What Is Product Information Management (PIM) Tools?

Product Information Management (PIM) tools are centralized software platforms designed to collect, manage, enrich, and syndicate product data across an organization's selling channels. This category covers the software used to manage the commercial lifecycle of product data: ingesting raw technical specs from engineering or suppliers, enriching that data with marketing copy and media, and distributing accurate, channel-specific content to e-commerce storefronts, marketplaces, and print catalogs. It sits between ERP (which manages transactional and inventory data) and external sales channels (which display the final content to buyers). It includes both general-purpose platforms suitable for broad retail use and vertical-specific tools built for complex industries like manufacturing and healthcare.

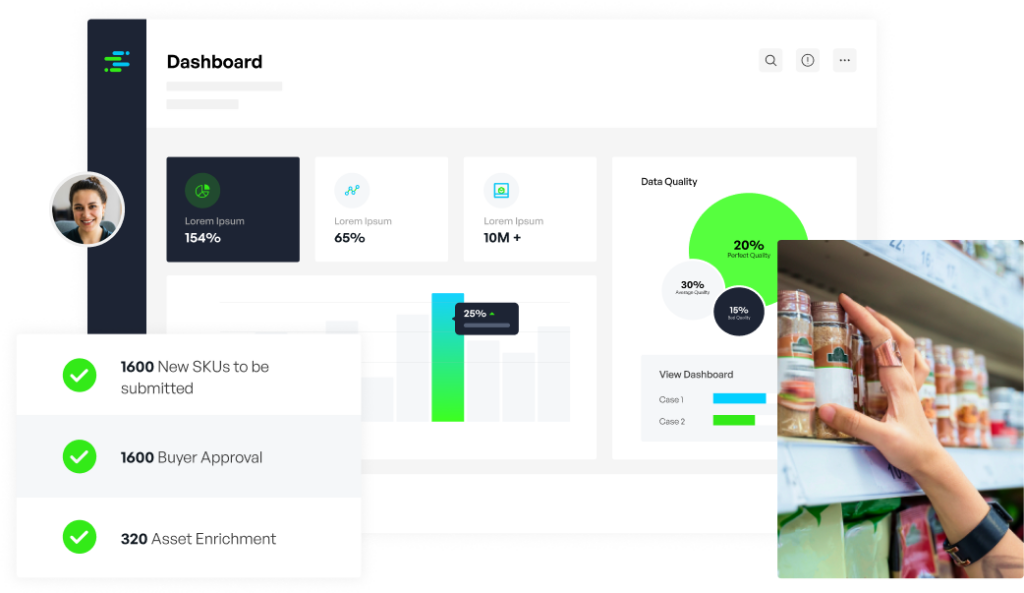

The core problem PIM solves is the fragmentation of product data. In the absence of a PIM, product specifications often live in static spreadsheets, legacy ERP fields, and scattered email threads. This fragmentation leads to data inconsistencies, slow time-to-market, and costly errors on the digital shelf. PIM matters because it acts as the single source of truth for marketing and sales data, ensuring that the technical attributes defined by engineers are translated into compelling, accurate descriptions that drive revenue. It is used primarily by e-commerce managers, product marketers, and catalog administrators who need to maintain data quality across an expanding array of digital touchpoints.

History of Product Information Management

The origins of modern Product Information Management can be traced back to the 1990s, emerging from the limitations of Enterprise Resource Planning (ERP) systems. As businesses began to digitize their operations, they initially relied on ERPs to store product data [1]. However, ERPs were designed for transactional efficiency—managing inventory levels, pricing, and logistics—not for the rich, descriptive content required for marketing. The fields were rigid, character limits were strict, and media management was non-existent. This created a "gap" where marketing teams were forced to manage product descriptions and images in disconnected spreadsheets and desktop folders [2].

In the late 1990s and early 2000s, with the rise of the internet and early e-commerce, this gap widened. The need to publish consistent data to web stores led to the development of the first specialized PIM solutions, often evolving out of Master Data Management (MDM) or Cross-Media Publishing tools [3]. These early systems were heavy, on-premise relational databases designed to centralize information for print catalogs and nascent websites. They were IT-heavy implementations focused on storage rather than agility.

The market shifted significantly in the 2010s with the explosion of omnichannel commerce. Brands were no longer just selling on their own website; they had to push data to Amazon, eBay, social media, and third-party distributors [4]. This era saw the rise of vertical SaaS and cloud-native PIMs that prioritized connectivity and user experience over raw database power. Market consolidation also reshaped the landscape, with larger data management firms acquiring nimble PIM providers to offer end-to-end "Product Experience Management" (PXM) suites. Today, buyer expectations have evolved from "give me a database" to "give me actionable intelligence," with modern tools integrating AI for automated enrichment and digital shelf analytics to measure content performance [5].

What to Look For

When evaluating PIM software, buyers must prioritize connectivity and flexibility. A robust PIM should offer pre-built connectors or a well-documented API to seamlessly ingest data from your upstream systems (ERP, PLM) and syndicate it to your downstream channels (Shopify, Magento, Amazon). Look for "headless" capabilities that allow you to decouple the back-end data management from the front-end presentation, ensuring your data structure can survive a website re-platforming.

Data governance features are critical. The system should allow you to define granular user roles and approval workflows. For example, a junior copywriter should be able to edit descriptions but not pricing, and a legal compliance officer should have the final sign-off before a product goes live. Without these controls, a PIM becomes just another chaotic data silo. Additionally, assess the enrichment tools: look for bulk editing capabilities, inheritance structures (where variants inherit data from a parent product), and asset management features that link images and videos directly to SKUs.

Red flags include proprietary data formats that make it difficult to export your own data, hidden fees for adding new sales channels or users, and a lack of support for complex product relationships (such as bundles, kits, or cross-sells). Be wary of vendors who claim "instant" integration without scoping your specific data model; mapping ERP fields to PIM attributes is rarely a plug-and-play process. Critical questions to ask include: "How does your system handle data validation rules to prevent incomplete products from being published?" and "Can we create custom attributes on the fly without IT intervention?"

Industry-Specific Use Cases

Retail & E-commerce

For retail and e-commerce, the primary driver for PIM adoption is speed to market and omnichannel consistency. Retailers often manage high volumes of SKUs with frequent turnover (e.g., seasonal fashion lines). They need a PIM that can handle complex variant structures (size, color, material) and automate the syndication of data to marketplaces like Amazon, Walmart, and social commerce platforms. A critical evaluation priority is the ability to manage "golden records" that merge data from multiple suppliers into a single, standardized format [6].

These tools must also support Digital Shelf Analytics to monitor how products appear on third-party sites. Retailers should look for PXM (Product Experience Management) features that allow for tailoring content to specific channels—for instance, sending a short, punchy description to Instagram while sending a detailed, spec-heavy description to Amazon [7]. Unique considerations include the ability to handle high-resolution media assets and facilitate rapid returns reduction through accurate sizing charts and descriptions.

Healthcare

In healthcare and medical devices, the focus shifts from marketing agility to regulatory compliance and patient safety. PIM tools in this sector must manage Unique Device Identification (UDI) compliance, submitting accurate data to the FDA's GUDID database and other global regulatory bodies [8]. The cost of error is not just lost revenue but potential legal action and patient harm. Therefore, audit trails and strict version control are non-negotiable features.

Healthcare buyers need PIMs that support the HL7 data standards and integrate with specialized healthcare ERPs. They often require the ability to manage different data views for different stakeholders—surgeons need technical specs, while procurement officers need pricing and packaging data. Validation rules must be rigorous, flagging any missing mandatory attributes before syndication [9].

Financial Services

While not "products" in the physical sense, financial institutions use PIM tools to manage banking products, insurance plans, and credit card offerings. The complexity here lies in the governance of terms, conditions, rates, and eligibility criteria across different regions and customer segments. A PIM for financial services must ensure that a change in interest rates or fee structures in the central system is instantly reflected across all branches, apps, and websites to avoid compliance fines [10].

Evaluation priorities include granular permission settings to ensure only authorized personnel can alter sensitive product terms. The system must handle complex hierarchies where a "parent" product (e.g., a checking account) has multiple "child" variations based on state regulations or customer tiers. Security is paramount, with requirements often mirroring those of ISO 27001 or SOC 2 compliance [11].

Manufacturing

Manufacturers deal with highly technical data and complex relationships, such as Bill of Materials (BOM) and spare parts compatibility. Their PIM needs to integrate with Product Lifecycle Management (PLM) systems to ingest engineering data and translate it into commercial information for distributors and dealers [12]. A unique challenge is managing data for B2B channels, which often requires different data sets (e.g., CAD drawings, safety data sheets) compared to B2C channels.

Manufacturing PIMs must support the Digital Product Passport (DPP) initiatives, particularly for those selling into the EU, tracking sustainability data and material composition throughout the supply chain [13]. Buyers should prioritize tools that can handle millions of SKUs and attribute combinations, ensuring that a change in a single component's specification automatically updates every finished good that uses that component.

Professional Services

For professional services firms, the "product" is a service offering, training course, or consulting package. PIM tools here are used to productize services, standardizing descriptions, deliverables, and pricing structures across the organization. This allows sales teams to generate accurate proposals and statements of work (SOWs) quickly. The focus is on knowledge management and ensuring that the sales force is selling active, approved service configurations [14].

Unique considerations include integration with CRM and CPQ (Configure, Price, Quote) tools. The PIM must allow for the management of "rate cards" and resource requirements associated with each service product. Unlike retail PIMs that focus on image assets, professional services PIMs prioritize document management, such as case studies, white papers, and CVs linked to specific service offerings.

Subcategory Overview

While the core function of PIM remains consistent, specific user groups require distinct workflows that generic tools often fail to support. Understanding these nuances is key to selecting a platform that aligns with your operational reality.

Digital Marketing Agencies often manage product feeds for multiple clients simultaneously, requiring multi-tenant architectures that segment data securely. Unlike a standard brand PIM, these tools must excel at feed optimization—manipulating data on the fly to meet the strict formatting requirements of Google Shopping, Facebook Ads, or affiliate networks without altering the client's source data. The pain point driving this niche is the need to rapidly A/B test titles and images across ad channels without waiting for the client's IT team to update the master catalog. For a deeper look at tools specialized for this high-velocity environment, see our guide to Product Information Management (PIM) Tools for Digital Marketing Agencies.

Ecommerce Brands, particularly Direct-to-Consumer (D2C) companies, require PIMs that prioritize visual merchandising and speed. These tools distinguish themselves by tightly integrating Digital Asset Management (DAM) directly into the product record, allowing teams to drag-and-drop media to specific SKUs. The workflow unique to this niche is the "collection launch," where marketing, merchandising, and inventory teams coordinate a synchronized release of new products across social, mobile, and web channels instantly. General tools often lack the visual interface required for this creative-led process. To explore solutions built for these agile teams, read about Product Information Management (PIM) Tools for Ecommerce Brands.

Marketing Agencies that handle creative production and brand management for clients face a different challenge: collaboration. These tools are designed to facilitate the approval loops between the agency's creative team and the client's brand managers. Unlike generic PIMs, they often feature robust "portal" capabilities that allow external stakeholders to review and annotate product content before it is finalized. The driver here is the elimination of "version control hell" where email threads bury the latest approved copy. For agencies needing these collaborative features, consult our guide on Product Information Management (PIM) Tools for Marketing Agencies.

Integration & API Ecosystem

The success of a PIM implementation hinges on its ability to talk to other systems. A standalone PIM is effectively a digital silo; its value is realized only when data flows automatically from the ERP and out to sales channels. Buyers must scrutinize the API documentation: is it REST-based? Is it well-documented? Are there rate limits? Gartner notes that integration challenges are a primary reason for project delays, and effective API management is a key differentiator for modern PIMs [6]. Statistics from MuleSoft indicate that custom integrations cost large enterprises on average $3.5 million annually in labor, highlighting the financial risk of choosing a PIM with poor native connectivity [15].

Consider a scenario where a 50-person professional services firm attempts to connect a legacy PIM to their NetSuite ERP and a custom quoting tool. If the PIM relies on outdated batch file transfers (CSV drops) rather than real-time APIs, a change in service pricing in NetSuite might take 24 hours to reflect in the quoting tool. This latency could lead to sales reps issuing proposals with expired pricing, resulting in margin erosion or contract disputes. A robust API ecosystem would enable a webhook architecture where the price update triggers an instant synchronization across all systems.

Security & Compliance

Data security in PIM is often overlooked, but as these systems increasingly hold sensitive intellectual property and regulated data, it is becoming a boardroom issue. Compliance with standards like ISO 27001 and SOC 2 is a baseline requirement for enterprise buyers. In highly regulated sectors like healthcare, the PIM must also support HIPAA compliance where patient data intersects with product usage. IBM's 2024 Cost of a Data Breach Report found that the average cost of a data breach in the healthcare sector reached nearly $9.8 million, the highest of any industry [16].

Imagine a medical device manufacturer using a PIM to manage labeling content for FDA submission. If the PIM lacks granular field-level security, a marketing intern might accidentally overwrite a clinically validated warning label with a "more catchy" version. If this unapproved change propagates to the packaging printer, the manufacturer could face a Class I recall, massive fines, and reputational damage. A secure PIM would prevent this by locking specific compliance fields to all but a few authorized regulatory affairs managers.

Pricing Models & TCO

PIM pricing is notoriously opaque, often shifting between per-SKU, per-user, or GMV (Gross Merchandise Value) models. A Total Cost of Ownership (TCO) analysis must look beyond the license fee to include implementation, storage overages, and connector fees. Research suggests that for every $1 spent on software licensing, organizations spend $3 to $5 on implementation and services [17].

Take a hypothetical mid-market retailer with a 25-person team evaluating two vendors. Vendor A offers a low flat rate of $20,000/year but charges $5,000 for every new sales channel connection. Vendor B charges $40,000/year but includes unlimited channels. If the retailer plans to expand to Amazon, Walmart, Target, and eBay in the next 18 months, Vendor A's TCO quickly balloons by $20,000, achieving parity with Vendor B while offering less predictable costs. Furthermore, if Vendor A charges for data storage and the retailer begins uploading 4K video assets, the monthly overage fees can destroy the budget.

Implementation & Change Management

The technical deployment of a PIM is often easier than the cultural shift required to use it. "Change management" is the discipline of transitioning individuals, teams, and organizations to a desired future state. McKinsey research has consistently shown that 70% of change programs fail to achieve their goals, largely due to employee resistance and lack of management support [18]. Successful PIM implementation requires a "PIM Champion"—a dedicated internal stakeholder who bridges the gap between IT and Marketing.

In practice, consider a manufacturing company where product data has historically been "owned" by engineering in the PLM system. Marketing has always manually copied this data into spreadsheets. When a PIM is introduced, engineers may resist the new workflow, viewing the PIM as "marketing fluff" and refusing to validate data within it. Without a change management strategy that aligns incentives—perhaps showing engineers how PIM reduces their ad-hoc data requests by 80%—the system will sit empty, bypassed by the very teams it was meant to help.

Vendor Evaluation Criteria

Selecting a PIM vendor requires a structured approach that balances current needs with future scalability. Forrester analysts emphasize that buyers should look for vendors that demonstrate "topline business growth by actively managing product information quality," rather than just providing a passive storage bucket [19]. Key criteria include the vendor's roadmap (are they investing in AI?), their partner ecosystem (do they have certified integrators?), and their support structure (is it 24/7 or email-only?).

A concrete evaluation scenario involves a "Proof of Concept" (POC) challenge. Instead of watching a generic demo, a buyer should provide the vendor with a messy, real-world dataset—500 SKUs with inconsistent formatting, missing fields, and duplicate images—and ask them to clean, organize, and syndicate this data to a dummy Shopify store live during the demo. This "stress test" reveals the true usability of the tool far better than a polished sales presentation. If the vendor struggles to map the messy data or the import tool crashes, it’s a clear warning sign.

Emerging Trends and Contrarian Take

Looking toward 2025-2026, the PIM market is rapidly evolving. Generative AI is moving from a buzzword to a utility, with PIMs integrating LLMs to auto-generate product descriptions and translate content for global markets instantly [20]. Another major shift is the Digital Product Passport (DPP), driven by EU regulations requiring detailed sustainability data to travel with the product, forcing PIMs to become repositories for carbon footprint and supply chain transparency data [21].

Contrarian Take: The "Single Source of Truth" is a myth. For years, vendors have sold PIM as the one place where data lives. In reality, data is fluid; pricing lives in the ERP, technical specs in the PLM, and creative assets in the DAM. The most successful businesses stop trying to force every data point into the PIM and instead treat PIM as a "Single Source of Context"—a specialized translation layer that contextualizes technical data for commercial use, rather than a master repository for the entire enterprise.

Common Mistakes

One of the most frequent mistakes is treating PIM as a data cleanup project rather than a business process transformation. Companies often delay implementation for months trying to "perfect" their data in spreadsheets before importing it. This is a trap; it is far more efficient to ingest imperfect data into the PIM and use the PIM's superior tools to clean it. Another error is over-customization. Buyers often try to bend the PIM to match their legacy (and inefficient) workflows, resulting in a brittle system that breaks with every update. Gartner estimates that poor data quality costs organizations an average of $12.9 million annually, a cost often perpetuated by poor implementation choices [22].

Questions to Ask in a Demo

- "Can you show me the exact workflow for correcting a data error reported by a customer on Amazon, and how that correction propagates back to the master record?" (Tests the round-trip capability and workflow efficiency).

- "How does your licensing model handle a sudden spike in SKUs, such as a seasonal catalog expansion or an acquisition?" (Reveals hidden scalability costs).

- "Show me the API documentation for your most recent release. How do you handle deprecation of endpoints?" (Tests the maturity of their developer ecosystem).

- "What are the specific limitations of your digital asset management features compared to a standalone DAM?" (Prevents overestimating the tool's media capabilities).

- "Can you demonstrate how permissions can be set at the attribute level, not just the product level?" (Crucial for governance in large teams).

Before Signing the Contract

Before finalizing the agreement, ensure the Service Level Agreement (SLA) clearly defines uptime guarantees and penalties for breaches. Negotiate the data exit strategy: confirm that if you leave the vendor, you can export your enriched data in a usable, structured format (like JSON or XML) without punitive fees. Check for "sandbox" environments included in the price—you need a safe space to test data model changes before pushing them to production. Finally, scrutinize the support tiers; "standard" support often means 48-hour response times via email, which is unacceptable during a Black Friday crisis. Ensure you have a defined escalation path to a human engineer.

Closing

Selecting the right PIM is a strategic decision that underpins your entire digital commerce operation. It requires balancing technical rigor with marketing agility. If you have specific questions about your PIM strategy or need guidance on vendor selection, feel free to reach out.

Email: albert@whatarethebest.com