Why We Love It

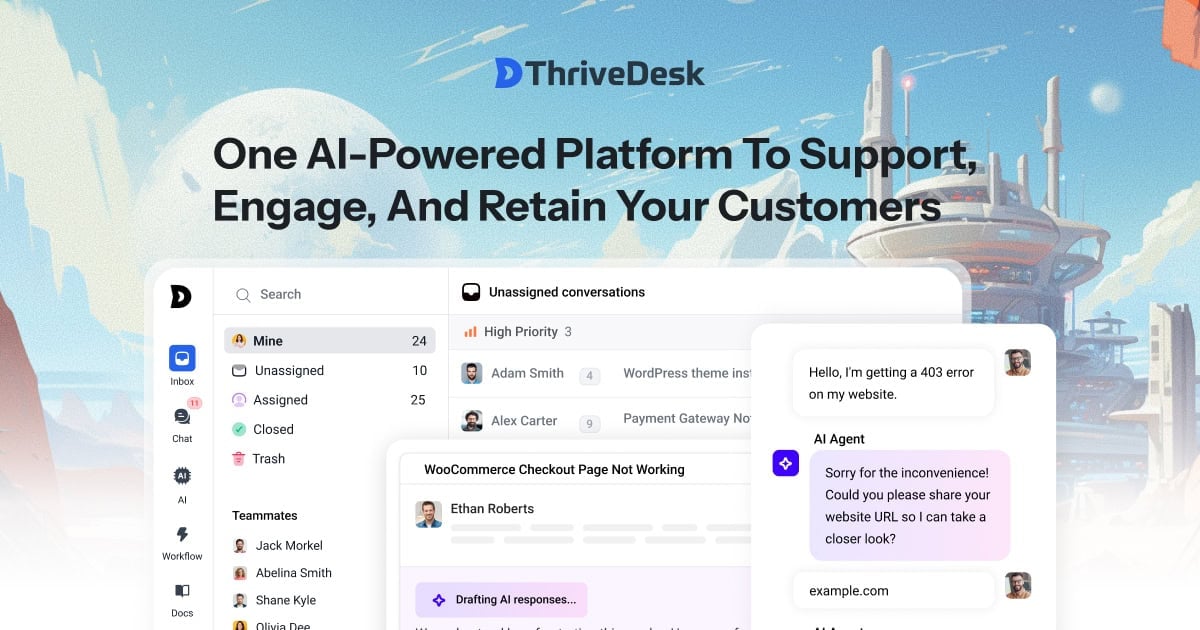

ThriveDesk's AI-powered solution is a game-changer for private equity firms. It is not just a chatbot; it is a highly specialized tool designed to understand and respond to industry-specific inquiries. This unique focus on private equity sets it apart. It saves time by automating responses to routine questions, allowing firms to focus more on strategic tasks. Moreover, its AI-driven nature ensures the information provided is accurate and up-to-date, which is crucial in the dynamic field of private equity.

Pros

- Automates routine queries

- Tailored to private equity industry

- AI-driven responses

- Efficient customer service

- Resource-saving

Cons

- No upfront pricing details

- May require technical setup

- Limited personal touch in interactions

Enterprise pricing available on request

ThriveDesk offers a cutting-edge AI chatbot and help desk solution tailored for private equity firms. It effectively automates responses to queries about fund strategies, portfolio companies, and investment criteria. This saves time and resources, allowing the firm to focus on their core investment activities.

Pros

- Automates routine queries

- Tailored to private equity industry

- AI-driven responses

- Efficient customer service

- Resource-saving

Cons

- No upfront pricing details

- May require technical setup

- Limited personal touch in interactions

Why We Love It

ThriveDesk's AI-powered solution is a game-changer for private equity firms. It is not just a chatbot; it is a highly specialized tool designed to understand and respond to industry-specific inquiries. This unique focus on private equity sets it apart. It saves time by automating responses to routine questions, allowing firms to focus more on strategic tasks. Moreover, its AI-driven nature ensures the information provided is accurate and up-to-date, which is crucial in the dynamic field of private equity.

Pros

- Automates routine queries

- Tailored to private equity industry

- AI-driven responses

- Efficient customer service

- Resource-saving

Cons

- No upfront pricing details

- May require technical setup

- Limited personal touch in interactions

Why We Love It

ThriveDesk's AI-powered solution is a game-changer for private equity firms. It is not just a chatbot; it is a highly specialized tool designed to understand and respond to industry-specific inquiries. This unique focus on private equity sets it apart. It saves time by automating responses to routine questions, allowing firms to focus more on strategic tasks. Moreover, its AI-driven nature ensures the information provided is accurate and up-to-date, which is crucial in the dynamic field of private equity.

Enterprise pricing available on request

ThriveDesk offers a cutting-edge AI chatbot and help desk solution tailored for private equity firms. It effectively automates responses to queries about fund strategies, portfolio companies, and investment criteria. This saves time and resources, allowing the firm to focus on their core investment activities.