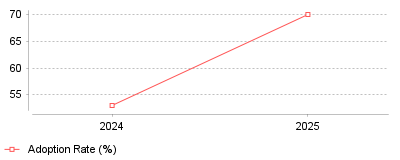

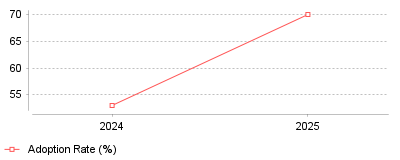

AI Adoption Rate in Transportation & Logistics

The "Operationalization" of AI in Logistics The most significant recent trend in route planning and optimization software is the rapid transition of Artificial Intelligence (AI) from a theoretical competitive advantage to a standard operational requirement. Recent industry surveys reveal a massive year-over-year surge in adoption, with 70% of transportation companies now deploying AI solutions—a

| Year | Adoption Rate (%) |

|---|

| 2024 | 53 |

| 2025 | 70 |

The Shift from Experimentation to Essential Infrastructure

What is this showing

Recent data indicates a pivotal shift in the logistics sector, where the adoption of AI-driven software has jumped significantly within a single year. According to the 2025 Transportation Leaders Survey, 70% of logistics and transportation companies report having adopted AI solutions, a sharp rise from 53% in 2024 [1] [2]. Furthermore, the market value for AI in logistics is experiencing explosive growth, projected to rise from approximately $11.6 billion in 2023 to over $26 billion in 2025 [3] [4].

What this means

This trend signifies that route optimization software is no longer just about digitizing maps; it has evolved into a predictive intelligence tool used to benchmark performance and secure margins. On a micro level, fleets are moving beyond basic GPS routing to AI systems that handle fleet planning (used by 36% of adopters) and dynamic route optimization (35%) to generate measurable ROI [5]. On a macro industry level, a bifurcation is emerging between "tech-forward" fleets and legacy operators; despite the high adoption rates, 84% of executives still believe the logistics industry lags behind other sectors, creating a competitive pressure cooker where technology is the primary differentiator for survival [6].

Why is this important

The operational impact of this trend is profound, with 40% of AI adopters reporting improvements of at least 50% in critical metrics like fuel usage, cost reduction, and distance traveled [6]. As economic volatility and supply chain disruptions become the norm, 93% of leaders now view AI as essential for organizational resiliency and agility [7]. This establishes AI-backed route planning not as a luxury, but as a mandatory defensive strategy against rising operational costs.

What might have caused this

The accelerated adoption is likely driven by the convergence of maturing Generative AI technologies and acute economic pressures, such as inflation and fuel price volatility. While early AI tools were complex and required data science expertise, modern platforms have become more accessible, offering "plug-and-play" efficiency that directly addresses the industry's need to do more with less [1]. Additionally, the fear of obsolescence is a powerful motivator; as major players publicize massive efficiency gains—such as 15-25% improvements in route optimization efficiency—competitors are forced to modernize rapidly to protect their margins [8].

Conclusion

The "experimentation phase" of AI in logistics has officially ended, replaced by a period of aggressive operationalization where software is expected to deliver immediate, tangible ROI. The 17% year-over-year jump in adoption suggests that by the end of 2026, non-AI-optimized fleets will be statistically unable to compete on cost-per-mile against their tech-enabled counterparts. The prominent takeaway is that route optimization software has transitioned from a tactical tool for drivers into a strategic asset for executive leadership.

Route Optimization Economics: The 53% Problem

Last-mile delivery costs hit a tipping point in 2024. Shipping expenses for the final leg of fulfillment now consume 53% of total transportation costs, up from 41% just five years prior

[1]. This escalation forces logistics operators to abandon static routing models in favor of dynamic systems capable of countering inflationary pressures. The global market for route optimization software reflects this urgency, with valuations projected to surge from $10.7 billion in 2024 to over $37 billion by 2033

[2].

Profit margins in the sector have narrowed significantly. Carriers can no longer absorb inefficiencies hidden by low fuel prices or abundant labor. FedEx responded to these pressures by launching its DRIVE program, which removed $1.8 billion in structural costs during fiscal year 2024 alone

[3]. The program targets distinct operational pillars—surface networks, air operations, and general administrative expenses—demonstrating that software-driven efficiency is now a financial survival mechanism rather than a competitive perk.

Organizations investing in

Route Planning & Optimization Software face a complex operational reality. They must navigate a shortage of 80,000 drivers, integrate electric vehicles (EVs) into diesel fleets, and comply with strict new emissions reporting mandates like the EU’s Corporate Sustainability Reporting Directive (CSRD). The era of manual dispatching is over; the era of algorithmic precision has begun.

Algorithmic Routing and the Move to Dynamic Planning

United Parcel Service (UPS) proved the financial viability of algorithmic routing with its On-Road Integrated Optimization and Navigation (ORION) system. The platform analyzes 200,000 routing options for every driver daily, saving the company 100 million miles and approximately $300 million to $400 million annually

[4]. These savings stem from reduction in idle time, fuel consumption, and vehicle wear and tear.

The market has since moved beyond proprietary internal tools toward commercial SaaS solutions. Walmart Commerce Technologies launched its internal route optimization engine as a commercial product in March 2024. The retailer reported that this technology helped it avoid 94 million pounds of CO2 emissions and eliminate 30 million unnecessary miles from its own network

[5]. By commercializing this capability, Walmart acknowledges that route density and efficiency are universal hurdles for

route optimization tools for delivery fleets across the retail sector.

Operational leaders now prioritize dynamic routing over static plans. Static routing assigns drivers to fixed territories regardless of volume, often leading to imbalances where one driver is overworked while another finishes early. Dynamic routing feeds orders into an algorithm that builds routes from scratch each day based on actual volume, traffic data, and delivery windows. This shift allows fleets to handle volume spikes without adding temporary headcount, a critical capability as e-commerce volumes continue to rise.

The Electrification Paradox: Managing Mixed Fleets

Fleet electrification introduces variables that break traditional routing logic. Diesel trucks can refuel in minutes at ubiquitous stations; electric trucks require hours to charge at scarce infrastructure. Operators managing transitionary mixed fleets—comprising both internal combustion engine (ICE) vehicles and EVs—face the "electrification paradox": optimization goals for diesel (shortest distance) often contradict optimization goals for EVs (range preservation and charger availability).

Regulatory pressure accelerates this complexity. The California Air Resources Board (CARB) Advanced Clean Fleets rule mandates that state and local agencies ensure 50% of vehicle purchases are zero-emission starting in 2024

[6]. Commercial fleets face similar phase-in requirements. Logistics planners must now account for battery degradation, payload weight impacts on range, and terrain grades. A heavy load traveling uphill depletes a battery faster than a flat route, a variable rarely calculated in legacy ICE routing.

Software providers have responded by adding "energy-aware" algorithms. These tools ingest telematics data to monitor real-time state-of-charge (SoC). If an EV cannot complete a route, the software must dynamically reroute it to a high-speed charger or swap the assignment to a diesel vehicle. This capability is particularly vital for municipalities using

route planning tools for waste and recycling fleets, where heavy payloads and frequent stops drain batteries aggressively.

Scope 3 Reporting and Carbon Accountability

Sustainability reporting has transitioned from a marketing exercise to a legal requirement. The European Union’s Corporate Sustainability Reporting Directive (CSRD) obligates nearly 50,000 companies to report Scope 3 emissions—indirect emissions that occur in the value chain, including outsourced transportation

[7]. U.S. companies with significant EU operations must comply, forcing American logistics providers to produce audit-ready carbon data for their clients.

This regulatory shift fundamentally changes software requirements. Shippers now demand that logistics providers prove the carbon footprint of every delivery. Route optimization platforms must calculate predicted CO2 emissions during the planning phase and reconcile them with actual emissions post-delivery. Failure to provide this data risks disqualification from RFP processes with major multinational retailers.

Urban access regulations further complicate emissions planning. London’s Ultra Low Emission Zone (ULEZ) expanded in 2023, imposing daily charges on non-compliant vehicles

[8]. New York City’s congestion pricing plan, though facing political delays, proposed peak tolls between $14.40 and $21.60 for trucks entering Manhattan’s Central Business District

[9]. Modern

route planning tools for courier and parcel delivery must now factor these variable toll costs into the "cost-to-serve" calculation, potentially routing drivers around congestion zones to protect margins.

The Labor Crisis: 80,000 Empty Seats

The American Trucking Associations (ATA) estimates a shortage of 80,000 drivers, a deficit that could double by 2030 if recruitment trends do not reverse

[10]. This labor gap forces fleet operators to maximize the productivity of every existing driver. Software that creates unrealistic schedules or fails to account for driver breaks significantly increases turnover rates in an industry where retention is already difficult.

Driver-centric routing apps have emerged as a retention tool. These

multi-stop route planning tools for drivers provide turn-by-turn navigation, proof-of-delivery features, and transparency into earnings. By optimizing stop sequences to reduce backtracking and ensuring shifts end on time, operators can improve driver satisfaction.

Walmart is hedging against this labor risk by investing in autonomous alternatives. The retailer expanded its drone delivery service to reach 75% of the Dallas-Fort Worth population in 2024, partnering with Wing and Zipline

[11]. While drones cannot replace heavy freight, they alleviate pressure on courier fleets for small, urgent orders, allowing human drivers to focus on higher-density routes.

Service vs. Delivery: Distinct Optimization Needs

A common procurement error involves treating field service management (FSM) the same as package delivery. Delivery drivers drop boxes; service technicians fix assets. The latter requires "skills-based routing," where the software matches a specific technician's certification (e.g., HVAC repair, electrical) to the job requirements.

Salesforce updated its Field Service platform in late 2024 to address this nuance, adding predictive AI that anticipates asset failures and adjusts schedules proactively

[12]. For example, if a connected MRI machine sends a distress signal, the software automatically dispatches a technician with the correct spare parts before the machine goes offline. This capability defines the category of

route optimization for service and repair teams, distinguishing it from pure logistics solutions.

Technicians also require different mobile tools. Unlike a courier who needs speed, a technician needs access to service history, manuals, and invoicing tools on site. Software that integrates

route planning tools for field technicians with CRM systems allows the back office to track "first-time fix rates," a metric far more critical to service profitability than miles driven.

Financial Implications of Inefficiency

The cost of inaction is quantifiable. For a mid-sized fleet of 75 vehicles, AI-driven optimization can reduce total miles driven by 12%, saving nearly $400,000 annually in fuel alone

[13]. When labor savings from reduced overtime are included, the ROI often materializes in less than six months.

Conversely, manual planning bleeds revenue. A dispatcher managing 20 drivers spends hours daily sequencing stops. If that dispatcher miscalculates traffic conditions, resulting in two missed delivery windows per driver per week, the costs in re-delivery attempts and customer churn compound rapidly. In the service sector, a missed appointment can result in Service Level Agreement (SLA) penalties, which often exceed the cost of the service call itself.

Future Outlook: Predictive Logistics

The next phase of

Field Service & Operations Software will move from reactive to predictive. Instead of optimizing a route after orders are received, AI models will predict order volumes based on historical data, weather patterns, and local events. Amazon already positions inventory in forward fulfillment centers based on predictive algorithms; smaller carriers will soon access similar capabilities via SaaS platforms.

Integration with "smart city" infrastructure will also mature. Traffic lights and toll gantries will communicate directly with fleet management systems, allowing heavy trucks to receive "green wave" priority signal timing or avoid dynamic toll spikes. As 5G networks expand, the latency of these communications will drop, enabling real-time micro-optimizations that save seconds per stop—seconds that add up to millions of dollars at enterprise scale.