There's no shortage of rankings that tell founders where they should start a business. Almost none explain to them what happens next: the labor costs that climb, the compliance mandates that compound, the tax burden that only appears once revenue scales. A new analysis of all 50 states measures both sides of that equation using a Launch Score, a Sustainability Score, and an original metric called the Founder Trap Index that captures the gap between them.

Most "best states for business" rankings answer a narrow question: where is it cheapest to get started? This one asks the question that matters more: where do businesses actually survive? All 50 states are scored on launch conditions and on the factors that determine whether a company is still operating at year five.

To measure the full picture, the analysis scores each state twice.

The Launch Score captures what a founder sees in year one: filing fees, initial tax exposure at $250,000 in revenue, whether businesses survive their first twelve months, how easily they can access SBA capital, what office space costs, and how fast the local economy is growing.

The Sustainability Score captures what that same founder sees in year five: how costs have compounded, whether businesses are still open, how much labor pressure has built, where rent is headed, what taxes look like at $1 million in revenue, and how heavy the compliance load has become. These are the costs that land squarely on the back office, from scaling payroll, managing workforce compliance, and keeping finance and HR operations running as revenue grows. By year five, a growing business is paying more than simply rent and wages. It's carrying a stack of software subscriptions across finance, HR, and sales, and the cost of that stack compounds faster in states where compliance mandates and payroll complexity demand more from each tool.

Two variables carry particular weight across both scores. Economic Dynamism, a composite of GDP growth, population growth, and business formation rate scaled 0 to 100, is the single strongest predictor of long-term viability in the dataset. The four highest-scoring states, Texas (96.3), Florida (92.8), Utah (84.0), and Arizona (83.9), all rank in the top 10 for sustainability. The Talent Score rates each state's workforce on a 0 to 100 scale using two inputs: average weekly wages and unemployment rate. Wages serve as a proxy for the skill level and depth of the available labor pool, while unemployment captures how tight that market is. New York (68.1), Massachusetts (63.4), and Florida (59.4) score the highest.

Both scores run from 0 to 100. The gap between a state's sustainability rank and its launch rank produces the Founder Trap Score. The higher the number, the tougher running the business gets after day one. Washington (+18) and Alaska (+19) are the biggest traps, states that look strong at entry but deteriorate as operating costs build. Massachusetts (-21) and New Hampshire (-18) are the biggest hidden gems, states that look expensive at the door but quietly reward founders who stay.

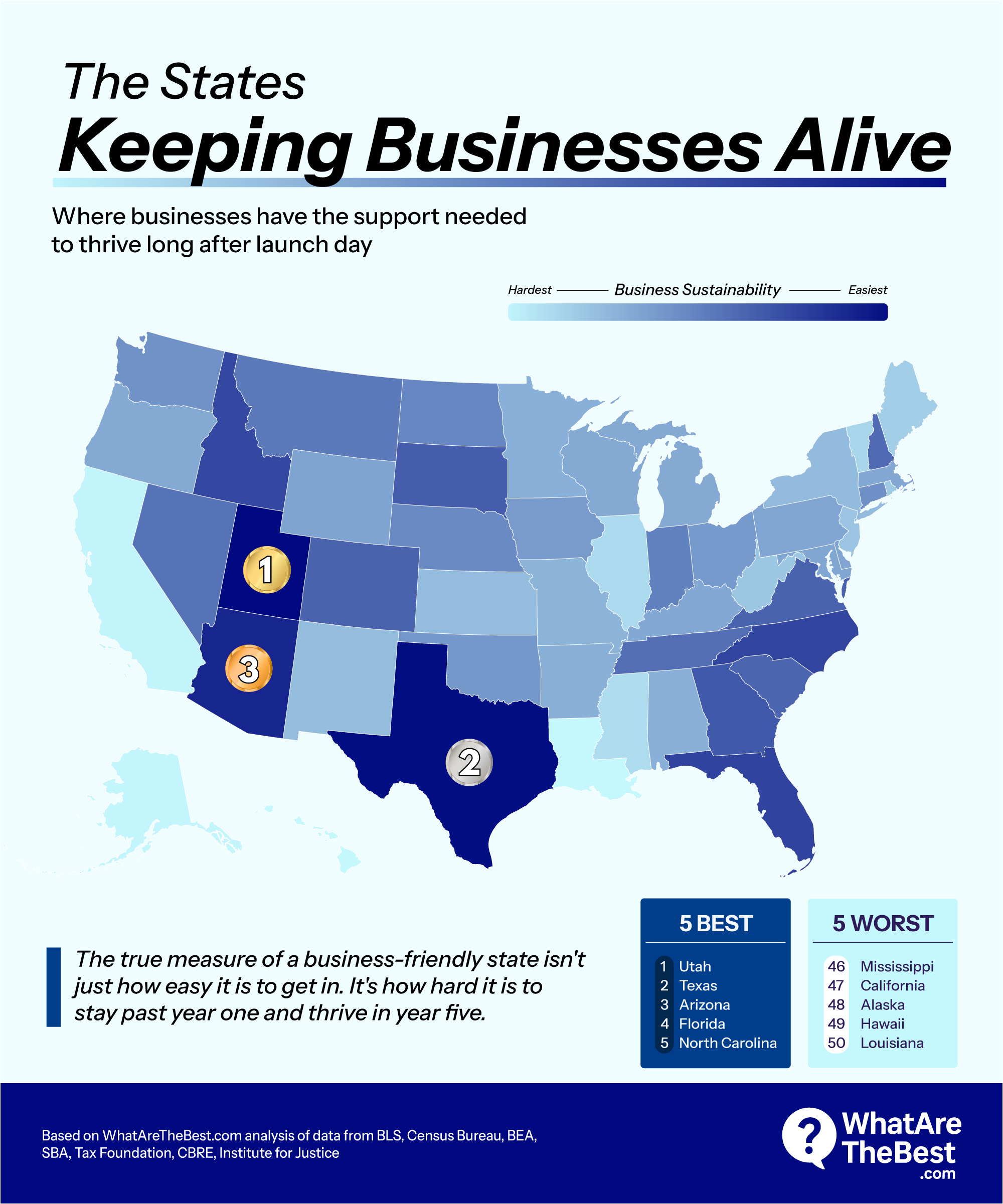

At the top of the sustainability rankings are Utah (75.5), Texas (74.7), and Arizona (71.3). At the bottom: Alaska (40.2), Hawaii (39.8), and Louisiana (39.8).

Utah ranks No. 1 for both launching and sustaining a business. It costs $21 to form an LLC in year one and $33 over five, the lowest in the nation. The corporate income tax rate is 4.85%, GDP growth runs at 4.5%, population growth at 1.45%, and the state's ALEC economic outlook ranking is No. 1. Compliance burden scores just 2.0 out of 10.

A Dynamism Score of 84.0, five-year survival of 53.0%, and a labor market that balances moderate wages ($1,385 per week) with low unemployment (3.2%) create conditions where the year-one picture and the year-five picture look nearly identical. For operations teams managing headcount growth and revenue scaling, the lack of a gap between launch and operating conditions means fewer surprises in the budget. There is no founder trap here. What you see at launch is what you get.

Texas has the highest economic dynamism score in the dataset at 96.3, fueled by 4.8% GDP growth, 1.55% population growth, and the highest business formation rate in the country at 7.2 applications per 1,000 residents. It has no traditional corporate income tax, though its franchise tax applies at higher revenue levels. SBA loan volume is the largest nationally with 8,950 approvals in fiscal year 2024 at an average of $455,000.

Five-year survival is 48.5% with erosion of 29.5%, moderate compared to top-ranked launch states like Washington. Office costs run $74,500 per year, the minimum wage sits at the federal floor of $7.25, and the compliance burden is 3.8 out of 10. That low compliance score has a practical meaning: fewer state-mandated filings, simpler payroll administration, and less time spent on regulatory overhead that pulls resources away from sales and growth. Businesses expanding across state lines face far less friction here than in high-mandate markets, where multi-state payroll platforms become a necessity rather than a convenience. Texas actually improves by two positions between the launch and sustainability rankings, one of the few high-ranking states where the operating environment gets slightly better over time rather than worse.

Arizona has the simplest formation structure of any top-ranked state. It costs $50 to form an LLC, there is no annual report requirement, and the five-year total stays at $50. Corporate income tax is 2.5%, among the lowest rates nationally. The state's Dynamism Score of 83.9 is powered by the highest population growth rate in the dataset at 1.58%, paired with 4.2% GDP growth and a business formation rate of 5.8 per 1,000 residents.

Five-year survival is 52.4% with erosion of 27.8%, among the lowest of any top-10 state. Office costs average $73,750 per year, unemployment is 3.5%, and the compliance burden sits at 3.5 out of 10. Like Utah, Arizona carries a Founder Trap Score of zero. The launch conditions and the sustainability conditions tell the same story.

Washington is the study's clearest cautionary tale. At launch, the numbers are exceptional: zero state income tax, the highest first-year survival rate in the country at 86.4%, strong SBA capital access (7.0 out of 10), and a Dynamism Score of 69.5. It ranks No. 2 for launch appeal.

By year five, the picture is unrecognizable. Washington's five-year survival rate is 41.1%, the lowest of any state, producing a survival erosion of 45.3 percentage points, also the worst nationally. The $17.13 minimum wage, paid family leave mandates, and a labor pressure score of 8.0 out of 10 compound into an operating burden that doesn't appear in the year-one profile. For growing businesses, those mandates translate into layered payroll complexity and HR compliance costs that compound with every hire, exactly the kind of operational drag that doesn't show up in a formation cost comparison. The 18-position drop between launch and sustainability rankings is the widest of any top-five launch state, and Washington is the reason the Founder Trap Index exists.

Massachusetts has the worst launch profile in the country after Vermont. Filing an LLC costs $500, with a $500 annual fee pushing the year-one total to $1,000 and the five-year total to $3,000, the highest nationally.

Then the sustainability numbers arrive. Massachusetts climbs 21 positions between the launch and sustainability rankings, the largest upward move of any state. Average weekly wages of $2,107 are the highest in the dataset, reflecting a Talent Score of 63.4, second only to New York. Five-year survival is 53.5% with erosion of just 26.0%, nearly 20 points better than Washington. The workforce is expensive because it's deep, skilled, and available, and that depth is what keeps five-year survival at 53.5% despite labor costs that would sink a business in a thinner market. Massachusetts is the strongest evidence in the dataset that high entry costs and strong long-term operating conditions can coexist.

California ranks poorly for both launch (No. 39) and sustainability (No. 47), but the underlying data is more complicated than the rankings suggest. Its first-year survival rate of 86.0% is the second highest nationally, behind only Washington. Its five-year survival rate of 54.6% is also among the best. SBA loan volume is the largest in the country at 9,850 approvals. And its Dynamism Score of 58.5, while not top-tier, reflects 3.8% GDP growth in the largest state economy in the nation.

What pulls California down is everything around those numbers. The corporate income tax rate is 8.84%, the highest in the dataset. Office costs average $114,500 per year, nearly double the national median. The compliance burden scores 8.5 out of 10, requiring businesses to invest in tax compliance software and dedicated HR systems earlier than they would in most other states. Unemployment is 5.2%. The minimum wage is $16.50 with ongoing indexing. California proves that strong survival rates and a massive economy are not enough to offset what it costs to operate there. Businesses last in California, but the data shows they last in spite of the operating environment, not because of it.

This analysis evaluates all 50 U.S. states across two composite indexes, each scaled 0 to 100. The Launch Score comprises six components (formation costs, first-year survival rate, SBA capital access, tax burden at $250,000 revenue, real estate pressure, and economic dynamism) weighted between 10% and 25%, with economic dynamism and survival rate receiving the highest weights. The Sustainability Score comprises seven components (ongoing formation costs, five-year survival rate, labor market pressure, real estate trajectory, tax burden at $1 million revenue, compliance burden, and economic dynamism), with survival, labor pressure, compliance, and dynamism each weighted at 20% and formation costs at 10%.

The Founder Trap Index is calculated as Sustainability Rank minus Launch Rank. Data sources include the Bureau of Labor Statistics (Business Employment Dynamics, QCEW, LAUS), U.S. Census Bureau, U.S. Small Business Administration (7(a) loan data), Tax Foundation (SBTCI, 2025), ALEC (Rich States, Poor States, 18th Edition), Institute for Justice (License to Work, 3rd Edition), CBRE/CoStar/CommercialEdge (office market data), Bureau of Economic Analysis, and the Kauffman Foundation.

Limitations: All figures represent state-level averages and do not capture metro or industry variation. The analysis is industry-neutral by design. Composite scores are best interpreted in tiers rather than as precise ordinal rankings. Two sources in the compliance index, ALEC and the Tax Foundation, are advocacy-affiliated organizations; their data was included for breadth but should be interpreted accordingly.