What Is Retail POS & Point of Sale Software?

Retail POS & Point of Sale Software covers the transactional and inventory management systems used to execute, record, and reconcile sales at the moment of purchase. Unlike broad financial tools, this category manages the specific operational lifecycle of a transaction: scanning or selecting items, calculating taxes and discounts in real-time, processing payments (via integrated hardware), updating inventory levels instantly across locations, and capturing customer data for loyalty and marketing purposes. It sits between E-commerce Platforms (which handle digital-only transactions) and ERP Systems (which manage back-office finance and supply chain). It includes both general-purpose cloud platforms designed for multi-location retail and highly specialized vertical tools built for complex workflows in industries like hospitality, automotive, and personal services.

The core problem this software solves is the synchronization of physical commerce with digital records. Without a competent POS, retailers face "inventory drift," where physical stock levels decouple from digital records, leading to overselling online and stockouts in-store. For modern operators, the POS is no longer just a cash register; it is the data origination point that feeds truth into accounting, CRM, and supply chain forecasting. Whether for a single boutique or a multinational chain, the POS system acts as the operational nerve center, determining how quickly a business can process customers and how accurately it can report on its own performance.

History of Retail POS Software

The evolution of POS software from the 1990s to the present is a case study in the shift from hardware-centric constraints to software-enabled agility. In the early 1990s, the market was dominated by "server-client" architectures running on Windows or DOS. These systems were essentially glorified calculators attached to local databases. They were robust but rigid; data lived on a server in the back office, and "polling" (sending sales data to headquarters) happened once a day, typically overnight via dial-up modems. This era was defined by the "siloed store" model—headquarters would not know a store's inventory position until the next day [1]. The gap that created the modern POS category was the inability of these legacy ERP-lite systems to handle real-time data exchange required by the burgeoning internet age.

The early 2000s introduced the first wave of cloud computing, though adoption in retail was slow due to internet reliability concerns. This period saw the rise of vertical SaaS—software built specifically for the unique workflows of restaurants (table management) versus retail (inventory density). The critical turning point occurred around 2010 with the introduction of tablet-based mobile POS systems. This decoupled the software from proprietary, expensive hardware terminals, allowing retailers to run enterprise-grade software on consumer-grade devices. This shift forced legacy providers to acquire cloud-native startups, leading to a massive wave of consolidation between 2012 and 2018. The market moved from selling "license keys" to selling "subscriptions," fundamentally changing the total cost of ownership for buyers.

Today, the historical trajectory has moved beyond simple cloud connectivity to "Unified Commerce." As noted by industry analysis, the focus has shifted from "give me a database" to "give me actionable intelligence." In the 2020s, the expectation is that a POS system does not just record a sale but actively orchestrates the order, routing it from a digital channel to a physical fulfillment point (like Buy Online, Pickup In-Store). The modern era is defined by API-first architectures that allow the POS to act as a headless engine, powering transactions on social media, mobile apps, and kiosks simultaneously, rather than just sitting on a counter [2].

What to Look For

Evaluating Retail POS software requires moving beyond the feature checklist and scrutinizing the architectural limitations of the platform. The most critical criterion is offline resiliency. Cloud-first does not mean "internet-dependent." A robust system must have a local database that allows full transaction processing—including credit card encryption and cash drawer operation—when the internet connection fails, syncing automatically once connectivity is restored. Buyers should look for "store-and-forward" capabilities that are invisible to the cashier.

Another critical factor is the API rate limit and depth. Many vendors claim to integrate with other tools, but their APIs may only sync data every 15 minutes or limit the number of calls per hour. For a high-volume retailer, this latency is unacceptable. You must look for webhooks that trigger immediate updates in your ERP or ecommerce platform the second a sale occurs. If the vendor relies on batch processing for integrations, it is a red flag for any business with high inventory velocity.

Red flags also include proprietary hardware lock-in. Be wary of vendors that require you to purchase credit card terminals or printers that only work with their software. This creates a "hardware hostage" situation where switching software requires a complete capital expenditure refresh. A healthy POS ecosystem supports standard protocols (like OPOS or JPOS) and generic peripherals. Furthermore, scrutinize the payment processing terms. Many modern POS vendors subsidize their software costs by locking you into their internal payment processing at non-negotiable rates. While convenient, this can cost thousands of dollars a month in hidden fees as your volume grows. Always ask: "Can I bring my own processor, and if so, what is the surcharge?"

Industry-Specific Use Cases

Retail & E-commerce

For the retail and e-commerce sector, the POS is the bridge between the digital and physical worlds. The specific need here is real-time inventory synchronization to prevent the "phantom stock" problem—where a customer buys an item online that was sold in-store five minutes prior. General-purpose POS systems often fail here because they rely on batched updates. Retailers must prioritize systems that support "endless aisle" capabilities, allowing store associates to sell online inventory to walk-in customers and ship it to their homes. Evaluation priorities should focus on the granularity of the matrix inventory (handling size, color, style variants efficiently) and the robustness of the return management system, specifically the ability to accept cross-channel returns (buying online, returning in-store) without breaking the tax or accounting logic [3].

Healthcare

In healthcare environments, such as hospital gift shops, cafeterias, and outpatient pharmacies, the POS plays a distinct role centered on compliance and identity verification. Unlike standard retail, these systems often need to integrate with employee payroll for "payroll deduction" payments (where staff buy lunch with their badge) and must handle HIPAA-compliant data if patient prescriptions are involved. Unique considerations include the ability to manage restricted items (like pseudoephedrine) and integration with hospital ADT (Admission, Discharge, Transfer) systems to deliver "meds-to-beds" services upon patient discharge. Evaluation must prioritize security certifications and the ability to handle complex, non-standard payment tenders unique to medical campuses [4].

Financial Services

For financial services, particularly in branch banking, the POS is transforming into a "service point" that blends transaction processing with relationship management. Banks use specialized POS software to handle the sale of financial products (like cashier's checks or foreign currency) while adhering to strict Anti-Money Laundering (AML) and Know Your Customer (KYC) regulations. The evaluation priority here is auditability and role-based access control. Every keystroke and drawer opening must be logged for compliance. Furthermore, these systems often need to integrate with core banking platforms to validate account balances in real-time before accepting funds, a workflow completely foreign to traditional retail POS tools [5].

Manufacturing

Manufacturing firms increasingly use POS software for Direct-to-Consumer (DTC) spare parts sales and factory outlet operations. The specific need is deep integration with complex ERP Bill of Materials (BOM) systems. When a customer buys a spare part at a factory counter, the POS must not only deduct the finished good but potentially trigger a production signal if safety stock is breached. Unlike retail, where the unit of measure is usually "each," manufacturing POS usage may need to handle fractional quantities or bulk commercial pricing tiers. The unique consideration is the ability to handle both B2B account receivables (selling on credit terms) and B2C immediate payments in the same interface [6].

Professional Services

For professional services (salons, repair shops, consultancies), the POS is secondary to the calendar and resource management function. The workflow here is "Book -> Service -> Pay," rather than "Pick -> Pay." Specific needs include the ability to bundle service labor hours with physical inventory (e.g., shampoo or replacement parts) in a single transaction. Evaluation should focus on "resource blocking," ensuring that the POS prevents booking a service if the required room or equipment is unavailable. The pain point with general retail POS tools in this sector is their inability to handle commissions structures for service providers, which are often complex and tiered based on performance [7].

Subcategory Overview

Retail POS Software for Retail Stores

This subcategory represents the foundational layer of the market, designed for high-velocity environments where speed at the checkout counter is paramount. What makes this niche genuinely different from generic tools is the depth of its matrix inventory management. General tools struggle when a single t-shirt comes in 5 sizes and 10 colors, creating 50 unique SKUs that must be reported on collectively and individually. Specialized tools handle this hierarchy natively. A workflow that only this tool handles well is the "stock transfer" between multi-unit locations—identifying a stockout in Store A, locating the item in Store B, and initiating a transfer request directly from the register. Buyers leave general tools for this niche when they hit the "reporting wall," where they can no longer see sell-through rates by category or brand efficiently. For a deeper analysis of matrix handling, see our guide to Retail POS Software for Retail Stores.

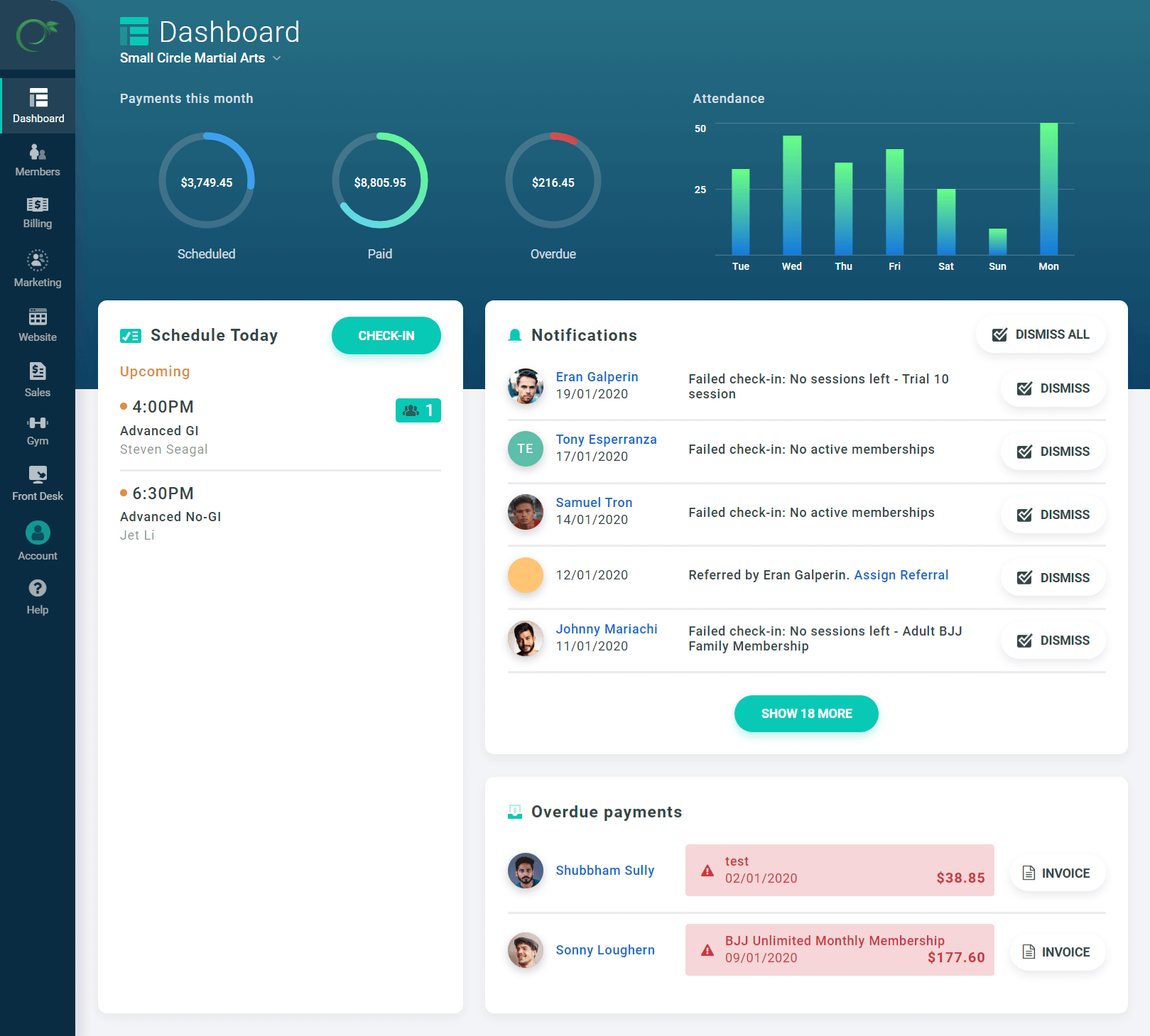

Retail POS Software for Gyms

POS software for gyms is distinct because it must function as an access control system first and a point of sale second. Unlike a retail store where anyone can enter, a gym POS often controls physical turnstiles or door maglocks based on membership status. The specific differentiator is "recurring billing automation." While a retail store processes one-time transactions, a gym POS must manage monthly direct debits and handle dunning (retrying failed payments) automatically. A workflow unique to this niche is the "check-in to upsell" flow: as a member scans their badge, the POS alerts the desk staff that the member’s credit card is expiring or that they have a balance due, prompting an immediate interaction. The pain point driving buyers here is the inability of generic POS to handle membership pauses, prorated cancellations, and family account structures. Explore more in our guide to Retail POS Software for Gyms.

Retail POS Software for Restaurants

The defining characteristic of restaurant POS is temporal order management—the ability to hold an order open over time while modifying it (courses, drinks) before payment. Generic POS systems treat a transaction as "open, scan, close," which breaks in a dining environment. This niche handles "modifier logic" (e.g., "Steak: Rare, No Sauce, Sub Fries") that forces kitchen printers to route specific items to specific stations (Grill vs. Fryer). A workflow only this specialized tool handles is "check splitting," where a single table's bill is divided by seat, by item, or by arbitrary fractions at the end of the meal. Buyers flee general tools toward this niche when the chaos of the kitchen pass leads to errors; they need a Kitchen Display System (KDS) integration that only restaurant-specific POS can provide. Read more about table management in our guide to Retail POS Software for Restaurants.

Retail POS Software for Rental Agencies

Rental POS software fundamentally changes the definition of "inventory" from "quantity on hand" to "availability over time." In a generic POS, selling an item removes it from the database forever. In a rental POS, the transaction is a "loan" with a specific return date. This niche excels at booking calendars and utilization tracking. A workflow unique to this tool is the "check-out / check-in" inspection process, where the condition of an item (cameras, heavy machinery, tuxedos) is verified upon return, and damage fees are automatically calculated against a security deposit. The specific pain point driving buyers to this niche is "double booking"—generic tools cannot prevent renting the same item to two different customers for overlapping dates. For details on availability logic, see Retail POS Software for Rental Agencies.

Retail POS Software for Ecommerce Businesses

This subcategory is built for "digital-native" brands expanding into physical spaces (pop-ups, brick-and-mortar). What makes it different is that the master record of truth is the web store, not the physical store. The POS is essentially a "skin" on top of the e-commerce backend. A workflow that only this tool handles well is the unified customer profile: a customer can walk into a store, and the associate can instantly see their online browsing history, abandoned carts, and lifetime value to tailor the in-person experience. The pain point driving buyers here is "catalog fragmentation"—they are tired of managing product descriptions and prices in two separate systems (POS and Website) and want a single dashboard that pushes updates everywhere instantly. Learn about unified commerce in our guide to Retail POS Software for Ecommerce Businesses.

Deep Dive: Integration & API Ecosystem

In the modern software stack, a POS system that stands alone is a liability. The strength of a Retail POS is measured by its ability to act as a data router—sending sales to the ledger, customer data to the CRM, and inventory decrements to the warehouse management system (WMS). The industry standard for API reliability is high; however, frequent synchronization errors plague poorly designed integrations.

A recent study by industry analysts highlights that system integration failures cost retailers millions annually, with 34% of retailers identifying weak connections between POS and other systems as a primary operational challenge [8]. This isn't just about data not showing up; it's about the operational latency that kills customer experience.

Expert Insight: As noted by Bain & Company in their 2025 Technology Report, the future of software interaction is moving from "human plus app" to "AI agent plus API," meaning the POS API must be robust enough to handle autonomous agents querying inventory without human intervention [9].

Real-World Scenario: Consider a mid-market fashion retailer with 50 locations and a centralized warehouse. They use a legacy POS that syncs with their ERP via a nightly batch file. On Black Friday, the warehouse inventory for a popular coat sells out online by 10:00 AM. However, because the POS integration is not real-time, the physical stores don't receive the "out of stock" signal until the next morning. Throughout the day, store associates continue to sell "ship-from-warehouse" orders for that coat to walk-in customers. By the time the batch processes at midnight, the retailer has oversold the coat by 200 units. The integration failure forces the operations team to manually cancel 200 orders, refund customers, and offer apology gift cards, damaging the brand's reputation and incurring significant support costs. A proper API-first integration would have triggered a webhook the moment the warehouse stock hit zero, instantly graying out the "ship-from-warehouse" button on every POS terminal chain-wide.

Deep Dive: Security & Compliance

Security in Retail POS is no longer just about locking the cash drawer; it is about protecting the encryption keys that guard customer financial data. The shift to cloud POS has moved the threat vector from physical skimming devices to remote network intrusions. Retailers are prime targets because they aggregate high-volume, low-value transactions that can be tested for validity by fraudsters.

The stakes are incredibly high. According to the 2024 IBM Cost of a Data Breach Report, the average cost of a data breach in the retail sector has reached $3.48 million, an 18% increase from the previous year [10]. This figure includes regulatory fines, forensic investigation costs, and the massive loss of customer trust.

Expert Insight: The IBM report further emphasizes that organizations using AI and automation in their security operations detected and contained breaches 98 days faster than those that did not, saving millions in potential costs [11].

Real-World Scenario: A regional grocery chain with 20 locations upgrades to a new tablet-based POS but neglects to segregate its network traffic. The POS tablets are connected to the same Wi-Fi network used by the store's guest Wi-Fi and the smart thermostats. A hacker accesses the network through a vulnerability in an unpatched smart thermostat. Because the network is flat (unsegmented), they are able to "sniff" the traffic moving between the POS tablets and the local server. Although the credit card data is tokenized (a standard compliance requirement), the hacker intercepts the unencrypted loyalty data, including names, phone numbers, and shopping habits of 50,000 local customers. The breach forces the grocer to publicly disclose the leak, pay for credit monitoring for all affected customers, and face a class-action lawsuit, ultimately costing them more than the initial price of the POS software implementation itself.

Deep Dive: Pricing Models & TCO

Pricing in the Retail POS market has shifted aggressively from large upfront license fees to "SaaS plus Processing" models. While the monthly software fee (often $60-$200 per terminal) appears low, the Total Cost of Ownership (TCO) is frequently hidden in the credit card processing rates. Vendors often incentivize—or contractually force—retailers to use their proprietary payment rails, which may charge a "flat rate" that is significantly higher than the interchange-plus market rate for high-volume merchants.

Data indicates that average credit card processing fees for merchants in 2024 range from 1.5% to 3.5%, but the effective rate can balloon if "non-qualified" surcharges are applied by the POS vendor [12].

Expert Insight: Financial analysts at Motley Fool note that in 2024, credit card companies earned a record $148.5 billion from merchant swipe fees, underscoring that for many POS vendors, the software is merely a Trojan horse to capture the lucrative payment stream [13].

Real-World Scenario: Imagine a boutique retailer processing $1,000,000 in annual sales. They choose a "free" POS software that requires using the vendor's payment processing at a flat rate of 2.9% + 30¢ per transaction. Their transaction count is 10,000 (avg ticket $100).

Annual Processing Cost: ($1,000,000 * 0.029) + (10,000 * $0.30) = $29,000 + $3,000 = $32,000.

Alternatively, they could pay for a premium POS system costing $200/month ($2,400/year) that allows them to choose their own processor. They negotiate an interchange-plus model that averages out to an effective rate of 2.2%.

Alternative Cost: ($1,000,000 * 0.022) + $2,400 (software) = $22,000 + $2,400 = $24,400.

Result: The "free" software actually costs the retailer $7,600 more per year than the premium software. This TCO trap is the most common financial mistake small retailers make.

Deep Dive: Implementation & Change Management

Implementation is the graveyard of retail technology projects. The technical installation of software is rarely the point of failure; rather, it is the inability to manage the human side of the transition. Retail staff are creatures of habit, and muscle memory at the checkout counter is powerful. Disrupting that workflow without adequate training and "buy-in" leads to slower checkout times, errors, and staff revolt.

According to Gartner, approximately 55% to 75% of ERP and major software projects fail to meet their original objectives, often due to poor change management and scope creep [14]. The failure isn't that the software doesn't work, but that the organization rejects it.

Expert Insight: A study by Panorama Consulting highlights that 95% of companies that fail in implementation dedicate less than 10% of their total budget to education, training, and change management, treating it as an afterthought rather than a core requirement [15].

Real-World Scenario: A franchise coffee chain decides to roll out a new POS system to 20 locations. The HQ IT team configures the system perfectly in a lab environment. They ship the iPads to the stores on a Tuesday with a link to a PDF manual. Wednesday morning, the morning rush hits. The baristas, who were used to the button layout of the old system, cannot find the "Extra Shot" modifier on the new screen. Lines grow out the door. Frustrated customers leave. In a panic, three store managers unplug the new system and hook the old legacy terminals back up to keep the line moving. The data for that day is now fractured between two systems, inventory is desynchronized, and the staff has lost confidence in the new tool. The rollout is paused for three months to "retrain," costing the company tens of thousands in delays. A proper implementation would have involved "pilot stores," on-site trainers during the first rush, and a simplified UI configuration for the first week.

Deep Dive: Vendor Evaluation Criteria

Selecting a vendor is an exercise in risk management. In the volatile SaaS market, a flashy website does not guarantee solvency. Buyers must evaluate the vendor's roadmap, support infrastructure, and financial health. The "support test" is crucial: call their support line at 7 PM on a Friday. If you get a voicemail, that vendor is not suitable for retail operations. Furthermore, scalability must be tested—not just claimed.

Research indicates that 42% of retailers are concerned that their current connectivity and infrastructure is too unreliable to support the modern in-store technology they are purchasing [16]. Vendors must be evaluated on how their system performs under stress—low bandwidth, high transaction volume, and hardware failure.

Expert Insight: Forrester analysts warn that one in five retailers will launch customer-facing generative AI applications in the near future, meaning your POS vendor must have a clear AI strategy or they will be obsolete within 3 years [17].

Real-World Scenario: A fast-growing apparel brand selects a boutique POS vendor that promises "white glove service." The software is beautiful and customizable. However, six months later, the brand opens five new stores in a single month. The vendor's onboarding team consists of only two people, who are fully booked. The retailer cannot get their new stores provisioned in time for the grand openings. Furthermore, as the retailer's transaction volume triples, the vendor's database starts to lag during Saturday peaks because they haven't auto-scaled their cloud servers. The retailer realizes too late that they bought a product that was still in "beta" regarding enterprise scale. They are forced to rip and replace the system after less than a year—a catastrophic waste of capital and momentum.

Emerging Trends and Contrarian Take

Emerging Trends 2025-2026: Agentic Commerce

The next frontier is not just "AI" but Agentic AI. As identified by Bain & Company, we are moving toward systems where AI agents can reason, plan, and execute complex workflows across applications [18]. In a retail context, this means the POS will soon host autonomous agents that monitor sales velocity and proactively negotiate reorders with suppliers without a human manager ever opening a spreadsheet. Additionally, biometric payments (palm scanning, facial recognition) are moving from novelty to necessity as retailers seek to reduce friction and fraud simultaneously. McKinsey predicts that retailers leveraging these advanced analytics and AI agents could see operating margins boost by over 60% [19].

Contrarian Take: The "All-in-One" Platform is a Trap

The industry marketing machine relentlessly pushes the "All-in-One" solution—POS, Ecommerce, Accounting, and HR all in a single suite. This is a strategic error for any business planning to scale. The contrarian reality is that "All-in-One" platforms are rarely best-in-class at anything; they are mediocre at everything. They create a "capability ceiling" where you cannot upgrade your loyalty program because you are stuck with the basic one built into your POS. The most resilient retailers are actually moving away from monolithic suites toward Composable Commerce—building a stack of the best possible POS, the best possible Ecommerce site, and the best possible ERP, connected by robust APIs. If a vendor tells you "you don't need other software, we do it all," they are essentially telling you "we will limit your growth to the speed of our own development team."

Common Mistakes

Buying for Today, Not Tomorrow

Retailers often select a POS based on their current SKU count (e.g., 500 items). When they expand to 5,000 items a year later, they discover the system's search function lags, or the inventory matrix cannot handle the complexity. A system must be stress-tested for 3x current volume.

Underestimating Cabling and Infrastructure

A wireless POS is great until the Wi-Fi drops. Relying solely on Wi-Fi for stationary terminals is a mistake. High-volume checkout lanes should always be hardwired via Ethernet. Wireless interference from customer cell phones and microwaves can cripple a "cloud" POS that lacks a physical connection.

Ignoring the "Click-Count"

Management often buys software based on the reports it generates for them, ignoring the workflow for the cashier. If a transaction takes 7 clicks instead of 3, you are artificially capping your revenue per hour. During evaluation, count the clicks required to add a customer, scan an item, and process a cash payment. Efficiency at the register is the heartbeat of retail profitability.

Questions to Ask in a Demo

- "Show me exactly what happens on the screen when the internet cable is unplugged. I want to see a transaction processed offline right now."

- "Does your open API allow me to extract 100% of my customer and transaction data, or are there fields that are restricted?"

- "If I use my own credit card processor, what is the specific 'gateway fee' or penalty you charge per transaction?"

- "How does your system handle a 'mixed cart' return where one item was bought online and another bought in-store, with different tax rates?"

- "Can you show me the backend log of a stock transfer between two stores? I want to see how the inventory decrement is timestamped."

Before Signing the Contract

The Data Ownership Clause

Ensure the contract explicitly states that you own your transaction and customer data. Some vendors aggregate your data to sell industry insights; you should know if your data is the product.

The "Evergreen" Renewal Trap

Watch for automatic renewal clauses that lock you in for another 3 years if you don't cancel 90 days prior. Negotiate for a 1-year term with an option to renew, or a buyout clause that decreases over time.

SLA (Service Level Agreement)

If the cloud server goes down on Black Friday, what does the vendor owe you? Demand an SLA that provides financial credits for downtime exceeding 99.9% uptime. If they won't offer it, they don't trust their own infrastructure.

Closing

Selecting a Retail POS system is one of the few decisions that physically touches every dollar your business earns. It is not a passive utility; it is the active constraints of your operation. By focusing on architecture over features, and resiliency over marketing promises, you can build a stack that empowers your growth rather than inhibiting it.

If you have specific questions about navigating the complexities of POS architecture or need an unbiased second opinion on a contract, feel free to reach out to me directly.

Email: albert@whatarethebest.com