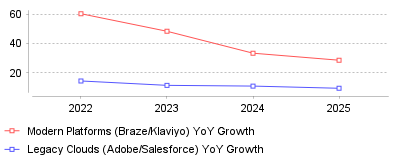

Recent financial data reveals a distinct "growth gap" in the Campaign Orchestration market: while legacy marketing clouds (Adobe and Salesforce) have settled into mature, single-digit or low-double-digit growth, modern, data-native platforms (Braze and Klaviyo) continue to expand at nearly triple that rate. This trend highlights a fundamental industry shift where enterprises are increasingly migra

| Fiscal Year | Modern Platforms (Braze/Klaviyo) YoY Growth | Legacy Clouds (Adobe/Salesforce) YoY Growth |

|---|---|---|

| 2022 | 60.5 | 14.5 |

| 2023 | 48.5 | 11.5 |

| 2024 | 33.5 | 11 |

| 2025 | 28.7 | 9.5 |

The data highlights a significant divergence in revenue growth trajectories between "Modern" customer engagement platforms (Braze and Klaviyo) and "Legacy" marketing clouds (Adobe Experience Cloud and Salesforce Marketing/Commerce Clouds). While both categories are growing, the modern cohort maintained a massive ~29% average growth rate in their most recent fiscal reports [1][2], compared to the mature ~9-11% growth seen in the legacy sector [3][4]. This trend persists even as the broader SaaS market faces consolidation pressures.

This growth gap signals that the market is favoring "systems of action" over traditional "systems of record." Legacy platforms, often built through acquiring older technologies (like ExactTarget or Omniture), are struggling to match the real-time data ingestion and activation capabilities of cloud-native competitors. For the industry, this implies that large enterprises are no longer defaulting to the "safe" option of a monolithic suite (e.g., buying everything from Salesforce). Instead, they are decoupling their stacks, preferring specialized orchestration layers that can handle the volume and velocity of mobile app data and SMS interactions, which are areas where Braze and Klaviyo excel [5][6].

As marketing pivots toward Artificial Intelligence, data freshness is critical; AI models personalized on stale, batch-processed data (common in legacy architectures) fail to deliver relevant experiences. The sustained high growth of modern platforms suggests they are better positioned to be the "brain" of the AI marketing stack because they were architected to stream data rather than store it in rigid silos [7]. Furthermore, the ability to demonstrate clear ROI through direct attribution—a strength of performance-focused tools like Klaviyo—has become non-negotiable for CFOs approving software budgets in a tighter economy.

The primary driver is likely technical debt within legacy platforms, which often requires complex, expensive integration projects to unify data, whereas modern platforms offer faster "time-to-value" with native data structures. Additionally, the shift in consumer behavior toward mobile apps and SMS has favored platforms like Braze, which was built mobile-first, over legacy tools originally designed for desktop email. Finally, the "platform vs. suite" dynamic is shifting; modern platforms have successfully expanded upmarket into the enterprise space, stealing market share from incumbents by offering better usability and lower total cost of ownership [8][7].

The "Agility Shift" demonstrates that brands are prioritizing speed and real-time capability over the convenience of a single-vendor suite. While legacy clouds remain massive in total revenue, their stagnating growth rates suggest they are becoming utility players, while modern orchestration platforms are capturing the new innovation budget. For buyers, the takeaway is clear: the future of campaign orchestration lies in platforms that can activate data in milliseconds, not hours.

The digital marketing landscape has reached a critical inflection point where traditional marketing automation is no longer sufficient to meet modern consumer expectations. As organizations graduate from static, linear campaign flows to dynamic, real-time engagement models, the Campaign Orchestration Platform market is undergoing significant structural shifts. Industry analysis indicates that while automation tools excelled at efficiency—scheduling emails and managing lists—orchestration platforms are now required to function as central nervous systems, making sub-second decisions based on live behavioral signals. With the global marketing automation sector projected to reach significant valuations by 2030, the focus has shifted from mere message delivery to the intelligent coordination of complex customer journeys.

However, this evolution is not without friction. Operational bottlenecks, particularly in data unification and content velocity, threaten to stall the ROI of these sophisticated platforms. Marketing leaders are currently navigating a "perfect storm" of channel fragmentation, data latency, and the pressure to integrate generative AI into existing workflows. This report analyzes the prevailing trends reshaping Campaign Orchestration Platforms, the operational hurdles impeding their full utilization, and the strategic imperatives for enterprise leaders.

The distinction between marketing automation and campaign orchestration is becoming increasingly sharp. Historically, Marketing & Advertising Platforms were designed to execute linear, "if/then" sequences—rigid paths that assumed a predictable customer journey. Orchestration represents a paradigm shift towards non-linear, probabilistic engagement.

Recent industry research underscores this transition. While automation focuses on execution (sending the message), orchestration focuses on decisioning (determining the next best action). According to Pega, orchestration acts as the strategic intelligence that directs automation, determining actions based on dynamic data rather than predetermined schedules [1]. This shift is driven by necessity; customer journeys are rarely linear. Buyers jump between channels, pause for weeks, and interact with service teams simultaneously. Traditional automation often fails in these scenarios, sending "buy now" emails to customers with open support tickets—a failure of context that orchestration seeks to resolve [2].

The market trajectory reflects this demand for intelligence. Reports suggest the global marketing automation market is on a trajectory to exceed $13 billion by 2030, driven by the need for full-funnel omnichannel marketing and predictive AI capabilities [3]. Businesses are moving beyond efficiency metrics toward revenue orchestration, viewing these platforms not just as departmental tools but as critical infrastructure for go-to-market (GTM) strategy [4].

One of the most significant trends in campaign orchestration is the decoupling of the data layer from the engagement layer. For years, marketers relied on bundled suites where customer data lived inside the execution tool. This model is collapsing under the weight of data duplication and latency.

The industry is witnessing the rise of "Composable CDPs," where campaign orchestration logic sits directly on top of cloud data warehouses like Snowflake or BigQuery. This architecture allows Campaign Orchestration Tools with Behavioral Data to access a single source of truth without costly and fragile sync processes. Unlike traditional CDPs that require copying data into a proprietary black box, composable solutions activate data where it resides.

Demand Gen Report highlights that legacy CDP players are facing shakeups due to outdated architectures and sluggish onboarding cycles. In contrast, composable solutions are gaining traction because they offer agile, scalable implementation that leverages existing data infrastructure [5]. This shift is critical for orchestration because it reduces the "data lag" that often renders personalization obsolete before it reaches the customer. When orchestration platforms can query the data warehouse directly, they can trigger campaigns based on real-time inventory changes, payment events, or usage metrics that traditional marketing clouds might miss.

Demographic targeting is being rapidly displaced by behavioral signaling. Research by Circana indicates that behavioral segmentation drives significantly higher marketing precision than demographic approaches, which often rely on inaccurate generalizations [6]. In 2025, the most effective orchestration platforms are those that can ingest high-velocity behavioral event streams—clicks, app opens, video views—and translate them into immediate campaign adjustments.

Despite the technological advancements, marketing teams face severe operational bottlenecks. The sophistication of the tools often outpaces the organizational capacity to manage them, leading to utilization gaps and performance issues.

A paradox exists in the modern marketing stack: teams have more data than ever but struggle to use it effectively. A 2025 report by Supermetrics reveals that marketing teams are using 230% more data compared to 2020, yet 56% report lacking the time to analyze it properly [7]. This data overload paralyzes orchestration efforts. Marketers often revert to basic "batch and blast" tactics because the operational effort to map complex, data-driven journeys is too high.

Furthermore, tool fragmentation exacerbates this issue. Marketing teams use an average of 19 different tools in everyday work, leading to massive data duplication. Airtable's 2024 Marketing Trends Report found that 43% of respondents believe up to half of their team's data is duplicated across multiple platforms [8]. For Campaign Tools with Real Time Segmentation, this fragmentation is fatal. If the segmentation engine cannot see that a customer just converted on a different channel due to data latency, it will continue to serve retargeting ads, wasting budget and degrading the customer experience.

The pressure to prove value is intensifying, yet visibility remains poor. Gartner's 2025 survey reveals that 87% of CMOs experienced campaign performance issues in the last 12 months, with nearly half reporting the need to terminate campaigns early due to poor results [9]. The complexity of cross-channel orchestration makes attribution difficult. When a customer interacts with ten different touchpoints managed by three different teams (social, email, web), determining which orchestration logic drove the sale is analytically challenging.

While Generative AI is touted as a solution for content velocity, its adoption in campaign workflows is uneven. Gartner found that 27% of marketing organizations still have limited or no adoption of GenAI for marketing campaigns [9]. High-performing organizations are leveraging it for creative development and strategy, but many others are stalled by governance concerns and a lack of skill sets. The operational challenge here is integrating AI *into* the orchestration flow—automating not just the delivery of the message, but the creation of the content variation itself in real-time.

Nowhere are the stakes of orchestration higher than in ecommerce, where cart abandonment remains a persistent revenue leak. Effective Campaign Orchestration Tools for Ecommerce must now handle highly specific use cases like browse abandonment, price drop alerts, and back-in-stock notifications with near-zero latency.

Data from 2024 and 2025 indicates that the global average cart abandonment rate hovers around 70% [10]. Mobile users show even higher rates, often exceeding 75% [11]. The operational challenge for orchestration platforms is to trigger recovery workflows that are timely but not intrusive.

Behavioral nuances are critical here. For example, a user who abandons a cart due to unexpected shipping costs requires a different orchestration path (e.g., a free shipping coupon) than a user who abandons because the site crashed (e.g., a "we saved your cart" service message). Generic recovery emails are yielding diminishing returns; orchestration platforms must now ingest checkout error logs and session data to contextualize the recovery message.

As orchestration platforms enable hyper-segmentation—creating thousands of micro-segments instead of a few broad ones—the demand for content explodes. You cannot target 1,000 different segments if you only have three creative assets. This is the "Content Supply Chain" bottleneck.

Generative AI is beginning to address this. Marketers using GenAI tools report saving an average of 2.5 hours per day, with some saving up to 15 hours a week by automating tasks like caption writing and trend identification [12]. Deloitte reports that early GenAI adopters are seeing a 12% ROI on their investments, primarily driven by the ability to meet the 1.5x growth in content demand that manual teams could not fulfill [13].

For Cross Channel Campaign Automation Platforms, the integration of GenAI is not just a feature; it is an infrastructure requirement. Platforms that can auto-generate subject lines, image variations, and body copy based on the recipient's behavioral profile are rapidly outpacing those that rely on static asset libraries.

The shift to advanced orchestration has profound business implications for organizational structure and budget allocation.

Looking ahead to 2026 and beyond, the industry is moving toward "Agentic AI." Unlike current workflows where humans define the rules ("If X happens, send Y"), Agentic systems will be given a goal ("Maximize conversions for segment Z") and will autonomously determine the best channel, time, and message content to achieve it.

Braze and other leaders are already integrating predictive analytics that move beyond manual segmentation to dynamic, real-time audience generation [14]. Consumers now expect this level of intuition; 71% of U.S. consumers expect personalized interactions and are frustrated when they don't get them [15].

The future of campaign orchestration is not "campaigns" at all, but "always-on" logic streams that react to customer intent in the moment. The operational winners will be those who can tame their data chaos and trust AI agents to execute the last mile of customer engagement.