What Is Document Scanning & OCR Software?

Document Scanning and Optical Character Recognition (OCR) Software is a category of technology designed to convert static, analog information—such as paper documents, PDF files, and images—into machine-readable, structured digital data. This software manages the initial stage of the information lifecycle: the "ingestion" phase. Its primary function is to capture visual data, interpret the characters and layout through recognition algorithms, and export usable text or structured data fields (like names, dates, and invoice totals) into downstream business systems.

The scope of this category is distinct. It is broader than simple "PDF Editors," which focus on manual manipulation of individual files, yet narrower than Enterprise Content Management (ECM) or Enterprise Resource Planning (ERP) systems, which serve as the final repositories for data. Document Scanning & OCR Software sits explicitly at the gateway of the enterprise tech stack. It acts as the bridge between the physical world of unstructured correspondence and the digital world of structured databases. The category includes both general-purpose desktop OCR tools used for ad-hoc conversion and vertical-specific Intelligent Document Processing (IDP) platforms designed for high-volume, automated workflows in industries like healthcare and finance.

This software solves a fundamental business problem: the "unstructured data gap." Without OCR, documents are merely images—black pixels on a white background—that computers cannot search, index, or analyze. By transforming these images into data, organizations unlock the ability to automate accounts payable, streamline patient intake, accelerate mortgage underwriting, and ensure regulatory compliance. It transforms an archive of "dead" pixels into an active intelligence asset.

History of the Category

The trajectory of Document Scanning & OCR Software since the 1990s is a story of moving from simple digitization to intelligent understanding. In the early 1990s, OCR technology was primarily a desktop commodity. The focus was strictly on "text recognition"—converting a scanned page into an editable Word document to avoid retyping. Accuracy was heavily dependent on scan quality, and the software struggled with complex layouts. During this era, the market was fragmented among hardware manufacturers bundling basic software with scanners, treating the software as a secondary utility rather than a strategic asset [1].

By the 2000s, the market saw a shift toward server-based "capture" solutions. This decade defined the category's middle era, where the goal evolved from personal productivity to enterprise workflow automation. Software vendors began introducing "zonal OCR," allowing businesses to define specific templates (like coordinates on a standard form) to extract data fields automatically. This period was marked by significant market consolidation, where large imaging conglomerates acquired specialized software vendors to create end-to-end capture suites. The capability gap that created this category—the inability of ERP systems to ingest paper—became a critical bottleneck as businesses adopted digital back-office systems.

From 2010 to the present, the industry transitioned from on-premise, template-based systems to cloud-native, AI-driven platforms. The rise of Vertical SaaS and machine learning fundamentally changed buyer expectations. Users no longer wanted a tool that required rigid templates; they demanded "Intelligent Document Processing" (IDP) that could understand context. The modern expectation is not just "give me a database of text," but "give me actionable intelligence." Today, the software uses Natural Language Processing (NLP) to interpret unstructured documents like emails and contracts, distinguishing a "shipping address" from a "billing address" without explicit rules. This evolution has transformed the category from a tactical administrative tool into a strategic engine for digital transformation [2].

What to Look For in Evaluation

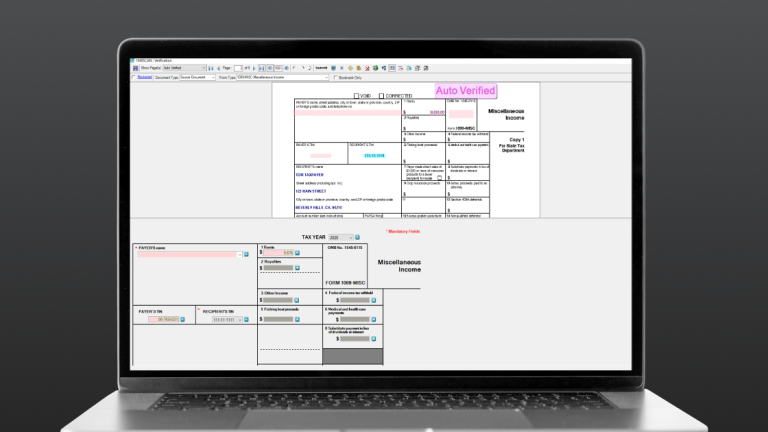

When evaluating Document Scanning & OCR Software, buyers must prioritize Straight-Through Processing (STP) rates over simple "accuracy" claims. A vendor may claim 99% character accuracy, but if the system fails to understand the document's structure, a human must still intervene. Critical evaluation criteria should include the engine's ability to handle multi-channel capture—ingesting documents from scanners, mobile devices, emails, and web portals seamlessly. Look for "confidence scoring" capabilities, where the software flags uncertain data for human review while automatically processing high-confidence fields. This "human-in-the-loop" interface is often where the real ROI is determined; a clumsy validation interface can destroy the efficiency gains of the OCR engine.

Red flags in this category are often found in the licensing models and support for non-standard documents. Be wary of vendors that rely exclusively on template-based extraction. While effective for standardized forms, these systems break when a vendor changes their invoice layout, requiring expensive professional services to re-configure. Another warning sign is a lack of pre-processing features. High-quality OCR depends on image cleanup—deskewing, despeckling, and binarization. If a solution lacks robust image enhancement tools, real-world performance on crumpled receipts or low-quality faxes will be abysmal [3].

Key questions to ask vendors include: "How does your system handle variable layouts without pre-defined templates?", "What is the mechanism for retraining the model when it encounters errors?", and "Can you demonstrate the validation workflow for a low-confidence document?" These questions reveal whether the tool is a static OCR engine or a modern, learning-based IDP platform.

Industry-Specific Use Cases

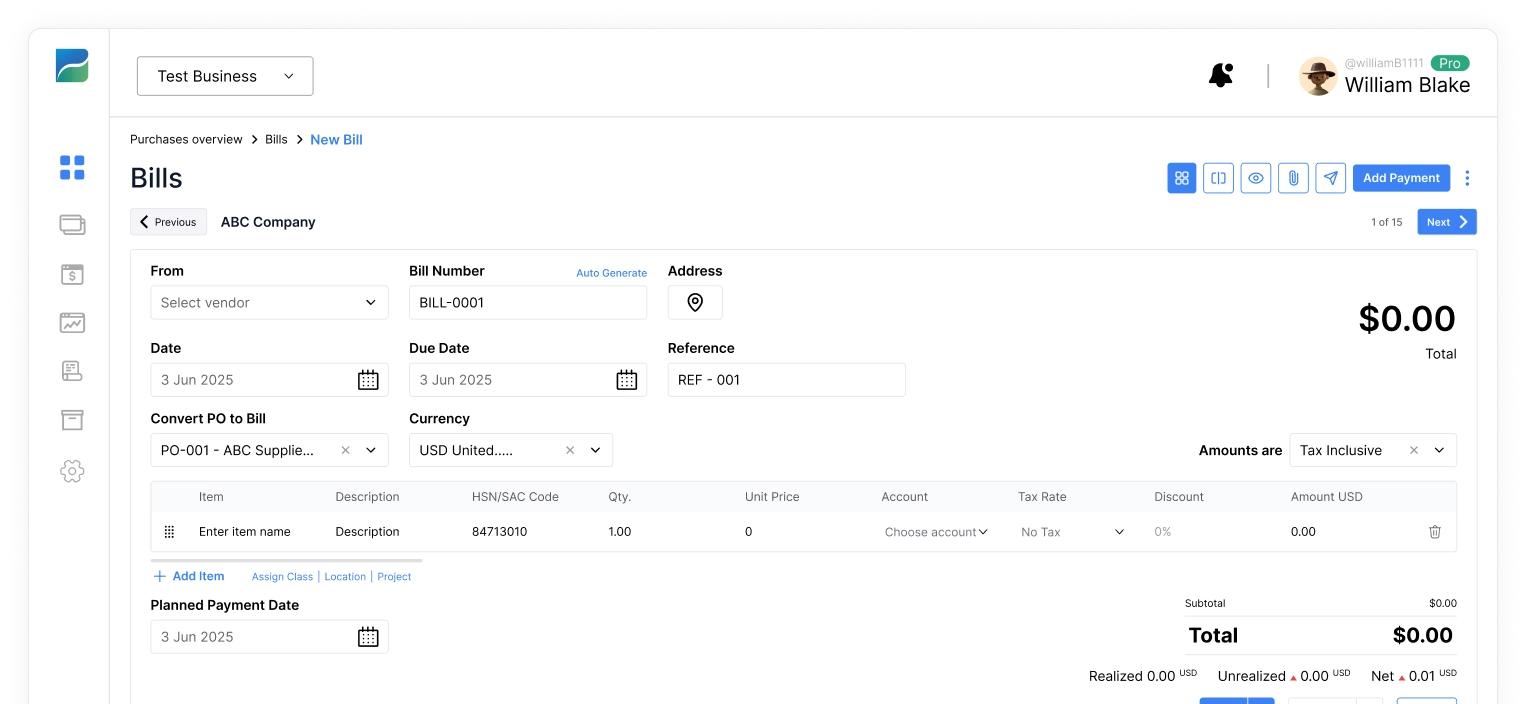

Retail & E-commerce

In the retail and e-commerce sectors, Document Scanning & OCR Software is the backbone of supply chain and inventory management. The primary use case here is Accounts Payable (AP) automation, specifically the "3-way match" process. Retailers receive thousands of invoices, purchase orders (POs), and delivery receipts monthly. OCR software automates the reconciliation of these three document types, verifying that what was ordered matches what was delivered and what was billed. This automation is critical for maintaining vendor relationships and securing early payment discounts. Unlike generic tools, retail-focused solutions must handle high volumes of diverse invoice layouts from hundreds of different suppliers without manual template creation [4].

Healthcare

Healthcare providers utilize this software to bridge the gap between paper records and Electronic Health Records (EHR) systems. The specific need here is HIPAA compliance and the ability to process standardized medical forms like the CMS 1500 or UB-04. Evaluation priorities focus heavily on security and the accuracy of extracting Patient Health Information (PHI). A unique consideration for this industry is the ability to scan and parse insurance cards and patient IDs during the intake process. The software must be able to extract group numbers and policy details from an image of a card and populate the patient's file in real-time, reducing data entry errors that lead to claim denials [5].

Financial Services

For banks and fintech companies, OCR software is pivotal for Know Your Customer (KYC) and Anti-Money Laundering (AML) workflows. The software is used to scan government-issued IDs and passports, verifying their authenticity and extracting data to populate onboarding forms. Beyond identity, financial institutions use these tools for processing loan applications, where they must ingest and analyze unstructured documents like tax returns, pay stubs, and bank statements. The critical evaluation metric here is fraud detection—modern OCR tools can detect pixel-level alterations in a scanned bank statement that might indicate forgery [6].

Manufacturing

Manufacturing firms deploy scanning software to manage the technical documentation that accompanies production and logistics. A key workflow involves processing Bills of Lading (BOL) and shipping manifests. These documents are often scanned at loading docks under poor lighting conditions, so the software must have exceptional image enhancement capabilities. Additionally, manufacturers use OCR to digitize engineering drawings and technical specifications. A unique consideration is the ability to recognize technical symbols and preserve large-format layouts (like blueprints) without degrading the visual fidelity required for quality control [7].

Professional Services

Law firms and consultancies rely on OCR software primarily for eDiscovery and expense management. In legal environments, the priority is converting millions of pages of case files into fully text-searchable PDFs (often complying with PDF/A archival standards). The searchability must be absolute; a missed keyword in a scanned contract could affect the outcome of litigation. For consultancies, the focus is often on mobile receipt scanning for expense tracking. The software must be able to categorize line items automatically and distinguish between client-billable and non-billable expenses, integrating directly with time-and-billing platforms [8].

Subcategory Overview

Document Scanning & OCR Software for Mortgage Brokers

This niche handles the complexity of the "loan packet"—a massive collection of disparate documents including tax forms, bank statements, ID cards, and gift letters. Unlike generic tools, software in this category is built to perform stack indexing: taking a single 500-page PDF containing multiple document types and automatically splitting, classifying, and naming each section (e.g., "Pages 1-3: Tax Return," "Page 4: Driver’s License"). A generic OCR tool would simply treat this as one long document, forcing the broker to manually separate pages. The specific pain point driving buyers here is the "stare and compare" fatigue of underwriting, where a broker must verify data across multiple documents. Specialized tools cross-validate income figures from W-2s against the application data automatically. For a deeper look at these tools, read our guide to Document Scanning & OCR Software for Mortgage Brokers.

Document Scanning & OCR Software for Insurance Agents

The differentiator for this subcategory is the handling of ACORD forms and handwritten claims applications. While generic OCR struggles with the dense, gridded layout of standardized insurance forms, specialized tools map these fields out-of-the-box. A workflow unique to this niche is the automated extraction of policy declarations to generate competitive quotes. An agent can scan a prospect's existing policy from a competitor, and the software extracts coverage limits and deductibles to pre-fill a quote for a better rate. The pain point driving adoption is the high volume of legacy paper processes in claims handling, where speed of data entry directly correlates to customer satisfaction during a loss. Learn more about Document Scanning & OCR Software for Insurance Agents.

Document Scanning & OCR Software for Accountants

This software is distinct because it focuses on General Ledger (GL) coding and tax compliance. It doesn't just read the text "Home Depot"; it recognizes that for a specific client, "Home Depot" should be coded to "Cost of Goods Sold" rather than "Office Supplies." The workflow that only this specialized tool handles well is the "shoebox" scenario: processing a disorganized pile of receipts and bank statements at tax time. The software automatically matches scanned receipts to bank feed transactions, highlighting missing items. The driving pain point is the seasonality of tax work; accountants need tools that can handle massive spikes in volume without requiring temporary staff for manual data entry. Explore our analysis of Document Scanning & OCR Software for Accountants.

Document Scanning & OCR Software for Medical Offices

The defining feature here is integration with EMR/EHR systems and the ability to parse insurance cards. Generic OCR tools cannot interpret the layout of a Blue Cross Blue Shield card versus an Aetna card, but medical-specific OCR is trained on these templates to extract Group IDs, Member IDs, and Co-pay amounts accurately. A critical workflow is patient intake, where front-desk staff scan IDs and insurance cards, and the data flows directly into the patient's digital chart, verifying eligibility in real-time. The specific pain point is claim denials caused by data entry errors at registration; this software acts as a gatekeeper to ensure clean data enters the billing cycle. Read more about Document Scanning & OCR Software for Medical Offices.

Document Scanning & OCR Software for Contractors

This niche serves the construction and field service industries, where the primary document is the crumpled receipt from a supply house or a handwritten job ticket. Unlike office-based tools, this software prioritizes mobile capture and project-based tagging (Job Costing). A unique workflow is the ability for a foreman to snap a photo of a material receipt on a job site and immediately tag it to "Project A - Plumbing," ensuring real-time budget tracking. General tools often lack this "project" dimension, burying costs in a general ledger. The pain point driving contractors to this niche is "leakage"—billable expenses that are never invoiced to the client because the paper receipt was lost in a truck dashboard. See our guide to Document Scanning & OCR Software for Contractors.

Integration & API Ecosystem

In the realm of Document Scanning & OCR, integration is not merely a feature; it is the primary delivery mechanism for value. Standalone OCR is rarely useful; its value is realized only when extracted data lands in a system of record like an ERP, CRM, or EHR. A robust API ecosystem allows for bi-directional data flow: the OCR tool pulls validation data (like a list of valid vendor names) from the ERP to improve recognition accuracy, and pushes clean data back.

Statistic: Research by McKinsey indicates that 70% of digital transformation efforts fail, often due to the inability to integrate new digital tools with legacy systems [9].

Expert Insight: As noted by Gartner analysts, "Integration is the bottleneck of automation. Tools that provide pre-built connectors to major ERPs significantly reduce time-to-value compared to those requiring custom API development."

Scenario: Consider a 50-person professional services firm using a specialized OCR tool for expense management. They attempt to connect it to their legacy on-premise accounting system. If the OCR tool relies on a modern REST API but the accounting system only accepts batch CSV uploads via SFTP, the "automation" breaks down. The firm ends up hiring an IT consultant to write a middleware script to translate the data. When the OCR vendor updates their API schema six months later, the script breaks, and invoices pile up for weeks. A well-designed integration would have offered a native connector or a supported "agent" for on-premise systems, handling these translation layers automatically.

Security & Compliance

Security in document processing is paramount because these systems ingest the organization's most sensitive data—financial records, personal identities, and legal contracts. Compliance is not just about encryption at rest and in transit; it involves rigorous adherence to standards like SOC 2 Type II, ISO 27001, and industry-specific regulations like HIPAA or GDPR. The OCR platform effectively becomes a data processor, and any breach here exposes the entire upstream flow of information.

Statistic: In 2023, the Office for Civil Rights (OCR) settled multiple HIPAA violation cases, with penalties ranging from tens of thousands to millions of dollars, highlighting the financial risk of mishandling PHI in digital formats [10].

Expert Insight: Cybersecurity experts emphasize that "The scanner is often the most overlooked endpoint in the network. Organizations secure their servers but leave their document ingestion pipelines wide open."

Scenario: A mid-sized healthcare clinic scans patient intake forms using a cloud-based OCR service to reduce paperwork. The service is fast and accurate but is not HIPAA compliant and stores data on servers outside the country. During a routine audit, it is discovered that patient names and social security numbers are being stored in plain text logs on the vendor's cloud for "service improvement." The clinic faces a massive fine not because of a hack, but because they failed to vet the vendor’s data residency and retention policies. A compliant tool would have offered automatic data redaction and zero-retention processing options.

Pricing Models & TCO

Pricing in this category is notoriously complex, often split between "per-page" consumption models and "per-seat" licensing. Hidden costs frequently arise in the form of "validation station" licensing—where you pay extra for the users who verify the data—and fees for setting up new templates. Total Cost of Ownership (TCO) must account for the labor saved versus the hard costs of the software.

Statistic: According to Ardent Partners, the average cost to process a single invoice manually is approximately $12.88, whereas best-in-class automation can drive this down to under $3.00 [11].

Expert Insight: Financial analysts warn, "The most expensive part of an OCR implementation is rarely the software license; it is the cost of the exceptions. If the software is cheap but only 80% accurate, your labor costs for verification will explode."

Scenario: A logistics company processes 10,000 bills of lading per month. They choose a "cheap" OCR vendor that charges $0.01 per page ($1,200/year). However, the engine struggles with the faint dot-matrix printing common on these forms, achieving only 70% accuracy. This forces the company to assign two full-time employees ($100,000/year combined) to manually correct the data. A premium vendor might have charged $0.10 per page ($12,000/year) but delivered 98% accuracy, requiring only a fraction of one employee's time. The "cheaper" option actually costs the company $89,000 more per year in TCO.

Implementation & Change Management

Implementing document scanning software is a behavioral change project as much as a technical one. It requires shifting staff from "data entry" roles to "data validation" roles. This shift can cause friction if users feel their jobs are threatened or if the new software is more cumbersome than the old manual process. Success depends on user adoption and the intuitive nature of the validation interface.

Statistic: Gartner reports that 85% of AI and automation projects fail to deliver on their intended promises, often due to poor change management and lack of user adoption rather than technical failure [12].

Expert Insight: A change management consultant notes, "Software doesn't fix a broken process. If your current approval workflow is a mess of emails and sticky notes, automating it just speeds up the chaos. You must map and optimize the workflow before turning on the OCR."

Scenario: A manufacturing firm implements a new OCR system for purchase orders. The technical setup is perfect. However, the procurement team, who used to manually key in orders, finds the new "verification screen" confusing and slow. They start bypassing the system, printing emails and typing them into the ERP directly because "it's faster." Six months later, the OCR system is active but processing zero volume. The implementation failed because the vendor and management did not involve the end-users in the interface design or provide adequate training on the new workflow.

Vendor Evaluation Criteria

Selecting a vendor requires looking beyond marketing claims of "AI-powered." Buyers need to evaluate the vendor's specific experience in their vertical, the robustness of their support, and the transparency of their accuracy metrics. "Accuracy" is a malleable term; vendors often quote accuracy on pristine digital PDFs, not the coffee-stained scans real businesses handle.

Statistic: Industry benchmarks suggest that while many vendors claim 99% accuracy, real-world performance on complex, variable documents typically hovers between 80-90% without significant customization [13].

Expert Insight: A procurement expert advises, "Never sign a contract based on a demo with the vendor's sample documents. Always require a proof-of-concept (POC) using your own 'ugliest' files—the ones with handwriting, stamps, and poor contrast."

Scenario: An insurance agency evaluates two vendors. Vendor A shows a slick demo extracting data perfectly from standard ACORD forms and quotes a low price. Vendor B asks for a sample of the agency's actual scanned claims, runs a test, and honestly reports that their engine struggled with the handwritten notes in the margins, offering a specific feature to route those for human review. The agency chooses Vendor A, only to find that in production, the system chokes on real-world handwriting, causing a backlog. Vendor B's transparency and realistic approach to "exception handling" would have been the superior choice.

Emerging Trends and Contrarian Take

Emerging Trends 2025-2026: The market is rapidly moving toward "Agentic Automation." Instead of just extracting data, AI agents will autonomously act on it—logging into portals, verifying data against external sources, and initiating transactions. We are also seeing the convergence of IDP with Generative AI (LLMs), enabling the system to "chat" with documents (e.g., "Summarize the liability clause in this contract") rather than just extracting fields [14].

Contrarian Take: The obsession with "99% Accuracy" is a distraction. In reality, accuracy is a commodity; the validation interface is the product. Most top-tier OCR engines (Google, Microsoft, ABBYY) now deliver comparable, high-quality results on standard text. The differentiator is no longer the engine itself, but how efficiently the tool helps a human fix the inevitable 1% of errors. A tool with 95% accuracy and a brilliant, keyboard-driven validation interface will outperform a tool with 98% accuracy and a clunky, mouse-heavy interface every time. Efficiency is determined by the speed of exception handling, not just the rate of straight-through processing.

Common Mistakes

One of the most frequent mistakes is overbuying for peak volume. Buyers often estimate their licensing needs based on their busiest month (e.g., tax season for accountants), locking themselves into expensive tiers that go unused for the rest of the year. A flexible, usage-based model is often more economical.

Another critical error is ignoring the "Long Tail" of document types. Businesses often focus their testing on the top 20% of vendors who send 80% of the invoices. They build templates and rules for these major suppliers and achieve great success. However, they neglect the hundreds of small vendors who send unique, one-off invoice layouts. In production, these "long tail" documents clog the system because no rules exist for them. A robust solution must have "generative" or "learning" capabilities to handle unseen layouts without crashing.

Finally, neglecting image pre-processing is a technical oversight that leads to failure. Implementing OCR software without configuring deskewing (straightening images), binarization (converting to black and white), and noise removal is like trying to read a book in the dark. Simple tweaks to the scanning hardware settings or software pre-processing rules can double accuracy rates overnight [15].

Questions to Ask in a Demo

- "Can you demonstrate the validation interface?" (Watch closely: Does the user have to use the mouse to click every field, or can they tab through errors? Speed matters here.)

- "How does the system handle a document layout it has never seen before?" (Does it require IT to build a new template, or does it learn on the fly?)

- "What are your confidence score thresholds, and can we customize them?" (You want control over what gets auto-approved vs. what gets flagged.)

- "Do you charge by page, by document, or by character count?" (Clarify this to avoiding billing surprises.)

- "Can we see a live test with our sample documents right now?" (Refusal is a red flag.)

- "How do you handle multi-page documents where the page count varies?" (e.g., A 3-page invoice vs. a 10-page invoice in the same batch.)

- "What are the data retention policies for your cloud servers?" (Critical for compliance.)

Before Signing the Contract

Before committing, ensure you have a clear Service Level Agreement (SLA) regarding uptime and support response times. If your AP process depends on this software, a 48-hour support ticket response is unacceptable. Negotiate for "sandbox" access to test updates before they are pushed to production, preventing a software update from breaking your critical workflows.

Check the Data Exit Clause. If you decide to leave this vendor in three years, in what format will you get your data back? Will you receive the raw images and the extracted metadata in a standard format (like JSON or XML), or will it be a proprietary dump that is impossible to migrate? Finally, ensure that the pricing model includes a "rollover" for unused pages or a buffer for overages, so you aren't penalized for a single busy month.

Closing

Document Scanning & OCR Software is a powerful enabler of efficiency, but only when selected with a clear understanding of your specific workflows and document types. If you have questions about which tool fits your unique requirements, or if you want to discuss a specific use case not covered here, I invite you to reach out.

Email: albert@whatarethebest.com