Why We Love It

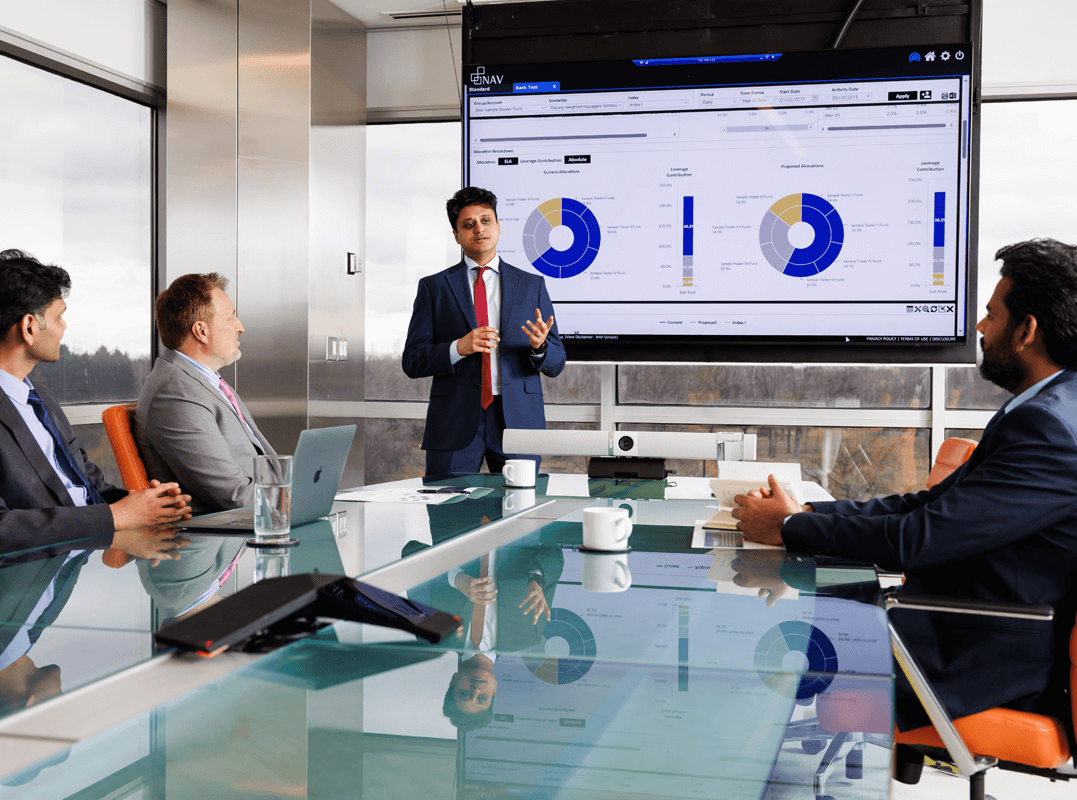

HubSpot for Private Equity is more than just a multichannel support platform. It's a tailored solution that takes into account the complexities and unique demands of private equity firms. From deal sourcing and tracking to improving portfolio performance, it provides a unified platform for all essential functions. The customizable nature ensures it adapts to the firm's specific needs, making it a truly indispensable tool for industry professionals.

Pros

- Optimized for PE firms

- Unifies deal flow

- Accelerates portfolio growth

- Comprehensive support and training

- Customizable for individual business needs

Cons

- Pricing not transparent

- Could be complex for beginners

- May require time for full implementation

Custom pricing available upon request

HubSpot for Private Equity, provided by digitalJ2, is designed specifically to cater to the unique needs of PE firms. The platform aids in optimizing operations, unifying deal flow, and accelerating growth across portfolio investments. It's an all-in-one solution that provides industry professionals with necessary tools for effective deal management and portfolio performance maximization.

Pros

- Optimized for PE firms

- Unifies deal flow

- Accelerates portfolio growth

- Comprehensive support and training

- Customizable for individual business needs

Cons

- Pricing not transparent

- Could be complex for beginners

- May require time for full implementation

Why We Love It

HubSpot for Private Equity is more than just a multichannel support platform. It's a tailored solution that takes into account the complexities and unique demands of private equity firms. From deal sourcing and tracking to improving portfolio performance, it provides a unified platform for all essential functions. The customizable nature ensures it adapts to the firm's specific needs, making it a truly indispensable tool for industry professionals.

Pros

- Optimized for PE firms

- Unifies deal flow

- Accelerates portfolio growth

- Comprehensive support and training

- Customizable for individual business needs

Cons

- Pricing not transparent

- Could be complex for beginners

- May require time for full implementation

Why We Love It

HubSpot for Private Equity is more than just a multichannel support platform. It's a tailored solution that takes into account the complexities and unique demands of private equity firms. From deal sourcing and tracking to improving portfolio performance, it provides a unified platform for all essential functions. The customizable nature ensures it adapts to the firm's specific needs, making it a truly indispensable tool for industry professionals.

Custom pricing available upon request

HubSpot for Private Equity, provided by digitalJ2, is designed specifically to cater to the unique needs of PE firms. The platform aids in optimizing operations, unifying deal flow, and accelerating growth across portfolio investments. It's an all-in-one solution that provides industry professionals with necessary tools for effective deal management and portfolio performance maximization.