The Strategic Imperative of Resource & Capacity Planning Software

In the modern enterprise technology stack, Resource & Capacity Planning Software occupies a critical, yet often misunderstood, position. While Customer Relationship Management (CRM) systems manage the demand for work (the pipeline of sales and deals) and Enterprise Resource Planning (ERP) systems manage the financial and operational result of that work (invoicing, payroll, and ledger), Resource & Capacity Planning Software manages the supply capability required to execute that work. It bridges the gap between "what we sold" and "how we deliver it."

Category Definition: This category covers software used to forecast, allocate, and optimize an organization's human and physical capital against project demands across their full operational lifecycle: assessing availability, matching skills to requirements, scheduling workload, monitoring utilization rates, and forecasting future hiring needs. It sits distinctly between Project Management (which focuses on task execution) and HCM/HRIS (which focuses on employee administration). It includes both general-purpose platforms suitable for cross-industry PMOs and vertical-specific tools built for the unique constraints of industries like healthcare, construction, and professional services.

The core problem this software solves is the "utilization paradox": the simultaneous occurrence of overworking key talent (leading to burnout and attrition) while other resources remain underutilized (eroding margins). For executives and operations leaders, the value proposition is not merely administrative organization; it is the financial optimization of the workforce, ensuring that the right cost-base is applied to the right revenue-generating activities at the precise moment required.

History: From Spreadsheets to AI-Driven Intelligence

The evolution of Resource & Capacity Planning Software tracks closely with the increasing complexity of the service economy and the digitization of the workforce. In the 1990s, resource planning was largely a function of Manufacturing Resource Planning (MRP II) systems or early ERP suites. At this stage, "resources" were primarily physical—machinery, raw materials, and assembly line slots. Human capital was treated as a static cost center rather than a dynamic asset. The primary tools for managing people were on-premise spreadsheets and cumbersome mainframe databases that required manual entry and offered zero real-time visibility.

The early 2000s marked the first major shift with the rise of Professional Services Automation (PSA) and dedicated Project Portfolio Management (PPM) tools. As the knowledge economy expanded, the need shifted from tracking widget production to tracking billable hours and consultant availability. However, these early digital tools were often "on-premise" monoliths—expensive to install, difficult to update, and disconnected from the financial reality of the business. They functioned as digital filing cabinets rather than planning instruments.

The 2010s introduced the cloud revolution, which democratized access to sophisticated planning tools. The shift from on-premise servers to Software-as-a-Service (SaaS) allowed for the decoupling of resource planning from heavy ERP systems. This era saw a proliferation of "best-of-breed" solutions that prioritized user experience (UX) and visual planning (Gantt charts, heatmaps). However, a new problem emerged: data silos. While the software was easier to use, it often didn't talk to the CRM or HRIS, leading to "swivel-chair" management where data had to be manually re-entered across systems.

Today, the market is undergoing a consolidation phase driven by the demand for "Actionable Intelligence." Buyers no longer accept a passive database; they demand predictive insights. The current generation of software leverages machine learning to forecast attrition risks, suggest optimal team compositions based on skills and margins, and simulate "what-if" scenarios for potential new business. We are witnessing the transition from "Resource Management" (tracking what happened) to "Resource Optimization" (prescribing what should happen), driven by the integration of AI agents and advanced analytics [1].

What to Look For: Critical Evaluation Criteria

When evaluating Resource & Capacity Planning Software, buyers must look beyond the user interface and interrogate the underlying data model. The most common pitfall is selecting a tool that looks pretty in a demo but fails to handle the complex, messy reality of actual business operations.

Dynamic Skills Ontologies: A robust platform must go beyond simple job titles. Look for systems that support complex skills matrices, including proficiency levels, certification expirations, and interest tracking. Can the system distinguish between a "Senior Developer" who can do Java but prefers Python? This nuance is critical for employee retention.

Multi-Dimensional Forecasting: The tool must allow you to forecast not just by "hours," but by revenue, cost, and margin. You should be able to answer: "If we win this deal in Q3, do we need to hire contractors or full-time employees to maintain our 40% margin target?"

Matrix Organization Support: Most enterprise teams do not operate in simple hierarchies. Resources often report to a line manager but are assigned work by multiple project managers. The software must handle these "soft bookings" and approval workflows without creating administrative gridlock.

Red Flags and Warning Signs:

- No Scenario Planning: If the vendor cannot show you a "sandbox" environment where you can test the impact of a project delay without affecting the live schedule, walk away.

- Manual Skills Updates: If keeping the skills database current requires manual data entry by HR, the data will be obsolete within six months. Look for tools that infer skills from work history or integrate with developer repositories.

- Opaque API Documentation: If the vendor claims "seamless integration" but cannot provide public, detailed API documentation, expect a costly and fragile implementation.

Key Questions to Ask Vendors:

- "How does your system handle 'soft bookings' versus 'hard bookings,' and how are conflicts resolved between them?"

- "Can we model the financial impact of using a contractor versus a full-time employee for a specific role in real-time?"

- "Show me how a resource manager would identify a utilization bottleneck three months in the future, not just in the current week."

Industry-Specific Use Cases

Retail & E-commerce

In the retail sector, resource planning is inextricably linked to seasonal volatility and logistics. Unlike professional services, where the "resource" is a consultant, here the resource is often warehouse staff, customer support agents, or in-store associates. The primary evaluation priority is scalability and shift management. Retailers face massive spikes in demand during peak periods like Black Friday or Cyber Monday [2]. Software in this space must handle high-volume, shift-based scheduling that adheres to complex labor laws and overtime regulations. It must integrate deeply with Point of Sale (POS) and Warehouse Management Systems (WMS) to forecast labor needs based on predicted shipment volumes, not just historical sales data.

Healthcare

Healthcare resource planning is a matter of patient safety and regulatory compliance. The critical metric here is "acuity-based staffing." Generic tools that simply count "heads" are insufficient; healthcare-specific tools must weigh the intensity of care required for specific patient populations against the specific certifications (e.g., ACLS, PALS) of the nursing staff [3]. Evaluation priorities include robust credential tracking to prevent compliance violations (e.g., scheduling a nurse with an expired license) and strict adherence to nurse-to-patient ratios mandated by law. Integration with Electronic Health Records (EHR) is mandatory to automate the flow of patient acuity data into the staffing schedule.

Financial Services

For financial services, particularly in audit, tax, and private equity, the resource planning focus is on "busy season" compression and deal flow management. Audit firms operate on rigid regulatory deadlines where a lack of capacity can lead to fines or reputational damage. Tools here must support rotational planning—managing staff who move between clients rapidly—and enforce independence compliance (ensuring auditors don't work on clients where they have conflicts of interest) [4]. In Private Equity, the focus shifts to post-merger value creation, where the "resource" is often an operating partner or interim executive deployed to a portfolio company to drive specific initiatives.

Manufacturing

Manufacturing resource planning extends beyond human capital to include machine availability and production line capacity. This is the domain of constraint-based planning. A human operator cannot be scheduled if the machine they operate is down for maintenance. Therefore, software in this sector must treat equipment and labor as interdependent variables. Evaluation priorities include the ability to model shift patterns against production targets and "takt time" (the rate at which a finished product needs to be completed to meet customer demand) [5]. Real-time integration with shop floor IoT sensors is increasingly becoming a standard requirement to adjust schedules dynamically based on machine health.

Professional Services

This is the "classic" use case for resource planning software, but the requirements have matured. The primary goal is margin protection. It is not enough to just staff a project; firms must staff it with the lowest-cost resource that can successfully deliver the work to maximize profit [6]. Key features include tracking billable vs. non-billable utilization, "shadowing" (assigning junior staff to learn from seniors without billing the client), and complex revenue recognition rules (ASC 606). The software must serve as the "source of truth" for the firm's operational health, bridging the gap between the sales pipeline (CRM) and the invoice (ERP).

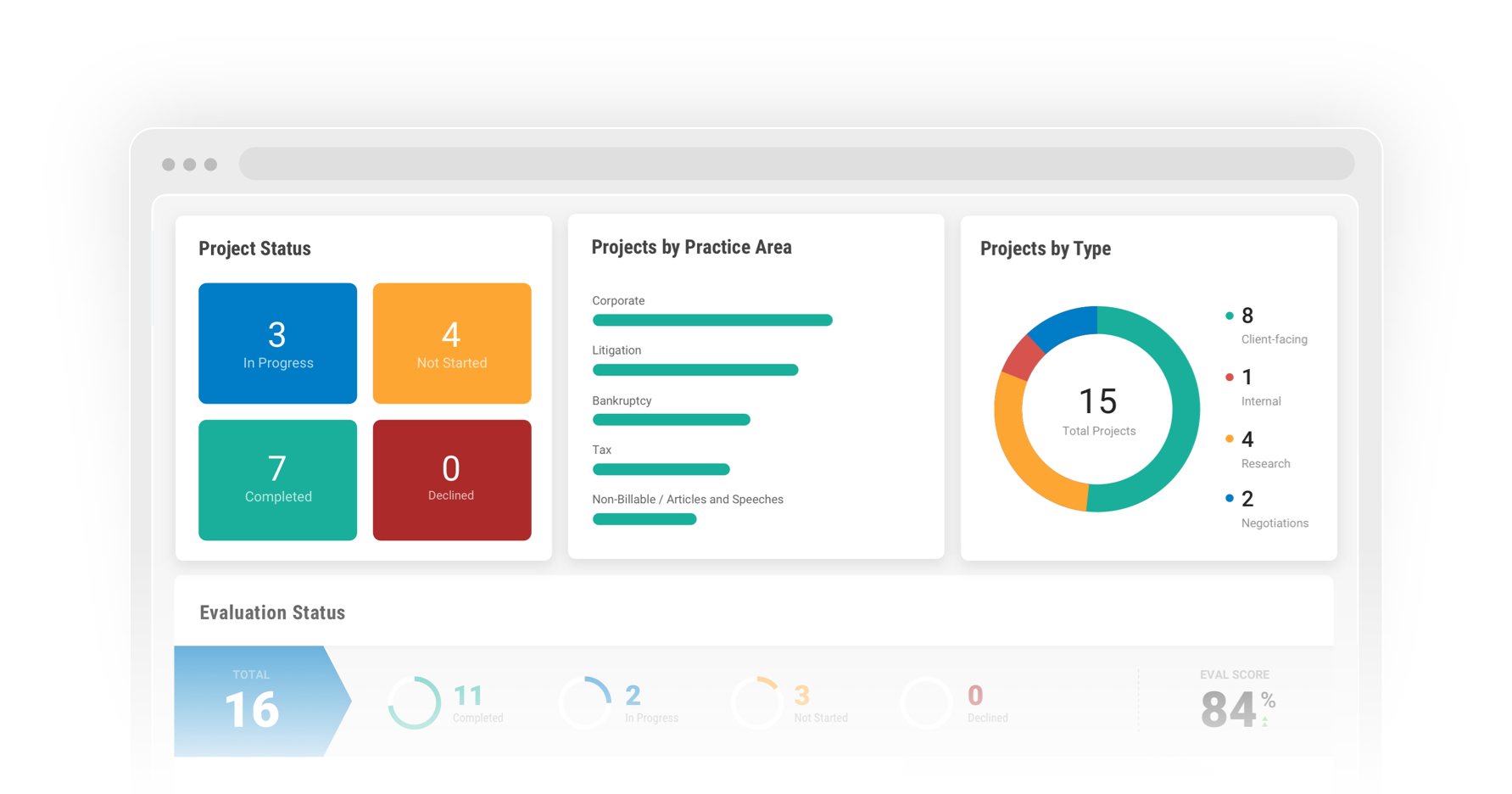

Subcategory Overview

Resource & Capacity Planning Software for Staffing Agencies

Staffing agencies operate on a fundamentally different model than internal HR or project teams. Their inventory is talent, and their goal is placement speed and margin arbitrage. Unlike generic tools that focus on long-term employee development, software for staffing agencies is built for high-velocity matching and roster management. The unique workflow here is the "bench management" process—tracking a pool of external candidates who are not yet employees but need to be deployed instantly when a client request comes in. Generic tools fail here because they assume a finite, internal pool of resources. Staffing tools often include Applicant Tracking System (ATS) features or deep integrations with job boards to replenish the supply constantly. The specific pain point driving buyers here is "time-to-fill"; every hour a role remains open is lost revenue. For a deeper look at tools specialized for this high-churn environment, refer to our guide to Resource & Capacity Planning Software for Staffing Agencies.

Resource & Capacity Planning Software for Private Equity Firms

Private Equity (PE) firms deal with resource allocation at a macro, portfolio level. They are not scheduling shifts; they are deploying high-value operating partners, interim CFOs, and transformation experts across dozens of portfolio companies to drive value creation. Generic planning tools lack the deal-centric data structure required by PE. A unique workflow for this niche is "deal team modeling"—simulating the capacity required to conduct due diligence on a potential acquisition without burning out the investment team. The pain point here is "deal flow bottlenecking," where lucrative investment opportunities are missed simply because the firm lacks the visibility to free up the right partner to lead the deal. To explore solutions that handle this level of strategic complexity, visit our page on Resource & Capacity Planning Software for Private Equity Firms.

Resource & Capacity Planning Software for SaaS Companies

SaaS companies face a unique accounting challenge: capitalizing R&D costs. Under GAAP rules, software development costs can be capitalized (treated as an asset) rather than expensed, but only for specific coding tasks during specific project phases. Generic tools rarely track time with the granularity required for this audit trail. Resource planning software for SaaS specifically handles Product Roadmap alignment, linking individual developer hours to specific feature releases (Capitalizable) vs. bug fixes (Expense). The specific pain point is the disconnect between Product Management (what we want to build) and Engineering (who is available to build it). These tools often integrate bi-directionally with Jira or GitHub to pull real-time status updates. For tools that bridge the gap between code commits and capacity, see our guide to Resource & Capacity Planning Software for SaaS Companies.

Resource & Capacity Planning Software for Contractors

For contractors in construction and field services, "remote" doesn't mean working from home; it means working from a job site with no internet. This niche requires mobile-first dispatching and union compliance. Generic software often fails to account for "windshield time" (travel time between jobs) or complex union rules regarding breaks and overtime seniority. A unique workflow here is the "crew dispatch," where a single resource (a foreman) and a group of dependent resources (crew members) and assets (trucks/excavators) must be scheduled as a single unit. The pain point driving this purchase is often "leakage"—lost billable hours due to inefficient routing or disputes over time worked. To find tools robust enough for the field, check out Resource & Capacity Planning Software for Contractors.

Deep Dive: Integration & API Ecosystem

In the era of the composable enterprise, a standalone resource planning tool is a liability. The value of these platforms is directly proportional to their connectivity. A recent report by Salesforce/MuleSoft indicates that 81% of IT leaders cite data silos as a hindrance to digital transformation, and resource planning is often the victim of these silos [7]. The modern requirement is a robust, RESTful API with high rate limits and pre-built connectors to the "Big Three": CRM (Salesforce, HubSpot), ERP (NetSuite, SAP), and Work Management (Jira, Asana).

Expert Insight: As noted by Gartner, integration is a primary hurdle to AI innovation; without unified data, predictive models fail [7]. If your resource planner thinks a consultant is "Available," but your HR system lists them as "On Leave," your forecast is garbage.

Scenario: Consider a 50-person professional services firm. They use HubSpot for sales and Jira for tasks. Without a tight integration, the Sales team closes a deal on Friday, but the Delivery team doesn't see it until the Monday morning meeting. By then, the required "Senior Architect" has been assigned to another project. With proper integration, the moment the HubSpot deal stage moves to "Verbal Agreement," a "Tentative Booking" should automatically appear on the resource planner, blocking that Architect's time and triggering a "Capacity Alert" if they are double-booked. This automation prevents the embarrassing client conversation of "We sold you the team, but they aren't available for three weeks."

Deep Dive: Security & Compliance

Resource planning software houses sensitive data: employee salaries, home addresses (for dispatch), performance reviews, and future strategic initiatives. The cost of negligence here is astronomical. IBM's 2024 Cost of a Data Breach Report reveals the global average cost of a data breach has reached $4.88 million, with costs in highly regulated industries like healthcare soaring even higher [8].

Expert Insight: Forrester emphasizes that privacy regulations are becoming localized. It is no longer enough to be "GDPR compliant." You must understand data residency—where specifically the data is physically stored [1].

Scenario: A mid-sized healthcare consultancy wins a contract with a government defense agency. The agency requires that all data regarding their project staffing be stored on servers located within the country (Data Residency). If the consultancy's resource planning tool is a multi-tenant SaaS solution hosted solely in a generic US-East AWS region, they are instantly non-compliant. They lose the contract not because of their lack of skill, but because their software vendor lacked the ability to partition data instances by geography.

Deep Dive: Pricing Models & TCO

Pricing in this category is notoriously opaque. The two dominant models are Per-User (Seat-Based) and Per-Resource (Managed Resource). In a Per-User model, you pay for the people logging in (PMs, Admins). In a Per-Resource model, you pay for the people being scheduled. This distinction can double your Total Cost of Ownership (TCO) if misunderstood.

Expert Insight: Gartner research on IT spending suggests that software spending will grow by over 13% through 2026, driven largely by price increases in SaaS licenses [9]. Buyers must lock in price caps for future seat expansion.

Scenario: Let's calculate the TCO for a 25-person creative agency.

Option A (Per-User): $30/month per login. Only the 3 Project Managers and 1 Director need login access. The 21 creatives just receive email schedules.

Cost: 4 users * $30 * 12 months = $1,440/year.

Option B (Per-Resource): $10/month per managed resource. You must pay for everyone on the schedule.

Cost: 25 resources * $10 * 12 months = $3,000/year.

Superficially, Option B looks cheaper ($10 vs $30), but in practice, it is over 100% more expensive for this specific team structure. Buyers must model their "ratio of planners to doers" before signing.

Deep Dive: Implementation & Change Management

Software implementation is where ROI goes to die. McKinsey data consistently shows that 70% of digital transformations fail to meet their original goals, often due to cultural resistance rather than technical failure [10]. Resource planning forces transparency, which can be threatening. Employees may view utilization tracking as "surveillance."

Expert Insight: The Project Management Institute (PMI) notes that organizations offering "enablers" like mentoring and change management see significantly better project performance [11]. Success depends on framing the tool as a shield against burnout, not a whip for productivity.

Scenario: A 100-person engineering firm rolls out a new resource planner. They technically migrate the data perfectly. However, they fail to explain why they need employees to log skills. Senior engineers, fearing they will be pigeonholed into legacy tech if they list it, refuse to update their profiles. The resource managers are left with a blank map. To fix this, the firm should have launched a "Skills Amnesty" program, guaranteeing that listing a legacy skill won't result in permanent assignment to legacy maintenance, effectively gamifying the profile completion.

Deep Dive: Vendor Evaluation Criteria

Evaluating a vendor is about assessing their long-term viability and partnership potential. The market is crowded, and consolidation is rampant. You do not want to implement a tool that gets acquired and sunsetted in 18 months.

Expert Insight: Gartner's market guides emphasize assessing the "composability" of the vendor—how easily can their modules be swapped or extended? [12]. Rigid, monolithic tools are a dying breed.

Scenario: A buyer is choosing between Vendor X (a massive ERP suite) and Vendor Y (a nimble, specialized startup). Vendor X has a "roadmap" that changes every 3 years. Vendor Y releases updates weekly. The buyer asks: "Show me your release notes for the last 6 months." Vendor Y shows consistent improvements in their AI forecasting engine. Vendor X shows only security patches. The buyer chooses Vendor Y, recognizing that in resource planning, stagnation is a security risk of its own kind—the risk of obsolescence.

Emerging Trends and Contrarian Take

Emerging Trends (2025-2026):

Agentic AI: We are moving beyond predictive text to autonomous agents. Forrester predicts that "Agentic AI" will not just suggest a schedule but actively negotiate it. Imagine an AI agent that notices a conflict, emails the two affected project managers, proposes a solution based on margin impact, and executes the change upon approval [13].

Skills-Based Hiring Integration: Tools will increasingly integrate with external labor markets (Upwork, Toptal) to instantly fill capacity gaps with freelancers, treating external talent as a fluid extension of the internal bench.

Contrarian Take:

The "Real-Time" Fallacy. The industry is obsessed with real-time data, but for resource planning, real-time is often too late. Accuracy in forecasting is infinitely more valuable than precision in tracking. Most organizations would get a higher ROI from hiring a dedicated "Resource Manager" human to curate data and negotiate conflicts than from buying the most expensive AI-driven platform. The software cannot have the difficult conversation with a client about delaying a project; a human armed with "good enough" data can. The mid-market is vastly over-served by complex tools when a simpler process change would solve 80% of the pain.

Common Mistakes

Over-Buying Complexity: Many firms buy enterprise-grade tools with 50 features when they only have the operational maturity to use 5. This leads to "shelfware" and user frustration. If you cannot do capacity planning on a napkin, software will not help you do it on a computer.

Ignoring Data Hygiene: A resource planner is a garbage-in, garbage-out system. The most common failure mode is populating the system with bad data (outdated skills, phantom projects) during implementation. The system then recommends bad staffing decisions, users lose trust, and they go back to spreadsheets.

Conflating Time Tracking with Resource Planning: These are different disciplines. Time tracking is looking continuously in the rearview mirror (accounting). Resource planning is looking through the windshield (strategy). Buying a time tracker and hoping it yields planning insights is a fundamental category error.

Questions to Ask in a Demo

- "Show me exactly how your system handles a situation where a project is delayed by two weeks. How many clicks does it take to shift the entire resource allocation?"

- "Can I create a 'ghost resource' (a placeholder for a hire we haven't made yet) and assign them to a project to see the budget impact?"

- "Demonstrate your API's error handling. If the sync with Salesforce fails, who gets notified, and does the system retry automatically?"

- "Show me the view that an individual contributor sees. Is it easy for them to update their availability, or will they hate using this?"

- "How does your reporting handle billable vs. non-billable utilization when a resource is split across both in the same week?"

Before Signing the Contract

Data Exit Strategy: Ensure the contract explicitly states that you own your data and defines the format in which it will be returned if you leave (e.g., SQL dump, CSV). Do not accept proprietary formats.

Service Level Agreements (SLAs): Negotiate SLAs not just for uptime, but for support response time. If your dispatch system goes down at 8 AM on a Monday, a "24-hour response time" is unacceptable.

Implementation Support: Demand that the implementation fee includes "post-go-live" check-ins. The real problems always emerge 30 days after you launch, not during the initial setup. Ensure you have access to a solution architect, not just a support ticket queue, during this critical window.

Closing

Mastering resource and capacity planning is the difference between a chaotic organization that burns out its people and a disciplined one that maximizes profit and potential. If you have specific questions about your unique use case or need an unbiased second opinion on your shortlist, feel free to reach out.

Email: albert@whatarethebest.com