Best for teams that are

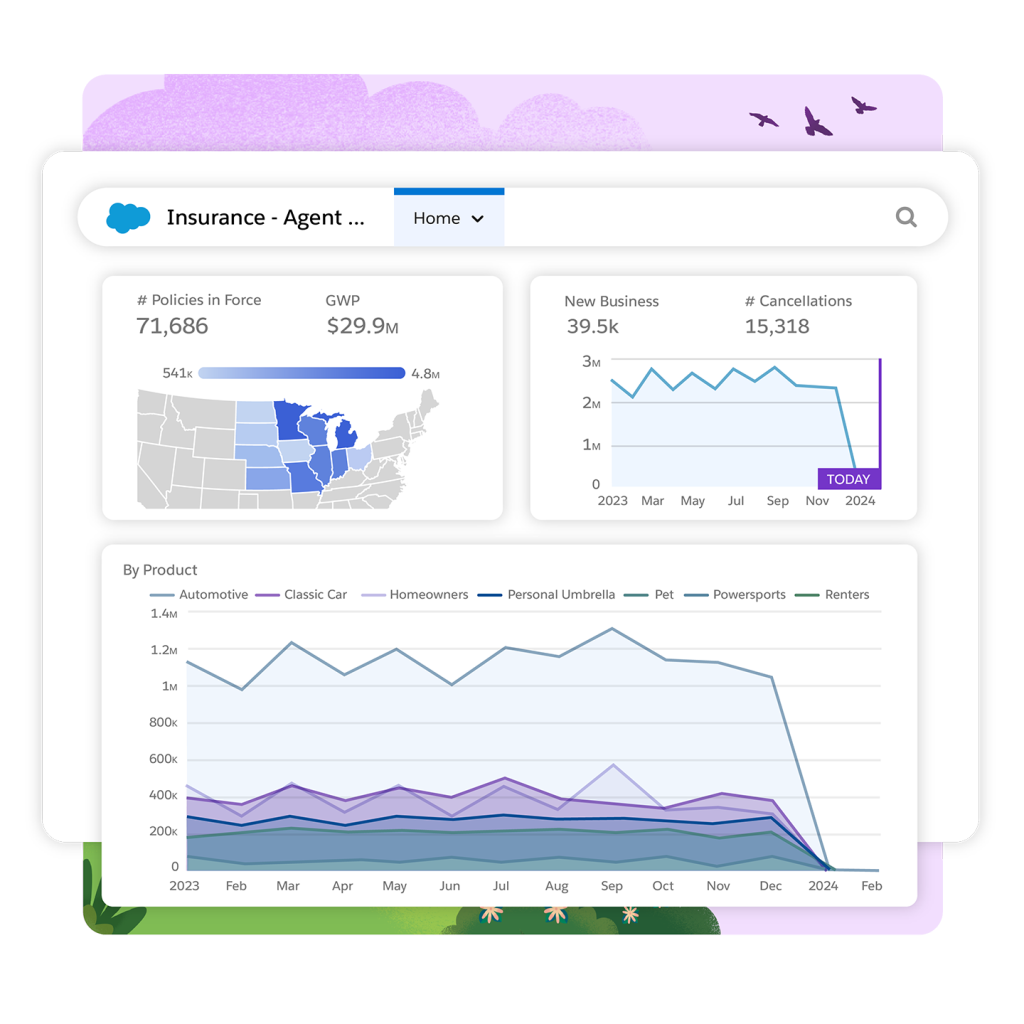

- Insurers focused on accelerating sales distribution and cross-selling capabilities

- Agents needing 'next best action' recommendations to personalize customer interactions

- Marketing teams wanting to leverage zero-party data for personalized campaigns

Skip if

- Operations teams focused solely on backend claims processing automation

- Small agencies lacking the data depth required to fuel recommendation engines

- Companies seeking a general-purpose chatbot rather than a sales-focused advisor

Expert Take

Our analysis shows Zelros stands out for its rigorous commitment to 'Responsible AI,' evidenced by its rare ISO 42001 certification. Unlike generic sales tools, it is purpose-built for the complex regulatory environment of insurance, embedding directly into Salesforce and Guidewire to guide agents without disrupting their workflow. The recent acquisition by Earnix further validates its technological depth and market value.

Pros

- ISO 42001 certified for AI safety

- Native Salesforce & Guidewire integrations

- Transparent per-user pricing model

- Specialized insurance recommendation engine

- Acquired by industry leader Earnix

Cons

- Low volume of public user reviews

- Significant setup fees likely apply

- Client base primarily European

- Requires core system integration