Expense Management & Receipt Tracking Tools: A Strategic Analysis

This category covers software designed to capture, validate, process, and reimburse employee-initiated spend across its entire operational lifecycle: from point-of-sale receipt capture and policy verification to approval workflows, reimbursement execution, and general ledger reconciliation. It occupies a critical position between Procurement (which manages pre-approved, large-scale vendor spend) and ERP (which serves as the final system of record for financial data). It encompasses both general-purpose platforms suitable for broad corporate use and vertical-specific tools engineered for complex regulatory environments such as healthcare, construction, and non-profit grant management.

What Is Expense Management & Receipt Tracking Tools?

Expense Management & Receipt Tracking Tools are specialized financial applications that digitize the submission, approval, and recording of employee expenses. At its core, this software solves the "information asymmetry" problem between field employees incurring costs and the finance teams responsible for controlling them. Without these tools, organizations rely on physical paper trails and spreadsheets, creating a lag between spend occurrence and financial visibility that often stretches into weeks or months.

The primary users of these tools are twofold: the "spenders" (employees, travelers, field workers) who require a frictionless way to be reimbursed, and the "controllers" (finance managers, accountants, CFOs) who require auditability, fraud detection, and policy enforcement. The strategic value of this category lies not merely in digitization, but in "control at the edge." By moving policy enforcement to the moment of purchase—via mobile apps and real-time card integrations—organizations shift from reactive auditing (catching errors after the money is gone) to proactive prevention.

History of Expense Management: From Spreadsheets to AI

The evolution of expense management mirrors the broader trajectory of enterprise software, moving from rigid, on-premise databases to fluid, intelligent cloud platforms. In the 1990s, expense "management" was largely a euphemism for Excel spreadsheets and physical envelopes of receipts stapled to paper forms. Early software solutions were essentially digital forms—monolithic on-premise installations that sat within an ERP environment. These systems were designed entirely for the back-office accountant, with little regard for the end-user experience. They digitized the data entry but did little to automate the workflow or validate the spend.

The late 1990s and early 2000s saw the emergence of the first wave of SaaS (Software as a Service) pioneers. Companies like Concur (founded in 1993, went public in 1998) began shifting the paradigm by offering web-based interfaces. This era marked the decoupling of expense tools from the heavy iron of on-premise ERPs, allowing for faster updates and broader accessibility. However, the workflow remained largely linear: scan (or mail) receipt, type data, submit, approve.

The true inflection point arrived with the proliferation of the smartphone in the late 2000s. The introduction of the iPhone and subsequent app ecosystems allowed vendors to push data capture to the point of sale. The camera became a scanner; GPS became a mileage log. This shift was critical because it reduced the "submission friction" that caused employees to hoard receipts until month-end. Market consolidation followed rapidly. SAP's acquisition of Concur in 2014 for $8.3 billion signaled the maturity of the sector, validating expense management as a critical pillar of the intelligent enterprise.

From 2015 to the present, the market has pivoted from "digitization" to "automation." Optical Character Recognition (OCR) matured from a buggy novelty to a reliable utility, capable of extracting line-item details with high accuracy. Today, the frontier is defined by Artificial Intelligence (AI) and machine learning. Modern platforms do not just record data; they analyze it for anomalies, flagging potential fraud (like duplicate submissions across different dates) before a human manager ever sees the report. The expectation has shifted from "give me a database of expenses" to "give me actionable intelligence on spend patterns and policy leakage."

What to Look For: Critical Evaluation Framework

When evaluating expense management solutions, buyers must look beyond the basic promise of "scanning receipts." Almost every tool on the market can capture an image and extract the date and amount. The differentiation lies in how the system handles complexity, exceptions, and data flow.

Policy Granularity and Enforcement: A robust system must support complex, multi-tiered policy definitions. Can the system distinguish between a client dinner (billable, higher limit) and a team lunch (internal, lower limit)? Look for "pre-submission" policy checks. The software should flag violations to the user immediately upon entry— "This hotel rate exceeds the London cap of £250"—allowing for self-correction before the report enters the approval queue.

OCR and Data Enrichment: Test the OCR capabilities with less-than-perfect receipts (crumpled, handwritten tips, foreign currencies). Critical evaluation criteria include the system's ability to match a receipt photo to a credit card feed transaction automatically. This "three-way match" (receipt image, user data, bank feed) is the gold standard for audit readiness.

Red Flags and Warning Signs: Be wary of vendors who gloss over the implementation of credit card feeds. Direct feeds from major networks (Visa, Mastercard, Amex) are reliable; "screen scraping" banking logins is a security risk and prone to breaking. Another red flag is a lack of "delegation" features. In enterprise environments, executive assistants often manage reports for leadership. If the tool does not support secure delegation, users will share passwords, creating a significant security hole.

Key Questions for Vendors:

- How does the system handle "split allocations" where one receipt covers multiple cost centers or projects?

- Is the credit card integration a direct bank feed or an aggregator service?

- Does the mobile app support offline mode for creating expenses while on a plane?

- What is the "exception rate" for your OCR technology—how often must a human intervene?

Industry-Specific Use Cases

Retail & E-commerce

In the retail sector, expense management often bleeds into petty cash and store operations. Unlike corporate environments where travel dominates, retail managers deal with ad-hoc store supplies, emergency repairs, and employee amenities. A critical evaluation priority here is the management of "petty cash" without the cash. Retailers are increasingly moving store managers to prepaid expense cards to eliminate the risk of cash handling [1]. The software must support high-volume, low-value transactions and provide multi-location reporting so regional managers can benchmark store spend. E-commerce businesses often face the specific challenge of reconciling high-volume digital advertising spend (Facebook, Google Ads) across multiple corporate cards, requiring tools that can parse digital invoices and map them to marketing project codes.

Healthcare

Healthcare organizations face a regulatory burden that dwarfs other sectors: the Physician Payments Sunshine Act (Open Payments). Manufacturers of drugs and devices must report payments and transfers of value to physicians and teaching hospitals to the Centers for Medicare & Medicaid Services (CMS) [2]. An expense tool for this sector effectively functions as a compliance engine. It must capture not just the amount of a dinner, but who was there (NPI numbers), their specialty, and the products discussed. Failure to accurately track and report this data can result in massive federal fines. Consequently, the evaluation priority is the "attendee tracking" module—it must integrate with the NPI registry for real-time validation of physician credentials [3].

Financial Services

For broker-dealers, asset managers, and investment banks, expense management is inextricably linked to FINRA and SEC compliance. Strict regulations govern gifts, gratuities, and entertainment to prevent conflicts of interest and bribery. FINRA Rule 3220, for instance, sets strict limits on gifts to associated persons. Expense tools in this sector must act as a "compliance firewall," blocking submissions that exceed annual aggregate limits per client. Furthermore, the granularity of "billable" expenses is critical. Financial firms often rebill expenses to clients; the system must accurately segregate non-billable overhead from client-chargeable costs to ensure invoice accuracy and prevent revenue leakage [4].

Manufacturing

Manufacturing spend profiles are bifurcated between corporate travel and industrial field maintenance. The unique challenge here is "plant maintenance spend" and field service costs. Technicians often purchase parts or tools urgently to prevent downtime—a $500 bearing might prevent a $50,000 production halt [5]. Expense tools must allow for these ad-hoc, high-criticality purchases while enforcing preferred vendor policies. Additionally, manufacturing firms often have extensive mileage and fleet expenses for sales and service reps. The ability to integrate with fleet management data and separate fuel for personal vs. business use is a key evaluation criterion [6].

Professional Services

For law firms, consultancies, and architects, expenses are essentially inventory—costs that must be resold to the client. The "billable vs. non-billable" distinction is the heartbeat of profitability. Revenue leakage—billable expenses that fall through the cracks and are never invoiced—averages around 4.3% for professional services firms [7]. The evaluation priority is the tightness of the integration with the firm's Practice Management or Billing system. A generic expense tool that exports a flat file is insufficient; the tool must sync expenses to specific client/matter codes in real-time to ensure they appear on the next draft bill. Speed of reimbursement is also critical to maintain cash flow when consultants are fronting significant travel costs.

Subcategory Overview

Expense Management Tools for Nonprofits and Associations

Nonprofits operate under a unique "fund accounting" paradigm where every dollar spent must be traced back to a specific restricted or unrestricted fund. Generic tools often fail here because they lack the multidimensional coding required to tag an expense to a specific grant, program, and funding source simultaneously. A specialized tool allows for "grant tracking" at the line-item level, ensuring that a flight for a program director is charged to the correct grant period. Furthermore, these organizations rely heavily on volunteers who incur expenses but are not on the payroll. Specialized tools facilitate "volunteer reimbursement" workflows that differ legally and operationally from employee reimbursements. To understand the nuances of fund accounting compliance, read our guide to Expense Management Tools for Nonprofits and Associations.

Expense Management Tools Integrated with ERP and Accounting Systems

While all expense tools claim integration, this subcategory refers to deep, bi-directional synchronization that supports "encumbrance accounting." In generic setups, an expense is only recorded when paid. In deeply integrated systems, an approved travel request can immediately "encumber" or reserve funds in the ERP budget, preventing other departments from spending that money before the trip even happens. This prevents the "budget surprise" at month-end. Buyers gravitate toward these tools when their finance team is spending days manually reconciling credit card statements against the General Ledger. The pain point is data integrity; these tools ensure the "single source of truth" in the ERP is always accurate. For details on deep integrations, see Expense Management Tools Integrated with ERP and Accounting Systems.

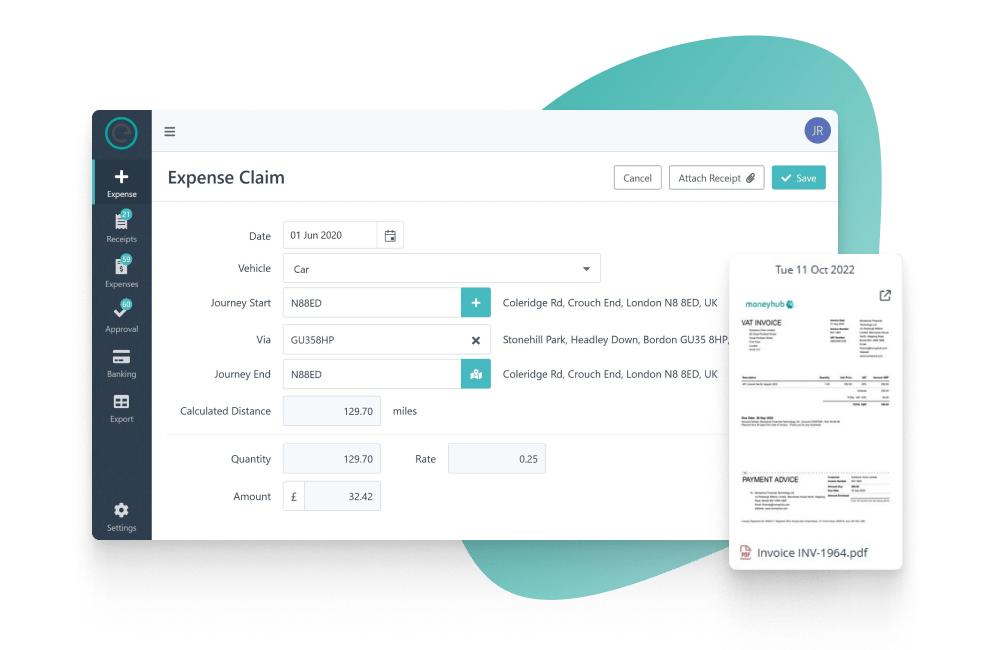

Expense Management Tools with Mileage and Per Diem Tracking

For organizations with heavy field fleets or "road warrior" sales teams, generic receipt scanning is secondary to accurate distance verification. This niche focuses on GPS-enabled tracking that automatically logs drives, distinguishing between business and personal mileage with swipe gestures. The differentiator is compliance with tax authority rates (like the IRS or HMRC mileage rates) which change annually. Generic tools often require manual rate updates; specialized tools update these statutory rates automatically. The driving pain point is "mileage padding"—employees rounding up distances. GPS tracking eliminates this, often saving organizations 20%+ on mileage reimbursements. Learn more about automated logging in our guide to Expense Management Tools with Mileage and Per Diem Tracking.

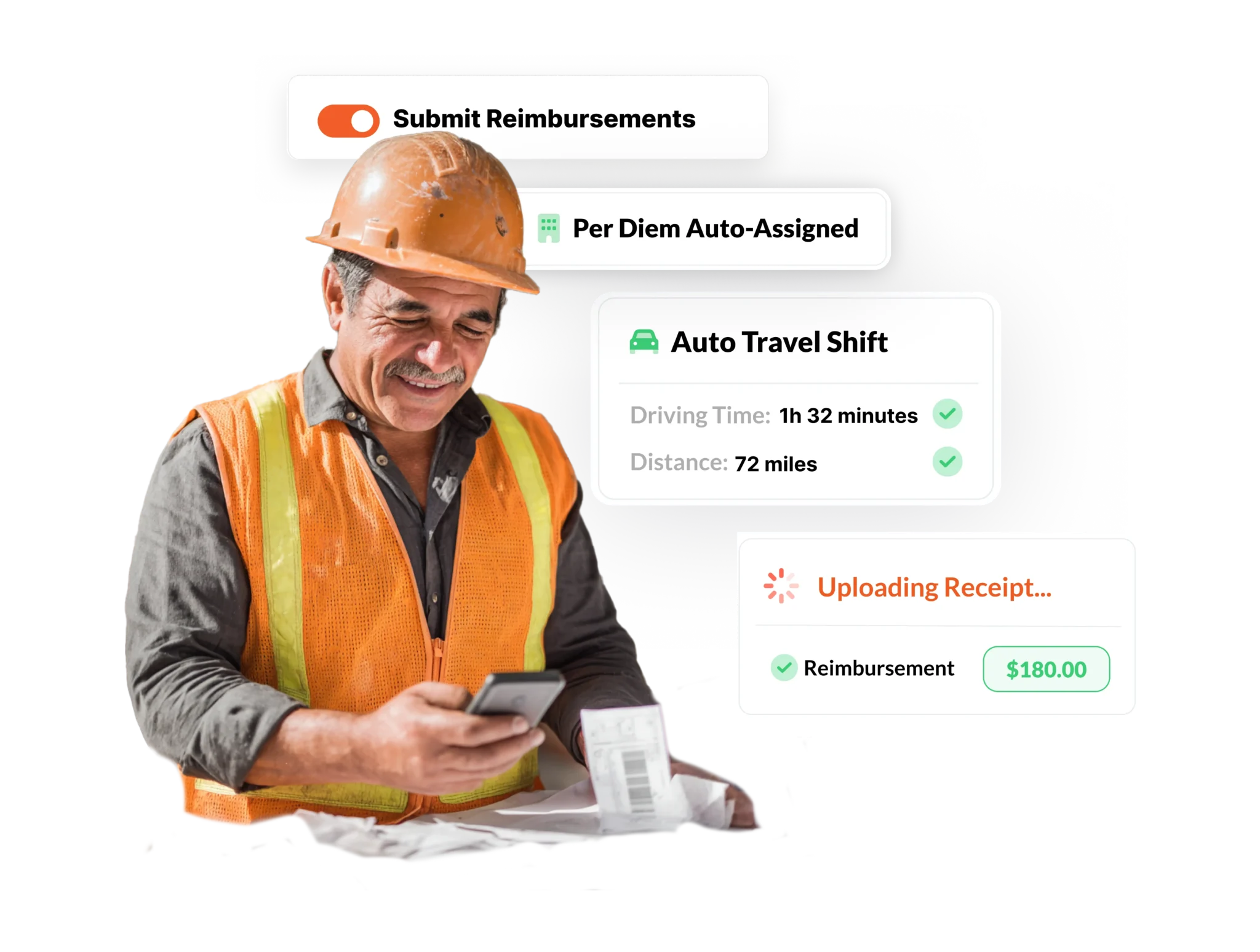

Expense Management Tools for Construction and Field Work

Construction expense management is distinct because of "job costing." A receipt for lumber isn't just an office supply; it is a direct material cost that must be attributed to a specific project phase to determine profitability. Generic tools lack the concept of "committed costs"—tracking expenses that have been approved but not yet spent to forecast project budget health. This niche handles field-specific workflows, such as a foreman buying fuel for a generator or emergency materials with a P-card. The primary pain point driving buyers here is the disconnect between the field and the office; without mobile-first job costing, project managers don't know they are over budget until weeks later. Dive deeper into job costing with Expense Management Tools for Construction and Field Work.

Expense Management Tools for Agencies and Creative Studios

Agencies live and die by project margins. This subcategory specializes in the complex "rebilling" workflow. When a creative director flies to a shoot, that flight might need to be billed to the client with a 10% markup, while the meal is billed at cost, and the alcohol is non-billable. Generic tools struggle to apply these variable markup rules automatically. Specialized tools integrate with project management software to ensure that every penny spent on a client's behalf is captured on the invoice. The specific pain point here is "expense leakage"—the 4-5% of billable costs that are never invoiced due to administrative errors [7]. Explore how to protect margins in Expense Management Tools for Agencies and Creative Studios.

Deep Dive: Integration & API Ecosystem

In the modern finance stack, an expense management tool that stands alone is a liability. The strength of an integration architecture often dictates the total ROI of the platform. "Flat file" transfers (exporting a CSV and importing it into the ERP) are no longer sufficient for agile businesses; they introduce latency and human error. The standard is now RESTful APIs that support real-time, bi-directional data flow.

Consider a practical scenario: A 50-person professional services firm uses Salesforce for CRM, NetSuite for ERP, and a specialized project management tool. If the expense tool only integrates with the ERP, the project managers are blind. A well-designed integration ecosystem pushes expense data to the ERP for the ledger and to the project management tool for budget tracking. When this integration is poorly designed or relies on batch processing, a project manager might approve a contractor's invoice on Tuesday, unaware that a massive travel expense submitted on Monday has already blown the project budget. According to IDC, integration of employee spend across travel, expense, and accounts payable is a primary trend driving the market, specifically to ensure data integrity and streamline processes [8]. Real-time visibility prevents this "budget blindness."

Deep Dive: Security & Compliance

Expense data is a goldmine of sensitive information, containing employee home addresses, credit card numbers, and travel patterns. Security goes beyond basic encryption. Data residency has become a critical compliance hurdle for global companies. With regulations like GDPR in Europe and various state-level privacy laws in the US, knowing where your data physically sits is mandatory.

For example, a US-based company with a subsidiary in Germany cannot simply store all expense receipts on a US server without violating GDPR data transfer mandates unless specific legal frameworks are in place. The IBM Cost of a Data Breach Report 2024 notes that the average cost of a data breach has reached $4.88 million, with lost business and post-breach response costs being major contributors [9]. In expense management, a breach doesn't just mean a fine; it means exposing the personal financial habits of your entire workforce to bad actors. Evaluators must verify SOC 2 Type II compliance and ask specifically about "sub-processor" data handling—who else does the vendor share data with?

Deep Dive: Pricing Models & TCO

Pricing in this category is notoriously opaque, generally falling into two buckets: "Per Active User" and "Per Expense Report." Understanding the nuance is critical for Total Cost of Ownership (TCO).

Per Active User: You pay a flat fee (e.g., $9/month) for every user who submits at least one report that month. This is predictable and rewards adoption.

Per Report: You pay a fee (e.g., $5) for every report submitted. This punishes frequency. If an employee submits expenses weekly to get reimbursed faster, your costs quadruple.

Let’s walk through a TCO calculation for a 100-person firm.

Scenario A (Per User): 50 employees travel in a given month. Cost = 50 * $9 = $450.

Scenario B (Per Report): Those 50 employees each submit 2 reports (one for travel, one for monthly phone). Cost = 100 reports * $5 = $500.

While seemingly close, the Per Report model discourages timely submission. Employees will "hoard" receipts to submit one giant report at month-end to save the company money, which destroys real-time visibility. Furthermore, hidden costs like "implementation fees" ($5k-$20k) and "credit card feed fees" can inflate year-one TCO by 30%. Forrester notes that organizations are increasingly scrutinizing these costs as they modernize financial operations [10].

Deep Dive: Implementation & Change Management

The number one cause of failure in expense management rollouts is not technical bugs, but user rejection. If the mobile app is clunky or the receipt scanning is slow, employees will revert to emailing spreadsheets to the controller, rendering the software useless. "Shadow processes" kill ROI.

Consider a mid-market manufacturing firm rolling out a new tool to field engineers. If the implementation plan focuses solely on the finance team's needs (GL coding structures) and ignores the field reality (offline capability, one-thumb operation), adoption will fail. A successful implementation requires a "pilot group" of the loudest potential detractors—usually the sales team. Win them over, and they become evangelists. According to ACFE's 2024 report, organizations lose 5% of revenue to fraud annually, often due to lack of internal controls or override of existing controls [11]. A system that employees refuse to use is a system that cannot enforce controls.

Deep Dive: Vendor Evaluation Criteria

When creating a shortlist, buyers must weigh "innovation" against "stability." The market is bifurcated between massive incumbents (SAP Concur) and agile challengers (Ramp, Brex, Navan).

Incumbents offer global scale, handling complex VAT reclamation across 50 countries and intricate union per diem rules. However, their user interface often feels dated, and innovation cycles are slow.

Challengers offer slick, consumer-grade interfaces and AI-driven automation but may lack the depth of configuration required for a multinational with complex transfer pricing needs.

Kevin Permenter, Research Director at IDC, notes that the "next generation of T&E software is all about intelligence and convenience," moving from manual processes to automated, transparent systems [12]. Therefore, the critical evaluation criterion is: "Does this vendor solve for my most complex user, or my average user?" If you have 5% of staff with insane complexity (expats, government contractors), an agile tool might fail them. If your complexity is low, an incumbent tool will feel like bloatware.

Emerging Trends and Contrarian Take

Emerging Trends 2025-2026:

The dominant trend is the dissolution of the "expense report" itself. We are moving toward "continuous expense management" where AI agents monitor transaction feeds and approve spend in real-time. Forrester predicts that expense management should "disappear," becoming an invisible layer of governance rather than a monthly administrative task [13]. Another trend is the convergence of travel booking and expense (T&E). Integrated platforms are using Generative AI to not just book trips but proactively predict total trip cost and policy compliance before booking.

Contrarian Take:

The corporate card is the only feature that matters; the software is just a wrapper.

The industry obsesses over software features—OCR speed, approval workflows, reporting dashboards. But the brutal truth is that payment method dictates control. If you issue virtual corporate cards with hard-coded limits (e.g., "this card only works for Uber and expires in 48 hours"), the software's approval workflow becomes redundant. You don't need to approve a transaction that has already been pre-controlled at the network level. In 5 years, standalone expense software that doesn't issue its own cards will be obsolete, replaced by fintech platforms that control the money directly. The "software" will essentially be free; the vendor will monetize the interchange fees.

Common Mistakes

Overbuying for "Edge Cases": Buying an enterprise-grade system because 2% of your staff travels internationally, forcing the other 98% to navigate a complex interface designed for global compliance.

Ignoring the "Receipt Hoarding" Behavior: Failing to configure the system to force frequent submissions. If you allow users to submit 50 receipts at once, approvers will "rubber stamp" the batch without reviewing, negating the purpose of the tool.

Underestimating Change Management: Assuming that because the new tool is "better," people will like it. Change fatigue is real. Without training and executive sponsorship, users will resent the new process.

Questions to Ask in a Demo

- "Show me the exact workflow for a user who forgets to upload a receipt. How does the system chase them so I don't have to?"

- "Can you demonstrate a 'split transaction' where a hotel bill includes room, tax, dinner (billable), and a movie (personal/non-reimbursable)?"

- "Does your OCR extract the 'merchant category code' (MCC) to prevent employees from buying gift cards at an office supply store and classifying it as 'Stationery'?"

- "How does your system handle a credit card refund? Does it automatically offset the previous expense, or do I have to manually process a negative expense report?"

- "If our ERP connection breaks, what is the data buffering capacity? Will we lose transactions?"

Before Signing the Contract

Data Ownership Clause: Ensure the contract explicitly states that you own your data. If you leave the vendor, they must provide your historical receipt images in a structured, usable format (not just a massive PDF dump) without exorbitant "exit fees."

Service Level Agreements (SLAs): Negotiate SLAs on "uptime" and "support response time." For finance teams during month-end close, a 24-hour support delay is unacceptable. Demand a <4 hour response time for critical issues.

Hidden Usage Fees: specific check for "storage fees" for archiving receipt images past 7 years (the IRS requirement). Some vendors charge extra for long-term retention.

Closing

Expense management is no longer just about paying people back; it's about financial agility and risk control. If you have questions about which tool fits your specific compliance or industry needs, reach out.

Email: albert@whatarethebest.com