription economy, where retention is the north star metric. What makes this niche genuinely different is its focus on the "customer journey" specific to software: Onboarding, Activation, Adoption, and Renewal. A workflow that only these tools excel at is the "Churn Prediction Pulse." By tracking subtle dips in sentiment scores alongside usage metrics (e.g., reduced logins), these tools can flag an account as "at-risk" months before the contract expires. The specific pain point driving buyers here is the "leaky bucket"—the inability to understand why users drop off during the trial-to-paid conversion window. These tools often come with pre-built templates for Product-Market Fit (PMF) and Customer Effort Score (CES). To explore solutions tailored for subscription businesses, see In App Survey Tools for SaaS Products.

In App Feedback Widgets for Web Apps

While surveys are active/solicited, Feedback Widgets are passive/unsolicited. This niche covers the "always-on" buttons (usually labeled "Feedback" or "Report a Bug") that sit on the periphery of the interface. The differentiator is availability; they allow users to initiate the conversation. A workflow unique to this category is "visual bug reporting." These tools often automatically capture a screenshot, browser version, OS, and console logs when a user submits feedback, saving engineering teams hours of reproduction time. The pain point driving buyers here is the inefficiency of traditional support tickets, which often lack technical context and require endless back-and-forth email chains to resolve simple UI issues. For tools that handle this passive collection, check out In App Feedback Widgets for Web Apps.

User Feedback Tools with NPS and CSAT

This subcategory focuses on standardized, longitudinal benchmarking. While other tools might offer flexibility, these platforms are rigid about methodology to ensure statistical validity for metrics like Net Promoter Score (NPS) and Customer Satisfaction (CSAT). The specific differentiator is "benchmarking and closing the loop." These tools don't just calculate a score; they provide workflows to categorize respondents (Promoters, Detractors) and trigger automated follow-up campaigns. A workflow unique to this niche is "Detractor Recovery," where a low score instantly alerts a Customer Success Manager to intervene. Buyers gravitate here when their pain point moves from "product usability" to "brand loyalty" and executive reporting. To implement these standard metrics, review our guide to User Feedback Tools with NPS and CSAT.

Integration & API Ecosystem

The true power of in-app feedback tools lies not in collection, but in connection. A siloed feedback tool is a graveyard for insights. The integration ecosystem must be evaluated based on its ability to push and pull data in real-time. According to Gartner, by 2025, 60% of organizations with Voice of the Customer (VoC) programs will supplement traditional surveys by analyzing voice and text interactions, necessitating robust API connections [7].

Scenario: Consider a 50-person professional services firm using a specialized feedback tool. They integrate it with their project management system (e.g., Jira) and their billing platform. When a client submits negative feedback about "slow delivery" via the in-app widget, a poorly designed integration might simply email the account manager. A robust integration, however, would automatically flag the client's account in the billing system to pause automated invoice chasing (to avoid adding insult to injury) and create a high-priority ticket in Jira for the project lead. Without this automated "air traffic control," the firm risks sending a bill to a furious client 10 minutes after they complained, leading to preventable churn.

Security & Compliance

Security is the silent killer of software deals. For in-app feedback tools, which sit inside your product and often capture sensitive user data, the standards are incredibly high. It is not enough to be "secure"; vendors must be compliant with frameworks like SOC 2 Type II, ISO 27001, and regional laws like GDPR and CCPA. In healthcare, HIPAA compliance is non-negotiable. Forrester notes that data security and privacy risks are among the top inhibitors for adoption of cloud-based feedback solutions in regulated industries [8].

Scenario: A mid-sized fintech company attempts to purchase a popular feedback tool. During the security review, the InfoSec team discovers that the vendor stores data in a multi-tenant database without cell-level encryption and lacks a defined data retention policy. Furthermore, the vendor cannot guarantee data residency in the EU, violating the company's GDPR obligations. The deal is killed instantly. To avoid this, buyers must simulate a "Data Subject Access Request" (DSAR) during the evaluation: ask the vendor, "If a user asks to be forgotten, show me exactly how we delete their feedback from your backups within 30 days."

Pricing Models & TCO

Pricing in this category typically falls into two camps: usage-based (based on Monthly Active Users or "MAU") and seat-based (based on admin users). Understanding the Total Cost of Ownership (TCO) requires forecasting your own growth. Bain & Company highlights that while 35% of software vendors have increased per-seat pricing, there is a distinct shift toward hybrid models layering usage fees on top [9].

Scenario: A SaaS startup with 25 employees and 50,000 MAUs evaluates two tools. Tool A charges $500/month for unlimited seats but caps surveys at 10,000 responses. Tool B charges $200/month per admin seat but allows unlimited responses. On the surface, Tool B looks cheaper for a 2-person product team ($400/month). However, as the company grows and wants to give access to Support, Success, and Engineering (10 users total), Tool B's cost balloons to $2,000/month. Meanwhile, Tool A remains stable unless their user base explodes. The TCO calculation must include not just the license, but the cost of "overage" fees—often priced punitively high—if you accidentally trigger a survey to your entire user base.

Implementation & Change Management

Technical implementation of an in-app feedback tool is usually lightweight (a JavaScript snippet or mobile SDK), but organizational implementation is where failure happens. The challenge is "Feedback Paralysis"—collecting so much data that teams freeze. McKinsey reports that organizations that successfully integrate customer insights into operations can reduce churn by 15% and increase win rates by 40%, but this requires distinct operational changes [4].

Scenario: An e-commerce team implements a new feedback tool and immediately launches three surveys: a site-wide NPS, a post-purchase CSAT, and a "report a bug" widget. Within week one, they receive 5,000 responses. The Product Manager is overwhelmed. Support is flooded with tickets they didn't know were coming. The "bug reports" are mostly complaints about pricing, which Engineering ignores. The implementation fails not because the software broke, but because there was no "triage protocol." A successful rollout requires defining before launch: Who owns pricing feedback? (Marketing). Who owns UI bugs? (Engineering). Who owns shipping complaints? (Operations). Without this routing, the tool becomes a noise generator.

Vendor Evaluation Criteria

Beyond features, buyers must evaluate the vendor's partnership potential. In a crowded market, support and roadmap influence are key differentiators. Gartner emphasizes that "Ease of Use" and "Support Experience" are top drivers for customer satisfaction in the Voice of the Customer market, often outweighing pure feature density [10].

Scenario: An enterprise buyer evaluates Vendor X and Vendor Y. Both have identical technical specs. The buyer asks, "Tell me about a time a customer requested a feature you didn't have, and how you handled it." Vendor X says, "We added it to the backlog." Vendor Y says, "We worked with them to find a workaround using our API, and then released the native feature 3 months later." The buyer chooses Vendor Y. The critical test is to ask for a reference call with a customer of similar size and ask specifically about downtime communication and support responsiveness during critical incidents.

Emerging Trends and Contrarian Take

Emerging Trends 2025-2026: The dominant trend is the shift from "solicited" to "inferred" feedback. AI agents are beginning to analyze user behavior (rage clicks, mouse thrashing) and open-text inputs to predict dissatisfaction before a survey is even shown. We are also seeing platform convergence, where feedback tools are being swallowed by broader Experience Platforms (like Medallia or Qualtrics) or Product Analytics suites (like Amplitude), reducing the need for standalone point solutions.

Contrarian Take: Most companies should stop measuring NPS entirely.

The industry is obsessed with Net Promoter Score as a holy grail metric, but for 90% of mid-market companies, it is a vanity metric that actively distracts from operational reality. A reader nodding along knows that a +50 NPS means nothing if churn is high. The counterintuitive insight is that Customer Effort Score (CES)—measuring how hard it was to do a task—is a far superior predictor of future loyalty than asking "Would you recommend us?" in a B2B context where users often have no choice in the software they use.

Common Mistakes

A frequent error is Over-Surveying, leading to user hostility. Sending an NPS survey every time a user logs in is a surefire way to train users to ignore your communications. Best practice suggests a "quarantine period" (e.g., do not survey the same user more than once every 90 days). Another massive mistake is Asking Questions You Already Know the Answer To. Never ask a logged-in user "What plan are you on?" or "How long have you been a customer?" Your tool should ingest this metadata automatically. It signals laziness and disrespects the user's time.

Finally, the "Black Hole" effect is damaging: collecting feedback and never acknowledging it. Even a simple automated "Thanks, we fixed that bug you reported!" message can turn a detractor into a promoter. Ignoring this "closing the loop" step negates the ROI of the entire program.

Questions to Ask in a Demo

- "Can you show me exactly how to prevent a user from seeing a survey if they have an open support ticket?" (Tests integration and logic).

- "What is the 'payload' weight of your SDK, and does it load synchronously or asynchronously?" (Tests performance impact).

- "Show me the export format of the raw data. Is it clean JSON/CSV, or does it require massive cleanup?" (Tests data portability).

- "How do you handle identity resolution if a user logs in from a different device mid-survey?" (Tests cross-platform capability).

- "Do you have a 'sandbox' environment where we can test surveys before pushing to production?" (Tests enterprise readiness).

Before Signing the Contract

Before the ink dries, ensure you have a Service Level Agreement (SLA) that covers support response times, not just uptime. Negotiate the definition of "Active User" if pricing is usage-based—does a login count, or only a survey impression? Ensure there is a "Data Exit" clause: if you leave the vendor, you must be able to export all your historical feedback data in a usable format without punitive fees. Finally, check the Business Associate Agreement (BAA) status if you are in healthcare, or Data Processing Addendum (DPA) for GDPR; do not sign until your legal team has validated their compliance claims.

Closing

Navigating the In-App Survey & User Feedback landscape requires balancing technical constraints with the human need for empathy. The right tool acts as a listening post that scales, turning millions of interactions into a coherent voice. If you have specific questions about your stack or need a sounding board for your TCO calculation, feel free to reach out directly.

Email: albert@whatarethebest.com