What is Portfolio & Program Management Software?

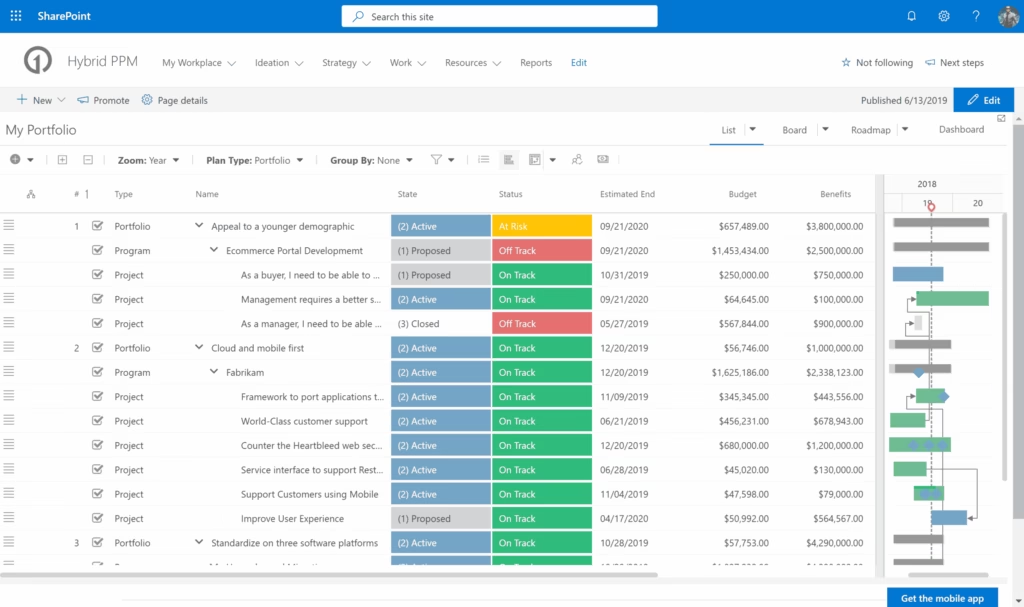

Portfolio & Program Management (PPM) Software is the centralized command center for organizations to select, prioritize, and control their investments in projects and initiatives. Unlike project management tools, which focus on the daily execution of individual tasks and deliverables (doing things right), PPM software focuses on the strategic alignment and value optimization of the entire collection of work (doing the right things). It provides the governance framework to balance capacity against demand, manage aggregate risk, and ensure that capital and resources are deployed toward initiatives that yield the highest strategic ROI.

This category covers software used to manage the aggregate investment lifecycle of an organization’s initiatives: capturing and evaluating demand, prioritizing investments based on strategic drivers, allocating cross-functional capacity, monitoring portfolio health and variance, and optimizing benefits realization. It sits between Strategic Planning (which sets the long-term vision) and Work Management (which handles the day-to-day execution). It includes both general-purpose strategic portfolio management (SPM) platforms and vertical-specific solutions built for complex environments like capital construction, new product development, and IT governance.

The core problem this software solves is the "alignment gap"—the disconnect between executive strategy and operational execution. Without it, organizations suffer from resource overcommitment, zombie projects that consume budget without delivering value, and a lack of visibility into how tactical work contributes to strategic goals. It is used primarily by PMOs (Project Management Offices), executives, portfolio managers, and steering committees to make evidence-based decisions about where to cut, where to double down, and how to sequence work to maximize business outcomes.

History

The evolution of Portfolio & Program Management software mirrors the maturation of the digital enterprise itself. In the 1990s, as the "Project Management Office" (PMO) began to formalize within IT departments, the initial need was purely administrative: organizations needed a central repository to track what projects were active. Early solutions were essentially glorified databases—heavy, on-premise "forms over function" systems designed to digitize the clipboard. They focused on time-tracking and basic cost accounting, driven largely by the fear of the Year 2000 (Y2K) bug, which necessitated a massive, coordinated audit of IT assets [1]. These early tools were rigid, expensive to implement, and detested by end-users.

The mid-2000s marked a pivot from "tracking" to "governance." Following the dot-com crash and the introduction of regulations like Sarbanes-Oxley, executives demanded rigorous financial oversight. The market saw a wave of consolidation as ERP giants acquired specialized PPM vendors to bolt portfolio capabilities onto financial systems. This era introduced the concept of "demand management"—controlling the intake funnel to prevent project overload. However, these systems remained siloed in IT, often failing to gain traction in product development or capital planning.

The modern era, beginning around 2010 with the rise of vertical SaaS and cloud computing, fundamentally shifted buyer expectations from "give me a database" to "give me actionable intelligence." The monolithic "one-size-fits-all" PPM suite began to fracture. Specialized tools emerged for distinct use cases: Agile planning for software teams, capital planning for construction, and new product introduction (NPI) for manufacturing. The defining shift of the last decade has been the move toward "Strategic Portfolio Management" (SPM), where the focus is no longer just on executing projects on time, but on continuous adaptive planning—shifting funding dynamically as market conditions change. Today's landscape is defined by the integration of execution data (from disparate work tools) into a unified strategic view, enabling what analysts call "federated" portfolio management.

What to Look For

Evaluating PPM software requires a shift in mindset from "feature counting" to "process enablement." The most robust platform will fail if it imposes a governance model that your organization is not mature enough to sustain. Conversely, a lightweight tool will collapse under the weight of complex interdependencies in a large enterprise.

Critical Evaluation Criteria:

- Scenario Planning & What-If Analysis: The hallmark of a true portfolio tool is the ability to model alternative futures. Look for engines that allow you to toggle constraints (e.g., "What if we cut the budget by 20%?" or "What if this key initiative is delayed by three months?") and instantly visualize the cascading impact on resources and dependencies across the portfolio.

- Resource Capacity Planning: Basic tools track hours; advanced tools model skills and roles. You need the ability to forecast bottlenecks months in advance. Look for "soft booking" capabilities and the ability to reconcile top-down capacity planning with bottom-up actuals without requiring manual spreadsheet exports.

- Financial Governance: The system must handle multiple currency types (Capex vs. Opex) and fiscal periods. It should support the full financial lifecycle: budget requests, approvals, forecast updates, and actuals reconciliation. Critical for public companies is the ability to create immutable audit trails for capital appropriation changes.

Red Flags and Warning Signs:

- The "All-in-One" Trap: Be wary of vendors claiming to replace your ERP, CRM, and Agile delivery tools simultaneously. The best PPM tools act as a "manager of managers," integrating with execution tools rather than trying to replace them. If a vendor insists you migrate your engineering teams off their preferred issue tracker to use the PPM's native task list, adoption will likely fail.

- Rigid Hierarchy: Avoid systems that enforce a strict Project > Program > Portfolio hierarchy if your organization works in a matrix or product-centric model. Modern work is fluid; the software must allow for many-to-many relationships where a single initiative might contribute to multiple strategic value streams.

Key Questions to Ask Vendors:

- "How does your system handle 'federated' data? Can we leave execution data in our existing DevOps and Work Management tools and only pull up the metadata we need for portfolio reporting?"

- "Show me the workflow for re-allocating budget mid-cycle. How many clicks does it take to move $100k from Project A to Project B, and does it automatically update the baseline variance reports?"

- "What is the upgrade path for the data model? If we decide next year to track 'strategic themes' instead of 'business units,' does that require a professional services engagement to re-architect the database?"

Industry-Specific Use Cases

Retail & E-commerce

In retail, portfolio management is often synonymous with Store Lifecycle Management (SLM). The "projects" here are not software releases but physical events: new store openings, retrofits, and closures. General-purpose PPM tools often fail here because they lack geospatial intelligence and lease-data integration. Retailers need software that can template the "Store Opening" program—a complex, repeatable workflow involving real estate selection, permitting, construction, merchandising, and hiring [2].

Evaluation priorities must focus on repeatability and scale. A retailer opening 50 stores a year needs a "cookie-cutter" project template that can be instantiated 50 times with preserved dependencies. The critical capability is "milestone tracking" across a massive volume of concurrent small projects rather than deep management of a few large ones. Integration with lease administration software and facility management systems is non-negotiable, as the "go-live" date is often contractually bound to rent commencement dates.

Healthcare

For healthcare providers, the portfolio is split between IT innovation (EMR upgrades, telemedicine) and capital planning (building new wings, acquiring MRI machines). The regulatory burden is immense. Software in this space must support rigorous stage-gate governance to ensure compliance with bodies like the Joint Commission or FDA regulations for medical device projects [3].

Unique considerations include the need for "capital prioritization" algorithms. Hospitals operate on thin margins and must rank funding requests based on complex weighted criteria involving patient safety, regulatory compliance, and financial return. A standard ROI calculator is insufficient; the software must support multi-dimensional scoring models that prioritize a negative-ROI safety project over a positive-ROI cosmetic upgrade. Furthermore, resource management must account for clinical staff who spend only a fraction of their time on projects, requiring granular "FTE partial allocation" features.

Financial Services

Financial institutions use PPM software as a primary engine for Risk Management and Regulatory Compliance. Whether it's a bank implementing Basel III standards or an insurer updating claims processing, the "project" is often a vehicle for regulatory adherence. The critical need here is traceability. If a regulator asks why a specific compliance project was de-prioritized in Q3, the PPM system must provide an immutable audit trail of the decision governance [4].

Security is the paramount evaluation criterion. Deployment often requires on-premise or dedicated private cloud instances with customer-managed encryption keys (BYOK). Functionally, these buyers look for "investment management" capabilities that rival financial trading desks—viewing the project portfolio as a basket of assets with volatility, risk profiles, and diversification requirements. Integration with Governance, Risk, and Compliance (GRC) platforms is a rapidly emerging requirement.

Manufacturing

Manufacturing portfolios are dominated by New Product Introduction (NPI) and R&D. The workflow here is not Agile; it is the rigid, sequential Stage-Gate® process. Manufacturers need software that enforces strict "Go/No-Go" decision points where a product cannot move from "Prototype" to "Production" without specific deliverables (e.g., QA certifications, supply chain validation) being approved [5].

The unique differentiator is the integration with Product Lifecycle Management (PLM) systems. While the PLM holds the CAD drawings and BOMs (Bill of Materials), the PPM tool manages the timeline and commercial viability. Manufacturers evaluate tools based on "pipeline visibility"—the ability to see that the 2026 product portfolio has a revenue gap, requiring immediate R&D investment today. The ability to track "target cost" vs. "estimated cost" throughout the engineering lifecycle is a specific pain point generic tools miss.

Professional Services

For consultancies, agencies, and IT services firms, the "portfolio" is the client revenue stream. PPM here overlaps heavily with Professional Services Automation (PSA). The primary metric is Billable Utilization. Unlike internal IT teams that aim for predictability, services teams aim for maximizing billable hours. The software must treat "revenue" and "resource schedule" as the same dataset [6].

Evaluation priorities shift toward "Opportunity-to-Cash" workflows. Can the system take a sales opportunity from the CRM, tentatively book resources against it (forecasting capacity needs before the deal closes), and then seamlessly convert it to a live project upon signature? The red flag here is a disconnect between the project plan and the invoice; top-tier tools for this sector automate billing milestones directly from project progress, reducing revenue leakage.

Subcategory Overview

Portfolio & Program Management Software for Contractors

This niche serves the heavy civil, commercial, and general contractor market, distinct from generic tools due to its focus on the physical "Work in Place" (WIP) and the complex financial structures of construction, such as retainage and AIA billing. Unlike standard PPM tools that track hours, these platforms track quantities (e.g., cubic yards of concrete poured) and link them directly to schedule performance and draw requests. The workflow that only this specialized tool handles well is the Submittal and RFI (Request for Information) log linked to the master schedule. In general tools, an RFI is just a "task"; in contractor software, an RFI is a legal document that, if unanswered, automatically triggers a schedule impact warning and potential change order claim.

The specific pain point driving buyers here is Field-to-Office latency. Contractors cannot afford tools that require a back-office scheduler to manually update Gantt charts once a week. They need mobile-first interfaces where superintendents update progress daily, instantly recalculating the portfolio's "Estimate at Completion" (EAC). For a deeper analysis of these specialized features, refer to our guide to Portfolio & Program Management Software for Contractors.

Portfolio & Program Management Software for SaaS Companies

SaaS companies face a unique challenge: their "product" is never finished. Consequently, they require tools that manage continuous Value Streams rather than finite projects. This niche software differentiates itself by replacing the "Project End Date" with "Release Cadences" and "Roadmaps." A workflow unique to this category is the Feature Prioritization Matrix, which pulls live data from customer support tickets or CRM opportunity values to score backlog items (e.g., RICE or WSJF scoring). This ensures development capacity aligns with current ARR (Annual Recurring Revenue) goals rather than arbitrary deadlines.

Buyers flee general tools for this niche because of the "Project vs. Product" friction. Traditional PPM forces continuous software work into artificial "projects" with start and stop dates, messing up reporting. SaaS-specific tools map directly to the SDLC (Software Development Life Cycle), integrating deeply with code repositories and CI/CD pipelines to track value delivery in real-time. To explore tools that bridge the gap between engineering and executive strategy, see our guide to Portfolio & Program Management Software for SaaS Companies.

Portfolio & Program Management Software for Private Equity Firms

Private Equity (PE) firms do not manage "projects" in the traditional sense; they manage a portfolio of companies (PortCos). Software in this niche acts as a Portfolio Monitoring and Value Creation platform. It differs from generic PPM by focusing on financial data ingestion rather than task completion. The critical workflow here is the automated Monthly Operating Pack collection—sucking in P&L, balance sheet, and cash flow data from dozens of disparate ERPs across the portfolio companies to normalize and aggregate them for fund-level reporting.

The driving pain point is the Excel Hell of quarterly reporting. General PPM tools cannot handle the complex entity structures, foreign exchange normalizations, and capitalization tables required by PE. These niche tools allow operating partners to benchmark performance across the portfolio (e.g., "Compare EBITDA margins across all our manufacturing holdings") to identify value creation opportunities. For detailed insights on these financial monitoring platforms, read our guide to Portfolio & Program Management Software for Private Equity Firms.

Integration & API Ecosystem

In the modern enterprise, a PPM tool that stands alone is shelfware waiting to happen. The true value of PPM is its ability to act as a "manager of managers," aggregating data from the tools where work actually happens (Jira, Salesforce, SAP, Oracle). The cost of getting this wrong is staggering. According to the Consortium for Information & Software Quality (CISQ), the cost of poor software quality—primarily driven by integration and data interoperability failures—reached approximately $2.41 trillion in the US alone [7]. This statistic highlights that a disconnected portfolio tool is not just an inconvenience; it is a massive financial liability.

Gartner VP of Research Raf Gelders notes that high-performing "digital vanguard" organizations distinguish themselves specifically by how they co-own digital delivery, effectively integrating IT and business data streams [8]. In practice, consider a 50-person professional services firm integrating their PPM tool with their invoicing (QuickBooks) and project execution (Asana) systems. If the integration is one-way or batch-based, a project manager might extend a schedule in Asana, but the billing trigger in QuickBooks doesn't update. The result? Work continues for two weeks without budget authorization, leading to $20,000 in unbillable leakage. A robust API ecosystem allows for bi-directional, event-driven synchronization: the schedule change in Asana instantly locks the "Work in Progress" limit in the finance tool until a change order is signed.

Security & Compliance

As PPM tools aggregate an organization’s most sensitive strategic data—future product launches, M&A timelines, and resource vulnerabilities—they become high-value targets. The stakes are quantified by IBM’s 2024 Cost of a Data Breach Report, which found the global average cost of a data breach has hit $4.88 million, with highly regulated industries like healthcare facing costs nearly double that [4]. Security can no longer be a checkbox; it is a fundamental architectural requirement.

Experts warn that the "SaaS sprawl" in portfolio management creates shadow IT risks. Gartner estimates that by 2027, 75% of employees will acquire technology outside of IT oversight, massively increasing the surface area for breaches [9]. A concrete scenario involves a financial services firm using a cloud-based PPM tool. If the vendor does not support "Bring Your Own Key" (BYOK) encryption, the firm’s data is technically accessible by the vendor’s admins. During a subpoena or audit, the firm cannot prove chain of custody. Buyers must demand SOC 2 Type II certification at a minimum, but for enterprise use, look for FedRAMP authorization or ISO 27001 compliance, and granular Role-Based Access Control (RBAC) that restricts visibility not just by project, but by specific data fields (e.g., hiding "Target Acquisition Cost" from external contractors).

Pricing Models & TCO

PPM pricing is notoriously opaque and complex. The market is split between "User-Based" models (per seat) and "Portfolio Value" models (percentage of managed budget). A silent budget killer is "shelfware"—software paid for but not used. Research by Zylo indicates that the average organization wastes $17 million annually on unused SaaS licenses, with nearly 44% of licenses being underutilized [10]. This typically happens when companies buy "Full User" licenses for stakeholders who only need "Read-Only" access.

Consider a TCO calculation for a 25-person PMO.

* **Per-Seat Model:** 25 users @ $60/month = $18,000/year. Seems cheap. However, if the vendor requires you to buy licenses for 50 "collaborators" (executives who just view dashboards) at $20/month, the cost jumps to $30,000.

* **Add-ons:** "Resource Management" or "API Access" are often gated behind a premium tier, doubling the per-seat cost.

* **Implementation:** A "low cost" tool might require $50,000 in consulting fees to configure.

In a real-world scenario, a buyer might choose a tool with a low license fee but fail to negotiate a cap on "storage" or "API calls." As their integration with Jira scales, they get hit with overage charges that exceed the licensing cost. Always calculate TCO based on *deployment* size (including read-only users) and *data volume*, not just the core team count.

Implementation & Change Management

The failure rate of digital initiatives is alarming. Gartner's 2024 survey reveals that only 48% of digital initiatives meet or exceed their business outcome targets [8]. The primary culprit is rarely the software itself, but the lack of organizational change management. Buying a tool does not fix a broken process; it simply digitizes the chaos.

Prosci, a leader in change management research, consistently finds that projects with excellent change management are six times more likely to meet objectives than those with poor change management [11]. An expert insight from McKinsey supports this, noting that "cultural and organizational barriers dominate transformation challenges," often exceeding technical ones [12].

Scenario: A manufacturing firm implements a rigid Stage-Gate PPM tool. They configure it to require 40 data fields for a "Concept" phase project. The engineering team, used to agile experimentation, refuses to use the cumbersome form and manages work in spreadsheets instead. The PPM tool becomes a "zombie graveyard" of outdated data because the implementation focused on data capture (management needs) rather than user enablement (team needs). A successful implementation would start with a "minimum viable governance" model—asking for only 5 key fields initially—and ramping up complexity only after adoption is secured.

Vendor Evaluation Criteria

When selecting a vendor, look beyond the feature matrix. You are choosing a long-term partner for your strategy. Gartner advises that by 2025, 70% of digital investments will fail to deliver expected business outcomes due to the absence of a strategic portfolio management approach [13]. This statistic implies that the vendor must offer more than software; they must offer a framework for strategic maturity.

Key criteria include ecosystem viability and customer community. Does the vendor have an active user group where you can learn best practices? Is there a marketplace of pre-built connectors? In a practical evaluation scenario, a buyer should test the vendor's support *before* signing. Open a technical ticket during the trial regarding a complex API issue. If the response is a generic link to documentation rather than a thoughtful engineering reply, it signals that the vendor is focused on sales volume, not customer success. For complex portfolios, prioritize vendors that are recognized as "Leaders" in analyst reports like the Gartner Magic Quadrant or Forrester Wave, as these designations often correlate with deeper R&D investment and longevity [14].

Emerging Trends and Contrarian Take

Emerging Trends 2025-2026:

The biggest shift is the move toward AI-Driven Autonomous Governance. We are moving past "predictive analytics" (telling you a project might be late) to "agentic AI" that actively proposes solutions. Expect tools to feature agents that say, "Project A is delayed; if you move Resource B from Project C, you can recover the schedule with minimal impact. Click here to execute." Another trend is Sustainability Portfolio Management, where carbon footprint becomes a weighted metric alongside ROI in portfolio selection, driven by ESG regulations.

Contrarian Take:

The "Single Source of Truth" is a myth that destroys value.

Most organizations spend millions trying to force every department into one monolithic PPM tool to achieve a "Single Source of Truth." This is a fool's errand. Engineering will always work better in Jira; Finance will always work better in SAP. The insight that savvy leaders are realizing is that federated data is superior to centralized data. You don't need *one* tool; you need a thin connectivity layer that respects the specialized tools of each department while aggregating just enough metadata for decision-making. Attempting to force a creative agency and a construction team into the same "one size fits all" platform guarantees that *both* teams will hate their daily work.

Common Mistakes

Overbuying Complexity: The most common error is buying a "Ferrari" when you need a "Honda." Organizations often purchase enterprise-grade tools with advanced Monte Carlo simulations and resource leveling, only to turn 90% of the features off because their internal process maturity is Level 1 (Ad-hoc). This leads to shelfware and user revolt.

Ignoring the "Garbage In, Garbage Out" Reality: Buyers often believe software will fix their data quality issues. It won't. If your project managers currently submit vague status reports in Excel, they will submit vague status reports in a $100k PPM tool. Without a cultural commitment to data integrity and honesty (psychological safety to report "Red" status), the tool becomes a dashboard of lies.

Failing to Define "Portfolio" Early: Implementing a tool without defining what constitutes a "project" vs. "operational work" is fatal. If the IT helpdesk tickets are mixed in with strategic initiatives, the portfolio view becomes cluttered and useless. Clear taxonomy definitions must precede software configuration.

Questions to Ask in a Demo

- "Show me the actual experience of a team member updating their status. Count the clicks. If it takes more than 30 seconds, my team won't do it."

- "Demonstrate how the system handles a reorganization. If we move Team A to Department B, does historical data move with them, or is it lost?"

- "Can I configure different governance workflows for different project sizes? I don't want the same approval rigor for a $10k update as a $10M launch."

- "Show me the API documentation. Is it open to the public, or do I need a login? (Hidden docs usually mean bad APIs)."

- "How does the tool handle multi-currency resource rates? If I have a developer in India and one in the US, does the project cost reflect their actual loaded costs?"

Before Signing the Contract

Final Decision Checklist:

Does the vendor have a localized support team in your time zone? Have you verified the "exit strategy"—can you export all your data in a usable format (not just PDFs) if you leave? Have you secured a "sandbox" environment for testing changes before they hit production?

Common Negotiation Points:

Never pay list price for implementation; vendors will often discount services to secure the subscription license. Negotiate a "ramp" model for licenses—start paying for 50 users in Q1 and scale to 500 in Q4, rather than paying for all 500 from Day 1 while you are still rolling it out. Ask for a "price lock" cap on renewals to prevent the vendor from hiking the price by 10%+ annually.

Deal-Breakers:

Lack of SSO (Single Sign-On) support in the base tier is a security deal-breaker. Proprietary data formats that lock you in. A vendor's refusal to agree to an uptime SLA (Service Level Agreement) with financial penalties.

Closing

Selecting the right Portfolio & Program Management software is not just an IT decision; it is a decision about how your organization will govern its future. If you have questions about specific vendors or need a sounding board for your evaluation strategy, feel free to reach out.

Email: albert@whatarethebest.com