Best for teams that are

- High-volume billers in utilities, government, and insurance

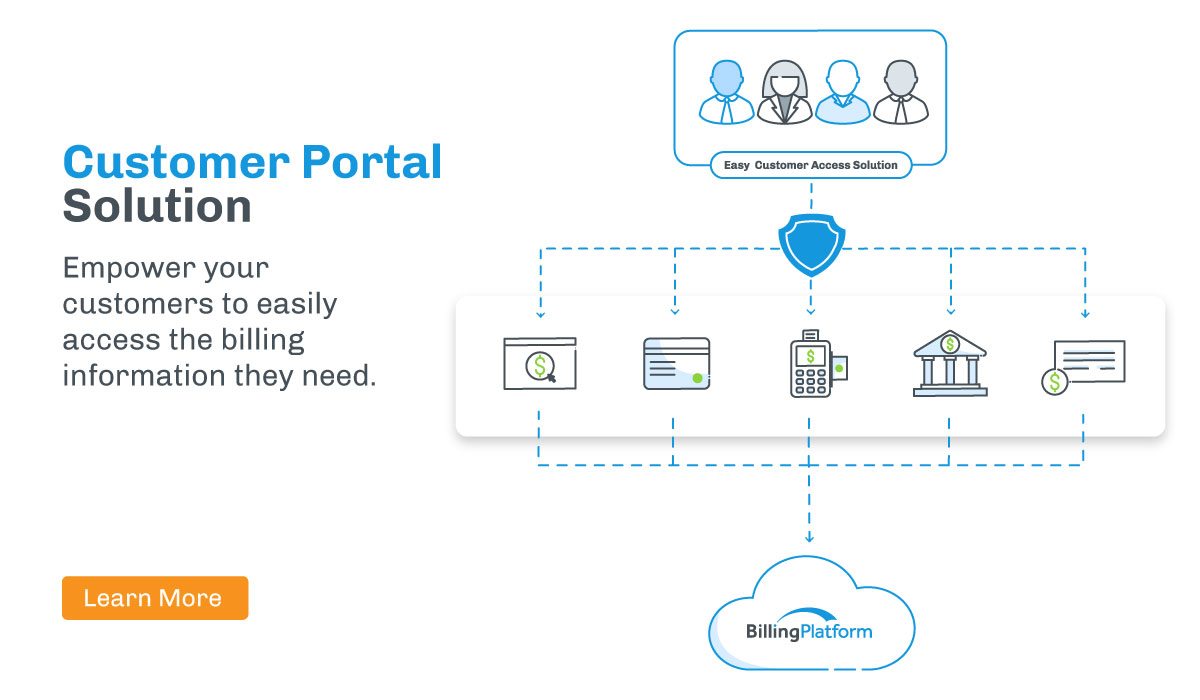

- Organizations needing complex electronic bill presentment

- Entities requiring customer self-service payment portals

Skip if

- Freelancers or small creative agencies

- Low-volume businesses not needing complex EBPP systems

- Companies looking for a simple, standalone invoice generator

Expert Take

Our analysis shows InvoiceCloud stands out for its 'True SaaS' architecture and deep ecosystem of over 160 real-time integrations with major utility and government ERPs like Oracle and Tyler Technologies. Research indicates its 'Guest Checkout' and behavioral engagement features tangibly drive results, often doubling or tripling paperless adoption rates compared to legacy systems. While convenience fees remain a friction point for payers, the platform's security credentials (PCI Level 1, SOC 2) and omni-channel capabilities make it a robust choice for high-volume billers.

Pros

- 160+ pre-built real-time integrations

- Guest checkout removes login friction

- PCI Level 1 & SOC 2 certified

- Omni-channel: Web, Text, IVR, POS

- Drives 2-3x higher paperless adoption

Cons

- Payer convenience fees ($2.95+) cause friction

- End-user support often reported as inaccessible

- Occasional login and session timeout issues

- Implementation fees apply for billers

- Sync delays reported by some users