Why We Love It

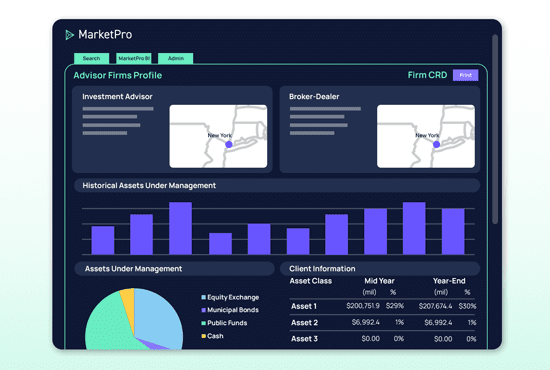

Collibra Data Governance stands out for its specific focus on the insurance industry. It understands the intricacies of this sector and provides a platform that caters to its unique needs. Professionals love its ability to bring transparency, control, and speed to their data-driven decisions, whether they're handling underwriting, claims, or annuities. It's a powerful tool for enhancing productivity and accuracy in these critical areas.

Pros

- Industry-specific features

- Advanced data governance

- Effective decision-making support

- Streamlined workflows

- Secure data management

Cons

- Requires IT expertise

- Could be complex for beginners

- Pricing info not transparent

Enterprise pricing available

Collibra Data Governance is an industry-specific tool designed to streamline decision making in the insurance sector. By providing enhanced control and visibility over data, it enables quicker, more accurate decisions in underwriting, claims, annuities, and more.

Pros

- Industry-specific features

- Advanced data governance

- Effective decision-making support

- Streamlined workflows

- Secure data management

Cons

- Requires IT expertise

- Could be complex for beginners

- Pricing info not transparent

Why We Love It

Collibra Data Governance stands out for its specific focus on the insurance industry. It understands the intricacies of this sector and provides a platform that caters to its unique needs. Professionals love its ability to bring transparency, control, and speed to their data-driven decisions, whether they're handling underwriting, claims, or annuities. It's a powerful tool for enhancing productivity and accuracy in these critical areas.

Pros

- Industry-specific features

- Advanced data governance

- Effective decision-making support

- Streamlined workflows

- Secure data management

Cons

- Requires IT expertise

- Could be complex for beginners

- Pricing info not transparent

Why We Love It

Collibra Data Governance stands out for its specific focus on the insurance industry. It understands the intricacies of this sector and provides a platform that caters to its unique needs. Professionals love its ability to bring transparency, control, and speed to their data-driven decisions, whether they're handling underwriting, claims, or annuities. It's a powerful tool for enhancing productivity and accuracy in these critical areas.

Enterprise pricing available

Collibra Data Governance is an industry-specific tool designed to streamline decision making in the insurance sector. By providing enhanced control and visibility over data, it enables quicker, more accurate decisions in underwriting, claims, annuities, and more.