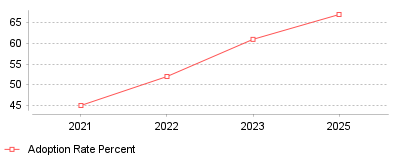

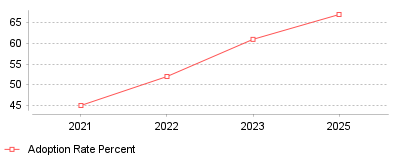

Adoption of Usage-Based & Hybrid Pricing Models

The Hybrid Billing Revolution: SaaS Abandons Flat Rates for Consumption Models Research into the Subscription Billing & Recurring Revenue Tools category reveals a decisive shift away from static, seat-based pricing toward Hybrid Billing Models—structures that combine a recurring subscription base with dynamic usage or consumption fees. Data from early 2025 reports indicates this trend has ac

| Year | Adoption Rate Percent |

|---|

| 2021 | 45 |

| 2022 | 52 |

| 2023 | 61 |

| 2025 | 67 |

The Shift to Hybrid Consumption Models

What is this showing

The data reveals a consistent migration from flat-rate subscriptions to usage-based and hybrid pricing strategies across the SaaS landscape. According to Maxio's 2025 Pricing Trends Report, 67% of SaaS companies now leverage usage or consumption-based pricing, a significant increase from 52% in 2022 [1]. This aligns with findings from Paddle, which reported that adoption of hybrid models specifically (combining platform fees with usage) jumped from 49% in 2024 to 61% in 2025 [2].

What this means

This trend signals the end of the "growth at all costs" era where companies relied on shelving expensive seat-based contracts. In the current micro-economic climate, businesses are demanding that costs align strictly with value received, forcing vendors to adopt "pay-as-you-grow" structures. On a macro level, this shift is fundamentally altering SaaS unit economics; companies using hybrid models are reporting median growth rates of 21%, outperforming both pure subscription and pure usage-based competitors [3]. It represents a maturation of the software industry into a utility-like economy, where revenue is tied to active consumption rather than passive access.

Why is this important

The survival of SaaS vendors now depends on retention and expansion rather than just net new logos. With subscriber acquisition rates crashing from 4.1% in 2021 to just 2.8% in 2024, it has become mathematically difficult to grow solely through acquisition [4]. Hybrid pricing solves this by lowering the barrier to entry (cheaper base fees) while allowing revenue to scale automatically as successful customers consume more resources, effectively building "Net Revenue Retention" (NRR) directly into the contract structure.

What might have caused this

Two primary factors are driving this rapid evolution: the "AI tax" and market efficiency pressures. As companies integrate Generative AI features, they face real variable costs (compute tokens) for every interaction, making unlimited flat-rate plans unprofitable; 44% of SaaS companies now explicitly monetize AI features to cover these costs [3]. Additionally, as noted by Bessemer Venture Partners, AI is shifting software value from "access" (seats) to "outcomes" (work done), necessitating pricing models that can capture value based on output and consumption rather than human headcount [5].

Conclusion

The "Hybrid Billing Revolution" is not a temporary experiment but a permanent structural change in how software is valued and sold. By 2025, the standard B2B contract has evolved to include a recurring platform fee for predictability alongside consumption elements for scalability. For founders and billing operators, the takeaway is clear: static pricing is becoming a competitive disadvantage, and implementing metering capabilities is now as critical as the core product itself.

The Evolution of Recurring Revenue: From Simple Subscriptions to Complex Monetization

The subscription economy has matured rapidly, transitioning from a novel business model into the dominant financial architecture for modern software, media, and service industries. As organizations move beyond simple flat-rate pricing, the operational machinery required to sustain recurring revenue has become increasingly sophisticated. The global market for subscription billing software, valued at approximately $7.63 billion in 2024, is projected to reach nearly $19 billion by 2029, driven by a fundamental shift toward hybrid monetization strategies and the need for automated financial compliance

[1].

For finance and operations leaders, the challenge is no longer just accepting recurring payments. It is managing the entire revenue lifecycle—from complex metering and rating to revenue recognition and churn mitigation—at scale. This report analyzes the critical trends reshaping the

Subscription Billing & Recurring Revenue Tools landscape and the operational hurdles businesses must overcome to maintain profitability in a high-interest, efficiency-driven market.

Trend 1: The Hegemony of Hybrid and Usage-Based Pricing

The most significant trend in the recurring revenue space is the decline of the pure "per-seat" model in favor of usage-based pricing (UBP) and hybrid structures. While fixed subscriptions offer predictability, they often fail to align price with value, leading to customer churn during budget cuts. Conversely, consumption models allow revenue to scale naturally with customer growth.

Research indicates that usage-based pricing is no longer a niche strategy for infrastructure companies. By 2025, approximately 85% of software companies report adopting some form of usage-based pricing, with 77% of large enterprises incorporating it into their revenue mix

[2]. However, few companies rely exclusively on usage. The prevailing model is "hybrid pricing", which combines a recurring base fee (for platform access) with variable consumption charges (for storage, API calls, or active users).

Operational Challenge: The Metering and Mediation Gap

Implementing usage-based models introduces severe complexity into the billing stack. Unlike flat subscriptions, UBP requires a robust "metering" infrastructure to track consumption events in real-time, and a "mediation" layer to aggregate these events into billable line items.

Many legacy billing systems were designed to handle simple recurring intervals (e.g., $50/month), not millions of usage events. This creates a technological gap where billing errors and revenue leakage become rampant. For organizations navigating this transition, deploying specialized Subscription Billing Platforms for Usage-Based Pricing Models is critical. These platforms act as a ledger for usage data, ensuring that every API call or gigabyte is accurately rated and billed, preventing the 1-5% revenue leakage often seen in manual usage reporting [3].

Trend 2: The Bifurcation of B2B and B2C Billing Requirements

As the subscription market matures, the operational requirements for Business-to-Business (B2B) and Business-to-Consumer (B2C) companies have diverged sharply. While early billing tools attempted to serve both, the current market favors specialized solutions that address the unique friction points of each model.

B2B Complexity: Contract Agility and Custom Invoicing

In the B2B sector, the "subscription" is often governed by a negotiated contract rather than a standard checkout flow. B2B buyers require purchase orders (POs), net-payment terms (e.g., Net 30/60), and consolidated invoicing for multiple child-accounts or departments.

A major operational bottleneck for B2B finance teams is managing contract amendments—mid-cycle upgrades, downgrades, or seat additions. If a billing system cannot automatically prorate these changes and generate a compliant invoice, finance teams are forced into manual spreadsheets, increasing Days Sales Outstanding (DSO). Consequently, there is rising demand for Subscription Billing Platforms for B2B Invoiced Subscriptions that integrate deeply with CPQ (Configure, Price, Quote) and CRM tools to automate complex contract lifecycles [4].

B2C Velocity: Volume and Retention

In contrast, B2C operations prioritize scale, speed, and churn prevention. B2C merchants process massive transaction volumes where even a 0.1% increase in payment failure rates can cost millions. The focus here is on "frictionless" payments—digital wallets, one-click upgrades, and mobile-first experiences.

The operational battleground for B2C is managing high-velocity transactions across borders while minimizing involuntary churn (discussed below). Solutions in this space, specifically Subscription Billing Platforms for Consumer Subscription Services, differentiate themselves through advanced dunning capabilities and direct integrations with global payment gateways to maximize acceptance rates [5].

Operational Challenge 3: The Revenue Recognition Trap (ASC 606)

Perhaps the most underestimated challenge in modern subscription billing is regulatory compliance, specifically

ASC 606 / IFRS 15 revenue recognition standards. These standards mandate that revenue must be recognized when the service is

delivered, not necessarily when the cash is collected.

For a simple monthly subscription, cash collected often equals revenue recognized. However, hybrid models, annual contracts with heavy discounts, and bundled services break this simplicity.

- Bundled Performance Obligations: If a B2B contract includes a software subscription (recognized over time) and professional onboarding (recognized upon completion), the total contract value must be allocated based on the Standalone Selling Price (SSP) of each component [6].

- Modifications: When a customer upgrades mid-year, the revenue "waterfall" must be recalculated dynamically.

Manual spreadsheets are incapable of handling this complexity at scale without error. This has driven the rapid adoption of

Subscription Billing Platforms with Revenue Recognition Automation. These tools automatically decouple billing schedules (when the customer pays) from revenue schedules (when the ledger records income), ensuring audit readiness and preventing restatements that can derail IPOs or funding rounds

[7].

Trend 3: Churn Mitigation via Payment Orchestration

Customer retention has two faces:

voluntary churn (the customer chooses to leave) and

involuntary churn (the payment fails). Research suggests that involuntary churn accounts for up to 26% of all churn in subscription businesses

[8]. This is effectively "accidental" revenue loss caused by expired cards, false fraud flags, or network declines.

The Rise of "Recovery Events"

Modern billing platforms are evolving into revenue recovery engines. They utilize machine learning to determine the optimal time to retry a failed card (e.g., retrying a debit card on payday) and employ "account updater" services to automatically refresh expired credentials. Data from 2024 shows that sophisticated recovery strategies can save over 70% of at-risk subscribers

[9].

For high-volume sectors, particularly those utilizing Subscription Billing Platforms for Media and Digital Content, these features are existential. Media streaming services face high "rotational churn" where users subscribe for specific content and then cancel. Minimizing payment friction ensures that the barrier to staying subscribed remains as low as possible [10].

Trend 4: Global Tax Compliance as a Barrier to Entry

Digital goods are increasingly subject to local taxation (VAT/GST) based on the location of the *buyer*, not the seller. With over 130 countries now enforcing digital service taxes, the operational burden of calculating, collecting, and remitting taxes globally is immense.

Legacy billing systems often offloaded this responsibility to the accounting team. Today, "Merchant of Record" (MoR) models and tight integrations with tax engines are becoming standard requirements for Subscription Billing Platforms for SaaS Companies. These tools determine the precise tax rate in real-time during checkout, preventing non-compliance fines that can reach significant percentages of global revenue [11].

Sector-Specific Implications

SaaS and Software

For software companies, the "growth at all costs" era has ended, replaced by a focus on efficient growth (The Rule of 40). This shifts the focus of the

Accounting & Finance Software stack toward

revenue intelligence. SaaS CFOs now demand billing tools that provide real-time visibility into Committed Monthly Recurring Revenue (CMRR), Net Revenue Retention (NRR), and Cohort Analysis. The operational challenge here is data silos; if the billing system does not sync perfectly with the CRM, sales teams may upsell customers who are currently in arrears, or success teams may miss renewal windows

[12].

Media and Publishing

Media entities face a distinct challenge: high volume, low transaction value. A $5/month subscription cannot sustain high payment processing fees or manual support costs. Trends in this sector point toward

bundling and

ad-supported tiers. Operational success relies on the billing system's ability to handle complex entitlement management—granting access to specific articles, videos, or archives based on the user's tier. Furthermore, "win-back" automation is critical; when a user cancels, the system must immediately trigger targeted offers to retain them, a capability that separates enterprise-grade media billing platforms from generic tools

[13].

Future Outlook: 2025 and Beyond

AI-Driven Financial Operations

Artificial Intelligence (AI) is beginning to permeate the billing stack, moving beyond simple chatbots to operational agents. By 2026, we expect AI to handle complex dispute resolutions and dynamic pricing optimization automatically. Algorithms will likely predict churn propensity based on usage patterns (e.g., a drop in login frequency) and trigger proactive billing adjustments or Customer Success alerts before the customer cancels

[14].

Outcome-Based Pricing

The next evolution beyond usage-based pricing is

outcome-based pricing, where customers pay for results (e.g., "per qualified lead" or "per successful transaction") rather than raw usage. This model demands even deeper integration between the product's performance data and the billing engine, likely forcing a new wave of innovation in data mediation layers

[15].

Consolidation of the "Revenue Architecture"

Historically, companies pieced together separate tools for CPQ, billing, revenue recognition, and collections. The future trend is the consolidation of these functions into unified "Revenue Architecture" platforms. This reduces the technical debt associated with maintaining integrations and provides a single source of truth for financial data.

Conclusion

The operational reality of subscription billing has shifted from administrative necessity to strategic differentiator. In a market defined by hybrid pricing, global regulation, and intense competition for retention, the capabilities of a company’s billing infrastructure directly dictate its agility. Businesses that treat billing as a static "back-office" function risk revenue leakage and compliance failures. Conversely, those that leverage modern, automated platforms to handle usage-based metering, global tax, and automated revenue recognition will be best positioned to monetize the next generation of digital services.