Why We Love It

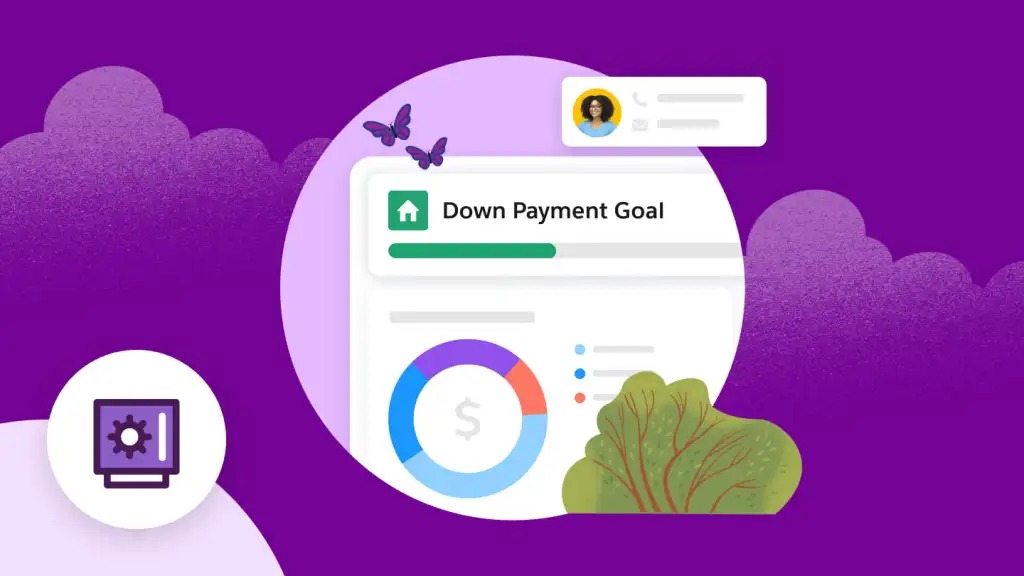

EZLynx is a game-changer for insurance agencies looking to scale. It's not just a software, it's a full-fledged solution designed with the unique needs of insurance professionals in mind. It simplifies complex tasks such as policy comparison, client management, and overall agency operations. Its powerful automation tools free up time for more critical tasks. The icing on the cake? Its user-friendly interface that makes onboarding a breeze, making it a favorite among growth-focused insurance agencies.

Pros

- Comprehensive management solution

- Insurance-specific features

- Streamlined policy comparison

- User-friendly interface

- Robust automation capabilities

Cons

- Potentially overwhelming for beginners

- Custom pricing may not fit all budgets

Custom pricing available on request

EZLynx is an all-in-one, comprehensive agency management system specifically designed for insurance agencies aiming for growth. It delivers a powerful suite of tools for managing and automating all facets of an insurance agency, from policy comparison to client management, easing the complexities of insurance selling.

Pros

- Comprehensive management solution

- Insurance-specific features

- Streamlined policy comparison

- User-friendly interface

- Robust automation capabilities

Cons

- Potentially overwhelming for beginners

- Custom pricing may not fit all budgets

Why We Love It

EZLynx is a game-changer for insurance agencies looking to scale. It's not just a software, it's a full-fledged solution designed with the unique needs of insurance professionals in mind. It simplifies complex tasks such as policy comparison, client management, and overall agency operations. Its powerful automation tools free up time for more critical tasks. The icing on the cake? Its user-friendly interface that makes onboarding a breeze, making it a favorite among growth-focused insurance agencies.

Pros

- Comprehensive management solution

- Insurance-specific features

- Streamlined policy comparison

- User-friendly interface

- Robust automation capabilities

Cons

- Potentially overwhelming for beginners

- Custom pricing may not fit all budgets

Why We Love It

EZLynx is a game-changer for insurance agencies looking to scale. It's not just a software, it's a full-fledged solution designed with the unique needs of insurance professionals in mind. It simplifies complex tasks such as policy comparison, client management, and overall agency operations. Its powerful automation tools free up time for more critical tasks. The icing on the cake? Its user-friendly interface that makes onboarding a breeze, making it a favorite among growth-focused insurance agencies.

Custom pricing available on request

EZLynx is an all-in-one, comprehensive agency management system specifically designed for insurance agencies aiming for growth. It delivers a powerful suite of tools for managing and automating all facets of an insurance agency, from policy comparison to client management, easing the complexities of insurance selling.