What Are Cloud Bookkeeping Platforms?

Cloud Bookkeeping Platforms are specialized software solutions designed to record, categorize, and reconcile an organization's financial transactions through a centralized, web-based ledger. This category covers the core financial operational lifecycle: ingesting bank feeds, managing accounts payable and receivable, reconciling bank statements, and generating trial balances for financial reporting. Unlike on-premise predecessors, these platforms facilitate real-time collaboration between internal finance teams and external accountants, utilizing API connectivity to synchronize with broader business systems.

In the enterprise software stack, Cloud Bookkeeping Platforms sit squarely between Customer Relationship Management (CRM) systems—which manage the sales pipeline and customer acquisition—and full-scale Enterprise Resource Planning (ERP) suites—which manage complex back-office operations like supply chain, manufacturing, and human capital. While ERPs often contain bookkeeping modules, dedicated Cloud Bookkeeping Platforms are narrower in scope, focusing intensely on financial data integrity and compliance rather than operational resource planning. The category includes both general-purpose platforms suitable for a wide range of small-to-mid-sized businesses and vertical-specific tools engineered for industries with unique regulatory requirements, such as construction, legal, or non-profit sectors.

This software is critical for organizations ranging from pre-revenue startups to mid-market enterprises. It serves as the financial "system of record," ensuring that every dollar flowing in or out of the business is accounted for, compliant with tax regulations, and visible to decision-makers. Without this foundational layer, businesses cannot accurately assess profitability, manage cash flow, or survive a regulatory audit.

History of the Category

The evolution of Cloud Bookkeeping Platforms tracks the broader shift from digitized manual processes to automated, interconnected financial ecosystems. In the late 1990s, the market was dominated by desktop-based solutions that effectively digitized the paper ledger but trapped data on local hard drives. The "sneakernet" era—where files had to be physically moved or emailed to accountants—created significant version control issues and latency in financial reporting.

The pivotal shift occurred around 1998 with the launch of NetLedger (later NetSuite), which pioneered the delivery of accounting software over the internet [1]. This marked the birth of the Application Service Provider (ASP) model, the precursor to modern SaaS. While early cloud tools were initially met with skepticism regarding security and speed, they solved a critical gap: the need for simultaneous access by multiple users in different locations.

Through the 2000s and early 2010s, a "gap" emerged between simple small-business tools and massive, six-figure on-premise ERP systems like SAP or Oracle. Cloud Bookkeeping Platforms rushed to fill this void, offering enterprise-grade features—such as multi-currency support and audit trails—at a subscription price point. This era also saw the rise of the API economy, transforming these platforms from isolated databases into hubs that connected directly to banks and payment processors.

Market consolidation has played a massive role in shaping the current landscape. Major strategic acquisitions have defined the tiers of the market. In 2016, Oracle acquired NetSuite for approximately $9.3 billion, validating the cloud ERP model for the mid-market [1]. Shortly after, in 2017, The Sage Group acquired Intacct for $850 million, signaling a definitive move by legacy incumbents to capture the cloud-native financial management space [2]. Today, the market is characterized by a "verticalization" trend, where generalist platforms are increasingly supplemented or replaced by industry-specific tools (Vertical SaaS) that handle niche workflows like trust accounting or construction retainage.

What to Look For

Evaluating Cloud Bookkeeping Platforms requires looking beyond the basic ability to debit and credit accounts. A robust platform must serve as a scalable financial engine. The primary evaluation criteria should focus on automation capabilities, specifically the quality of bank feed integrations and the intelligence of reconciliation rules. Buyers should look for "zero-touch" reconciliation features that can learn from past transactions to categorize recurring expenses automatically.

Auditability and Controls are non-negotiable. A red flag in any system is the ability to delete transactions permanently without a trace. High-quality platforms will only allow "voiding" or reversing entries, maintaining a permanent audit trail of who changed what and when. This is critical for fraud prevention and eventual due diligence during fundraising or acquisitions. Additionally, role-based access control (RBAC) should be granular enough to separate duties—for example, ensuring the person who approves bills is not the same person who initiates payments.

When interviewing vendors, ask pointed questions about data ownership and portability. "If we leave your platform, in what format can we export our general ledger, and does it include all historical transactional detail and attached source documents?" Many inferior platforms hold data hostage by only allowing summary-level exports. Furthermore, inquire about the API rate limits. As your transaction volume grows, you do not want your integrations to fail because the platform throttles the number of times your CRM can "talk" to your ledger.

Industry-Specific Use Cases

The suitability of a Cloud Bookkeeping Platform often depends entirely on the specific operational workflows of an industry. Generic tools often fail to capture the nuance of sector-specific financial data.

Retail & E-commerce

For retailers, and specifically e-commerce merchants, the primary challenge is high-volume transaction matching and sales tax compliance across multiple jurisdictions (economic nexus). A standard bookkeeping tool often crumbles under the weight of thousands of small transactions from Shopify or Amazon. Specialized platforms or heavy integrations are needed to handle settlement reconciliation. Amazon, for example, deposits a net amount that bundles sales, refunds, FBA fees, and advertising costs. The bookkeeping platform must be able to "gross up" this net deposit to record the correct revenue and expense lines, rather than just recording the cash received [3]. Failure to do this results in understated revenue and expenses, distorting margins.

Healthcare

Healthcare organizations face a unique set of constraints centered on HIPAA compliance and insurance reconciliation. Bookkeeping platforms in this sector must support Business Associate Agreements (BAAs) if they handle any Protected Health Information (PHI). More importantly, they must handle the complex workflow of contractual adjustments versus bad debt. When a provider bills $200 but the insurance allows $140, the $60 difference is a contractual adjustment (not a write-off) and must be tracked specifically to analyze payer yield [4]. Generic tools often lack the specific transaction codes to differentiate these adjustments easily.

Financial Services

Firms in asset management, wealth management, and fintech prioritize multi-currency consolidation and real-time position reporting. The cost of a data breach in the financial sector is the highest of any industry, averaging over $6 million per incident in 2024 [5]. Consequently, security protocols in bookkeeping platforms for this sector are scrutinized intensely. Functionally, these firms need platforms that can handle automated inter-entity transactions and continuous revaluation of foreign currency assets in accordance with fluctuating exchange rates [6].

Manufacturing

The "deadly sin" for manufacturers using generic bookkeeping software is poor inventory accounting. Manufacturers need to track Work-In-Process (WIP) and capitalize labor and overhead into the cost of finished goods. A simple expense-based system that expenses materials immediately upon purchase will continually misstate profitability. The platform must handle landed costs—allocating freight and duties to specific inventory items—and support bill of materials (BOM) explosions to deduct raw materials as finished goods are produced [7].

Professional Services

Agencies, consultancies, and law firms live and die by revenue recognition and project profitability. Unlike retail, where a sale is a sale, services firms often bill retainers upfront or bill based on milestones. The bookkeeping platform must support ASC 606 compliance, separating deferred revenue (liability) from earned revenue [8]. Additionally, these firms need to track "realization rates"—the revenue earned versus the billable value of hours worked—which requires tight integration between the time-tracking system and the general ledger.

Subcategory Overview

Beyond broad industry verticals, specific functional needs drive buyers toward specialized subcategories. These niches address pain points that generalist platforms ignore.

Nonprofits and Associations

Standard business accounting focuses on profit; nonprofits focus on fund accounting. A general ledger for a nonprofit must track "net assets with donor restrictions" versus "unrestricted net assets." General commercial tools often force nonprofits to use "classes" or "locations" as clumsy workarounds for funds. Specialized Cloud Bookkeeping Platforms for Nonprofits and Associations handle the specific workflow of "releasing funds from restriction"—moving money from a restricted bucket to an operating bucket once grant conditions are met [9]. This ensures compliance with donor intent and grant reporting requirements.

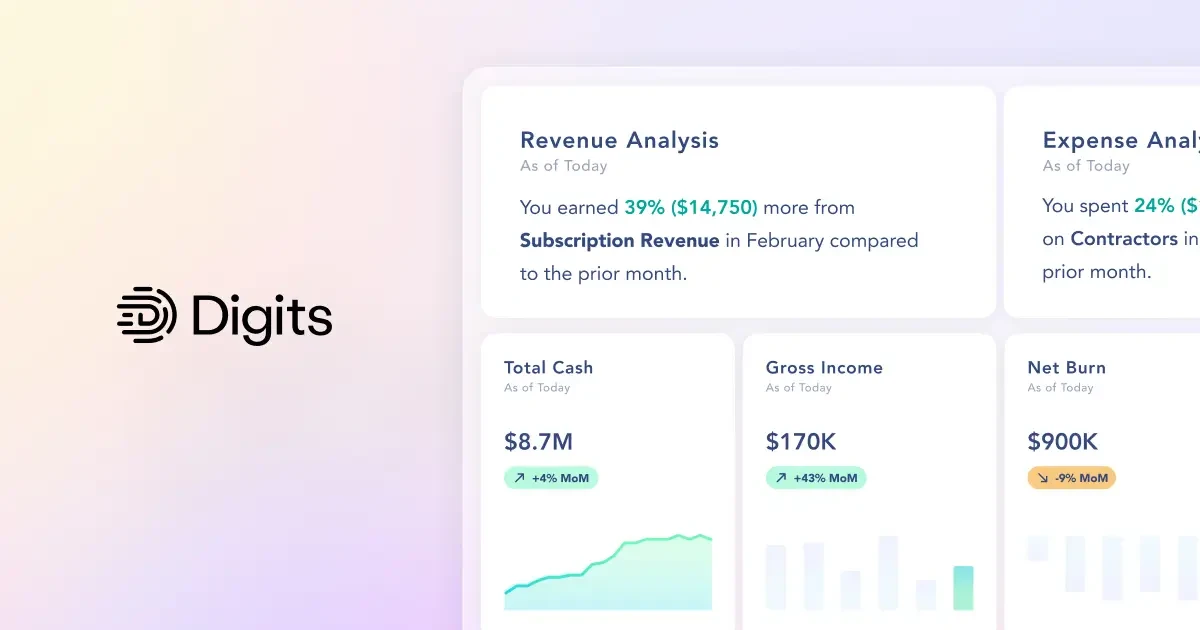

Built-In Financial Dashboards

While most platforms offer basic reporting, some organizations require deep, real-time Business Intelligence (BI) without the latency of exporting data to a separate tool like Tableau or Power BI. Cloud Bookkeeping Platforms with Built-In Financial Dashboards differentiate themselves by embedding visualization layers directly atop the transaction ledger. This solves the "latency gap" where decision-makers are viewing data that is days or weeks old. In volatile markets, the ability to drill down from a dashboard graph directly into the underlying transaction is a workflow that disconnected BI tools cannot replicate efficiently [10].

Agencies and Services Firms

The specific pain point here is retainer management. A creative agency billing $10,000 a month against hours needs to know exactly when the retainer is exhausted to avoid "scope creep" or working for free. General tools treat the invoice as the end of the process. Specialized Cloud Bookkeeping Platforms for Agencies and Services Firms treat the invoice as the beginning of a drawdown process, matching timesheets against the prepaid balance. This ensures that revenue is recognized only as work is performed, adhering to accrual accounting principles essential for accurate agency valuation.

Multi-Entity Organizations

Franchises, holding companies, and conglomerates struggle with intercompany eliminations. If Entity A sells services to Entity B within the same group, a consolidated report must remove this transaction to avoid double-counting revenue. Doing this in spreadsheets is prone to error. Cloud Bookkeeping Platforms for Multi-Entity Organizations automate these eliminations and handle currency triangulation for international subsidiaries. They allow a CFO to sign in once and view a consolidated trial balance instantly, rather than waiting weeks for a manual close process [11].

Real Estate Investors and Landlords

This niche requires trust accounting capabilities. Property managers often hold security deposits or rent on behalf of owners, which legally belongs to the owner, not the manager. Commingling these funds is a major compliance violation. Cloud Bookkeeping Platforms for Real Estate Investors and Landlords are built to perform "three-way reconciliation" (matching the bank balance, the book balance, and the sum of all tenant/owner ledgers) automatically [12]. They also track profitability at the "unit" level, a granularity that general ledgers find difficult to manage without excessive chart-of-accounts bloat.

Deep Dive: Integration & API Ecosystem

In the modern stack, a bookkeeping platform that stands alone is a liability. The strength of a platform is defined by its connectivity. A MuleSoft connectivity report highlights that the average enterprise uses 991 distinct applications, yet only 29% are integrated [13]. This "integration gap" is where finance teams lose countless hours to manual data re-entry.

Expert Insight: Gartner analysts consistently note that integration platform as a service (iPaaS) capabilities are becoming a standard expectation for finance platforms, shifting focus from "does it have an API?" to "does it have pre-built connectors that support bi-directional sync?"

Scenario: Consider a 50-person professional services firm using a specialized project management tool (like Monday.com) and a separate CRM (like Salesforce). If the bookkeeping platform lacks a robust API, the billing manager must manually export "closed won" deals from the CRM and re-key them as invoices in the ledger. When a project manager updates a milestone in the PM tool, finance isn't notified to bill the client. The result is "revenue leakage"—work is done but never invoiced because the signal was lost between systems. A robust integration would automate the creation of the invoice draft upon the milestone completion trigger, ensuring 100% billing capture.

Deep Dive: Security & Compliance

Security is the bedrock of financial software. Buyers must look for SOC 2 Type II compliance, which attests that the vendor's security controls have been tested over a period of time, not just at a single point in time. Encryption at rest and in transit (AES-256) is the industry standard.

Statistic: According to IBM’s 2024 Cost of a Data Breach Report, the average cost of a data breach globally has reached $4.88 million, with the financial sector facing even higher average costs of $6.08 million per breach [14], [5].

Scenario: A mid-sized fintech company uses a bookkeeping platform to manage client assets. A junior accountant falls for a phishing email, granting an attacker access to the system. Without Multi-Factor Authentication (MFA) enforced at the platform level and strict IP whitelisting capabilities, the attacker could change vendor bank account details and drain funds. A secure platform would not only mandate MFA but also flag "impossible travel" logins (e.g., logging in from Russia five minutes after a login from New York) and require secondary approval for any changes to vendor payment routing information.

Deep Dive: Pricing Models & TCO

Pricing in this category has shifted from simple perpetual licenses to complex SaaS models based on usage (transaction volume), seats (users), or modules. The hidden killer in Total Cost of Ownership (TCO) is rarely the license fee—it is the implementation and waste.

Statistic: Research indicates that organizations waste significant budget on shelfware, with studies showing that approximately 51% of SaaS licenses go unused in a given month [15].

Scenario: A 25-person finance team buys a platform priced at $150/user/month. They purchase 30 seats to be "safe" for growth. However, only 5 core accountants use the system daily; the other 20 users (department heads) only log in once a month to approve expenses. Under a strict per-seat model, the company pays $4,500/month. A smarter TCO calculation would favor a platform that offers "light user" or "approver" licenses at a nominal fee (e.g., $10/month) while charging full price only for power users. Over three years, the difference in models could save the company over $100,000, illustrating why "price per seat" is a deceptive metric without analyzing user roles.

Deep Dive: Implementation & Change Management

Implementation is the graveyard of software projects. The "Big Bang" approach—switching everything overnight—is a high-risk strategy that often leads to operational paralysis.

Statistic: Gartner estimates that 55% to 75% of ERP and financial system implementation projects fail to meet their original objectives [16].

Scenario: A manufacturing firm decides to switch bookkeeping platforms at the start of their fiscal year. They migrate customer lists and open balances but fail to map the "Item Master" list correctly to the new Chart of Accounts. On Day 1, the shipping department cannot generate packing slips because the inventory codes don't exist in the new system. Invoicing halts for three weeks while consultants scramble to fix the mapping. A proper implementation would have involved a "parallel run" phase where both systems operated simultaneously for a month to catch such mapping errors before cutting over.

Deep Dive: Vendor Evaluation Criteria

When selecting a vendor, look beyond the feature list to the vendor's viability and ecosystem. Is the vendor profitable, or are they burning venture capital with a runway that might expire? Furthermore, assess the Partner Ecosystem. A bookkeeping platform is only as good as the consultants and accountants who know how to use it.

Expert Insight: Forrester analysts emphasize that for financial systems, the "stickiness" of the product means you are entering a 5-10 year marriage. Therefore, the vendor's roadmap for regulatory compliance (e.g., supporting new e-invoicing mandates in Europe or changes to US GAAP) is more important than flashy new AI features.

Scenario: A growing SaaS company evaluates two vendors. Vendor A has a slick UI but few third-party consultants. Vendor B has a dated UI but a massive network of certified CPA partners. The company chooses Vendor A. Six months later, their Controller quits. They cannot find a contract CFO familiar with Vendor A's proprietary scripting language. The finance function stalls. Had they chosen Vendor B, they could have hired from a deep pool of talent ready to step in immediately. Talent availability is a hidden but critical vendor evaluation criterion.

Emerging Trends and Contrarian Take

Emerging Trends (2025-2026):

We are witnessing the rise of Autonomous Finance Agents. Unlike simple automation (rules-based), AI agents will autonomously investigate anomalies—such as emailing a vendor to ask why an invoice amount deviates from the contract—before a human ever sees it. Additionally, we see a shift toward Vertical SaaS Convergence, where industry-specific operating systems (like ServiceTitan for trades or Toast for restaurants) are embedding full-ledger capabilities, threatening to relegate generalist bookkeeping platforms to the background.

Contrarian Take:

The "Single Source of Truth" is dead. For years, consultants have preached that the accounting system must be the central repository of all truth. This is no longer feasible or desirable. Operational data (customer health, engineering velocity, detailed inventory logistics) is too complex and high-volume for a general ledger. The future is Federated Data, where the bookkeeping platform acts merely as a financial router and compliance finality, while the actual operational "truth" remains in specialized vertical tools. Businesses trying to force all operational data into their accounting software are over-engineering their ledger and degrading its performance.

Common Mistakes

Over-customization is the most expensive mistake buyers make. They try to bend the software to match their legacy (inefficient) processes rather than adapting their processes to the software's best practices. This leads to "technical debt" where the system becomes so customized it cannot be updated.

Another frequent error is ignoring historical data migration complexity. Buyers assume they can simply "import" five years of history. In reality, mapping old chart of accounts to new ones is messy. Often, it is cleaner to migrate only "opening balances" and keep the old system as a read-only archive, rather than polluting the new, clean system with messy historical data.

Finally, underestimating change management. Software doesn't reconcile accounts; people do. If the staff isn't trained on why the new workflow matters (e.g., "we need to tag invoices by department so we can track budget vs actuals"), they will simply bypass the required fields, leading to "garbage in, garbage out."

Questions to Ask in a Demo

- "Show me the error log." Don't just show me the happy path where the bank feed works. Show me what happens when a sync fails. How does the system alert me?

- "How do you handle 'un-do'?" If I accidentally reconcile the wrong transaction, how many clicks does it take to fix it? Is there a traceable audit trail for that reversal?

- "What is your API rate limit?" If we batch-upload 10,000 invoices at month-end, will the system choke or timeout?

- "Demonstrate a multi-entity consolidation live." Do not accept a slide. Make them log in to a parent entity and run a consolidated P&L in real-time.

- "What does the export look like?" Download a General Ledger dump. Is it a usable CSV, or a formatted PDF that is impossible to analyze in Excel?

Before Signing the Contract

Final Decision Checklist: Ensure you have validated the "must-have" integrations. If the sales rep says an integration is "on the roadmap," assume it does not exist. Verify the Service Level Agreement (SLA) for uptime; financial systems cannot go down during month-end close. Check the data exit clause—ensure you legally own your data and can extract it without punitive fees if you terminate the contract.

Negotiation Points: Vendors are often flexible on implementation fees and contract term length. Push for a "ramp" deal where you pay for fewer seats during the implementation phase and only scale up billing when the system goes live. Avoid locking into multi-year contracts without an "opt-out" clause at the 12-month mark in case the implementation fails.

Deal-Breakers: Lack of a Sandbox environment. You must have a safe place to test integrations and new workflows without corrupting your actual financial data. If a vendor does not offer a Sandbox/Test environment, do not sign.

Closing

Selecting a Cloud Bookkeeping Platform is a foundational decision that dictates your organization's financial agility for years to come. If you have questions about specific vendors or need help navigating the nuances of your industry's requirements, feel free to reach out.

Email: albert@whatarethebest.com