Why We Love It

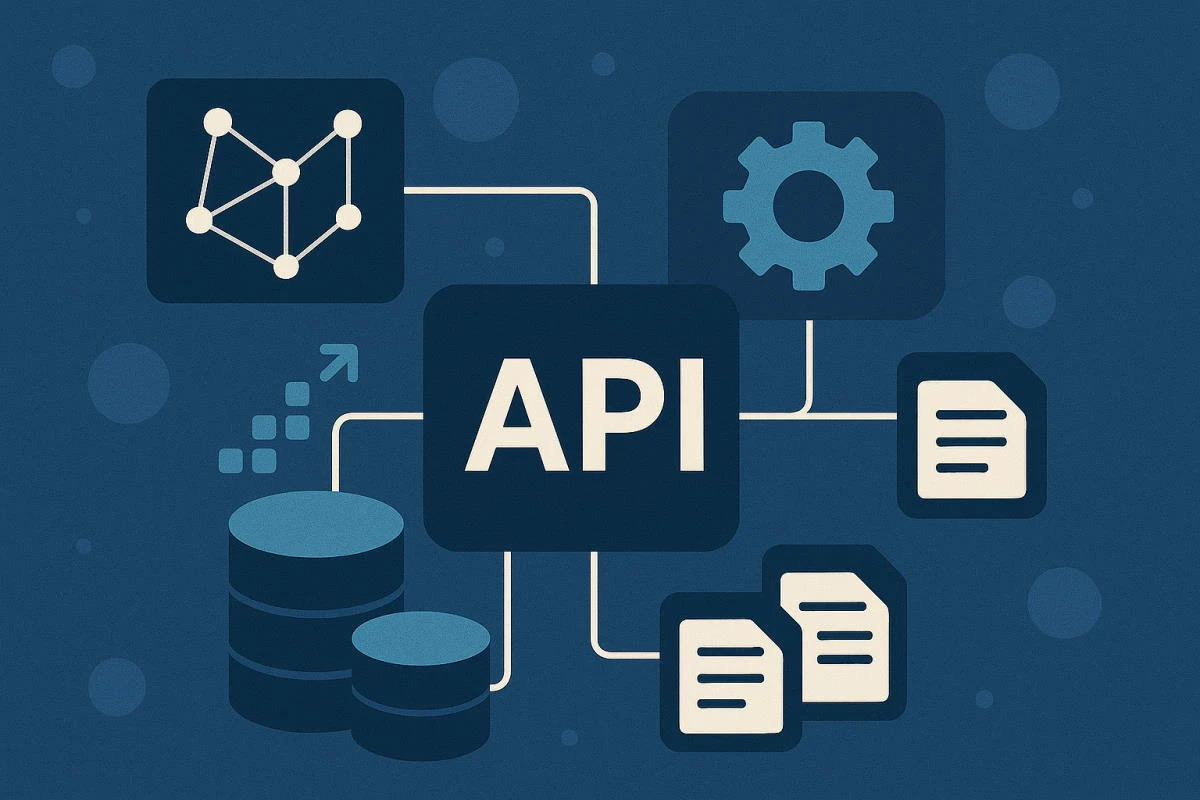

Kong's API platform is a game-changer in the insurance industry, loved for its effortless customization and repurposing of APIs. It caters to the unique needs of insurance agents, ensuring efficient data management, thereby saving valuable time and resources. Its ease of integration with existing systems and robust 24/7 support make it a highly reliable and effective tool in an industry where swift and smooth data flow is key.

Pros

- Industry-specific features

- Easy API customization

- Efficient resource management

- Smooth integration

- 24/7 support

Cons

- Enterprise pricing only

- May require technical expertise

- Dependent on internet connectivity

Enterprise pricing available

Kong's unified API management platform is an industry-specific SaaS solution, designed specifically for the insurance sector. It streamlines API customization and repurposing to save time and resources, addressing the unique needs of insurance agents who require smooth integration and seamless data flow.

Pros

- Industry-specific features

- Easy API customization

- Efficient resource management

- Smooth integration

- 24/7 support

Cons

- Enterprise pricing only

- May require technical expertise

- Dependent on internet connectivity

Why We Love It

Kong's API platform is a game-changer in the insurance industry, loved for its effortless customization and repurposing of APIs. It caters to the unique needs of insurance agents, ensuring efficient data management, thereby saving valuable time and resources. Its ease of integration with existing systems and robust 24/7 support make it a highly reliable and effective tool in an industry where swift and smooth data flow is key.

Pros

- Industry-specific features

- Easy API customization

- Efficient resource management

- Smooth integration

- 24/7 support

Cons

- Enterprise pricing only

- May require technical expertise

- Dependent on internet connectivity

Why We Love It

Kong's API platform is a game-changer in the insurance industry, loved for its effortless customization and repurposing of APIs. It caters to the unique needs of insurance agents, ensuring efficient data management, thereby saving valuable time and resources. Its ease of integration with existing systems and robust 24/7 support make it a highly reliable and effective tool in an industry where swift and smooth data flow is key.

Enterprise pricing available

Kong's unified API management platform is an industry-specific SaaS solution, designed specifically for the insurance sector. It streamlines API customization and repurposing to save time and resources, addressing the unique needs of insurance agents who require smooth integration and seamless data flow.