Why We Love It

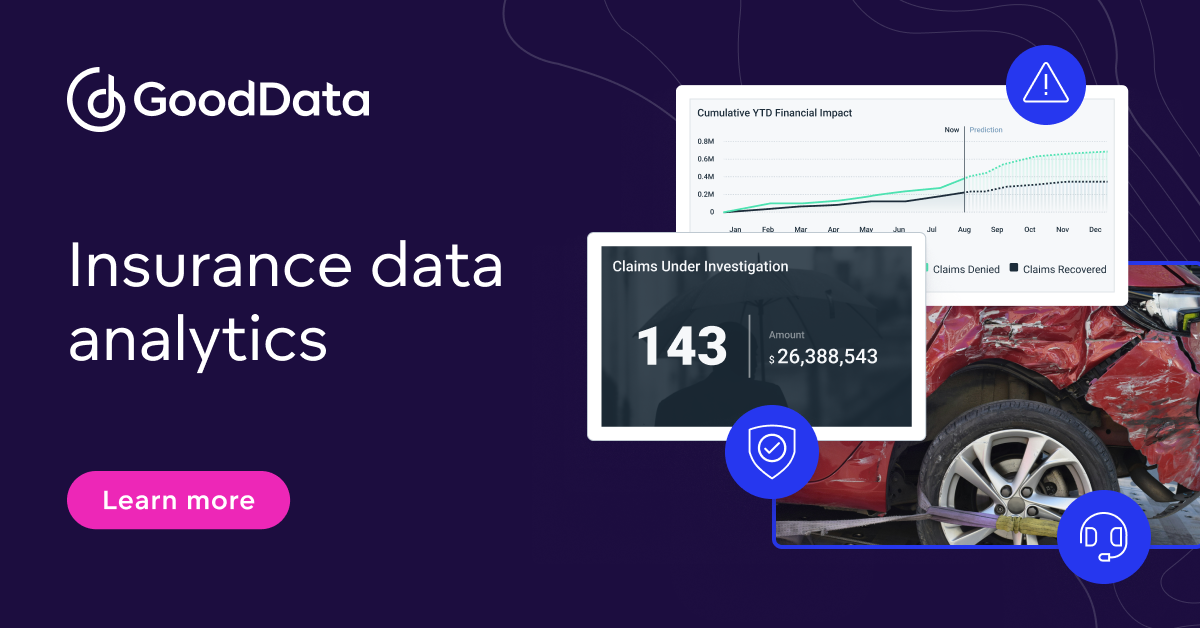

InsureSense stands out in the insurance industry due to its dedicated focus on business intelligence for insurance agents. It uses advanced AI and data analytics to extract meaningful insights from complex insurance data. It not only simplifies data management but also empowers agents with actionable information to optimize their strategies. Its industry-specific design allows it to cater to the unique needs of insurance professionals, making it a valuable tool in a competitive market.

Pros

- Industry-specific design

- AI-driven insights

- Reliable data management

- Comprehensive analytics

- From reputed Deloitte firm

Cons

- Complex interface

- May require technical know-how

- Premium pricing

Enterprise pricing available

InsureSense, developed by Deloitte, is a unique business intelligence tool created specifically for the insurance industry. It leverages artificial intelligence and data analytics to provide comprehensive insights, helping insurance agents optimize their strategies and decision-making processes.

Pros

- Industry-specific design

- AI-driven insights

- Reliable data management

- Comprehensive analytics

- From reputed Deloitte firm

Cons

- Complex interface

- May require technical know-how

- Premium pricing

Why We Love It

InsureSense stands out in the insurance industry due to its dedicated focus on business intelligence for insurance agents. It uses advanced AI and data analytics to extract meaningful insights from complex insurance data. It not only simplifies data management but also empowers agents with actionable information to optimize their strategies. Its industry-specific design allows it to cater to the unique needs of insurance professionals, making it a valuable tool in a competitive market.

Pros

- Industry-specific design

- AI-driven insights

- Reliable data management

- Comprehensive analytics

- From reputed Deloitte firm

Cons

- Complex interface

- May require technical know-how

- Premium pricing

Why We Love It

InsureSense stands out in the insurance industry due to its dedicated focus on business intelligence for insurance agents. It uses advanced AI and data analytics to extract meaningful insights from complex insurance data. It not only simplifies data management but also empowers agents with actionable information to optimize their strategies. Its industry-specific design allows it to cater to the unique needs of insurance professionals, making it a valuable tool in a competitive market.

Enterprise pricing available

InsureSense, developed by Deloitte, is a unique business intelligence tool created specifically for the insurance industry. It leverages artificial intelligence and data analytics to provide comprehensive insights, helping insurance agents optimize their strategies and decision-making processes.