Why We Love It

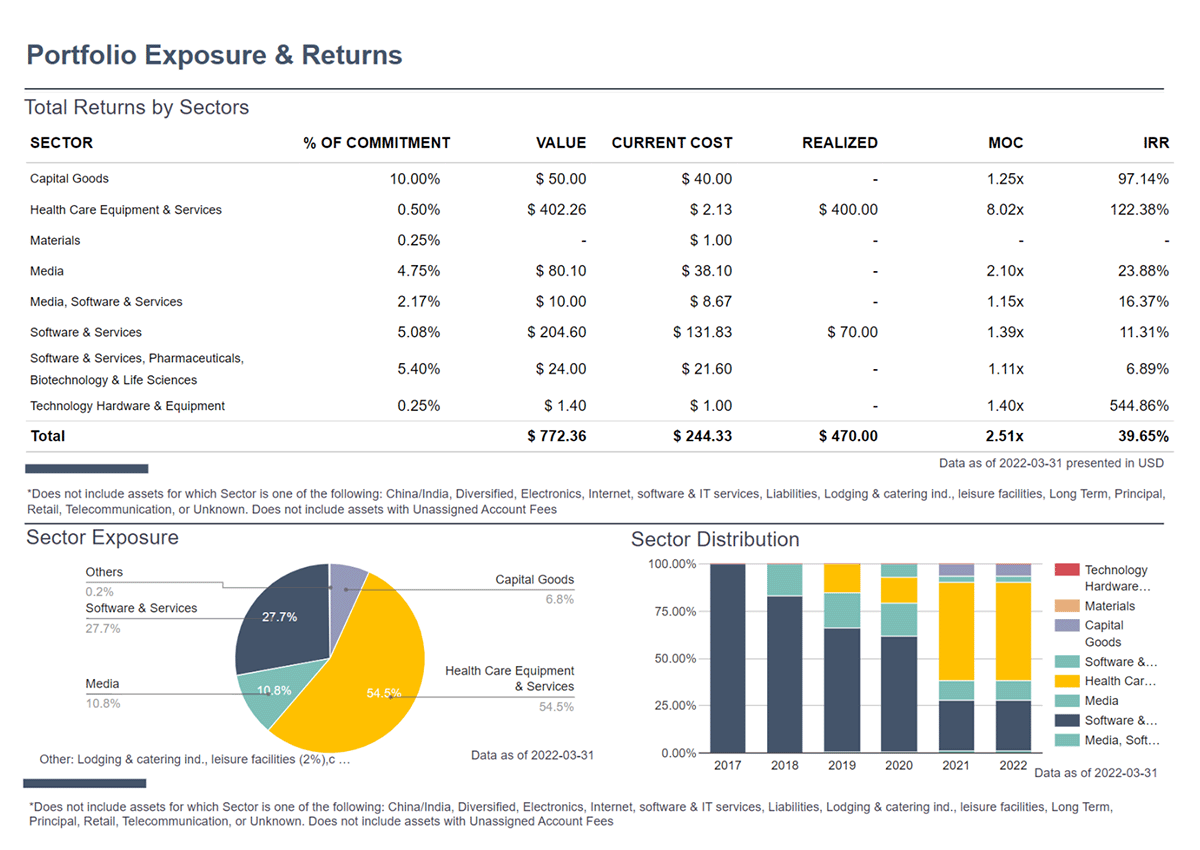

Imagineer's Traditional Asset Management Software is a game-changer for venture capital firms. It provides an industry-specific solution that helps firms gain a competitive edge by providing a comprehensive view of asset flows, teams, and partnerships. With its enhanced CRM and client portal, it enables efficient communication and deep insights into customer data, leading to improved decision making and better investor relations.

Pros

- Tailored for venture capital firms

- Enhanced CRM and Client Portal

- Real-time insights into asset flows

- Improved client communication

- Comprehensive data analysis

Cons

- No clear pricing structure

- May be complex for beginners

- Limited customization options

Enterprise pricing available

Imagineer's CRM and Client Portal is a prime solution for venture capital firms, catering to their need for improved client relationships and increased visibility into asset flows, teams, and partnerships. It is specifically designed to streamline communication and provide comprehensive insights into client data and asset management.

Pros

- Tailored for venture capital firms

- Enhanced CRM and Client Portal

- Real-time insights into asset flows

- Improved client communication

- Comprehensive data analysis

Cons

- No clear pricing structure

- May be complex for beginners

- Limited customization options

Why We Love It

Imagineer's Traditional Asset Management Software is a game-changer for venture capital firms. It provides an industry-specific solution that helps firms gain a competitive edge by providing a comprehensive view of asset flows, teams, and partnerships. With its enhanced CRM and client portal, it enables efficient communication and deep insights into customer data, leading to improved decision making and better investor relations.

Pros

- Tailored for venture capital firms

- Enhanced CRM and Client Portal

- Real-time insights into asset flows

- Improved client communication

- Comprehensive data analysis

Cons

- No clear pricing structure

- May be complex for beginners

- Limited customization options

Why We Love It

Imagineer's Traditional Asset Management Software is a game-changer for venture capital firms. It provides an industry-specific solution that helps firms gain a competitive edge by providing a comprehensive view of asset flows, teams, and partnerships. With its enhanced CRM and client portal, it enables efficient communication and deep insights into customer data, leading to improved decision making and better investor relations.

Enterprise pricing available

Imagineer's CRM and Client Portal is a prime solution for venture capital firms, catering to their need for improved client relationships and increased visibility into asset flows, teams, and partnerships. It is specifically designed to streamline communication and provide comprehensive insights into client data and asset management.