What Is Invoicing & Billing Automation Tools?

Invoicing and Billing Automation Tools are specialized software solutions designed to digitize, orchestrate, and optimize the financial exchange between a provider of goods or services and their customers. At its core, this category addresses the "revenue realization" gap—the critical operational phase where a signed contract or a completed order must be converted into recognized cash. Unlike simple document generators that merely produce a PDF, these tools manage the logic, timing, and compliance of financial transactions. They automate the capture of billable data (whether hours, milestones, or usage events), apply complex pricing schemas, generate accurate invoices, deliver them via preferred channels (email, EDI, portals), and reconcile payments against general ledgers.

This category sits distinctly between Customer Relationship Management (CRM) and Enterprise Resource Planning (ERP) systems. While CRM focuses on customer acquisition and pipeline management, and ERP focuses on the comprehensive back-office record of truth (accounting, inventory, HR), Invoicing & Billing Automation Tools function as the operational bridge. They are broader than simple "accounting software" modules, which often lack sophisticated dunning or usage-based rating capabilities, yet narrower than full ERP suites. The category encompasses both general-purpose platforms capable of handling standard recurring billing and vertical-specific tools engineered for the unique regulatory and workflow demands of industries such as healthcare, legal, and construction.

The core problem these tools solve is revenue leakage and administrative friction. In manual environments, businesses lose an estimated 1-5% of revenue due to under-billing, errors, and uncollected payments. By automating the quote-to-cash cycle, these tools ensure that every billable event is captured, taxed correctly across jurisdictions, and collected promptly, transforming the billing function from a back-office cost center into a strategic asset for cash flow optimization.

History of the Category

The evolution of Invoicing and Billing Automation reflects a broader shift in enterprise technology from static record-keeping to dynamic, intelligent workflow automation. In the 1990s, billing was largely a prisoner of on-premise ERP systems. These monolithic architectures treated invoicing as a final, static output—a "print" command at the end of a supply chain process. Modifications to billing logic (e.g., introducing a new tier or discount structure) often required expensive custom coding by IT specialists or consultants. The "database" era focused on storage and accuracy but offered little in terms of agility or customer experience.

The early 2000s and the advent of the cloud fundamentally fractured this model. As Software-as-a-Service (SaaS) business models began to displace perpetual licenses, traditional ERP billing modules struggled to cope. They were built for one-time transactions, not the complex, recurring, and usage-based relationships that defined the new economy. This gap birthed the first wave of specialized recurring billing engines—tools designed specifically to handle subscriptions, prorations, and dunning management (the automated process of recovering failed payments). This era marked the decoupling of "billing" from "accounting," allowing businesses to be agile in their pricing strategies without destabilizing their core general ledger.

By the mid-2010s, a second wave of "Vertical SaaS" began to reshape the market. Generic billing tools were insufficient for industries with idiosyncratic requirements, such as law firms needing LEDES coding or construction firms requiring AIA-style progress billing. This led to a market fragmentation where specialized vendors emerged to dominate specific niches, offering deep feature sets that generalist platforms could not match. Simultaneously, market consolidation waves saw large financial and ERP incumbents acquiring these agile cloud players to modernize their own stacks, a trend that continues to shape the competitive landscape today.

Entering the 2020s, buyer expectations shifted from "give me a database" to "give me actionable intelligence." Modern buyers no longer just want to send invoices; they demand platforms that can predict churn based on payment behavior, automate revenue recognition under complex standards like ASC 606, and integrate seamlessly via APIs into a headless technology stack. The current era is defined by the rise of embedded finance and AI-driven automation, where the billing tool is not just a system of record, but an active agent in optimizing cash flow and customer lifecycle value.

What to Look For

Evaluating Invoicing and Billing Automation Tools requires a disciplined approach to distinguish between superficial feature lists and genuine architectural fit. The stakes are high; a poor choice can lead to customer churn, recognized revenue errors, and operational paralysis.

Critical Evaluation Criteria:

- Agility in Pricing Models: Can the system handle hybrid models? Many businesses are moving beyond simple subscriptions to "usage-based" or "outcome-based" pricing. Ensure the tool can support tiered, volume, stairstep, and formula-based pricing without requiring custom code.

- Dunning and Collections Logic: Look for sophisticated "smart retries" rather than static schedules. Top-tier tools use machine learning to retry failed credit cards at times they are most likely to succeed, significantly recovering revenue that would otherwise be lost.

- Global Compliance and Tax: If you operate across borders, the tool must natively handle multi-currency and, more importantly, the complexities of digital services taxes and VAT MOSS. It should integrate with or include a tax engine that updates automatically as local regulations change.

- The "Golden Record" Capability: The tool acts as a source of truth for customer financial data. Evaluate how it synchronizes with your CRM. Changes in the billing system (e.g., a downgrade or churn event) must instantly reflect in the CRM so account managers are not blindsided.

Red Flags and Warning Signs:

- Proprietary Scripting for Basic Changes: If a vendor tells you that changing a billing frequency requires "a few lines of script" or a "consulting engagement," walk away. Modern tools should handle these changes via configuration in the UI.

- Lack of API Documentation: Invoicing sits in the middle of your stack. Opaque, outdated, or non-existent API documentation is a critical warning sign that the tool will become a data silo.

- Weak Revenue Recognition Engines: Be wary of tools that treat revenue recognition as an afterthought (e.g., just cash-basis reporting). For any business at scale, the ability to recognize revenue accurately over time (accrual accounting) is non-negotiable for audits and valuation.

Key Questions to Ask Vendors:

- "How does your system handle mid-cycle upgrades and downgrades, specifically regarding proration and credit note generation?" (This breaks many basic systems).

- "Can you demonstrate a live API call that triggers a usage event, and show me where that appears on the draft invoice?"

- "What is your specific roadmap for electronic invoicing mandates (like Peppol or country-specific clearance models) for the next 24 months?"

Industry-Specific Use Cases

Retail & E-commerce

In the high-volume world of retail and e-commerce, the billing system serves as the backbone of the customer experience. Unlike B2B environments where an invoice might be paid in 30 days, retail billing is often immediate and transactional. The critical requirement here is speed and scale. Automation tools must handle thousands of transactions per minute during peak periods without latency. A key differentiator for this industry is the ability to handle "cart abandonment" recovery through billing—if a recurring payment fails, the system must trigger a customer-friendly workflow to update payment details without cancelling the service.

Furthermore, tax compliance is exceptionally complex for e-commerce due to economic nexus laws. Retail-focused billing tools must calculate sales tax in real-time based on the exact street address of the buyer, distinguishing between taxable and non-taxable goods (e.g., digital downloads vs. physical apparel). Evaluation should prioritize integrations with major shopping cart platforms and merchant of record services that can offload liability. A failure here can result in significant regulatory penalties and audit risks.

Healthcare

Healthcare billing is structurally unique due to the "third-party payer" model, where the recipient of the service (the patient) is rarely the primary payer (insurance). Automation tools here must navigate the labyrinth of claims clearinghouses, CPT codes, and strict HIPAA regulations. A primary focus is denial management. According to research from MGMA, 48% of medical group leaders identify denials and appeals as the biggest source of revenue leakage in their practice [1]. Effective software must not only generate a claim but "scrub" it against payer rules before submission to prevent rejections.

Additionally, with the rise of high-deductible health plans, "patient responsibility" billing has become critical. Modern tools are incorporating "propensity to pay" scoring and automated payment plan options to collect from patients. Evaluation priorities must include the robustness of the eligibility verification engine—checking insurance coverage before service is rendered—to prevent downstream revenue loss. The ability to separate patient-facing statements from payer-facing claims is a fundamental functional requirement.

Financial Services

For financial services firms, billing automation is inextricably linked to compliance and security. Whether billing for asset management fees (often calculated as a basis point percentage of fluctuating assets under management) or SaaS fintech subscriptions, the precision of calculation is paramount. These tools must maintain an immutable audit trail to satisfy regulators (like the SEC or FCA) that every cent billed was contractually accurate. Security is the top evaluation priority; data breaches in the financial sector are among the costliest, with IBM reporting an average breach cost of $6.08 million in this industry, 22% higher than the global average [2].

Another unique need is the handling of complex hierarchies. A financial institution may bill a parent company for services used by dozens of subsidiaries, requiring "consolidated invoicing" capabilities that roll up charges while retaining granular reporting. Buyers in this sector should prioritize vendors with SOC 2 Type II certification and robust Know Your Customer (KYC) integration capabilities to ensure that the automated billing process does not inadvertently violate anti-money laundering (AML) statutes.

Manufacturing

Manufacturing billing is often distinct because it is tied to physical fulfillment and long-term project milestones rather than simple time or subscriptions. Milestone billing is a standard requirement, where invoices are triggered by specific events: 20% upon contract signing, 30% upon design approval, and 50% upon shipping [3]. Generalist tools often fail here, lacking the project management integration to know when a "milestone" has actually been met. The billing software must "talk" to the ERP and Warehouse Management System (WMS) to validate that goods have shipped before generating an invoice.

Furthermore, manufacturers frequently deal with complex trade spend and rebate management. A distributor might be billed a list price but is owed a rebate at the end of the quarter based on volume. Advanced billing automation tools for manufacturing can track these "off-invoice" accruals in real-time, preventing the common cash flow shock of unexpected rebate payouts. Evaluation should focus heavily on the depth of two-way synchronization with supply chain data.

Professional Services

In Professional Services (legal, consulting, architecture), the "product" is time and expertise, making utilization tracking the core billing engine. The unique challenge here is the "WIP" (Work In Progress) management—tracking hours that have been worked but not yet billed. Tools must support complex retainer models (e.g., "evergreen" retainers that auto-replenish) and handle "write-downs" where a partner decides to bill a client for fewer hours than were actually worked to maintain the relationship. This requires a flexible approval workflow before the invoice is finalized.

For legal specifically, adherence to standards like LEDES (Legal Electronic Data Exchange Standard) is mandatory for working with corporate clients [4]. These codes categorize tasks (e.g., "communication," "drafting") to provide transparency. Professional services firms effectively sell trust; therefore, the billing tool must produce highly detailed, readable invoices that justify the value delivered. Evaluating the "client view" of the invoice is as important as evaluating the backend efficiency.

Subcategory Overview

Invoicing and Billing Platforms for Subscription and Retainer Services

This niche caters to the "recurring revenue" economy—SaaS companies, membership organizations, and subscription box services. What makes this genuinely different from generic tools is the handling of the customer lifecycle rather than just the transaction. Generic tools see an invoice; these tools see a "subscription object" that evolves over time through upgrades, downgrades, pauses, and reactivations. A specific workflow that only these tools handle well is "proration logic"—automatically calculating the exact credit due when a user switches from a $50/month plan to a $100/month plan on day 12 of a 30-day cycle. The pain point driving buyers here is "churn management." General tools simply fail a payment and give up; specialized platforms implement "dunning" strategies (smart retries, automated emails) to recover the customer. For a deeper analysis of these capabilities, refer to our guide to Invoicing and Billing Platforms for Subscription and Retainer Services.

Invoicing and Billing Platforms for Agencies and Studios

Marketing agencies, design studios, and dev shops live and die by project profitability. This subcategory is distinct because it tightly couples project management with billing. Unlike a generic tool that asks you to manually input "5 hours," these platforms integrate directly with the creative workflow. A workflow unique to this niche is the "estimate-to-project-to-invoice" conversion. A studio can turn an approved client quote into a live project budget, track staff hours against that budget in real-time, and auto-generate an invoice when a specific phase is complete. The driving pain point here is "scope creep revenue leakage"—where extra rounds of edits or hours are worked but never billed because the billing tool was disconnected from the project management tool. Learn more about optimizing creative workflows in our guide to Invoicing and Billing Platforms for Agencies and Studios.

Invoicing and Billing Platforms for Legal and Professional Services

This category is defined by regulatory precision and trust accounting. It differs from generic tools because it must adhere to strict ethical guidelines regarding client funds. A generic tool treats all money as revenue; specialized legal tools distinguish between "operating accounts" (the firm's money) and "trust/IOLTA accounts" (the client's money), ensuring compliance with bar association rules. A workflow unique to this sector is "conflict checking" and "LEDES electronic billing," which formats invoices into specific code strings required by corporate legal departments and insurance companies [5]. The specific pain point driving buyers here is compliance risk—using a general tool for legal billing can lead to disbarment if trust funds are mishandled. Explore these compliance-focused tools in our guide to Invoicing and Billing Platforms for Legal and Professional Services.

Invoicing and Billing Platforms with Client Portals and Online Pay

This subcategory prioritizes the buyer experience over the biller's workflow. While most tools send a PDF, these platforms create a secure, interactive "microsite" for each client. The distinct differentiator is "self-service transparency." Instead of emailing "can you resend that invoice?", clients log in to view their entire history, download statements, and update payment methods securely. A unique workflow is the "dispute resolution flow," where a client can flag a specific line item on a digital invoice for review without holding up payment for the rest of the bill. The pain point driving adoption here is high Days Sales Outstanding (DSO) caused by friction in the payment process and communication delays. See how these tools accelerate cash flow in our guide to Invoicing and Billing Platforms with Client Portals and Online Pay.

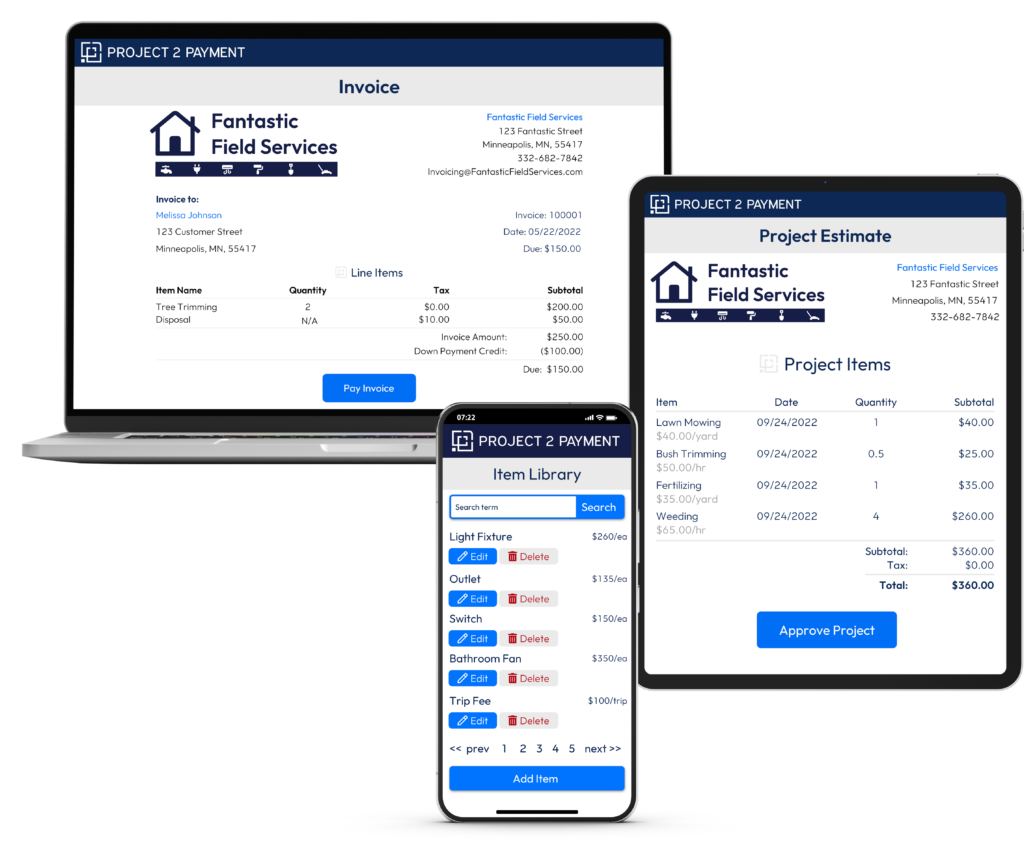

Invoicing and Billing Platforms for Trades and Home Services

Built for plumbers, electricians, and HVAC technicians, this niche is defined by mobility and field capability. Unlike desk-based billing software, these tools are mobile-first, designed to generate a professional invoice on a tablet in a customer's driveway. A workflow unique to this tool is the "Good, Better, Best" proposal presentation [6]. A technician can present three tiered options for a repair on an iPad, and once the homeowner taps to sign, the tool instantly converts that selection into a work order and final invoice. The specific pain point here is the "paperwork lag"—the delay between finishing a job and the office sending a bill days later. These tools close that gap instantly. Read more about field-ready solutions in our guide to Invoicing and Billing Platforms for Trades and Home Services.

Integration & API Ecosystem

In the modern enterprise stack, a billing tool that stands alone is a liability. The true power of automation lies in the API ecosystem—the connective tissue that allows the billing engine to trigger actions across the organization. Best-in-class integration goes beyond simple data syncing; it enables "event-based" architectures. For example, a provisioning system (like AWS or a proprietary SaaS platform) detects a user utilizing a new feature and fires an API call to the billing engine to rate that event and add it to the next invoice.

Consider a Concrete Scenario: A 50-person marketing technology firm attempts to connect their HubSpot CRM, a proprietary SaaS platform, and QuickBooks Online. They choose a billing tool with a "closed" ecosystem. When a sales rep closes a deal in HubSpot with a custom discount, the data doesn't sync correctly to the billing engine because of rigid field mapping. The finance team manually re-keys the contract data. Six months later, the proprietary platform logs overages for 100 clients, but the billing tool's API has a rate limit and times out during the nightly batch sync. The result? $50,000 in usage revenue is never billed, and the finance team is spending 20 hours a week fixing sync errors. A robust API with high throughput and webhooks for error handling would have prevented this "swivel chair" integration failure.

Expert Insight: According to research by Ardent Partners, best-in-class AP and billing departments that leverage high levels of integration and straight-through processing can process invoices 81% faster and at 76% lower cost than their peers [7]. The bottleneck is rarely the software's capability, but the "data plumbing" connecting it to upstream sales data.

Security & Compliance

Security in billing automation is not just about protecting passwords; it is about safeguarding the financial lifeblood of the customer and the legal standing of the vendor. Compliance requirements have exploded in complexity, moving from simple PCI-DSS (for credit cards) to GDPR (data privacy) and SOX (financial controls). A billing tool acts as a repository for PII (Personally Identifiable Information) and banking details, making it a prime target for attackers.

Concrete Scenario: A mid-sized fintech company processes payments for 10,000 users. They use a legacy billing tool that is not SOC 2 Type II compliant. An attacker gains access through a compromised API key that lacked proper rotation policies. They download the customer database, including partial billing addresses and last-4 digits of credit cards. While no full card numbers are stolen, the reputational damage is catastrophic. IBM's 2024 Cost of a Data Breach Report highlights that the average cost of a data breach in the financial sector has reached $6.08 million [2]. Beyond the fine, the company loses 15% of its customer base due to lost trust. A modern tool would have enforced role-based access control (RBAC), API key rotation, and encrypted fields at rest, mitigating the blast radius of the breach.

Expert Insight: Security analysts emphasize that compliance is no longer a "check-the-box" exercise. With the rise of global e-invoicing mandates, the billing system must now essentially "report" to government tax authorities in real-time (e.g., Italy's SDI or India's IRP), turning security into a matter of national legal compliance.

Pricing Models & TCO (Total Cost of Ownership)

Pricing for billing automation is notoriously opaque. Vendors often present a simple "per user" or "per month" fee, but the Total Cost of Ownership (TCO) tells a different story. The hidden costs typically lie in "take rates" (a percentage of revenue processed), implementation fees, and premium connector costs. For a growing company, a tool charging 1% of transaction volume might seem cheap initially but becomes punitive as revenue scales from $5M to $50M.

Concrete Scenario: A subscription box company with $10M in annual revenue evaluates two vendors. Vendor A charges a flat $2,000/month. Vendor B charges $0/month but takes 0.8% of revenue. On the surface, Vendor B looks safer. However, at $10M revenue, 0.8% amounts to $80,000 per year—over 3x the cost of Vendor A. Furthermore, Vendor B requires a $15,000 implementation package and charges extra for the NetSuite connector. The "free" option ends up costing nearly $100,000 in Year 1. A proper TCO analysis must calculate volume scaling over a 3-year horizon.

Expert Insight: Forrester's research on software implementation suggests that hidden costs, such as ongoing training and integration maintenance, can inflate the total expenditure by 50% or more over the initial license fees [8]. Buyers must demand a 3-year "all-in" cost projection during negotiation.

Implementation & Change Management

Implementation is the graveyard of billing automation projects. It is rarely a plug-and-play exercise; it involves migrating sensitive financial data, mapping complex legacy products to new catalogs, and changing the daily habits of the sales and finance teams. The biggest failure point is data migration—underestimating the "messiness" of historical data (e.g., inconsistencies in how customer names or contract terms were recorded).

Concrete Scenario: A 200-person logistics firm decides to switch billing platforms. They assign the implementation to a junior finance manager as a "side project." The team skips the data cleansing phase, importing 5,000 customer records "as is." On go-live day, the new system generates invoices for cancelled contracts and applies incorrect tax rates to 30% of clients because the "state" field was formatted differently in the old system (e.g., "CA" vs. "California"). The support lines flood with angry customers. The firm has to pause billing for two weeks to manually fix the data, causing a massive cash flow crunch.

Expert Insight: Research from McKinsey indicates that 70% of digital transformations, including ERP and billing rollouts, fail to meet their original goals, often due to a lack of focus on the "soft" side of change management and data hygiene rather than the software itself [9]. Success requires a dedicated project owner and a "sandbox" phase where billing runs are simulated in parallel with the old system before the full switch.

Vendor Evaluation Criteria

When selecting a vendor, buyers must look beyond the feature matrix to the vendor's viability and support structure. In a consolidated market, the risk of a vendor being acquired or sunsetting a product is real. Evaluation should focus on the "post-sales" experience: the quality of the knowledge base, the availability of customer success managers, and the frequency of product updates.

Concrete Scenario: A B2B software company selects a billing vendor based solely on a flashy demo and low price. Six months in, they encounter a critical bug preventing them from billing their largest enterprise client. They discover that "support" is only available via email with a 48-hour SLA (Service Level Agreement). The delay forces the CFO to manually calculate and send the invoice in Excel to avoid breaching contract terms. The vendor's roadmap slows down, and it becomes clear they are "harvesting" the product for cash flow rather than innovating. A robust evaluation would have included reference calls with similar-sized customers specifically asking about "crisis support" responsiveness.

Expert Insight: Gartner advises that by 2027, more than 70% of ERP and billing initiatives will fail to fully meet their original business case goals, emphasizing the need for "composable" strategies where vendors are selected for their adaptability and ability to integrate, rather than just their current feature set [10].

Emerging Trends and Contrarian Take

Emerging Trends 2025-2026:

- Agentic AI in Exception Handling: We are moving beyond simple automation to "agents" that can resolve problems. Instead of just flagging a failed payment, an AI agent will analyze the failure code, draft a personalized email to the customer based on their tone in previous support tickets, and offer a specific alternative payment method, requiring human approval only as a final gate.

- Global E-Invoicing Standardization (Peppol & ViDA): Governments are becoming the biggest drivers of billing tech. The adoption of the Peppol standard and the EU's "VAT in the Digital Age" (ViDA) initiative means that by 2026, sending a PDF invoice via email may be illegal for B2B transactions in many jurisdictions. Billing tools will become "compliance engines" first, and document generators second [11].

- Convergence of Billing and Payments: The line between "software" and "bank" is blurring. Platforms are increasingly offering "embedded finance" products—like invoice financing or virtual cards—directly within the billing interface, allowing businesses to borrow against unpaid invoices with a single click.

Contrarian Take:

Invoicing is ceasing to be a standalone software category and is becoming a feature of embedded banking.

The mid-market is currently overserved by expensive, standalone billing platforms that justify their existence through complexity. However, the future belongs to platforms that give the software away for free (or near-zero cost) and monetize through the transaction flow (payments and lending). Gartner and Bain Capital predict that by 2026, embedded B2B payments will reach trillions in transaction volume [12]. In this world, paying $50,000 a year for "billing software" will seem archaic when your banking partner or vertical SaaS platform offers the same capability natively to capture the payment volume. The standalone "billing unicorn" may soon be an endangered species, forced to consolidate into broader ERP or fintech ecosystems.

Common Mistakes

Buying for Today, Not Tomorrow: A classic error is selecting a tool that fits your current pricing model perfectly but breaks the moment you introduce a new revenue stream (e.g., adding a usage component to a subscription). Migration is painful; always buy for the business model you aspire to have in 3 years.

Underestimating Data Hygiene: Buyers often assume the software will "fix" their messy customer data. It won't. If you import duplicate accounts or incomplete addresses, the automation will simply scale your errors. "Garbage in, garbage out" is the iron law of automation.

Ignoring the End-Customer Experience: Finance teams often select tools based on back-office efficiency (GL reconciliation, reporting) and forget that the invoice is a brand touchpoint. A confusing, ugly, or hard-to-pay invoice increases friction and DSO. If the client portal is clunky, your customers will resent paying you.

Questions to Ask in a Demo

Use these specific questions to cut through the sales script and expose the tool's actual capabilities:

- "Can you show me the exact steps to handle a 'mid-cycle upgrade' where a customer changes plans on day 14? I want to see the credit calculation logic live."

- "Open your API documentation right now. Show me the endpoint for creating a usage event and explain your rate limits."

- "Show me how your system handles a 'parent-child' account relationship where the parent pays for 5 subsidiaries but needs 5 separate usage reports."

- "Demonstrate the 'failed payment' workflow. What exactly does the customer receive, and can I customize that email without HTML coding?"

- "How does your system handle 'revenue recognition' for a contract that includes both a one-time implementation fee and a recurring subscription?"

Before Signing the Contract

Final Decision Checklist:

- Integration Proof: Have you successfully tested the connector with your specific CRM and Accounting instances in a sandbox? (Do not rely on "it's standard functionality").

- Data Portability: Does the contract explicitly state that you own your data and that the vendor will provide a structured export (SQL or CSV) if you leave?

- Compliance Verification: Have you received their latest SOC 2 report and verified their tax engine coverage for every state/country you operate in?

Common Negotiation Points:

- Implementation Fees: These are often the most flexible part of the quote. Ask for them to be waived or converted into training credits.

- Transaction Fees: If the vendor charges a % of revenue, negotiate a "cap" or a tiered structure where the % drops as your volume increases.

- Sandbox Access: Ensure a full persistent sandbox is included in the license, not just during implementation. You will need it for testing future changes.

Deal-Breakers:

- No API access on the tier you are buying.

- Inability to export customer credit card tokens (this locks you into their payment processor forever).

- Lack of multi-currency support if you have any international ambition.

Closing

Invoicing and billing automation is the financial nervous system of your company. Getting it right liberates your team to focus on growth; getting it wrong paralyses your cash flow. If you have specific questions about your tech stack or need a sounding board for your evaluation, feel free to reach out.

Email: albert@whatarethebest.com