Best for teams that are

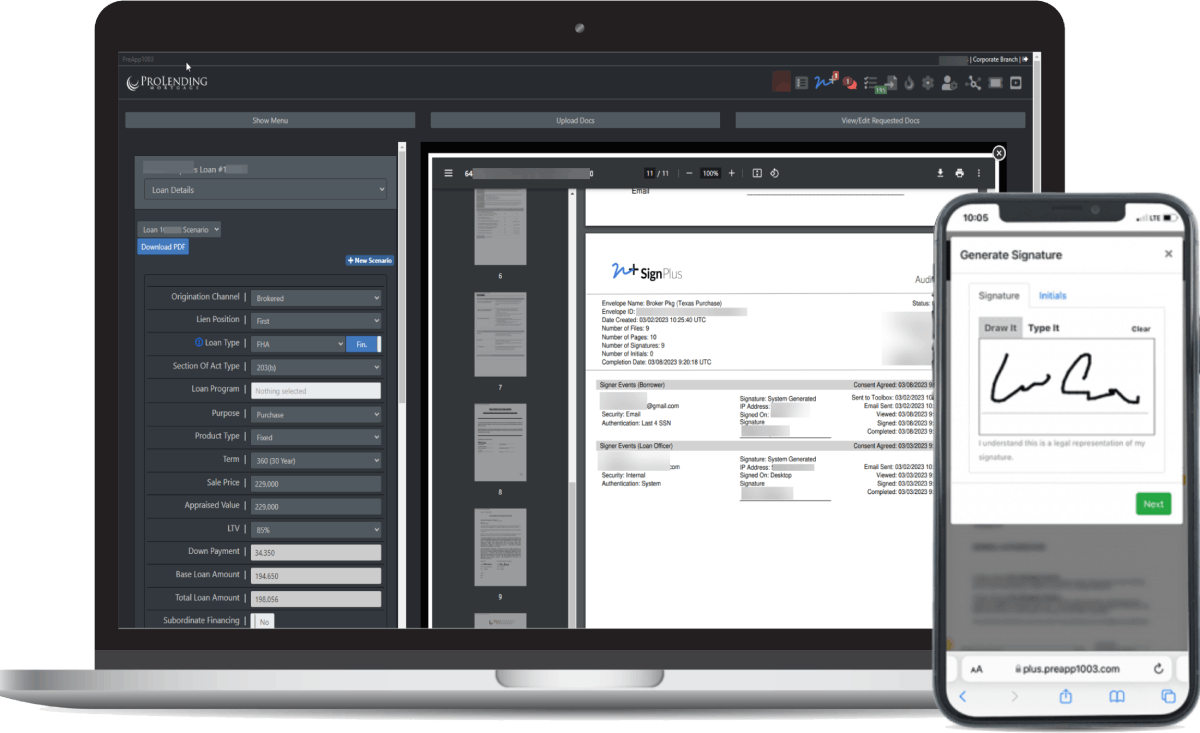

- Mortgage lenders needing full eClosing and eNotary compliance

- Settlement providers requiring secure eVault storage and management

Skip if

- General businesses needing simple, non-mortgage eSignatures

- Small agents wanting a lightweight, standalone signing tool

Expert Take

Our analysis shows DocMagic is not just an eSignature tool but a specialized 'Total eClose' ecosystem designed specifically for the mortgage industry. Research indicates it is the only document generation provider with MISMO eClosing System Certification, offering deep value through its transactional pricing model and seamless MERS integration. While its interface is utilitarian, its backend compliance and eVault capabilities are industry-leading.

Pros

- MISMO eClosing System Certified

- Transactional pricing model (no seat fees)

- Built-in MERS eRegistry integration

- AutoPrep AI for document tagging

- Deep integration with Encompass & Empower

Cons

- Interface described as basic

- Low public review volume

- Niche focus limits general use

- Support sometimes blames data vendors

- Confusing notary onboarding fees