What Is Employee Engagement & Pulse Survey Platforms?

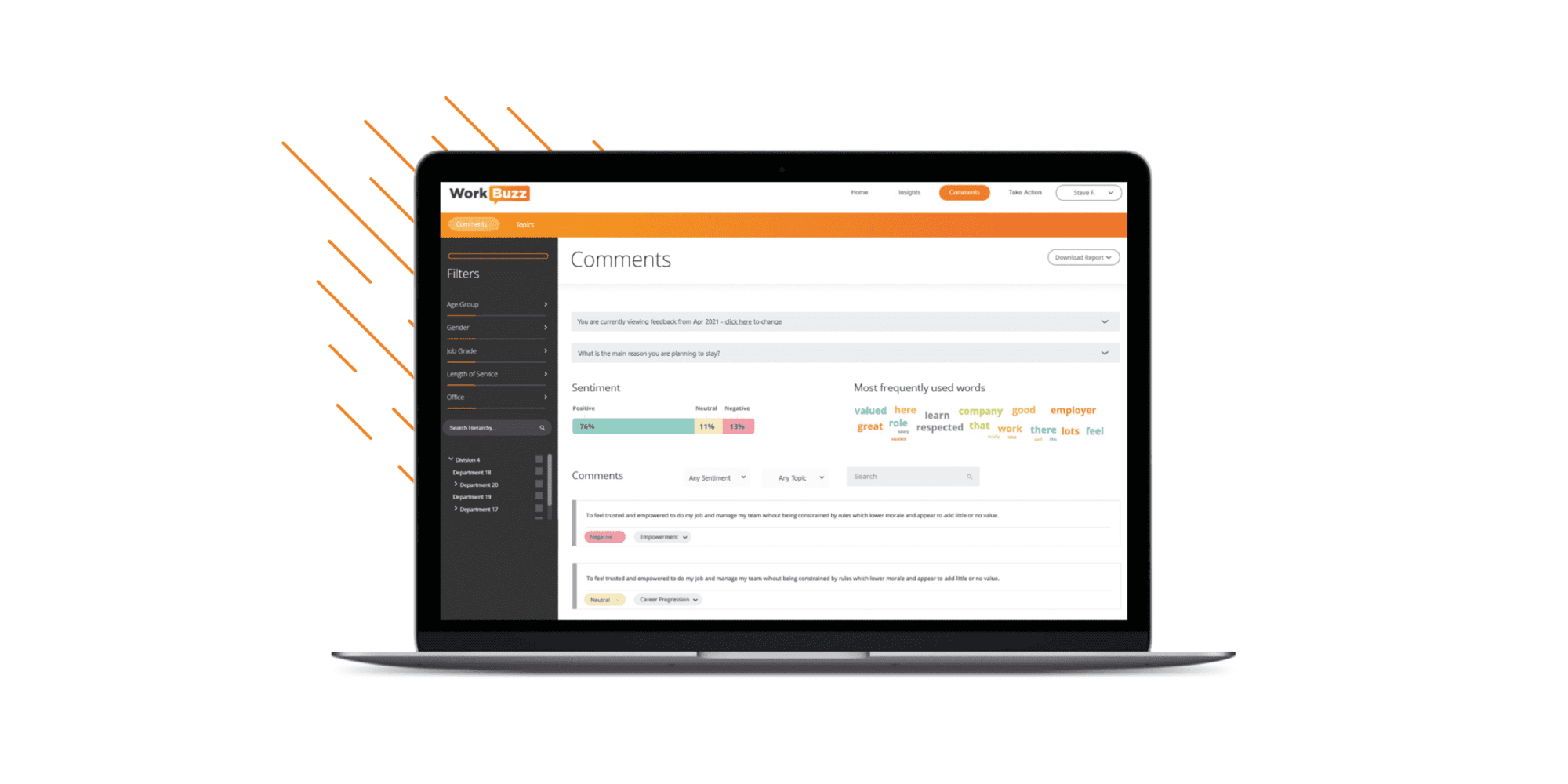

This category covers software designed to measure, analyze, and improve the emotional commitment and psychological investment employees have in their organization across their full tenure. Unlike traditional HR systems that record status (hired, promoted, terminated), these platforms track sentiment and experience. Their operational lifecycle encompasses the continuous collection of feedback through pulse surveys, the analysis of open-text responses via natural language processing (NLP), the distribution of recognition and rewards, and the facilitation of action planning for managers. They provide the "voice of the employee" data layer that informs leadership decisions regarding culture, retention, and productivity.

It sits between Core HR/HRIS (which focuses on administrative records and compliance) and Performance Management (which focuses on individual output and appraisal). While Performance Management asks "how well is this employee working for the company?", Employee Engagement platforms ask "how well is the company working for this employee?". It is broader than simple survey tools (like SurveyMonkey) because it includes benchmarking, hierarchical reporting, and nudges for behavioral change, yet narrower than a full Employee Experience (EX) Platform, which often includes intranet, learning management (LMS), and benefits administration. The category includes both general-purpose platforms suitable for any office environment and vertical-specific tools built for complex workforce dynamics in industries like manufacturing, healthcare, and retail.

The core problem these platforms solve is the "feedback latency" gap. In the past, annual engagement surveys provided a autopsy of company culture—delivering insights months after employees had already disengaged or resigned. Modern pulse survey platforms solve this by treating engagement as a fluctuating metric rather than a static score, allowing leaders to diagnose burnout, lack of clarity, or management issues in real-time. Who uses it? While HR leaders own the system, the primary active users are people managers who need data to lead their teams effectively, and executives who monitor "cultural health" alongside financial KPIs.

History of the Category

The concept of "employee engagement" as a distinct management science is surprisingly young. In the 1990s, academic William Kahn formally coined the term "personal engagement," defining it as the harnessing of organization members' selves to their work roles [1]. Before this, the corporate world relied on the "job satisfaction" model from the 1930s—a passive measure of whether an employee was content, rather than psychologically invested. The 1990s marked the shift from viewing employees as inputs to be managed to assets to be motivated, yet the technology lagged behind the theory. For most of the decade, "measuring engagement" meant expensive, consultant-led annual paper surveys that took months to process. The gap that created this software category was the inability of ERP and early HRIS systems to capture qualitative human data; they could tell you an employee was present, but not if they were productive or flight risks.

The 2000s saw the rise of the first digital survey tools, but they were largely "database" solutions—digitized versions of the paper survey. The real inflection point arrived with the explosion of Vertical SaaS and the cloud transition in the early 2010s. As the "War for Talent" intensified post-recession, companies realized that annual data was insufficient. This led to the "Pulse" revolution—short, frequent check-ins designed to capture the heartbeat of the organization. Buyer expectations evolved drastically during this period: the demand shifted from "give me a report" to "give me actionable intelligence." It was no longer enough to know engagement was low; software had to tell a manager exactly why (e.g., lack of recognition, poor tools) and what to do about it.

Recent market consolidation has seen these standalone engagement tools being snapped up by larger Human Capital Management (HCM) suites, yet the standalone market remains vibrant due to the depth of analytics required. Today, the frontier has moved beyond simple surveys to "continuous listening" and AI-driven sentiment analysis. We are currently witnessing a shift where the "survey" itself is becoming secondary to passive data collection—analyzing communication patterns (metadata from Slack/Teams/Email) to predict burnout before an employee even answers a question. This evolution reflects a broader trend in enterprise software: the move from systems of record to systems of insight.

What to Look For

When evaluating Employee Engagement and Pulse Survey platforms, buyers must look beyond the user interface and scrutinize the validity of the data model. A critical evaluation criterion is the platform's Industrial-Organizational (I/O) Psychology backing. Does the vendor utilize a scientifically validated question set? Many flashy tools allow you to create custom questions easily, but without a validated framework, you risk gathering "vanity metrics" that look good but do not correlate with business outcomes like retention or profitability. You want a tool that benchmarks your data against relevant peers (e.g., "Tech companies with 500-1000 employees") rather than a generic global average.

Another crucial factor is hierarchy management and data isolation. In complex organizations, an employee might report to a functional manager, a project lead, and a regional director. The platform must handle matrixed reporting lines so that the right managers see the right feedback without compromising anonymity. Red flags include vendors that are vague about their "anonymity thresholds." If a team has only three people, the software should automatically suppress results or roll them up to the next level to prevent identifying respondents. A vendor that allows you to drill down to individual responses in small groups is a liability, not an asset.

Actionability is the final differentiator. The market is flooded with tools that are great at diagnosing illness but terrible at prescribing the cure. Look for platforms that offer "nudges" or "suggested actions" for managers based on survey results. If a team scores low on "Recognition," the system should prompt the manager with specific, bite-sized actions to take, or even integrate with a recognition module to facilitate immediate change.

Key questions to ask vendors:

- "What is your k-anonymity threshold, and can it be customized by department?" (Standard is usually 5 responses; anything lower risks privacy violations).

- "Does your benchmark data come from your own customer base, or do you purchase third-party data? How often is it refreshed?"

- "How does the platform handle historical data if we restructure our teams? Do we lose the trend line?"

- "Can the system correlate engagement scores with performance data from our HRIS to show proof of impact?"

Industry-Specific Use Cases

Retail & E-commerce

In retail, the primary challenge is the "deskless" workforce. Store associates do not sit in front of computers, so engagement platforms must be mobile-first and capable of functioning via SMS, QR codes, or kiosk modes. Evaluation priorities shift heavily toward ease of access and speed of completion; a survey that takes more than 3 minutes will see abandonment rates skyrocket. Retailers specifically look for correlations between engagement and shrinkage (theft) or customer satisfaction scores (CSAT). Research indicates that highly engaged retail teams can see up to 28% less shrinkage [2]. A unique consideration here is the high turnover rate; the platform must be able to deploy "exit surveys" automatically and analyze why staff are leaving in near real-time to stem the bleeding during peak seasons.

Healthcare

For healthcare organizations, employee engagement is literally a matter of life and death. The Magnet Recognition Program® by the ANCC requires hospitals to empirically demonstrate higher nurse satisfaction and engagement to achieve designation [3]. Therefore, healthcare buyers need platforms that offer specific "Magnet-compliant" reporting templates and benchmarks against other nursing units, not just generic companies. Burnout prediction is the top evaluation priority; with 46% of healthcare workers reporting burnout [4], systems must identify early warning signs like emotional exhaustion before they lead to patient safety incidents. Data privacy is also heightened; the platform must be HIPAA-compliant even if it doesn't store patient data, as it operates within a regulated environment.

Financial Services

In the financial sector, engagement is closely tied to Conduct Risk and compliance culture. Regulators increasingly view poor culture as a precursor to misconduct. Platforms here are used to measure "psychological safety"—do employees feel safe speaking up about errors or unethical behavior? Financial services firms prioritize longitudinal trend analysis to detect cultural erosion during mergers and acquisitions, which are frequent in the sector. A unique consideration is the "protected" nature of some employee groups; firewalls must exist between investment banking and research arms, and the survey platform must respect these "Chinese walls" in its reporting structures to prevent data leakage or conflicts of interest.

Manufacturing

Manufacturing environments share the "deskless" challenge of retail but add a critical layer: Safety. There is a documented correlation where top-quartile engaged teams see 70% fewer safety incidents [5]. Consequently, manufacturing buyers look for platforms that can integrate safety "pulse checks" alongside engagement questions (e.g., "Do you have the equipment you need to do your job safely?"). The "Blue Collar" vs. "White Collar" divide is a specific pain point; the tool must be able to segment data distinctly between the shop floor and the corporate office, as the drivers of engagement for these two groups are often diametrically opposed. Kiosk integration for clock-in/clock-out areas is a standard requirement.

Professional Services

For law firms, consultancies, and agencies, the inventory is the people. High billable utilization rates often lead to burnout, so firms use these platforms to monitor the delicate balance between productivity and fatigue. An 80% utilization rate is often cited as a red line for burnout [6]. These buyers value 360-degree feedback mechanisms heavily, as feedback often comes from project peers rather than a single direct manager. The "Project-Based" survey is a unique workflow here: instead of surveying everyone quarterly, the system surveys a team immediately after a client engagement concludes to capture sentiment while it is fresh. This requires deep integration with Project Management software to trigger surveys based on project milestones.

Subcategory Overview

Employee Engagement & Feedback Platforms for Recruitment Agencies

This niche serves agencies where the "employees" are recruiters driven by high-commission structures. What makes this distinct is the focus on incentive alignment and burnout related to KPIs. General tools measure "happiness," but tools in this space specifically measure satisfaction with commission structures and placement targets. One workflow ONLY this tool handles well is the correlation of engagement data with redeployment rates (the ability to place a candidate again). The pain point driving buyers here is the high turnover of top-billing recruiters; general tools fail to capture the specific frustrations of a sales-driven, high-pressure recruitment desk. For more, see our guide to Employee Engagement & Feedback Platforms for Recruitment Agencies.

Employee Engagement & Feedback Platforms for Contractors

This subcategory deals with a non-permanent workforce, often involving distinct legal constraints. The defining difference is the mitigation of co-employment risk. General platforms treat everyone as an employee, but surveying contractors about "company culture" or "career growth" can be used as evidence of employment status in legal battles. Specialized tools phrase questions to focus on project clarity and resource availability rather than belonging. The specific pain point is "blended workforce visibility"—managers need to know if contractors are disengaged (risking project failure) without crossing legal lines into managing them like employees. Read more about Employee Engagement & Feedback Platforms for Contractors.

Employee Engagement & Feedback Platforms for Private Equity Firms

These platforms are designed not for a single company, but for a portfolio of companies. The differentiator is the "Operating Partner Dashboard," which aggregates engagement scores across 20-30 different companies to identify leadership risks before they impact EBITDA. A workflow unique to this niche is the Value Creation Plan alignment—surveying portfolio leadership specifically on their alignment with the PE firm's 100-day plan. The driving pain point is "blind spots" in asset performance; PE firms buy this software to avoid being surprised by the resignation of a key CEO or a toxic culture that could devalue an exit. Explore Employee Engagement & Feedback Platforms for Private Equity Firms.

Employee Engagement & Feedback Platforms for SaaS Companies

While SaaS companies use general tools, this niche focuses on engineering culture and product velocity. These tools often integrate with Jira or GitHub to correlate developer sentiment ("I feel blocked") with code output. A specific workflow is the "Sprint Retrospective" pulse—automating feedback cycles to align with agile development sprints rather than calendar quarters. The pain point driving this purchase is the fierce competition for technical talent; general tools don't capture the nuances of "developer experience" (DevEx) or technical debt frustration that causes engineers to quit. Check out Employee Engagement & Feedback Platforms for SaaS Companies.

Employee Engagement & Feedback Platforms for Staffing Agencies

Distinct from recruitment agencies (which place permanent staff), staffing agencies manage large volumes of temporary workers deployed to client sites. The critical differentiator is remote/off-site connectivity. The tool must engage workers who physically work for a different company (the client) but are paid by the agency. A workflow unique to this is Net Promoter Score (NPS) for Candidates—measuring the temp's satisfaction with the client site to predict assignment completion. The pain point is "assignment abandonment"; agencies lose revenue when temps ghost, so they need tools to detect dissatisfaction with a client placement immediately. Learn more at Employee Engagement & Feedback Platforms for Staffing Agencies.

Deep Dive: Integration & API Ecosystem

The days of standalone engagement islands are over. A platform's value is now directly proportional to its ability to ingest context from other systems. The gold standard is a bi-directional sync with the HRIS (Human Resource Information System). This ensures that demographic data—tenure, gender, department, performance rating—is automatically updated. Without this, you are analyzing "anonymous" data with no context.

According to Gartner, by 2025, 60% of large enterprises will integrate their employee engagement data with performance and retention data to derive actionable insights [7]. Expert Josh Bersin has also noted that the market is moving toward "integrated employee listening," where survey data is combined with operational data.

Example Scenario: Consider a 50-person professional services firm. They use an engagement tool that doesn't integrate with their Project Management (PM) software or Invoicing system. An employee, "Sarah," reports low engagement scores on her pulse survey. The HR manager sees this but doesn't know why. If the systems were integrated, the engagement platform could ingest data from the PM tool showing Sarah has logged 60 hours a week for three weeks straight on a difficult client account. The "break" here is the lack of context—HR might try to "engage" Sarah with a gift card, when the actual solution (visible in the integrated data) is to staff a junior associate to help her. Poor integration leads to "solution mismatch," where management solves the wrong problem.

Deep Dive: Security & Compliance

Security in this category goes beyond encryption; it centers on Anonymity and Pseudo-Anonymity. The concept of "k-anonymity" is the industry standard, usually set to a threshold of 5. This means no data is reported unless at least 5 unique individuals have responded. European GDPR regulations complicate this further, as "employee sentiment" can be considered personal data if it can be reverse-engineered to identify a person.

The GDPR explicitly acknowledges that complete absence of re-identification risk is impossible, but requires "state of the art" measures to mitigate it [8]. A breach here isn't just a fine; it's a total collapse of employee trust. If employees believe their "anonymous" survey is being read by their boss, response rates drop to near zero, rendering the software useless.

Example Scenario: A mid-sized healthcare provider with 200 employees runs a "Diversity & Inclusion" survey. The platform is SOC2 compliant, but the HR administrator sets the reporting threshold to 3 instead of 5. A specific department has only one Black female employee. When the report is generated, filtering by "Demographic: Female" + "Ethnicity: Black" + "Department: Radiology" isolates her responses perfectly. She mentioned feeling marginalized by her manager. The manager reads the report, identifies her, and retaliates. The "security" of the software (encryption) held up, but the compliance logic failed, leading to a legal liability for the firm and a destroyed culture.

Deep Dive: Pricing Models & TCO

Pricing typically falls into two camps: Per Employee Per Month (PEPM) or Annual Flat Fee tiers. PEPM is standard for the mid-market and enterprise, ranging from $3 to $10 per user/month depending on the feature set (e.g., adding "Performance" modules usually doubles the cost) [9]. Small business tools often use tiered buckets (e.g., "$200/month for up to 50 users").

Hidden costs are the killer in TCO (Total Cost of Ownership). These often include "Implementation Fees" (consulting hours to set up the hierarchy), "Custom Benchmarking" fees, and "Manager Training" workshops. Gartner notes that organizations often underestimate the TCO of HR tech by 20-30% due to these professional services add-ons.

Example Scenario: A 150-person tech company evaluates two vendors. Vendor A offers $4/user/month ($7,200/year). Vendor B offers $7/user/month ($12,600/year). They choose Vendor A. However, Vendor A charges for every "Admin" user ($500/year) and requires a $3,000 "onboarding package." Furthermore, Vendor A does not automate the HRIS sync, requiring an HR admin to spend 5 hours a month manually updating CSV files. If the HR admin's time is valued at $50/hour, that’s $3,000/year in labor. The True TCO of Vendor A is $7,200 + $3,000 + $3,000 = $13,200. Vendor B included the integration and unlimited admins. The "cheaper" option was actually more expensive and less efficient.

Deep Dive: Implementation & Change Management

Software implementation is easy; cultural implementation is hard. The technical setup involves whitelisting emails, syncing the HRIS, and configuring the hierarchy. The failure point is almost always Change Management—preparing managers to receive feedback. If you launch a survey tool without training managers on how to have "post-survey conversations," you will decrease engagement, not increase it. This is known as the "Feedback Void."

McKinsey research highlights that companies successful in transformation are 1.5 times more likely to have clear change-management goals [10]. In the context of engagement software, this means defining who is responsible for the score.

Example Scenario: A manufacturing firm rolls out a new pulse app to 500 factory workers. They put up posters and send one email. Participation in the first month is 80%. The results show deep dissatisfaction with shift scheduling. Management ignores this because "we can't change the schedule right now." They do not communicate why they can't change it; they just stay silent. By month 3, participation drops to 15%. The implementation "technically" worked (the app functions), but the initiative failed because the loop was not closed. The workers now feel more ignored than before they were asked.

Deep Dive: Vendor Evaluation Criteria

When selecting a vendor, look for Partnership vs. Product. At the enterprise level, you are buying the benchmark data and the I/O psychology expertise as much as the software. Does the vendor offer "Executive Readouts" where an organizational psychologist presents the findings to your C-Suite? This is often critical for getting executive buy-in for action plans.

Forrester emphasizes that the differentiator in the Employee Experience (EX) market is "deep research" capabilities—tools that go beyond surveys to include virtual focus groups and interaction analysis [11]. A vendor that only offers a library of templates is a commodity; a vendor that offers predictive intelligence (e.g., "Team B is at risk of turnover in 3 months based on current trends") is a strategic partner.

Example Scenario: A rapidly scaling SaaS company evaluates Vendor X and Vendor Y. Vendor X has a beautiful, Apple-like interface but standard question banks. Vendor Y has a clunkier interface but offers "Predictive Attrition Modeling" based on 10 million data points from the tech industry. The buyer chooses Vendor X for the UI. Six months later, key engineers quit. The exit interviews reveal issues that Vendor Y's model would have flagged as "risk factors" months earlier (e.g., perceived lack of career movement). The buyer optimized for User Experience (UX) when they should have optimized for Data Science validity.

Emerging Trends and Contrarian Take

Emerging Trends 2025-2026:

The next frontier is Passive Listening and AI Agents. We are moving away from asking employees "How are you?" to inferring it from their digital exhaust. "AI Agents" will soon act as personal career coaches within these platforms, nudging employees to take time off or suggesting learning modules based on their sentiment [12]. Another trend is "Structured Flexibility"—using these tools to manage the hybrid work tension by coordinating in-office days based on team sentiment rather than top-down mandates [13].

Contrarian Take:

Engagement is a lagging indicator; "Energy" is the leading one. Most platforms measure sentiment that has already crystallized. The industry is obsessed with "Engagement Scores" (eNPS) as the holy grail, but by the time a score drops, the damage is done. The contrarian insight is that organizations should stop optimizing for "Happiness" and start optimizing for "Friction Removal." High-performers don't leave because they aren't "happy" (a vague emotion); they leave because operational friction (bad tools, slow approvals, unclear goals) prevents them from doing their best work. Buying an engagement platform to fix a friction problem is like buying a thermometer to cure a fever. The mid-market is particularly guilty of over-surveying and under-fixing; most would get higher ROI from canceling the subscription and hiring one "Operations Fixer" to remove the blockers identified in the very first survey.

Common Mistakes

The "Launch and Abandon" Cycle:

The most fatal mistake is treating the survey as the deliverable. A survey is a diagnostic; the deliverable is the action. Organizations often spend 3 months designing the perfect survey, 1 month collecting data, and 0 days taking action. This teaches employees that their feedback is a waste of time.

Over-Surveying (Survey Fatigue):

Launching weekly pulses without the operational capacity to respond to weekly issues. If you ask a question, you incur a debt to answer it. If you can't pay that debt (fix the issue), don't ask the question. A quarterly cadence with high action is infinitely superior to a weekly cadence with low action.

Weaponizing the Data:

Using engagement scores as a KPI for manager bonuses. This inevitably leads to "score gaming," where managers pressure teams to "score us a 10 so we get our bonus." This destroys the data integrity. The score should be a flashlight for the manager to see where to improve, not a baton to beat them with.

Questions to Ask in a Demo

- "Show me the 'Manager View.' How does a frontline supervisor see their data versus a VP?"

- "Can I see your library of 'Action Plans'? If a manager scores low on 'Trust,' what specifically does the system recommend they do?"

- "How do you handle 'small n' reporting? If a team has 4 responses, what exactly does the report look like?"

- "Can we benchmark our data against specifically [Industry X] companies of [Size Y], or is the benchmark just a general 'Global Average'?"

- "What is the process for exporting raw data if we want to run our own regression analysis?" (If they say no, it's a red flag).

- "Show me the mobile experience for a user without a corporate email address." (Crucial for frontline/retail).

Before Signing the Contract

Final Decision Checklist:

Ensure you have a committed "Executive Sponsor" (not just HR). Without a C-level leader validating the importance of the tool, managers will ignore the "nudges." Verify the implementation timeline—vendors often promise "2 weeks" but complex integrations take 8-12 weeks. Check the Data Processing Addendum (DPA) for GDPR compliance if you have any EU staff.

Negotiation Points:

Most vendors will negotiate on implementation fees and admin licenses. Push for "unlimited admins" so you aren't penalized for growing your HR team. Ask for a "Pilot Clause"—the ability to break the contract after 6 months if adoption thresholds aren't met. Deal-breakers should include: lack of SSO (Single Sign-On), vague data retention policies, or refusal to define clear anonymity thresholds in writing.

Closing

If you have specific questions about fitting these platforms into your unique tech stack or culture, I’m happy to offer a more tailored perspective. Reach out to me at albert@whatarethebest.com.